Capitalized Leases On Balance Sheet

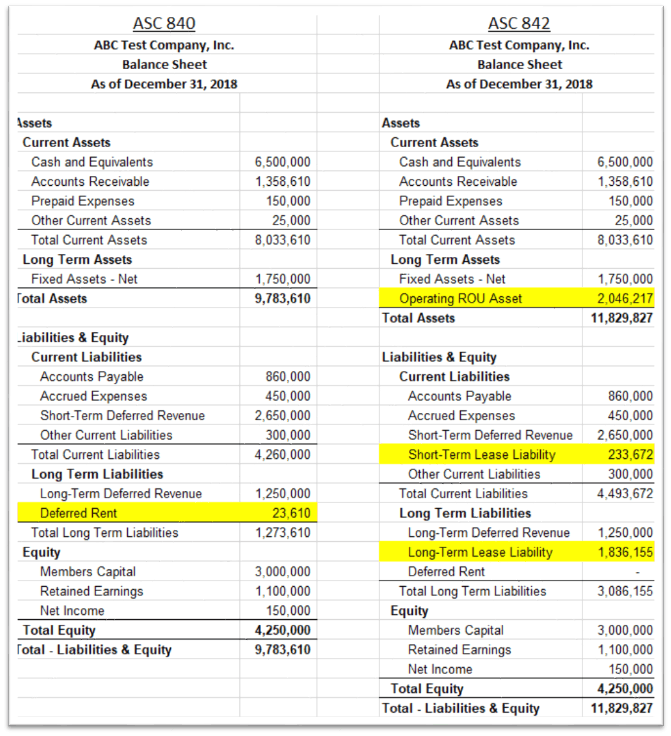

Capitalized Leases On Balance Sheet - However, you will still need to classify them as either finance leases (previously called capital leases) or as. A lessee must capitalize leased assets if the lease. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. Web what is asc 842? When you capitalize a lease, the asset appears on your balance sheet the same as if you had bought it. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web the effects of a capitalized lease and balance sheet entries.

When you capitalize a lease, the asset appears on your balance sheet the same as if you had bought it. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. However, you will still need to classify them as either finance leases (previously called capital leases) or as. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Web what is asc 842? Web the effects of a capitalized lease and balance sheet entries. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. A lessee must capitalize leased assets if the lease.

Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. A lessee must capitalize leased assets if the lease. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. However, you will still need to classify them as either finance leases (previously called capital leases) or as. When you capitalize a lease, the asset appears on your balance sheet the same as if you had bought it. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web what is asc 842? Web the effects of a capitalized lease and balance sheet entries. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet.

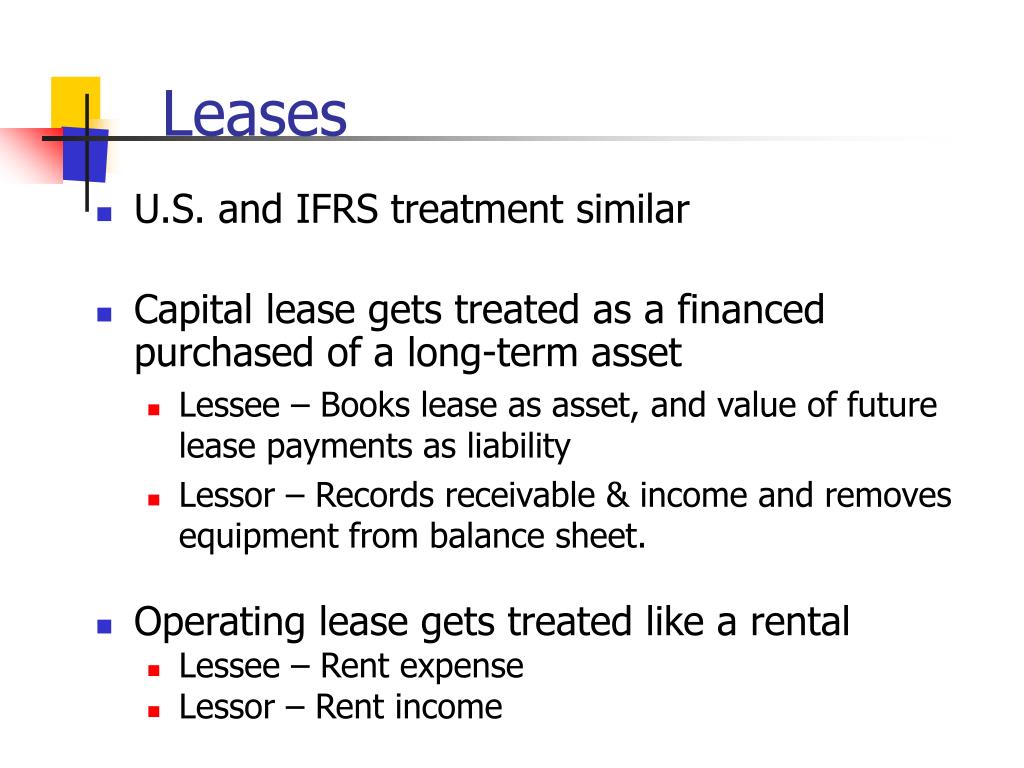

PPT GAAP Differences and The Balance Sheet in Detail PowerPoint

A lessee must capitalize leased assets if the lease. Web what is asc 842? Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Web the effects.

How to Account for a Capital Lease 8 Steps (with Pictures)

However, you will still need to classify them as either finance leases (previously called capital leases) or as. Web what is asc 842? Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. When you capitalize.

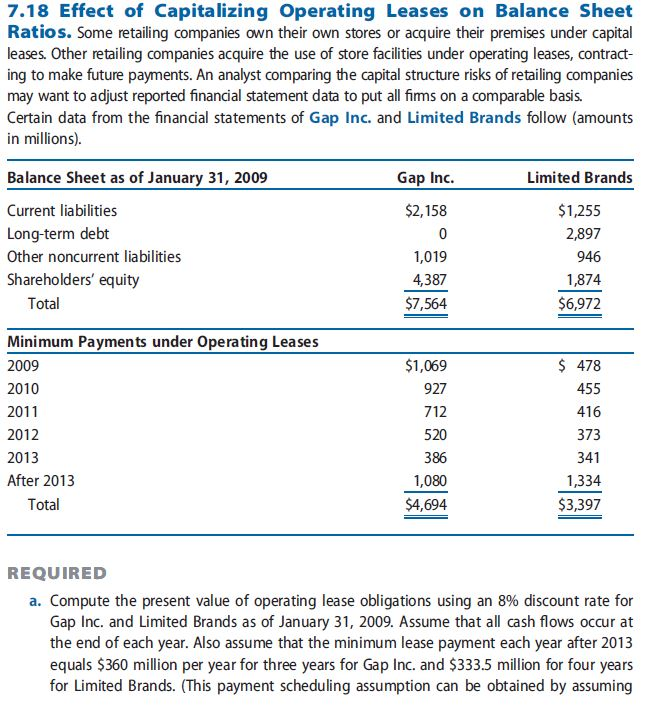

Solved 7.18 Effect of Capitalizing Operating Leases on

However, you will still need to classify them as either finance leases (previously called capital leases) or as. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web what is asc 842? Web upon adoption.

(Get Answer) WalMart Case Study WalMart Cost Of Capital WalMart

Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Web the effects of a capitalized lease and balance sheet entries. A lessee must capitalize leased assets.

Accounting for Capital Lease Steps, Accounting Entries and More

Web what is asc 842? Web the effects of a capitalized lease and balance sheet entries. A lessee must capitalize leased assets if the lease. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities.

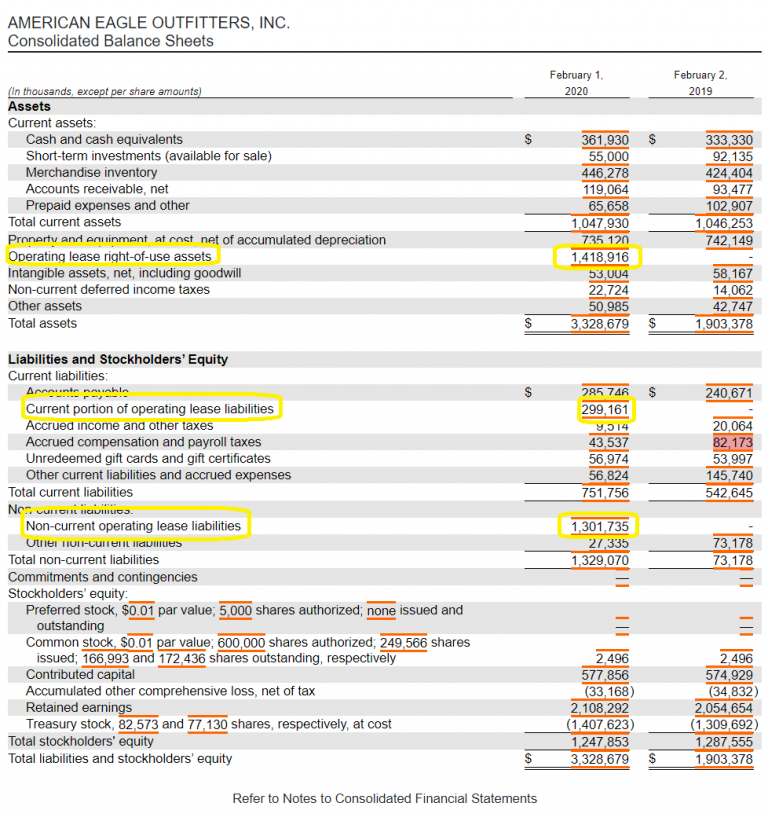

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. When you capitalize a.

ASC 842 Lease Accounting Balance Sheet Examples Visual Lease

Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. When you capitalize a.

Balance Sheet( in thousands)(1) Includes capital lease obligations of

Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Web what is asc 842? Web the effects of a capitalized lease and balance sheet entries. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation.

Operating leases on the balance sheet? ADKF

A lessee must capitalize leased assets if the lease. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation.

The Balance Sheet

Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Web what is asc 842? However, you will still need to classify them as either finance leases (previously called capital leases) or.

Web What Is Asc 842?

A lessee must capitalize leased assets if the lease. Web finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the. However, you will still need to classify them as either finance leases (previously called capital leases) or as. Web the effects of a capitalized lease and balance sheet entries.

When You Capitalize A Lease, The Asset Appears On Your Balance Sheet The Same As If You Had Bought It.

Web key takeaways the capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the. Web upon adoption of asc 842, almost all leases will be capitalized on the balance sheet. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements.