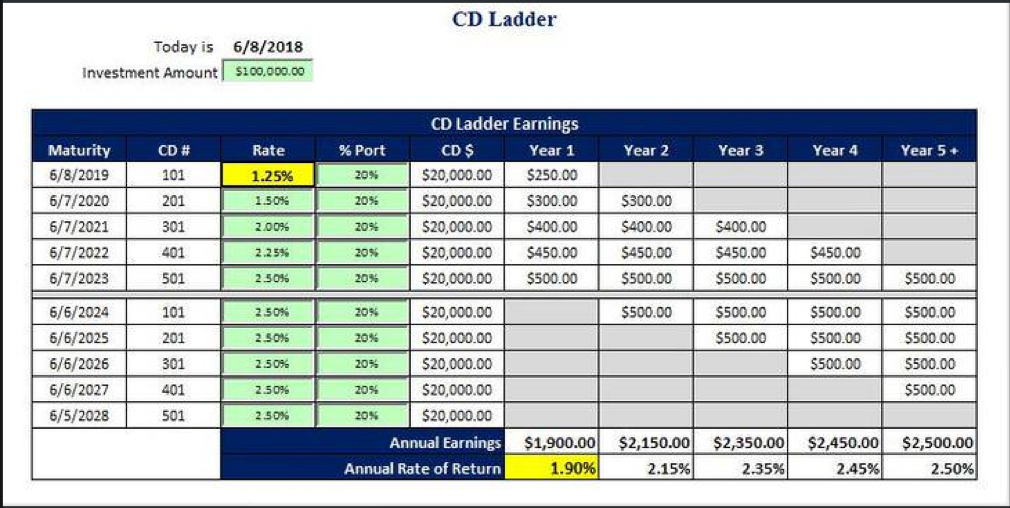

Cd Ladder Excel Spreadsheet Template

Cd Ladder Excel Spreadsheet Template - Search spreadsheets by type or topic, or take a look around by browsing the catalog. Each cd will have a different maturity date, so that one of your cds will mature at the frequency you specify. Web step 1 label cell a1: Use excel fv function to create cd interest calculator in this method we will use the fv function of excel to make a cd interest calculator. An important part to note about cd ladders is that you have to meet the minimum deposit requirement for each account you open. A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. Web cd ladder calculation example. With a bond/cd ladder, by the way, i mean holding a portfolio of bonds and/or cds so the cash flows comprised of maturing cds/bonds plus interest income exactly matches a specified time series of target cash flows over time. Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. Video of the day step 2 type the principal of the cd in cell a2.

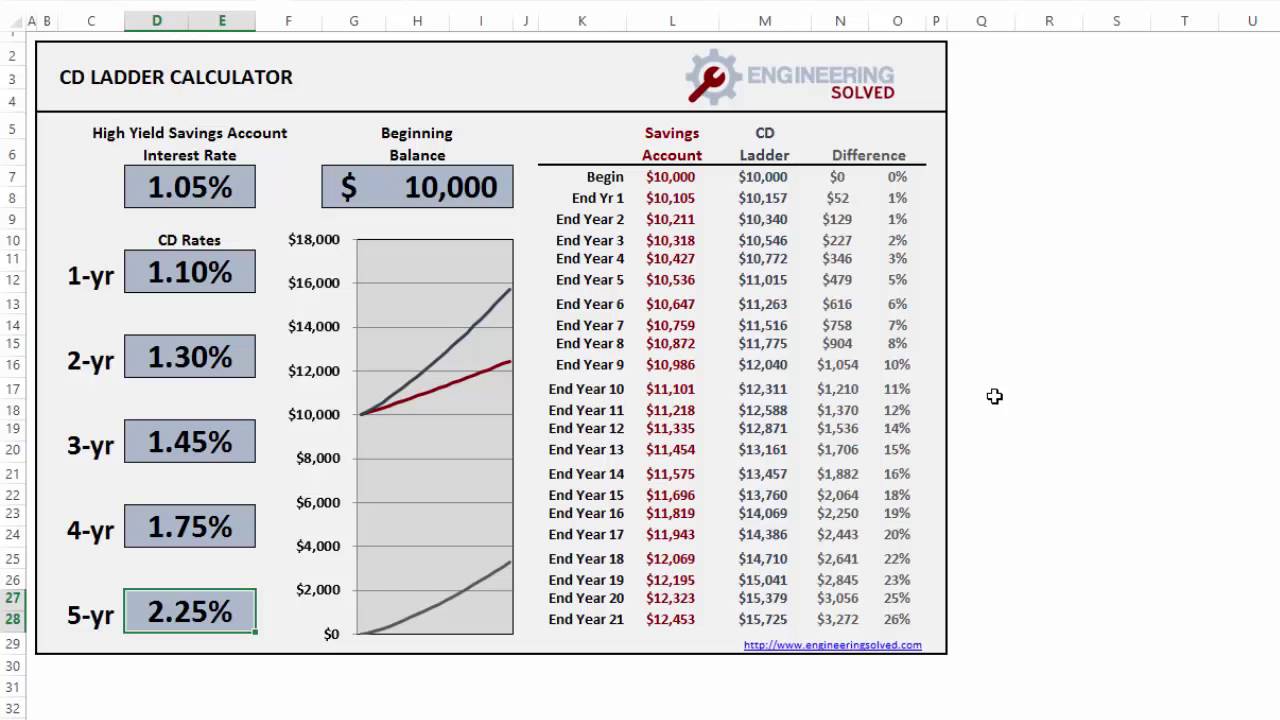

Web should i build a cd ladder? For example, with a $10,000, 1 year cd paying 8 precent interest compounded daily, the principal is $10,000. Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. Web this calculator will help you build a cd ladder that's right for you. The benefits of cd laddering. Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! You will have earned $1,304.92 more using cd laddering.* *note that at the end of the time period shown, only a portion of your cd ladder balance is liquid, while the entire single cd balance is liquid. 3 months 3 months 6. The first is the interest rate on your cds. Web find the perfect excel template.

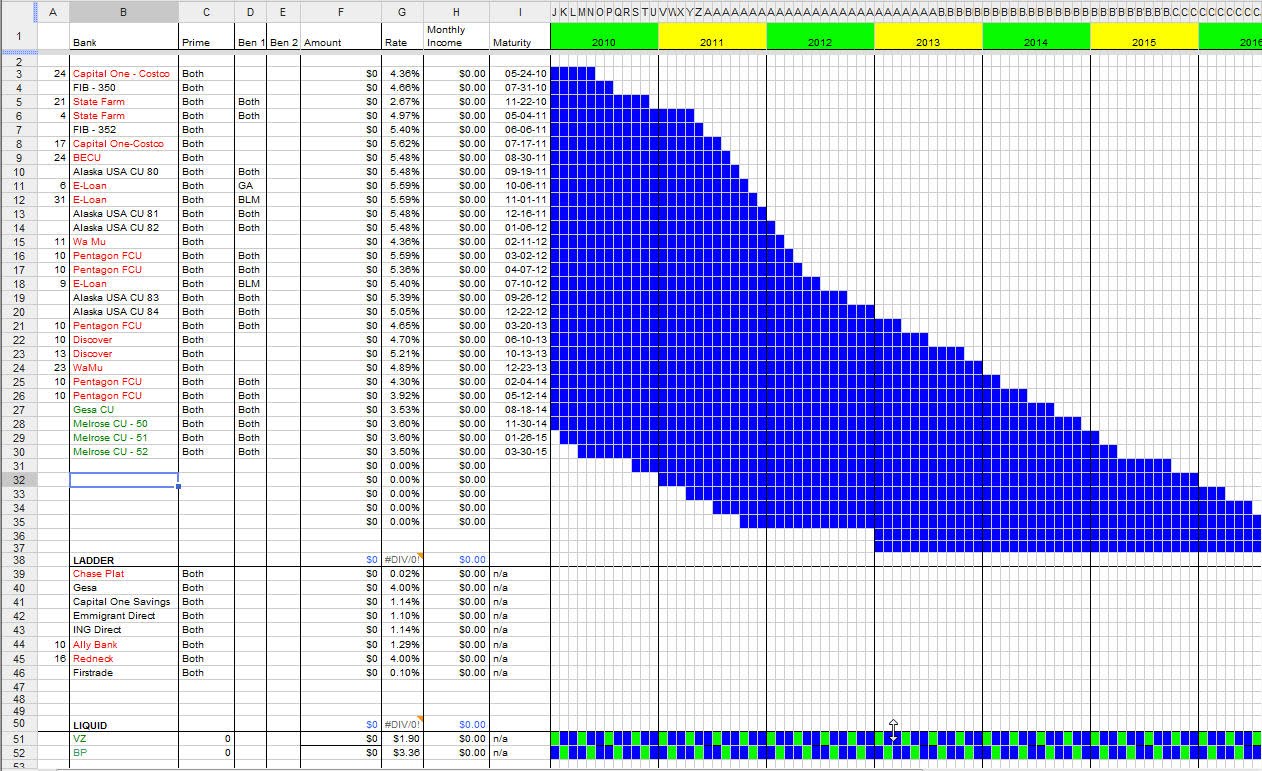

Web for anyone interested in laddering their investments in bank certificates of deposit (cds), this spreadsheet may be of great benefit. For example, with a $10,000, 1 year cd paying 8 precent interest compounded daily, the principal is $10,000. Each cd will have a different maturity date, so that one of your cds will mature at the frequency you specify. Banks typically require a minimum deposit of $500 or higher to open a cd account. An important part to note about cd ladders is that you have to meet the minimum deposit requirement for each account you open. Web $10k $100k $1m frequency of maturing cd:* ? Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Choose ladder 5 year ladder total initial amount $ calculate A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. Web a while ago i created a little toolkit to design my own bond and/or cd ladder.

Cd Ladder Excel Spreadsheet Pertaining To An Awesome And Free

The benefits of cd laddering. The first is the interest rate on your cds. Web step 1 label cell a1: Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. Banks typically require a minimum deposit of $500 or higher to open a cd account.

My Financial Demise? Tracking CD Ladders

Select the template that fits you best, whether it's a planner, tracker, calendar, budget, invoice, or something else. Web the number of cds that will be in your cd ladder. However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. An important part to note about cd ladders is that you have.

Cd Ladder Calculator Excel Spreadsheet Spreadsheet Download cd ladder

Web the number of cds that will be in your cd ladder. Select the template that fits you best, whether it's a planner, tracker, calendar, budget, invoice, or something else. Web cd ladder calculator citi has cd options to suit your needs. I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. There are a.

Cd Ladder Excel Spreadsheet —

Each cd will have a different maturity date, so that one of your cds will mature at the frequency you specify. With a bond/cd ladder, by the way, i mean holding a portfolio of bonds and/or cds so the cash flows comprised of maturing cds/bonds plus interest income exactly matches a specified time series of target cash flows over time..

7. CD Ladder Simplified YouTube

You can use cds or ira cds. Web one way to do this is to use a cd ladder calculator excel. Web cd ladder overview the basics step by step quick calculator quick cd ladder calculator choose your terms and total deposit to estimate your earnings. Web table of contents what is a cd ladder? Web cd ladder calculator citi.

Cd Ladder Spreadsheet Template pertaining to Cd Ladder Spreadsheet

Choose from the tools below to see how this simple method could work for you. Web $10k $100k $1m frequency of maturing cd:* ? The fv function gives the future value of an input number, it requires arguments consisting rate, nper (number of period for compounding), pmt (withdrawable amount), pv (investment). Some minimum requirements can reach as high as $10,000.

Cd Ladder Calculator Excel Spreadsheet Spreadsheet Download cd ladder

Web what can a cd ladder do for you? Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Calculator assumes that as each cd in the ladder matures, it is.

Cd Ladder Calculator Excel Spreadsheet —

When you open a cd, you select a term, such as six months, two years. You will have earned $1,304.92 more using cd laddering.* *note that at the end of the time period shown, only a portion of your cd ladder balance is liquid, while the entire single cd balance is liquid. Search spreadsheets by type or topic, or take.

Here’s Why You Should Consider a CD Ladder as a Savings Tool American

Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! Choose from the tools below to see how this simple method could work for you. The first is the interest rate on your cds. Web a while ago i created a little toolkit to design my own bond and/or cd ladder. Web depot template 10 followers.

Cd Ladder Excel Spreadsheet With Cd Ladder Spreadsheet Csserwis — db

Do not throw away your energy! This calculator allows you to work out the best way to invest your money so that you can get the most interest. Use excel fv function to create cd interest calculator in this method we will use the fv function of excel to make a cd interest calculator. Web what can a cd ladder.

Web The Number Of Cds That Will Be In Your Cd Ladder.

Individualize along with manage your very own information. Learn more about citi cds and cd rates. When you open a cd, you select a term, such as six months, two years. Calculator assumes that as each cd in the ladder matures, it is renewed for the term, interest rate, and annual percentage yield (apy) associated with the longest term cd in the laddered portfolio.

Choose Ladder 5 Year Ladder Total Initial Amount $ Calculate

I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. This calculator assumes that you redeposit all matured cds into new cds that have a term of the longest maturity in your original cd ladder. Search spreadsheets by type or topic, or take a look around by browsing the catalog.

If You're Looking For A Savings Strategy With Both Short And Long Term Benefits, Consider Cd Laddering.

Some minimum requirements can reach as high as $10,000 while other banks don’t require a minimum at. With a bond/cd ladder, by the way, i mean holding a portfolio of bonds and/or cds so the cash flows comprised of maturing cds/bonds plus interest income exactly matches a specified time series of target cash flows over time. The first is the interest rate on your cds. Select the template that fits you best, whether it's a planner, tracker, calendar, budget, invoice, or something else.

You Will Have Earned $1,304.92 More Using Cd Laddering.* *Note That At The End Of The Time Period Shown, Only A Portion Of Your Cd Ladder Balance Is Liquid, While The Entire Single Cd Balance Is Liquid.

However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! Web this calculator will help you build a cd ladder that's right for you. Web one way to do this is to use a cd ladder calculator excel.