Chapter 13 Test Accounting

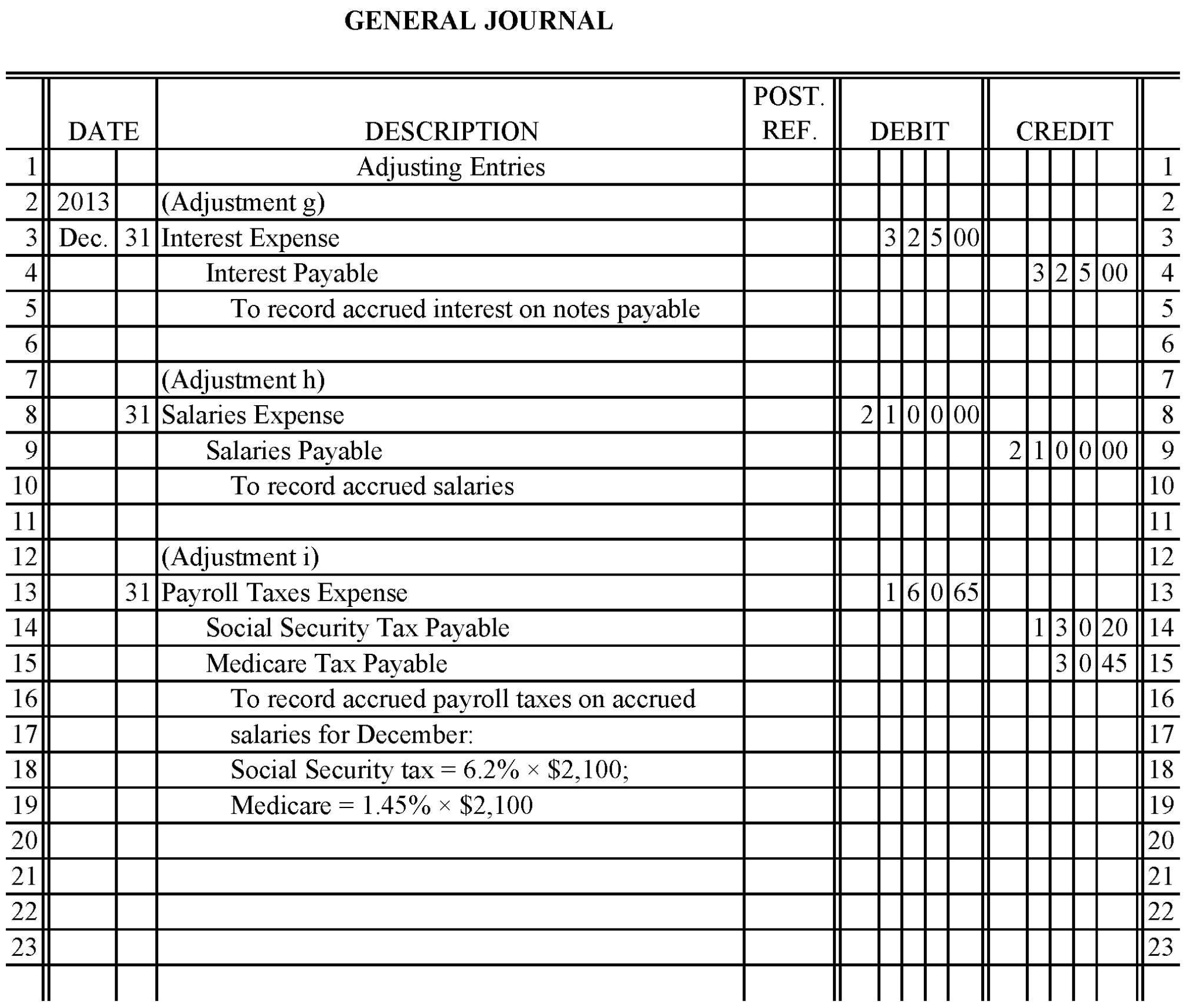

Chapter 13 Test Accounting - Click the card to flip 👆 salaries. Kristina russo | cpa, mba, author. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her. Web 35 basic accounting test questions. Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Determination of gain or loss, basis considerations, and nontaxable exchanges. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Take this short quiz to. Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Web accounting chapter 13 test review t/f:

Web describe the nature, type, and valuation of current liabilities. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Kristina russo | cpa, mba, author. Web accounting chapter 13 test review t/f: Take this short quiz to. Web test bank chapter 13 property transactions: Determination of gain or loss, basis considerations, and nontaxable exchanges. Web 35 basic accounting test questions. Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each.

Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web accounting chapter 13 test review t/f: Web 35 basic accounting test questions. Web test bank chapter 13 property transactions: Governmental auditing standards identifies four categories of professional. When a business transfers money from its regular checking account to the payroll. Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Kristina russo | cpa, mba, author. Web accounting chapter 13 study guide. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her.

UpWork (oDesk) & Elance Accounting Principles Test Question & Answers

Web 1.1 define managerial accounting and identify the three primary responsibilities of management 1.2 distinguish between. Governmental auditing standards identifies four categories of professional. Determination of gain or loss, basis considerations, and nontaxable exchanges. Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Web accounting chapter.

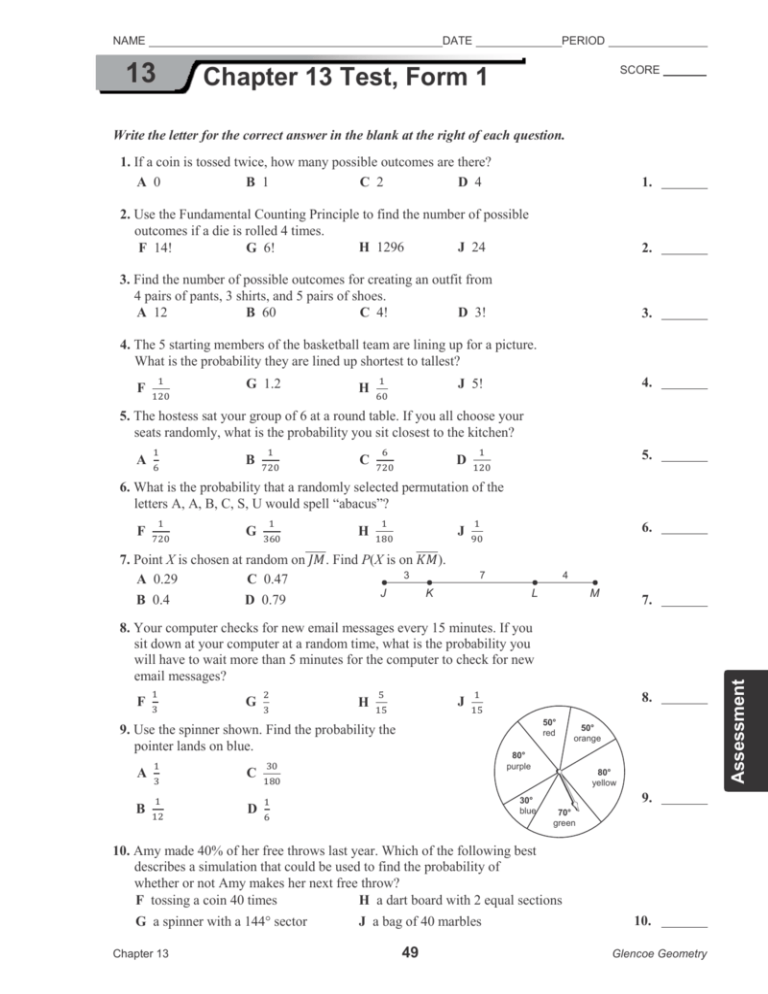

chapter 13 test form 1

Web 35 basic accounting test questions. Take this short quiz to. Web the management approach to the definition of segments for financial reporting expects a company to: Web 1.1 define managerial accounting and identify the three primary responsibilities of management 1.2 distinguish between. Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle:

Accounting Principles 13th Edition Weygandt Test Bank by Soraka Issuu

This expresses each item as a percent of a. Take this short quiz to. Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Web 35 basic accounting test questions. Click the card to flip 👆 salaries.

135 Mastery Accounting 1 YouTube

Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Describe the nature, type, and valuation of current liabilities. Web accounting chapter 13 test review t/f: Web terms in this set (20) the ss tax is.

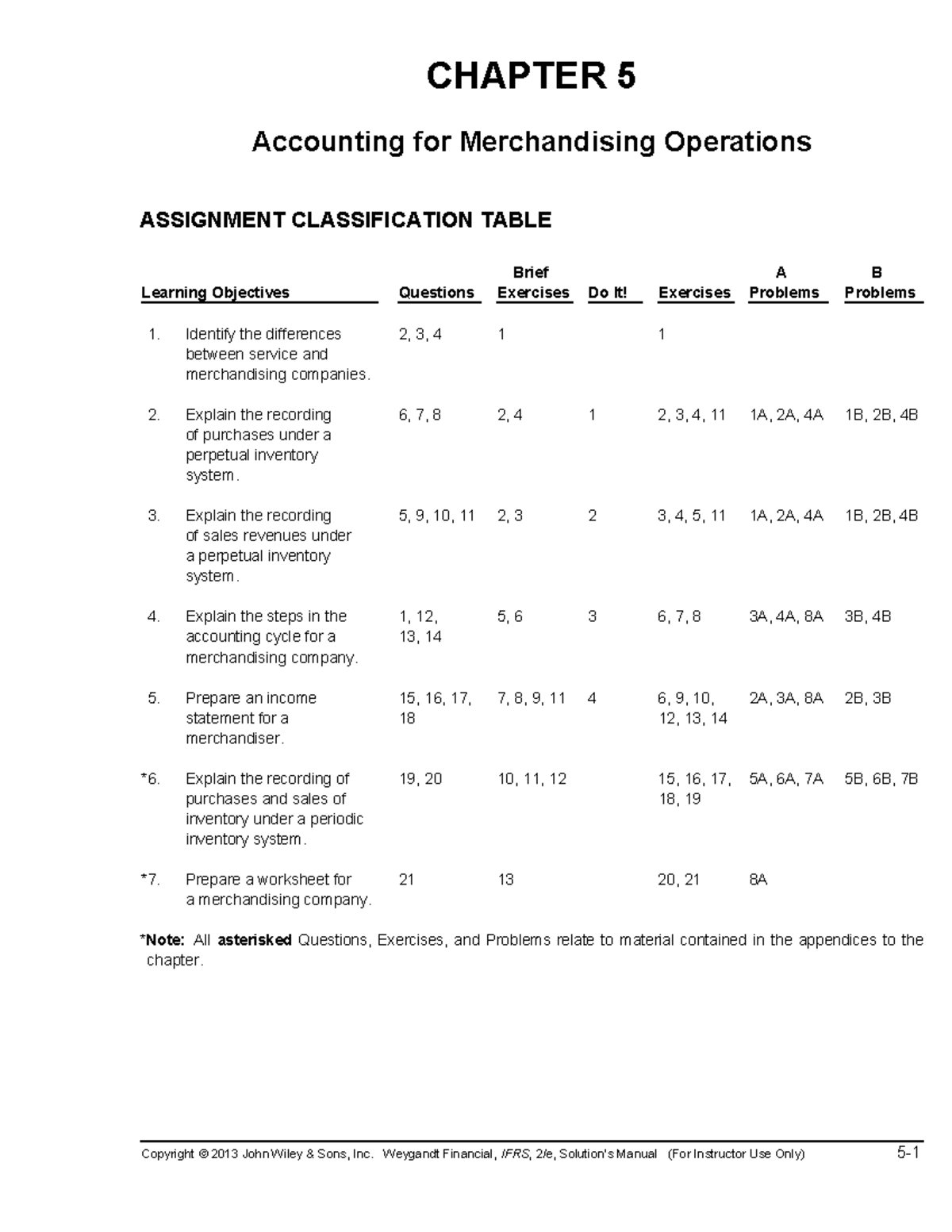

Ch05solutions Accounting Principles 13th Edition chapter 5 solutions

Describe the nature, type, and valuation of current liabilities. Governmental auditing standards identifies four categories of professional. Click the card to flip 👆 salaries. Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Web 1.1 define managerial accounting and identify the three primary responsibilities of management 1.2.

Chapter 4 DoubleEntry Accounting Test

Web describe the nature, type, and valuation of current liabilities. Click the card to flip 👆 salaries. Web accounting chapter 13 test review t/f: Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web test bank chapter 13 property transactions:

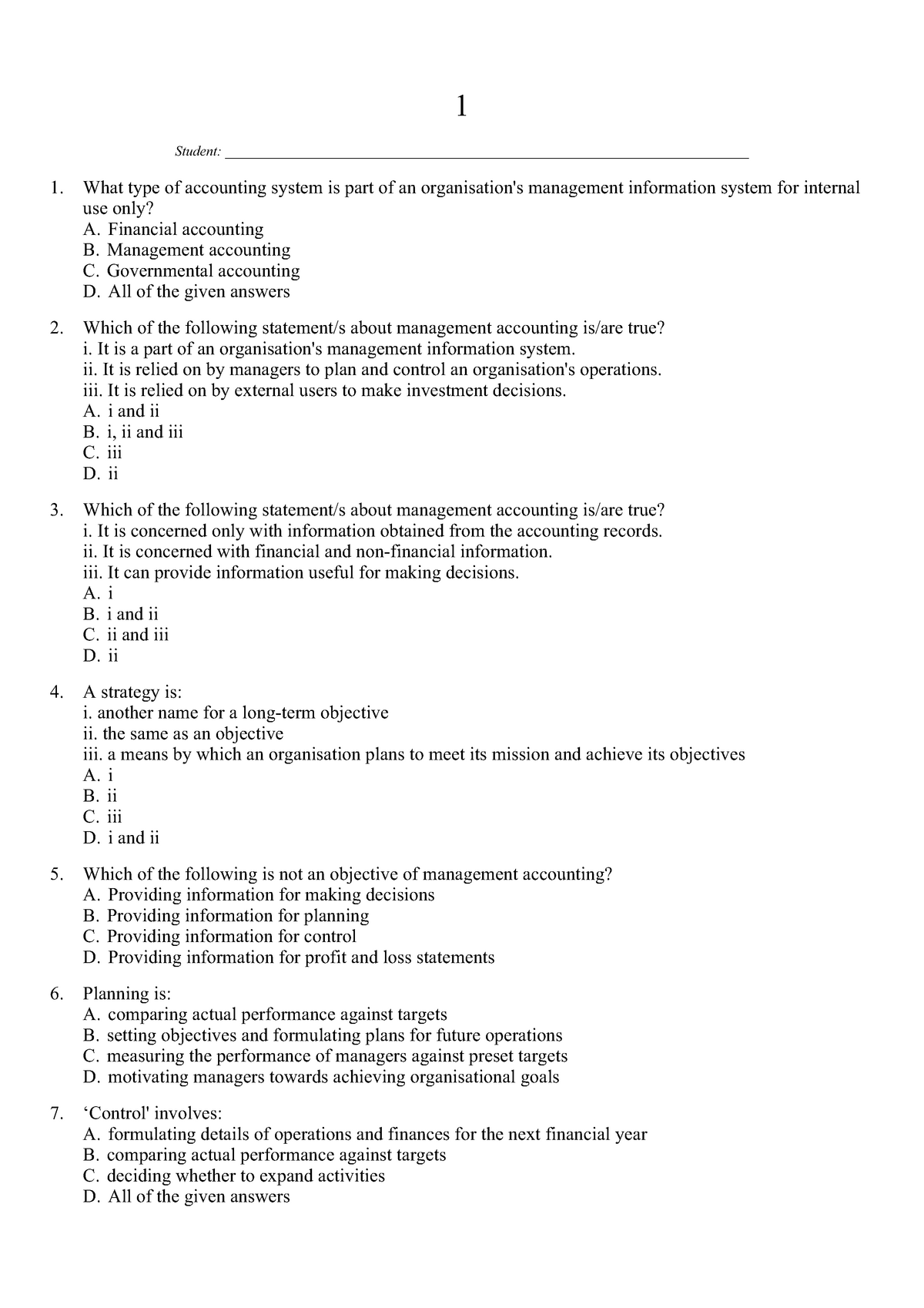

1 practice accounting questioins with answers StuDocu

This expresses each item as a percent of a. Web terms in this set (20) the ss tax is paid by both the employer and employees. Web test bank chapter 13 property transactions: When a business transfers money from its regular checking account to the payroll. Web show changes in the relative importance of each financial statement item.

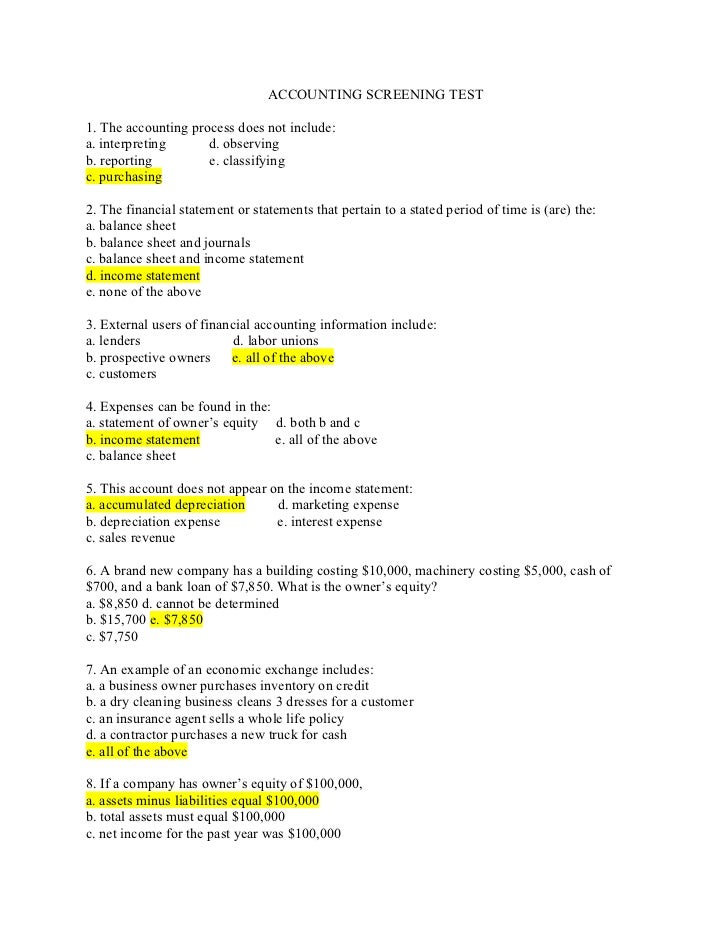

Accounting screening test

Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Click the card to flip 👆 salaries. Web test bank chapter 13 property transactions: Describe the nature, type, and valuation of current liabilities. Web describe the nature, type, and valuation of current liabilities.

accounting transactions exercises with answers pdf

Governmental auditing standards identifies four categories of professional. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Web test bank chapter 13 property transactions: Web accounting chapter 13 study guide. Web accounting chapter 13 test review t/f:

Glencoe Accounting Chapter 10 Answer Key Gamers Smart

This expresses each item as a percent of a. Kristina russo | cpa, mba, author. When a business transfers money from its regular checking account to the payroll. Web 35 basic accounting test questions. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her.

Click The Card To Flip 👆 Salaries.

Governmental auditing standards identifies four categories of professional. Web accounting chapter 13 test review t/f: Web accounting chapter 13 study guide. Determination of gain or loss, basis considerations, and nontaxable exchanges.

Kristina Russo | Cpa, Mba, Author.

Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Take this short quiz to. Web describe the nature, type, and valuation of current liabilities.

Web 35 Basic Accounting Test Questions.

Web accounting information systems, 14e (romney/steinbart) chapter 13 the expenditure cycle: Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Describe the nature, type, and valuation of current liabilities. Web the management approach to the definition of segments for financial reporting expects a company to:

This Expresses Each Item As A Percent Of A.

When a business transfers money from its regular checking account to the payroll. Web show changes in the relative importance of each financial statement item. Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Web terms in this set (20) the ss tax is paid by both the employer and employees.