Chapter 7 Bankruptcy Secured Debt

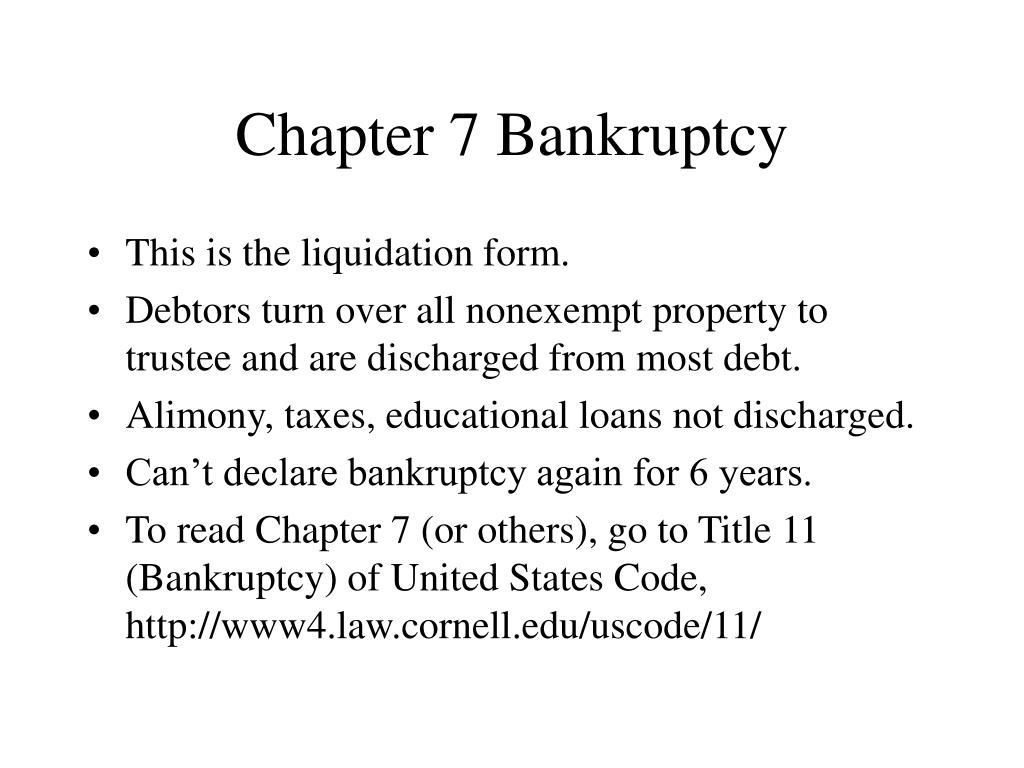

Chapter 7 Bankruptcy Secured Debt - The filings, which are dated august 9, are for two related entities: Is a secured credit card right for me? Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Reduce debt with bbb & afcc accredited debt consolidation companies. Compare online the best debt loans. Apply today for financial freedom! You might be able to keep financed. Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Web chapter 7 bankruptcy —also called straight or liquidation bankruptcy—is designed to give you a fresh start by wiping out many types of debt. Start your path to solvency.

Web chapter 7 bankruptcy —also called straight or liquidation bankruptcy—is designed to give you a fresh start by wiping out many types of debt. For example, your mortgage is secured by your home. However, some forms of debt, such as back taxes, court. Start your path to solvency. Reduce debt with bbb & afcc accredited debt consolidation companies. Ad debt consolidation is the first step toward a healthy financial life. Web recommended on wall street william cohan apollo’s mission in finance but in the frantic weeks leading up to the bankruptcy, no superior rival financing offer had materialised. Web most debt settlement companies don’t settle secured debts. Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Web secured debts in chapter 7 bankruptcy:

The filings, which are dated august 9, are for two related entities: Web most debt settlement companies don’t settle secured debts. What happens to secured credit card debt in. Ad debt consolidation is the first step toward a healthy financial life. Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured debt payments, is not less than the lesser of (i) 25% of the debtor's nonpriority unsecured debt, or $9,075,. By cara o'neill, attorney updated:. Findlaw covers debt discharge 101 when you file chapter 7. Web bankruptcy is the legal process in which a person’s debts are discharged, making the debtor no longer liable for their dischargeable debts. If only one spouse in a marriage owes debt, only that partner.

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

Compare online the best debt loans. By cara o'neill, attorney updated:. Web babylon is seeking chapter 7 relief, which means it plans to liquidate assets rather than attempt to restructure. Web secured debts in chapter 7 bankruptcy: Web a person with secured debt who files chapter 7 bankruptcy has three options for resolving the debt.

Does Chapter 7 Bankruptcy Wipe Out All Debt in New York? Michael H

Web secured debts in chapter 7 bankruptcy: If you default on your loan, the lender can sell. A secured debt is one that is secured by property, which the creditor can take if you default. Web what happens to secured debt in a chapter 7 bankruptcy? For example, your mortgage is secured by your home.

Secured and Unsecured Debt Limitations Under Chapter 13

Bankruptcy court honorable john c melaragno current as of 8/25/2023 at 2:28 pm tuesday, august 29, 2023. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. Findlaw covers debt discharge 101 when you file chapter 7. Web chapter 7 bankruptcy —also called straight or liquidation bankruptcy—is designed to give you a fresh.

Long Island Chapter 7 Bankruptcy Lawyer Macco Law Group

Apply today for financial freedom! Web chapter 7 bankruptcy allows liquidation of assets to pay creditors. Web secured debts in chapter 7 bankruptcy: Web babylon is seeking chapter 7 relief, which means it plans to liquidate assets rather than attempt to restructure. Compare online the best debt loans.

When Does Chapter 7 Bankruptcy Fall Off Credit Report Bankruptcy Talk

Web a person with secured debt who files chapter 7 bankruptcy has three options for resolving the debt. Learn when a bankruptcy trustee will sell your home or car and use the proceeds to pay other creditors. Reduce debt with bbb & afcc accredited debt consolidation companies. An overview learn about secured debts, what happens to them in bankruptcy, and.

PPT Lecture 18 The Democratization of Finance Consumer Finance

In a chapter 11 bankruptcy, the company. However, some forms of debt, such as back taxes, court. Findlaw covers debt discharge 101 when you file chapter 7. The filings, which are dated august 9, are for two related entities: Reduce debt with bbb & afcc accredited debt consolidation companies.

Can I File Chapter 7 Bankruptcy to Get Rid Of Business Debt? Karra L

Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Findlaw covers debt discharge 101 when you file chapter 7. For example, your mortgage is secured by your home. Reduce debt with bbb & afcc accredited debt consolidation companies. Redeeming secured property in chapter 7 bankruptcy.

Chapter 7 Bankruptcy Consumer Law Pro

Ad don't declare bankruptcy before comparing consolidation loans. In return, the bankruptcy trustee sells (liquidates) your nonexempt. #1 complaint to determine the dischargeability of debt. Chapter 7 bankruptcy stays on your credit report for ten years, while chapter 13 remains for seven years. Web when will the trustee pay secured debt in chapter 7 bankruptcy?

Chapter 7 Bankruptcy Attorney Burrow & Associates

Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Web learn which debts will go away in a chapter 7 bankruptcy and which debts you need to pay off. In a chapter 11 bankruptcy, the company. Ad debt consolidation is the first step toward a healthy financial life. Web.

Infographic Chapter 7 vs. Chapter 13 Bankruptcy Richard M. Weaver

Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of real property (like a house or land) or personal property (like a car). Web a secured creditor's rights in chapter 7 because the secured creditor has a payment mechanism in place, if money is available to distribute to creditors, a secured creditor.

Start Your Path To Solvency.

If you default on your loan, the lender can sell. Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. A secured debt is one that is secured by property, which the creditor can take if you default. #1 complaint to determine the dischargeability of debt.

Web Abuse Is Presumed If The Debtor's Current Monthly Income Over 5 Years, Net Of Certain Statutorily Allowed Expenses And Secured Debt Payments, Is Not Less Than The Lesser Of (I) 25% Of The Debtor's Nonpriority Unsecured Debt, Or $9,075,.

Web a person with secured debt who files chapter 7 bankruptcy has three options for resolving the debt. Priority debt includes domestic support obligations and. For example, your mortgage is secured by your home. In a chapter 11 bankruptcy, the company.

Web In A Chapter 7 Bankruptcy, The Assets Of A Business Are Liquidated To Pay Its Creditors, With Secured Debts Taking Precedence Over Unsecured Debts.

Bankruptcy court honorable john c melaragno current as of 8/25/2023 at 2:28 pm tuesday, august 29, 2023. Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of real property (like a house or land) or personal property (like a car). Compare online the best debt loans. Web babylon is seeking chapter 7 relief, which means it plans to liquidate assets rather than attempt to restructure.

Unsecured Priority Debt Is Paid First In A Chapter 7, After Which Comes Secured Debt And Then Nonpriority Unsecured Debt.

Is a secured credit card right for me? Web bankruptcy is the legal process in which a person’s debts are discharged, making the debtor no longer liable for their dischargeable debts. By cara o'neill, attorney updated:. How do i choose the best secured credit card?