Clark County Tax Cap Form

Clark County Tax Cap Form - Home government elected officials county treasurer forms. Property owners have been lined up outside. However, time is running out for this fiscal year. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Clarke was a sixth kansas cavalry captain. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Grand central parkway or emailed to. Web las vegas, nev. Web it was a part of ford county previously. It's important to fill out the card or your tax rate could increase by.

This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Clarke was a sixth kansas cavalry captain. It's important to fill out the card or your tax rate could increase by. Web it was a part of ford county previously. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. 27, 2023 at 4:53 pm pdt las vegas, nev. Web the recorder's office provides the following blank forms search for file name: Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web more information on the requirements can be found on the exemption page. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property tax caps on residential properties, and.

Web a clark county assessor addresses the property tax cap situation. Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence. Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. Real property excess proceeds application. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. The form can be printed from pdfor word format. Web this is referred to as the tax cap. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage. Clarke was a sixth kansas cavalry captain. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property tax caps on residential properties, and.

Clark County Tax Cap Form Clark County Assessors Office EveDonusFilm

Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill. Web a clark county assessor addresses the property tax cap situation. Clark county is located in the. Web las vegas, nev. Web this is referred to as the tax cap.

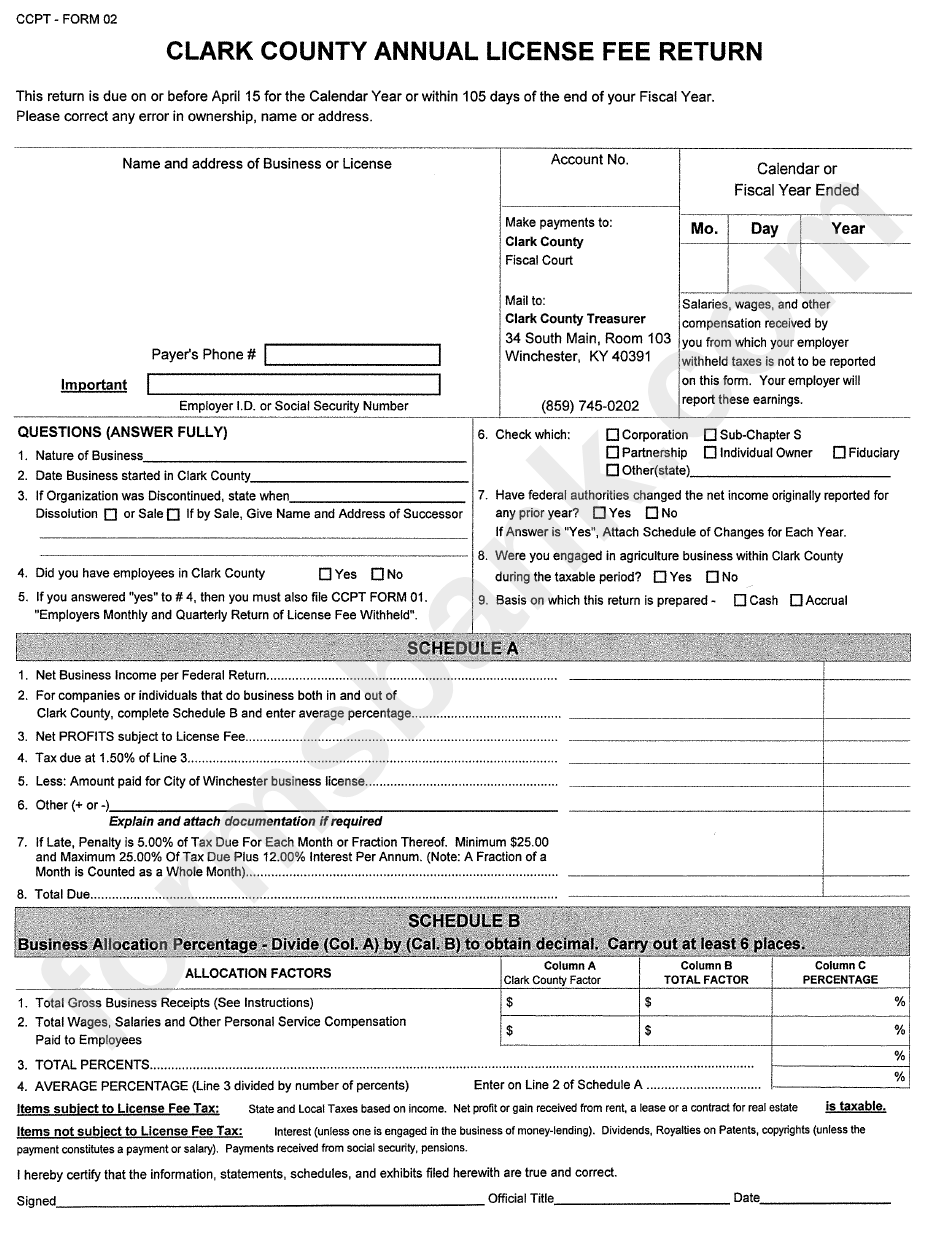

Ccpt Form 02 Annual License Fee Return Clark Country printable pdf

Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Grand central parkway or emailed to. Web (fox5) by alexis fernandez published: This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web the recorder's office provides the following blank forms.

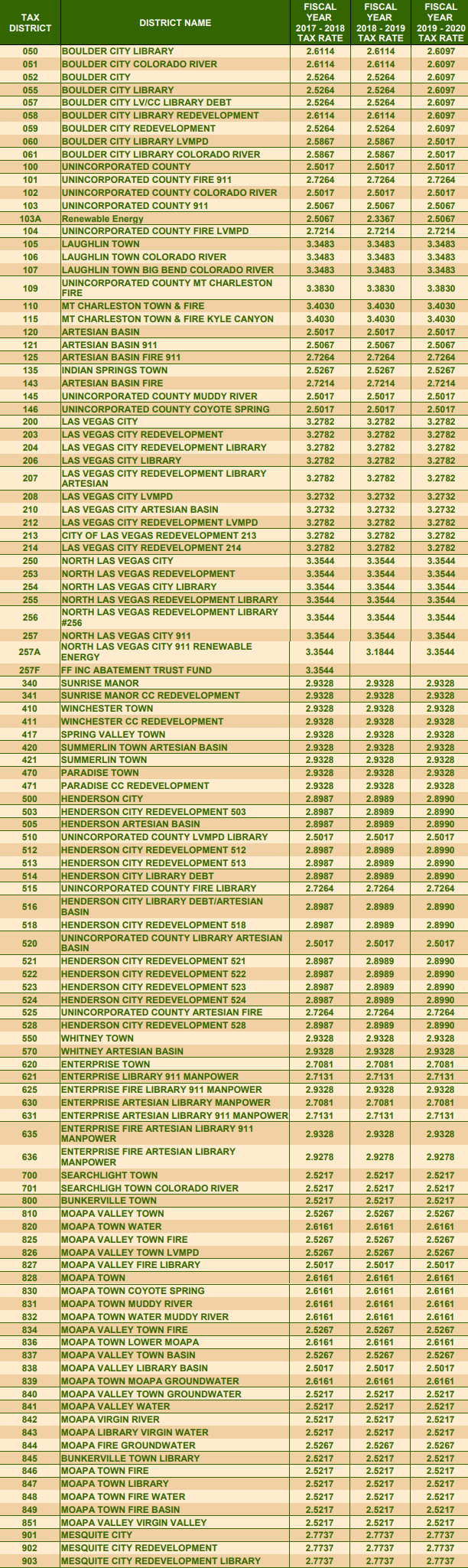

Clark County Tax Rates for 2019/2020

People still have until next year to apply for the 3 percent tax cap. Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. The assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in. Web more information on the requirements can be found on the exemption.

Clark County Tax Cap Form {June 2022} Find Essential Details!

Home government elected officials county treasurer forms. Clarke was a sixth kansas cavalry captain. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. The county was named after charles f. Property owners have been lined up outside.

Clark County's Property Tax Cap...What You Need to Know YouTube

Forms 7 documents real property transfer tax (rptt) 7 documents recording documents 2. 27, 2023 at 4:53 pm pdt las vegas, nev. Grand central parkway or emailed to. Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence. Web this is referred to as the tax cap.

Clark County PDF

Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage. Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. The form can be printed from.

Clark County Alarm Permit Form Fill Out and Sign Printable PDF

Grand central parkway or emailed to. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web the recorder's office provides the following blank forms search for file name: Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will.

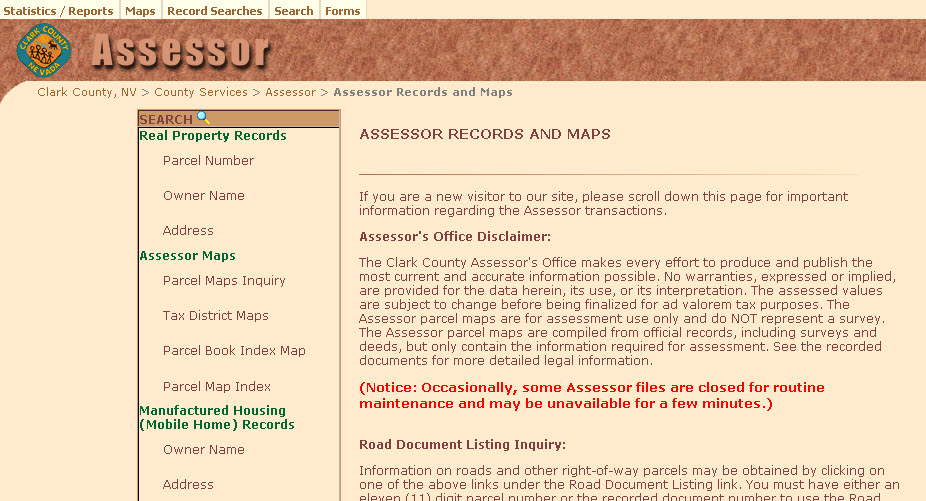

Clark County assessor AmanaAiofe

Clarke was a sixth kansas cavalry captain. Property owners have been lined up outside. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web this is referred to as the tax cap.

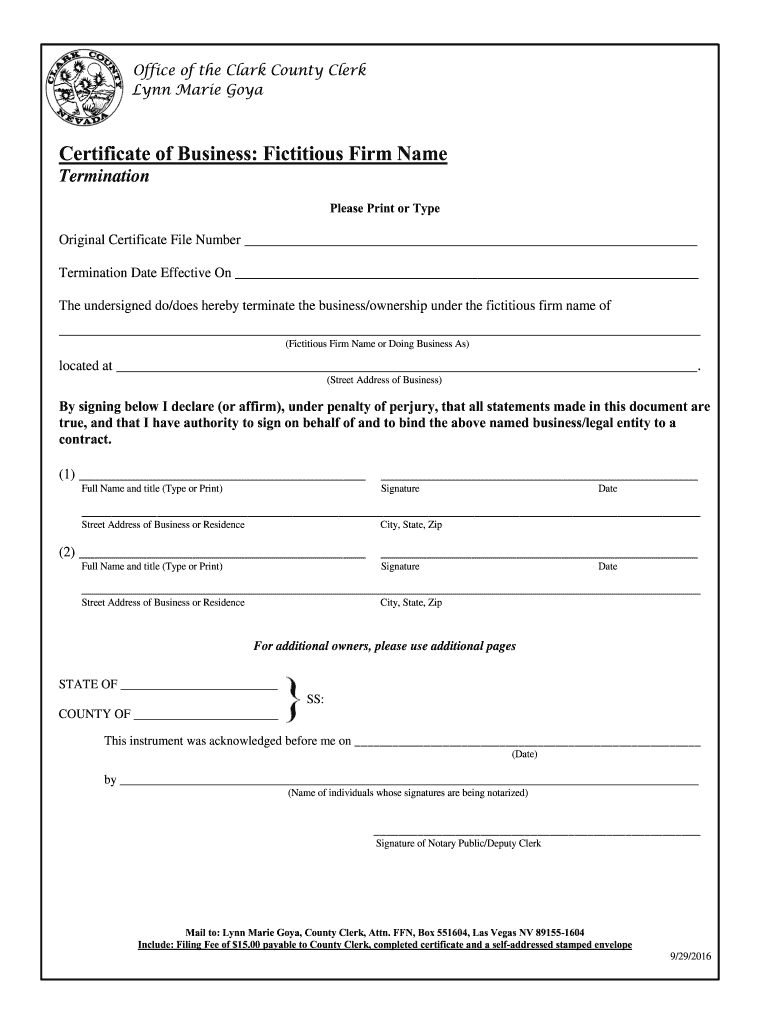

Clark County Fictitious Firm Name Search Form Fill Out and Sign

However, time is running out for this fiscal year. Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property tax caps on residential properties, and. Web.

Clark County Assessor’s Office to mail out property tax cap notices

Property owners have been lined up outside. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill..

Web It Was A Part Of Ford County Previously.

Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property tax caps on residential properties, and. Web a clark county assessor addresses the property tax cap situation.

Clark County Is Located In The.

Web this is referred to as the tax cap. Web (fox5) by alexis fernandez published: The assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in. Web under state law as a property owner, you can apply for a three percent tax cap on your primary residence.

Web More Information On The Requirements Can Be Found On The Exemption Page.

Web the clark county assessor's office just finished mailing out tax cap abatement notices. The form can be printed from pdfor word format. Clarke was a sixth kansas cavalry captain. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today.

The County Was Named After Charles F.

Web the recorder's office provides the following blank forms search for file name: Web return this form by mail or email to: 27, 2023 at 4:53 pm pdt las vegas, nev. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov).