Colorado Form 104

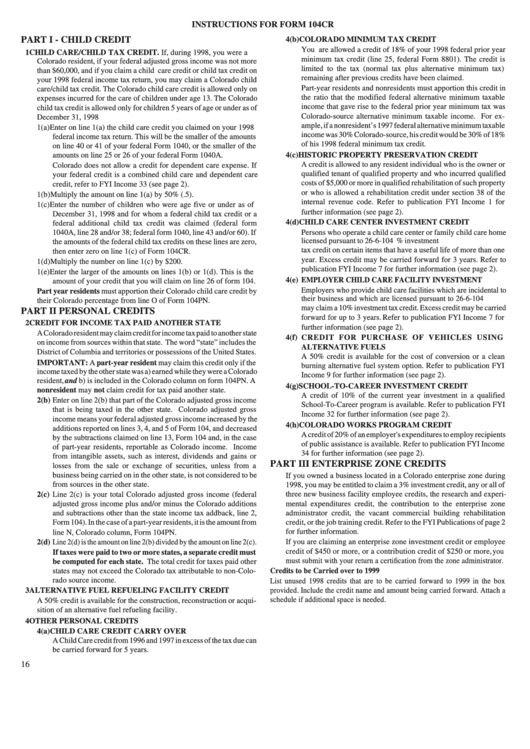

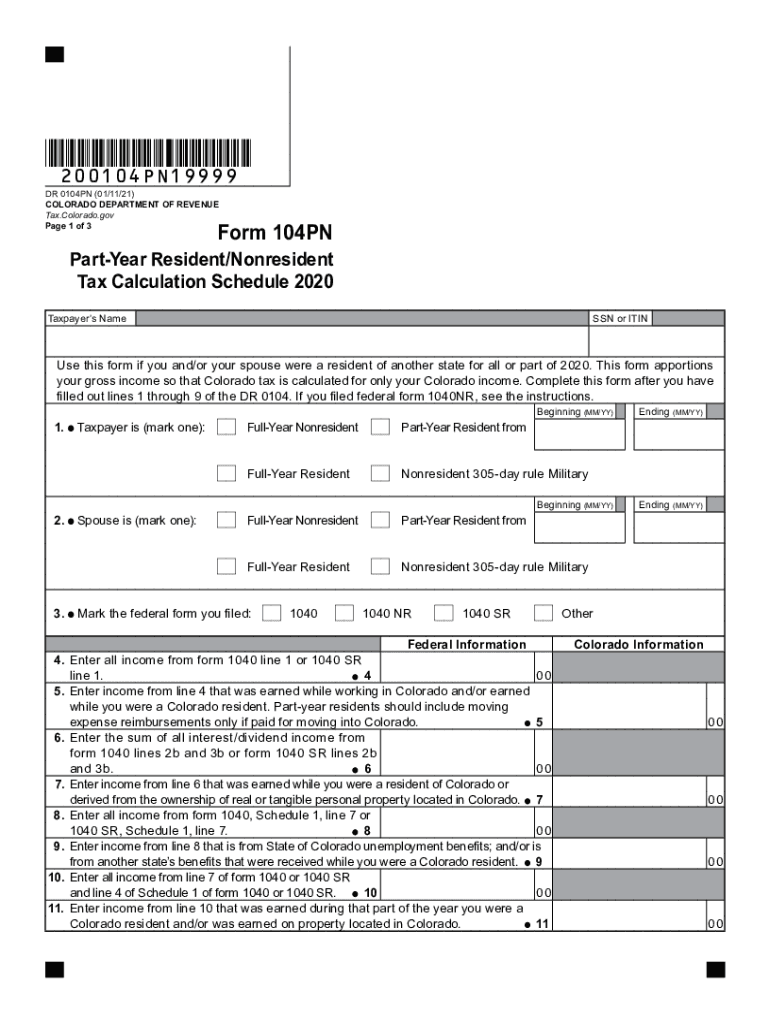

Colorado Form 104 - Generally, you must file this return if you are required to file a federal income tax return with the irs for this year or will have a colorado income tax liability for this year and you are: We last updated colorado form 104 in february 2023 from the colorado department of revenue. This form apportions your gross income so that colorado tax is calculated for only your colorado income. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Web each year you must evaluate if you should file a colorado income tax return. Web colorado state income tax form 104 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Additions to federal taxable income You may file by mail with paper forms or efile online. Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax year 2022. You must pay estimated income tax if you are self employed or do not pay.

Web colorado state income tax form 104 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. You must pay estimated income tax if you are self employed or do not pay. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web city state zip code foreign country (if applicable) enter federal taxable income from your federal income tax form: Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Additions to federal taxable income Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax year 2022. Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web each year you must evaluate if you should file a colorado income tax return. You can print other colorado tax.

We last updated colorado form 104 in february 2023 from the colorado department of revenue. Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web each year you must evaluate if you should file a colorado income tax return. You can print other colorado tax. You may file by mail with paper forms or efile online. Web colorado state income tax form 104 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. This form apportions your gross income so that colorado tax is calculated for only your colorado income. Additions to federal taxable income Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023.

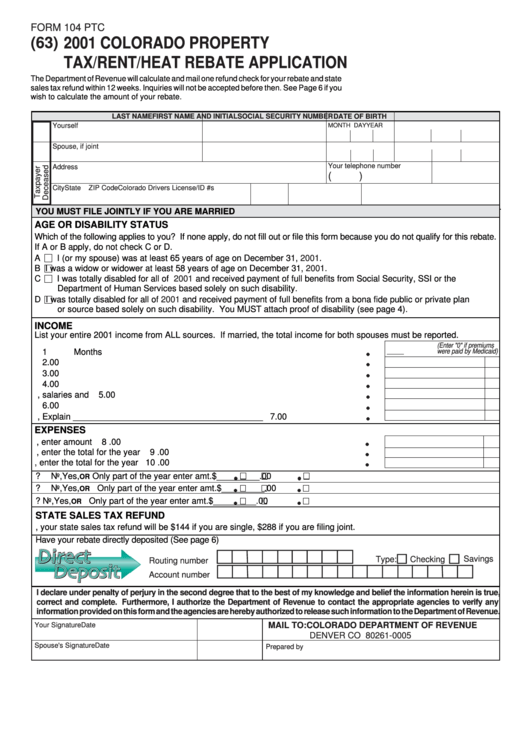

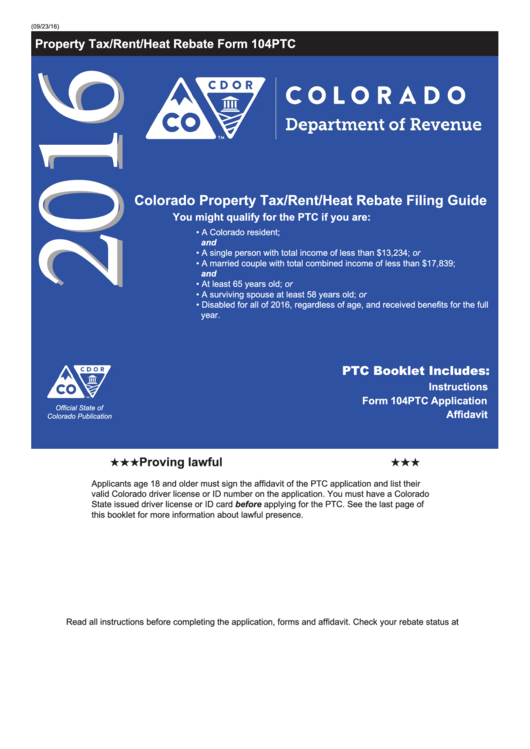

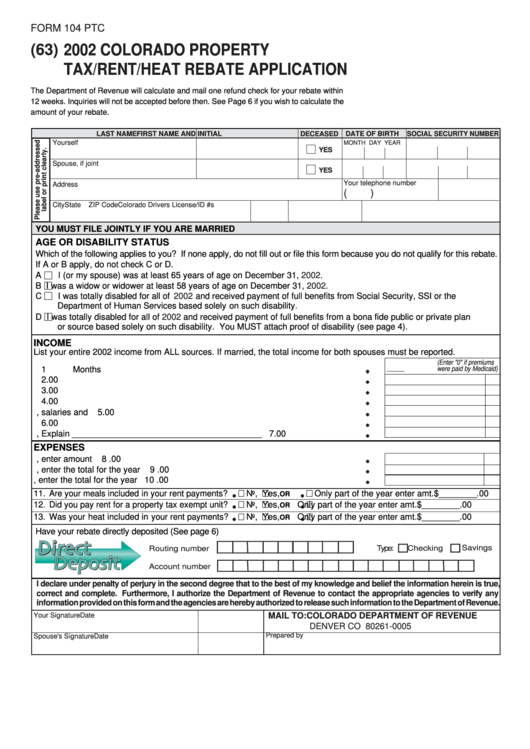

Form 104 Ptc Colorado Property Tax/rent/heat Rebate Application

You must pay estimated income tax if you are self employed or do not pay. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. This form.

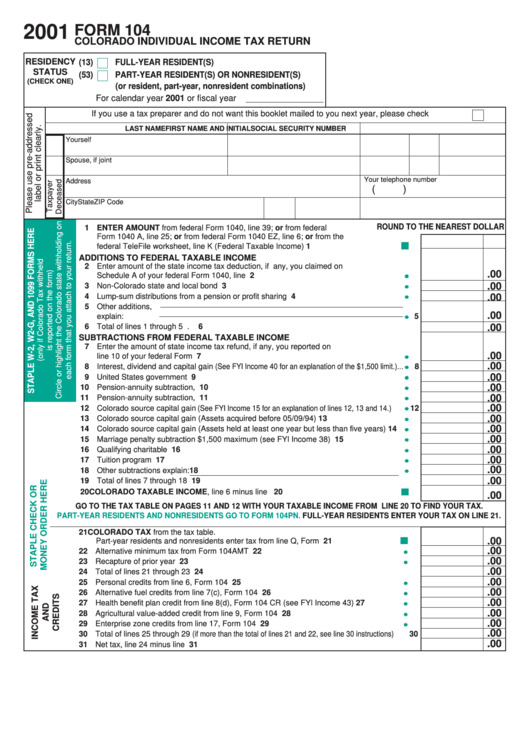

Form 104 Colorado Individual Tax Return 2001 printable pdf

This form apportions your gross income so that colorado tax is calculated for only your colorado income. You must pay estimated income tax if you are self employed or do not pay. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. You can print other colorado tax. Additions to federal.

Top 5 Colorado Form 104 Templates free to download in PDF format

Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. This form apportions your gross income so that colorado tax is calculated for only your colorado income. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file.

Colorado 2015 form 104 Fill out & sign online DocHub

Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax year 2022. Generally, you must file this return if you are required to file a federal income tax return with the irs for this year or will have a colorado income tax liability for this.

How To File Colorado Tax Taxes The Finance Gourmet

You must pay estimated income tax if you are self employed or do not pay. Web each year you must evaluate if you should file a colorado income tax return. Additions to federal taxable income Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax.

Fillable Form 104 Ptc Colorado Property Tax/rent/heat Rebate

Web colorado state income tax form 104 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You can print other colorado tax. We last updated colorado form 104 in february.

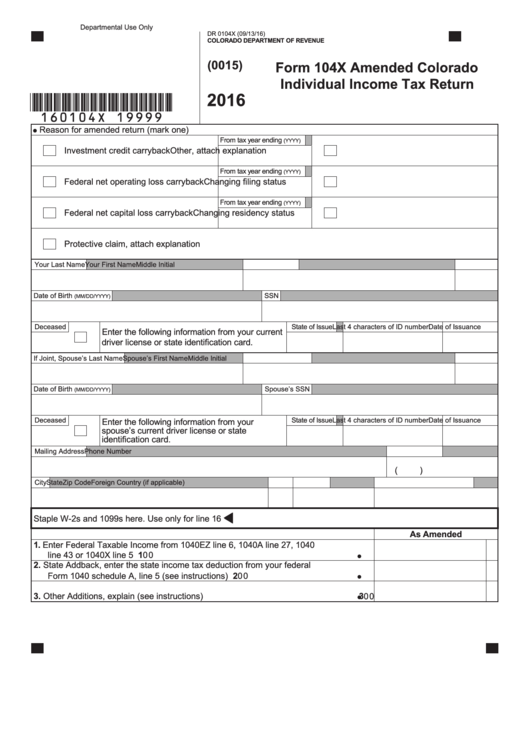

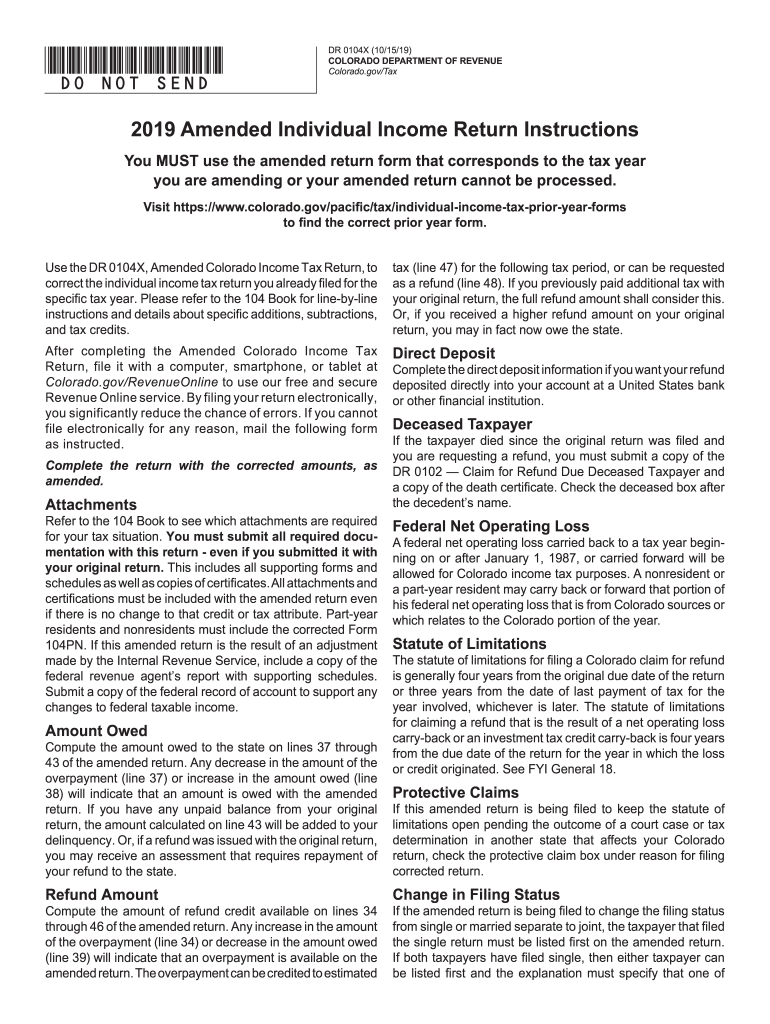

Fillable Form 104x Amended Colorado Individual Tax Return

We last updated colorado form 104 in february 2023 from the colorado department of revenue. Web each year you must evaluate if you should file a colorado income tax return. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web colorado state income tax form 104 must be postmarked by april 18, 2023.

Colorado Form 104X Fill Out and Sign Printable PDF Template signNow

Web colorado state income tax form 104 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. This form is for income earned in tax year 2022, with tax returns due in april 2023. Additions to federal taxable income You must pay estimated income tax if you are self employed or do not pay. You.

Individual Tax Form 104 Colorado Free Download

Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax year 2022. We last updated colorado form 104 in february 2023 from the colorado department of.

Form 104 Ptc Colorado Property Tax/rent/heat Rebate Application

Generally, you must file this return if you are required to file a federal income tax return with the irs for this year or will have a colorado income tax liability for this year and you are: Additions to federal taxable income This form apportions your gross income so that colorado tax is calculated for only your colorado income. We.

Web Colorado State Income Tax Form 104 Must Be Postmarked By April 18, 2023 In Order To Avoid Penalties And Late Fees.

Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. We last updated colorado form 104 in february 2023 from the colorado department of revenue. Printable colorado state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You can print other colorado tax.

This Form Apportions Your Gross Income So That Colorado Tax Is Calculated For Only Your Colorado Income.

Web we last updated the colorado income tax return in february 2023, so this is the latest version of form 104, fully updated for tax year 2022. You must pay estimated income tax if you are self employed or do not pay. You may file by mail with paper forms or efile online. Web city state zip code foreign country (if applicable) enter federal taxable income from your federal income tax form:

Web Form 104 Is The General, And Simplest, Income Tax Return For Individual Residents Of Colorado.

Additions to federal taxable income Web each year you must evaluate if you should file a colorado income tax return. Generally, you must file this return if you are required to file a federal income tax return with the irs for this year or will have a colorado income tax liability for this year and you are: This form is for income earned in tax year 2022, with tax returns due in april 2023.