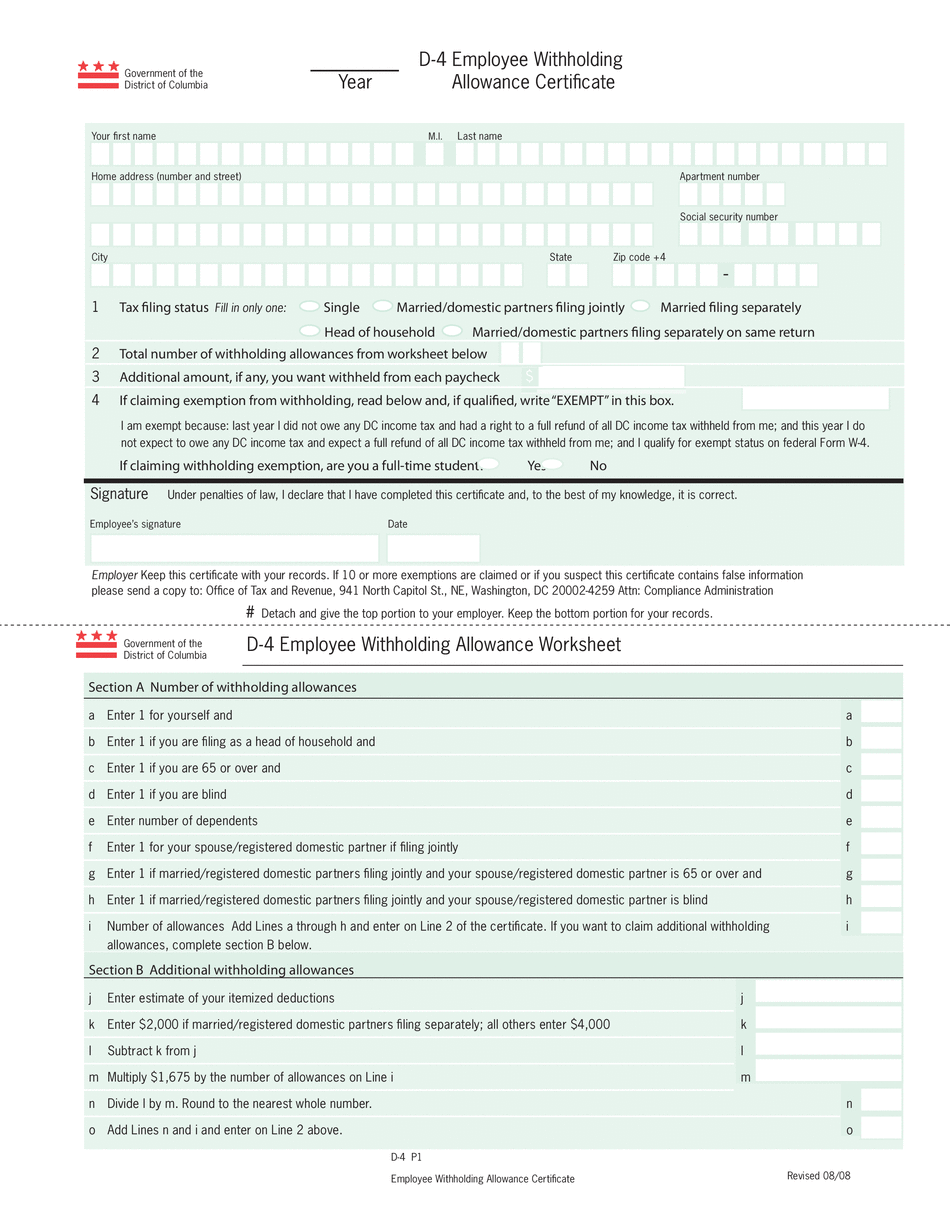

Dc Withholding Form 2022

Dc Withholding Form 2022 - Washington — the internal revenue service today reminded individuals and businesses in parts of four states that their 2022 federal. File with employer when starting new employment or when claimed allowances change. If too little is withheld, you will generally owe tax when. If you are not liable for dc income. Web washington, dc tax forms and publications in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes. Web dc inheritance and estate tax forms; If you are not liable for dc income. Withholding tax forms for 2023 filing season (tax year 2022/2023) The new irs federal tax rates have been implemented, which may impact your federal tax withholding amounts from your. On or before april 18,.

If you are not liable for dc income. Withholding tax forms for 2023 filing season (tax year 2022/2023) File with employer when starting new employment or when claimed allowances change: If you are not liable for dc taxes because you. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Washington — the internal revenue service today reminded individuals and businesses in parts of four states that their 2022 federal. Web friday, may 20, 2022. Withholding tax registration (part iii) • sales and use tax. Web dc tax withholding form. Web dc inheritance and estate tax forms;

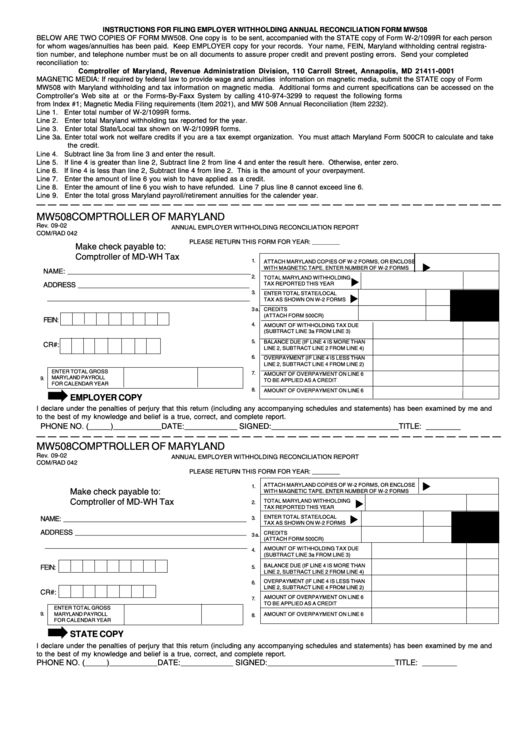

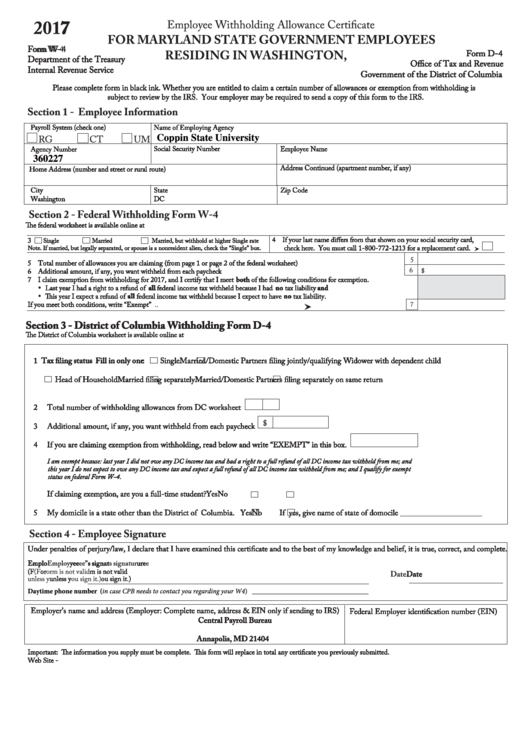

File with employer when starting new employment or when claimed allowances change: If you are not liable for dc taxes because you. If you are not liable for dc income. Web dc inheritance and estate tax forms; Withholding tax registration (part iii) • sales and use tax. Web employee withholding allowance certificate for maryland state government employees residing in washington, d.c. File with employer when starting new employment or when claimed allowances change. Web employee withholding allowance certificate. If too little is withheld, you will generally owe tax when. If you are not liable for dc taxes because.

Form d 4a Fill out & sign online DocHub

If too little is withheld, you will generally owe tax when. File with employer when starting new employment or when claimed allowances change. Withholding tax registration (part iii) • sales and use tax. File with employer when starting new employment or when claimed allowances change: Individual income tax forms and instructions for single and joint filers with no dependents and.

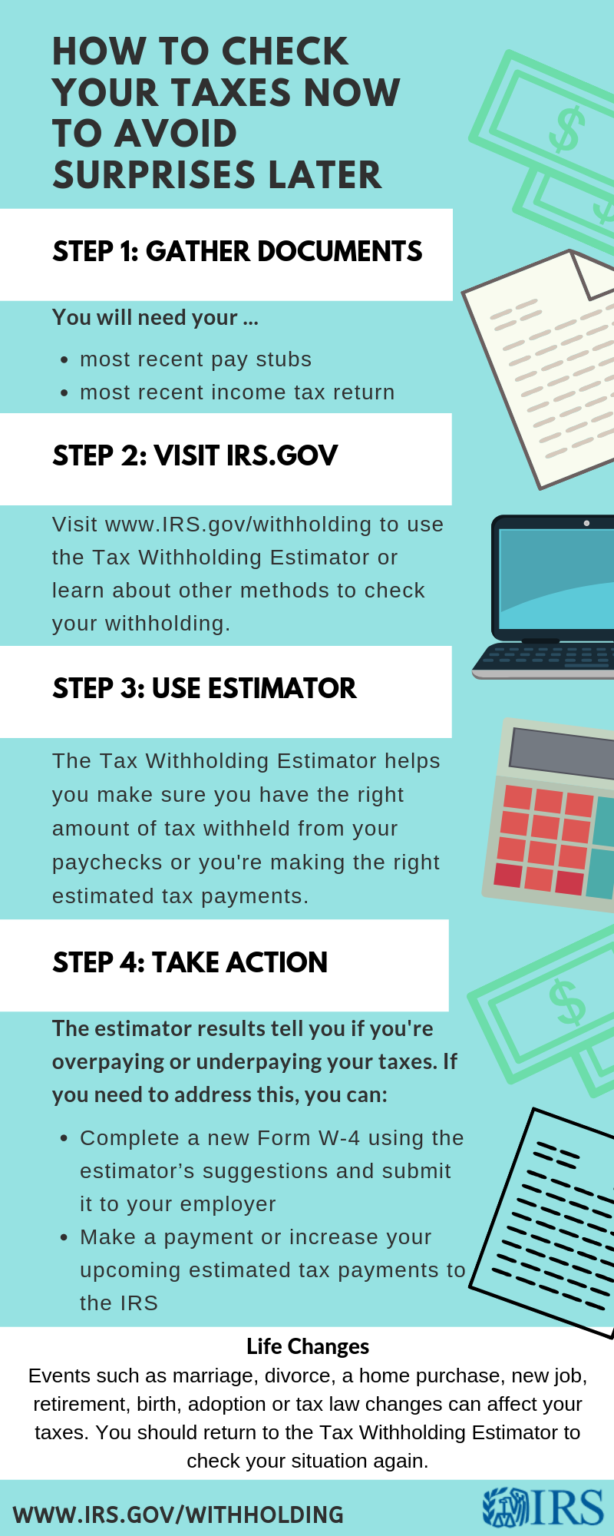

Tax Withholding Estimator 2022 Federal Withholding Tables 2021

On or before april 18,. Withholding tax forms for 2023 filing season (tax year 2022/2023) Web employee withholding allowance certificate for maryland state government employees residing in washington, d.c. Unless changes are required, employees who have submitted a w. If you are not liable for dc taxes because you.

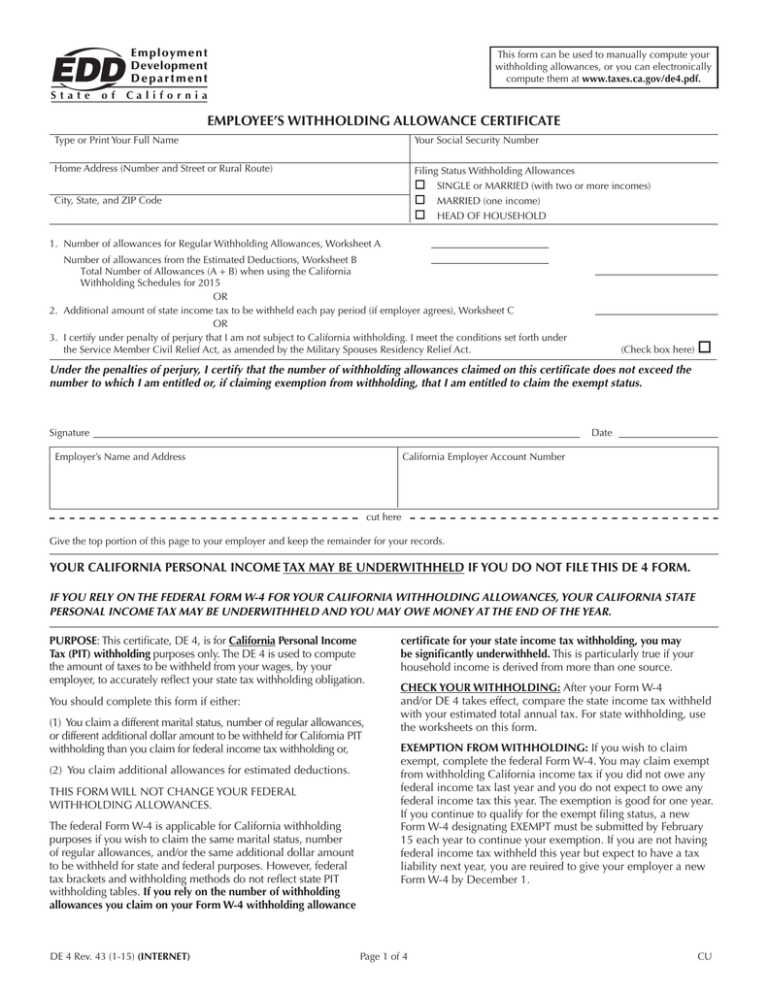

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

If too little is withheld, you will generally owe tax when. If you are not liable for dc taxes because. File with employer when starting new employment or when claimed allowances change: On or before april 18,. Web washington, dc tax forms and publications in addition to the forms available below, the district of columbia offers several electronic filing services.

Employee Dc Tax Withholding Form 2022

Web employee withholding allowance certificate. Web friday, may 20, 2022. Web dc inheritance and estate tax forms; If you are not liable for dc income. If too little is withheld, you will generally owe tax when.

Maryland Withholding Form 2021 2022 W4 Form

Web dc tax withholding form. Web dc inheritance and estate tax forms; Withholding tax forms for 2023 filing season (tax year 2022/2023) Withholding tax registration (part iii) • sales and use tax. If you are not liable for dc income.

20182022 Form NC NC1099ITIN Fill Online, Printable, Fillable, Blank

If too little is withheld, you will generally owe tax when. The new irs federal tax rates have been implemented, which may impact your federal tax withholding amounts from your. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web employee withholding allowance certificate for maryland state government employees residing in.

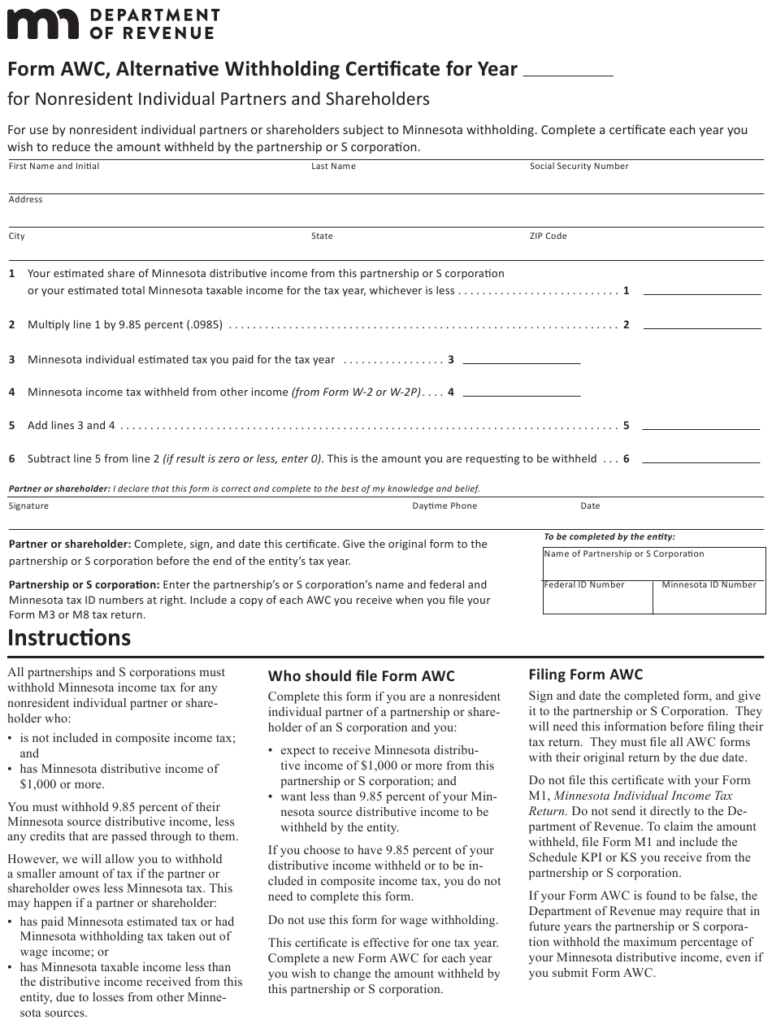

Minnesota State Withholding Form 2021 Federal Withholding Tables 2021

Unless changes are required, employees who have submitted a w. Web employee withholding allowance certificate. Web employee withholding allowance certificate for maryland state government employees residing in washington, d.c. Washington — the internal revenue service today reminded individuals and businesses in parts of four states that their 2022 federal. If too little is withheld, you will generally owe tax when.

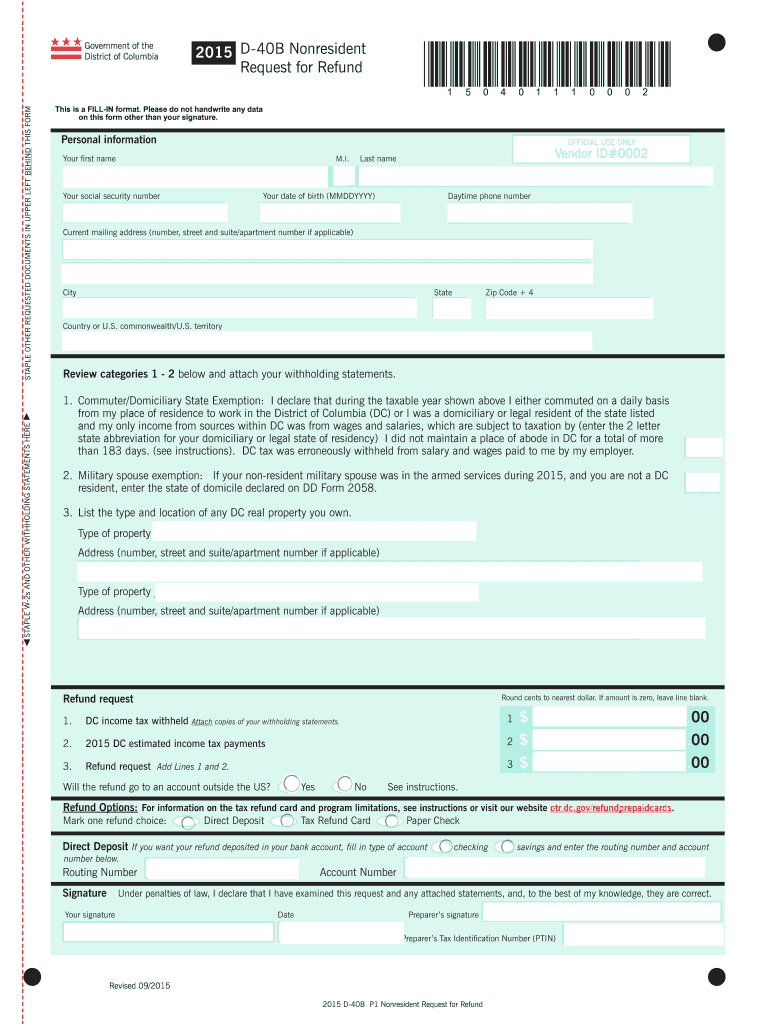

D 40B Fill Out and Sign Printable PDF Template signNow

If you are not liable for dc taxes because you. If you are not liable for dc income. Web washington, dc tax forms and publications in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes. If you are not liable for dc income. Web employee withholding allowance certificate.

Fillable Form W4 (Form D4) Employee Withholding Allowance

Web dc inheritance and estate tax forms; The new irs federal tax rates have been implemented, which may impact your federal tax withholding amounts from your. If you are not liable for dc income. Withholding tax forms for 2023 filing season (tax year 2022/2023) Web employee withholding allowance certificate.

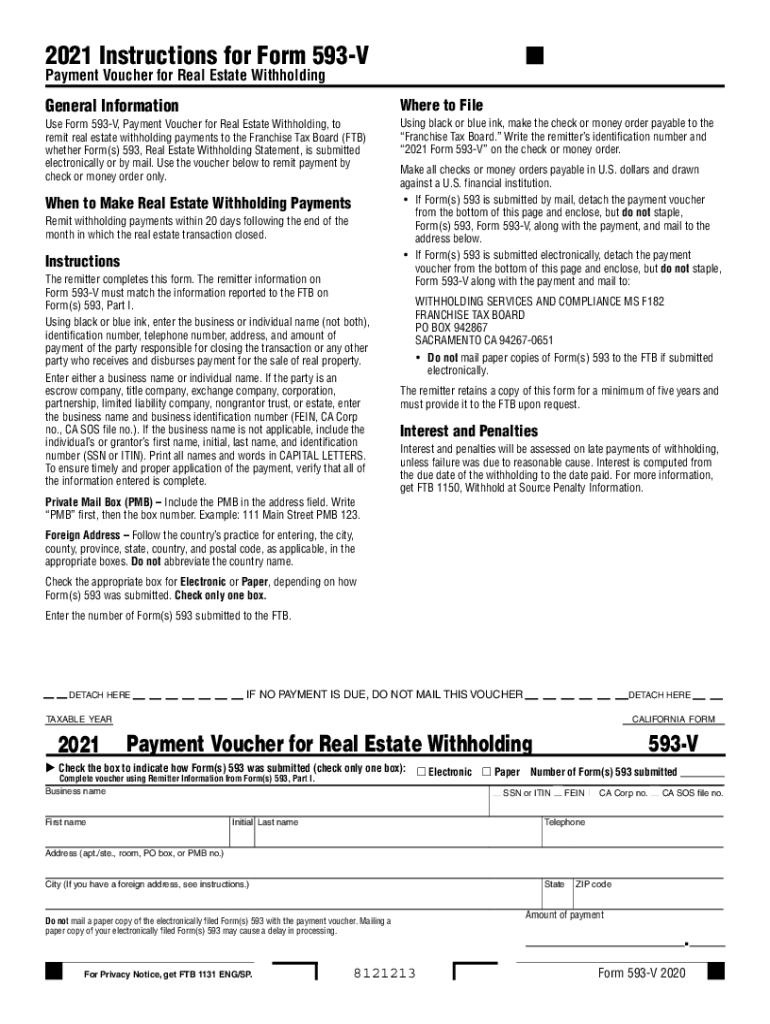

Withholding Tax Forms For 2023 Filing Season (Tax Year 2022/2023)

Unless changes are required, employees who have submitted a w. If you are not liable for dc taxes because you. On or before april 18,. If you are not liable for dc income.

If You Are Not Liable For Dc Income.

Withholding tax registration (part iii) • sales and use tax. If you are not liable for dc income. File with employer when starting new employment or when claimed allowances change: If too little is withheld, you will generally owe tax when.

Web Dc Tax Withholding Form.

Web dc inheritance and estate tax forms; If you are not liable for dc taxes because. The new irs federal tax rates have been implemented, which may impact your federal tax withholding amounts from your. Web washington, dc tax forms and publications in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes.

File With Employer When Starting New Employment Or When Claimed Allowances Change.

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Washington — the internal revenue service today reminded individuals and businesses in parts of four states that their 2022 federal. Web employee withholding allowance certificate. Web friday, may 20, 2022.