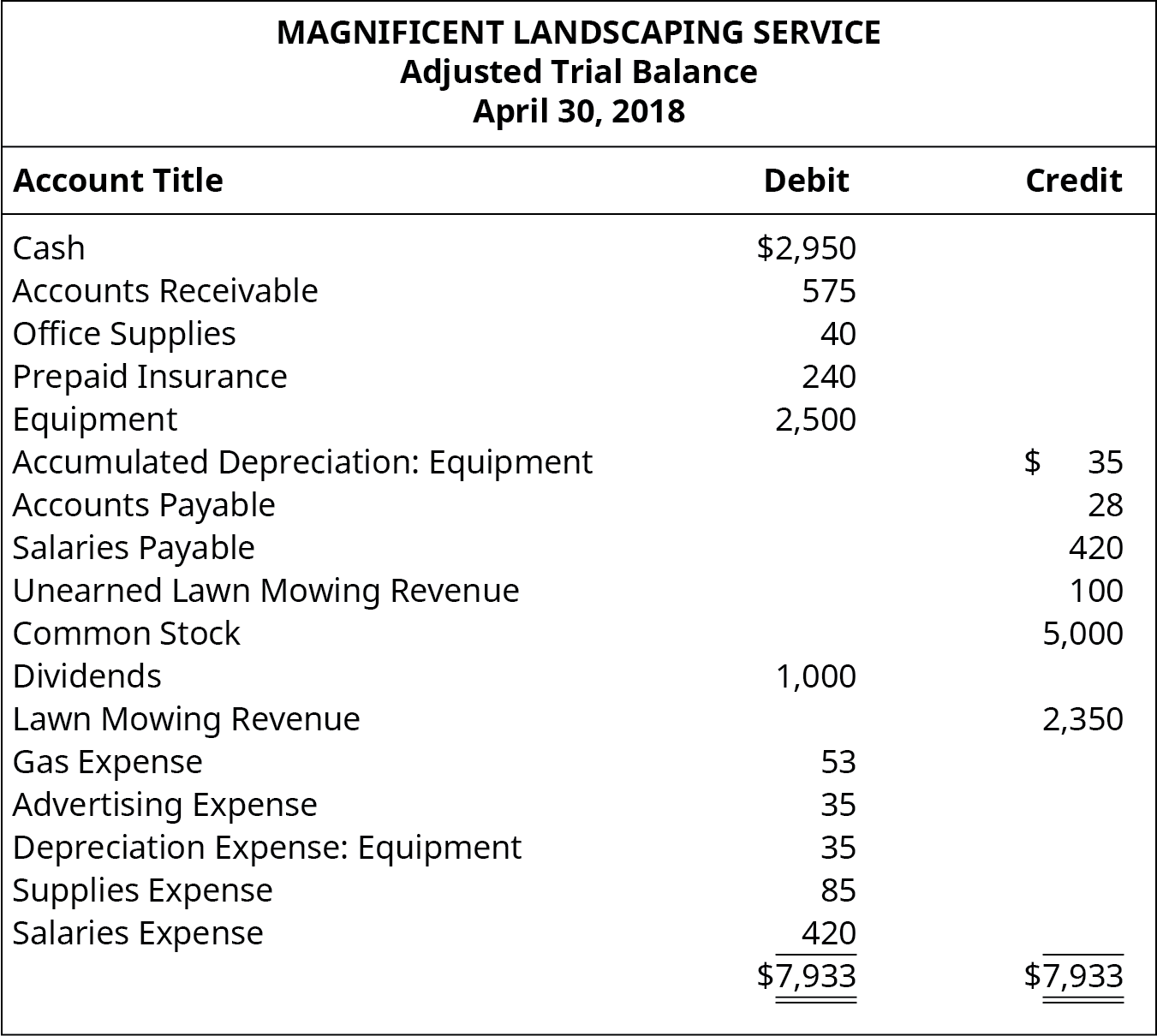

Depreciation Expense Income Statement Or Balance Sheet

Depreciation Expense Income Statement Or Balance Sheet - Web depreciation is typically tracked one of two places: On an income statement or balance sheet. Web depreciation on the balance sheet. It accounts for depreciation charged to expense for the. Accumulated depreciation appears in a contra asset. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. On the balance sheet, it is listed as. Depreciation expense is not a current asset; The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. It is reported on the income statement along with other normal business expenses.

Web depreciation is typically tracked one of two places: It accounts for depreciation charged to expense for the. Depreciation expense is not a current asset; For income statements, depreciation is listed as an expense. It is reported on the income statement along with other normal business expenses. Accumulated depreciation appears in a contra asset. Accumulated depreciation is listed on the balance. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Web depreciation on the balance sheet. On an income statement or balance sheet.

It is reported on the income statement along with other normal business expenses. It accounts for depreciation charged to expense for the. Accumulated depreciation appears in a contra asset. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Web depreciation on the balance sheet. On the balance sheet, it is listed as. Web depreciation is typically tracked one of two places: Depreciation expense is not a current asset; The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. Accumulated depreciation is listed on the balance.

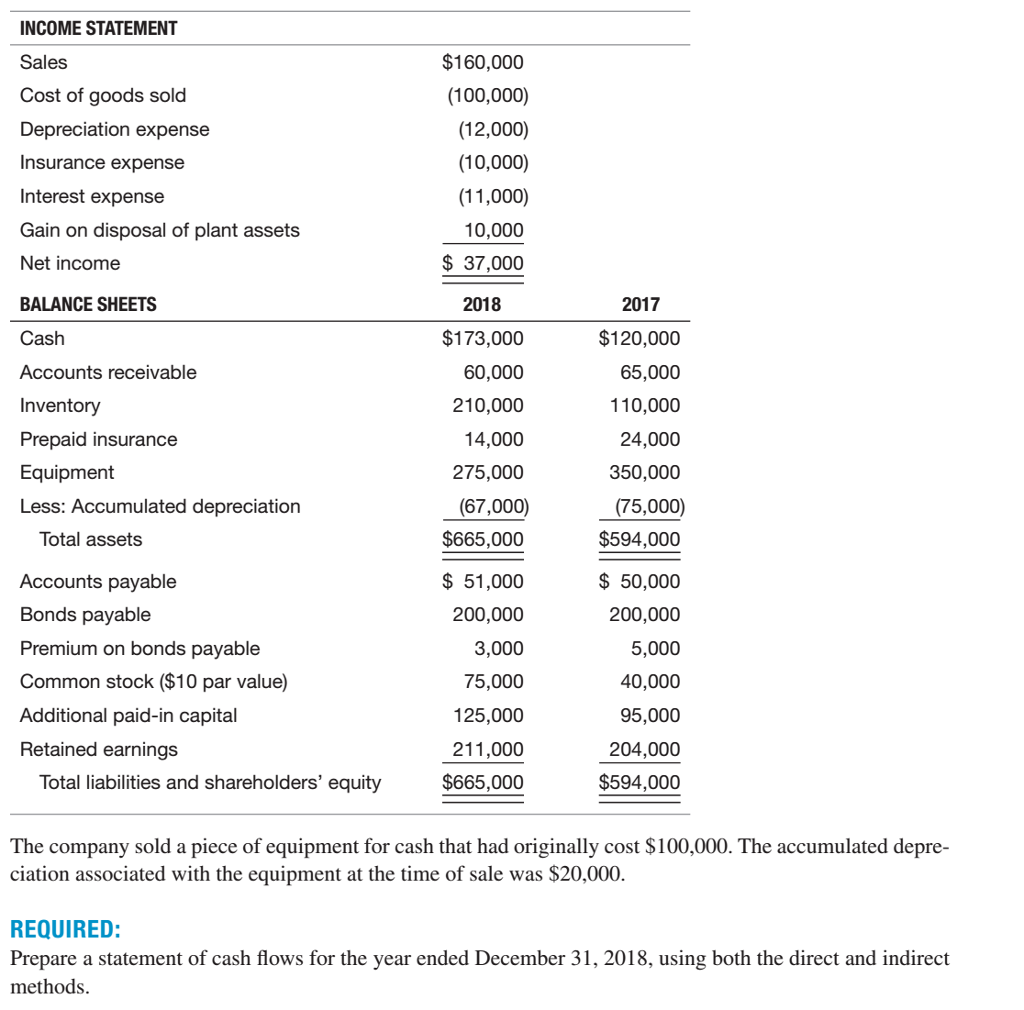

Solved STATEMENT Sales Cost of goods sold

It accounts for depreciation charged to expense for the. On an income statement or balance sheet. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation.

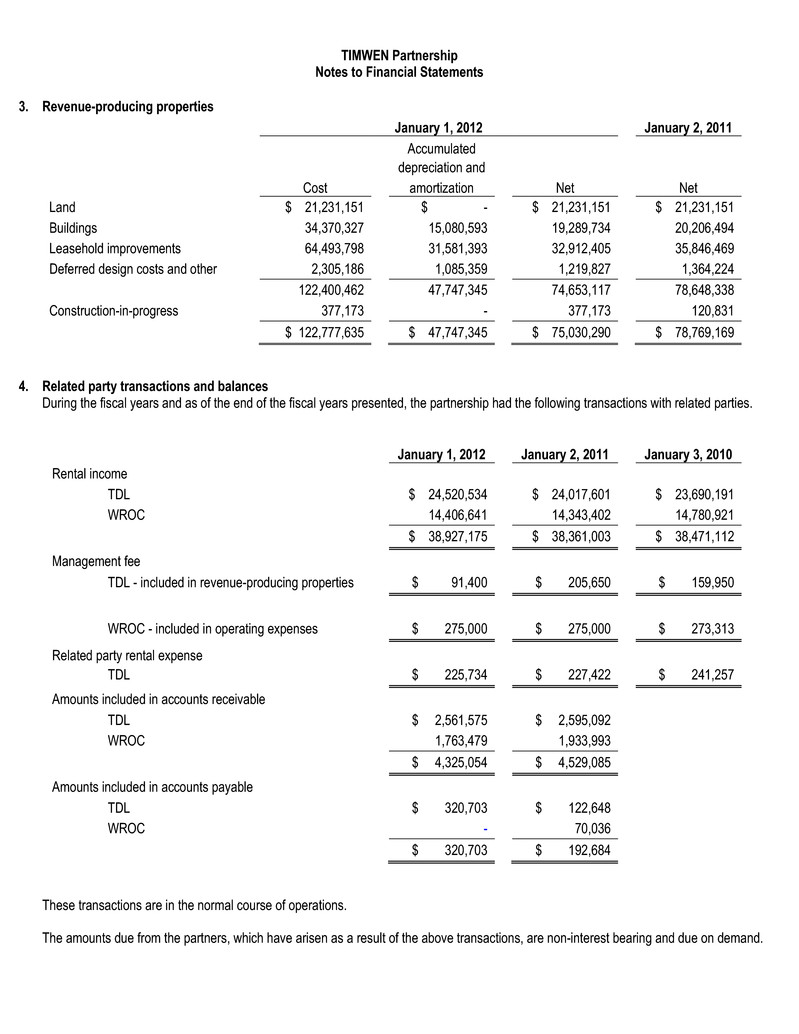

Why does accumulated depreciation have a credit balance on the balance

Accumulated depreciation is listed on the balance. Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. Web depreciation on the balance sheet. On the balance sheet, it is listed as.

You may have to read this Accumulated Depreciation Balance Sheet

Accumulated depreciation is listed on the balance. On the balance sheet, it is listed as. Web depreciation on the balance sheet. Accumulated depreciation appears in a contra asset. On an income statement or balance sheet.

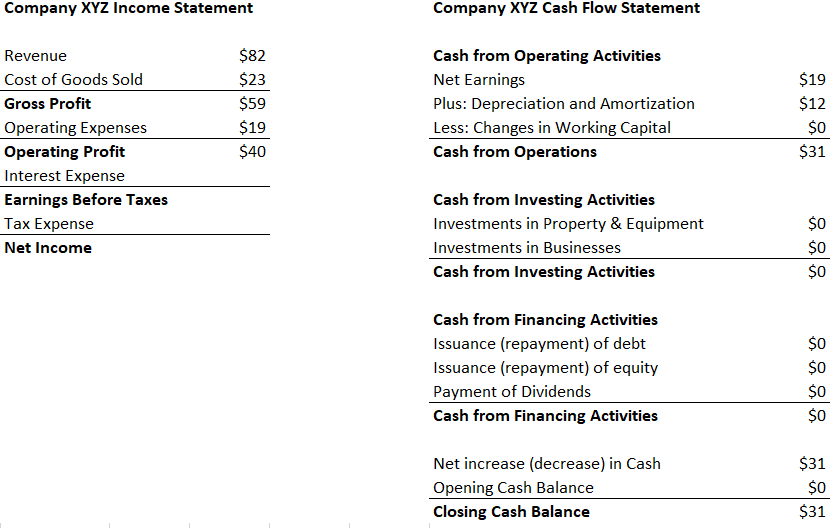

Statements for Business Owners Enkel BackOffice Solutions

On an income statement or balance sheet. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. It accounts for depreciation charged to expense for the. On the balance sheet, it is listed as. Depreciation expense is not a current asset;

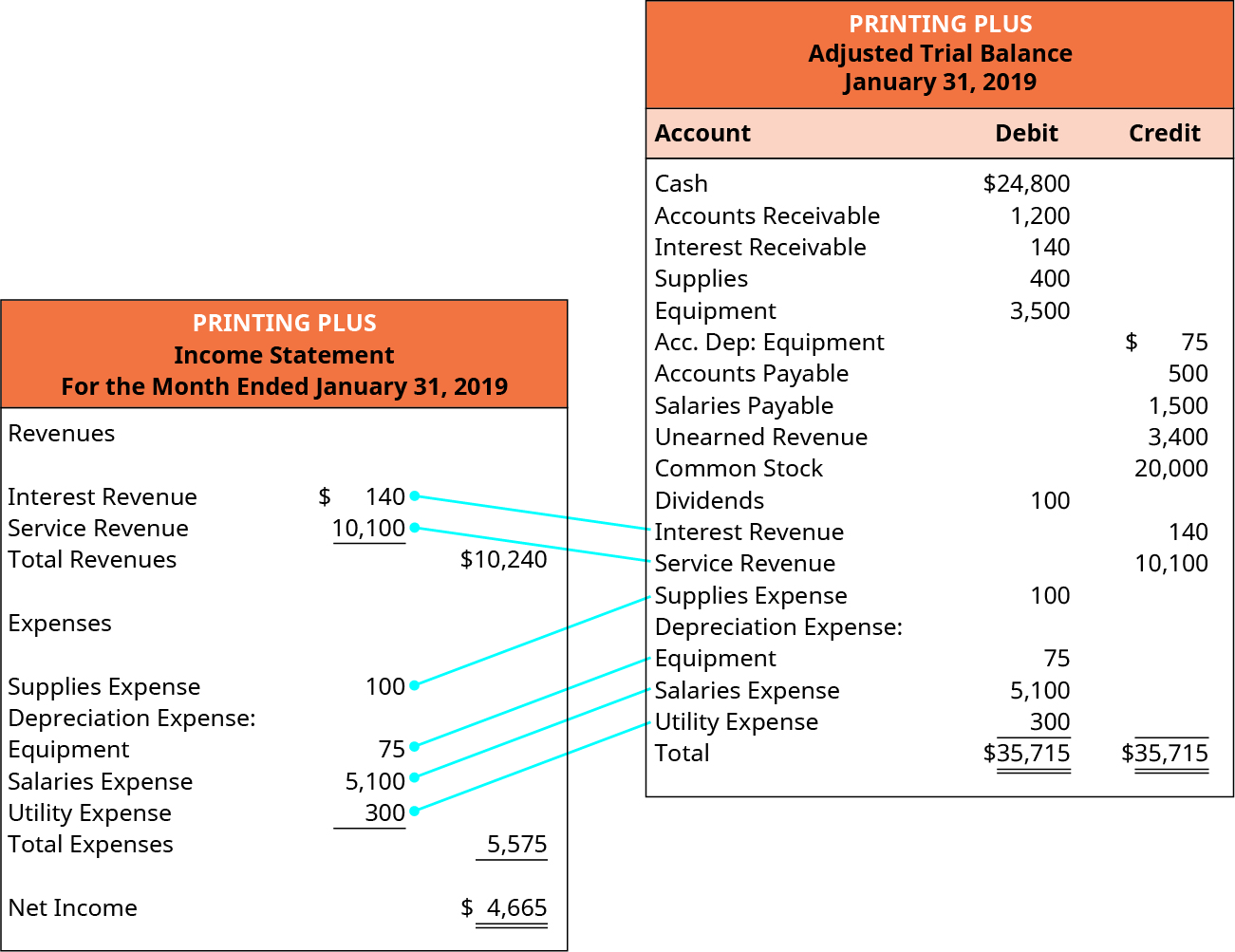

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

It is reported on the income statement along with other normal business expenses. On the balance sheet, it is listed as. It accounts for depreciation charged to expense for the. Accumulated depreciation appears in a contra asset. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense.

4.5 Prepare Financial Statements Using the Adjusted Trial Balance

Depreciation expense is not a current asset; Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. For income statements, depreciation is listed as an expense. Web depreciation is typically tracked one of two places: On the balance sheet, it is listed.

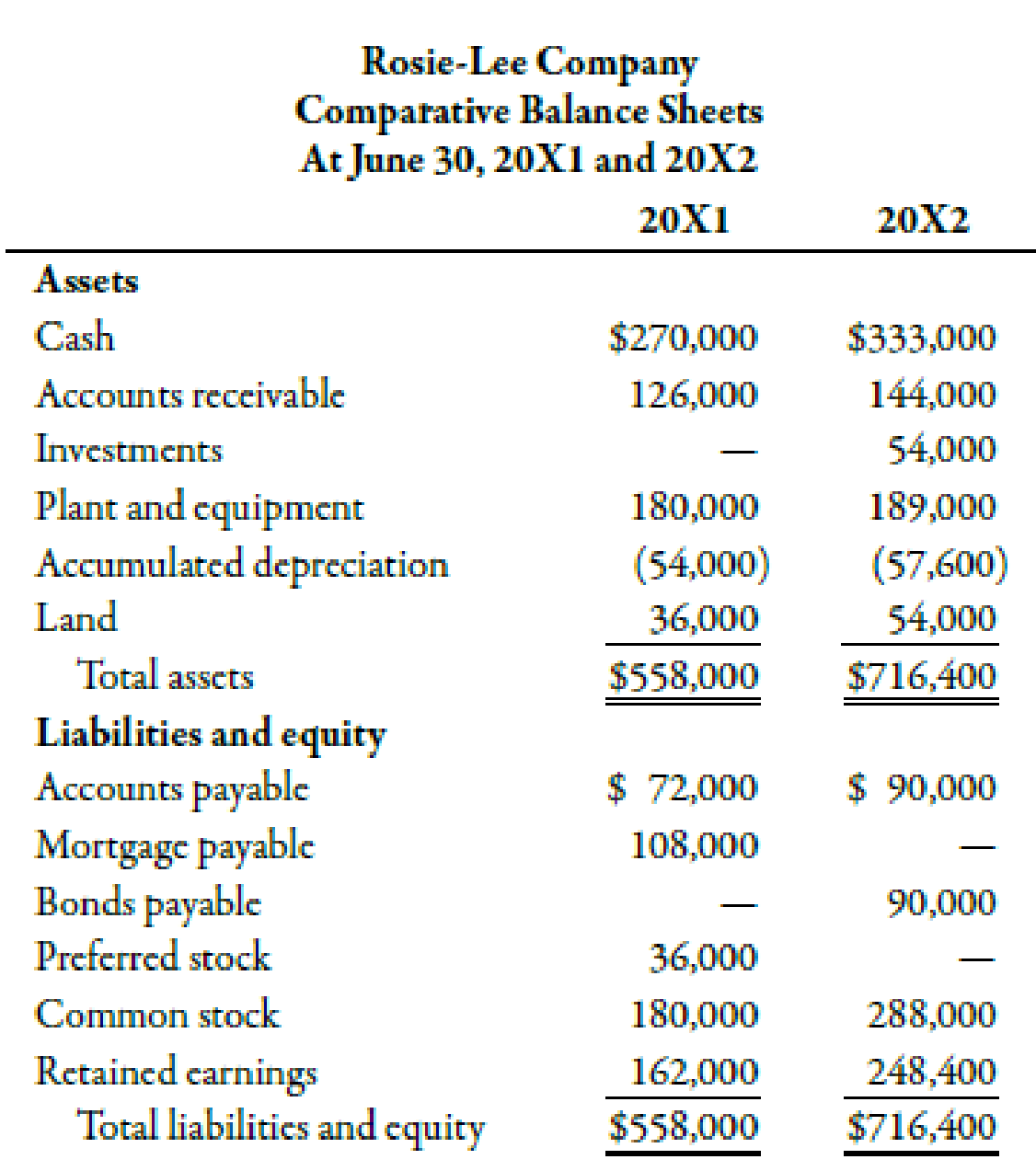

The following balance sheets and statement were taken from the

Depreciation expense is not a current asset; For income statements, depreciation is listed as an expense. Accumulated depreciation is listed on the balance. Web depreciation on the balance sheet. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period.

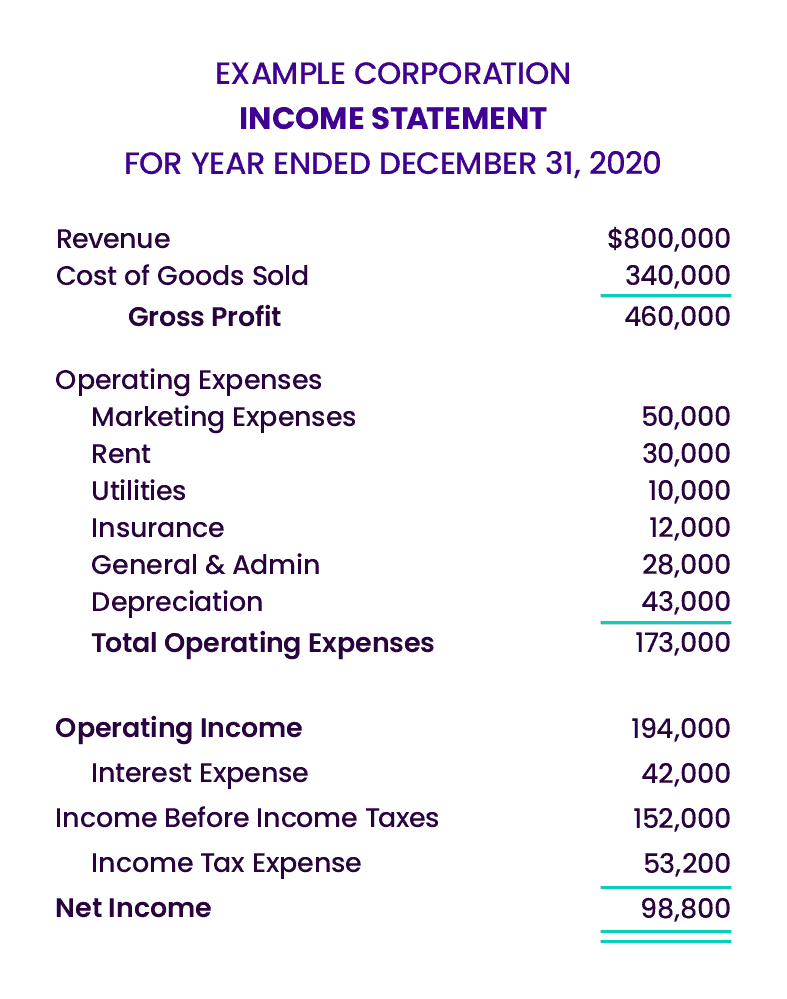

Depreciation Turns Capital Expenditures into Expenses Over Time

On the balance sheet, it is listed as. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. Web depreciation on the balance sheet. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was.

LO 4.5 Prepare Financial Statements Using the Adjusted Trial Balance

On an income statement or balance sheet. Depreciation expense is not a current asset; Accumulated depreciation is listed on the balance. It accounts for depreciation charged to expense for the. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period.

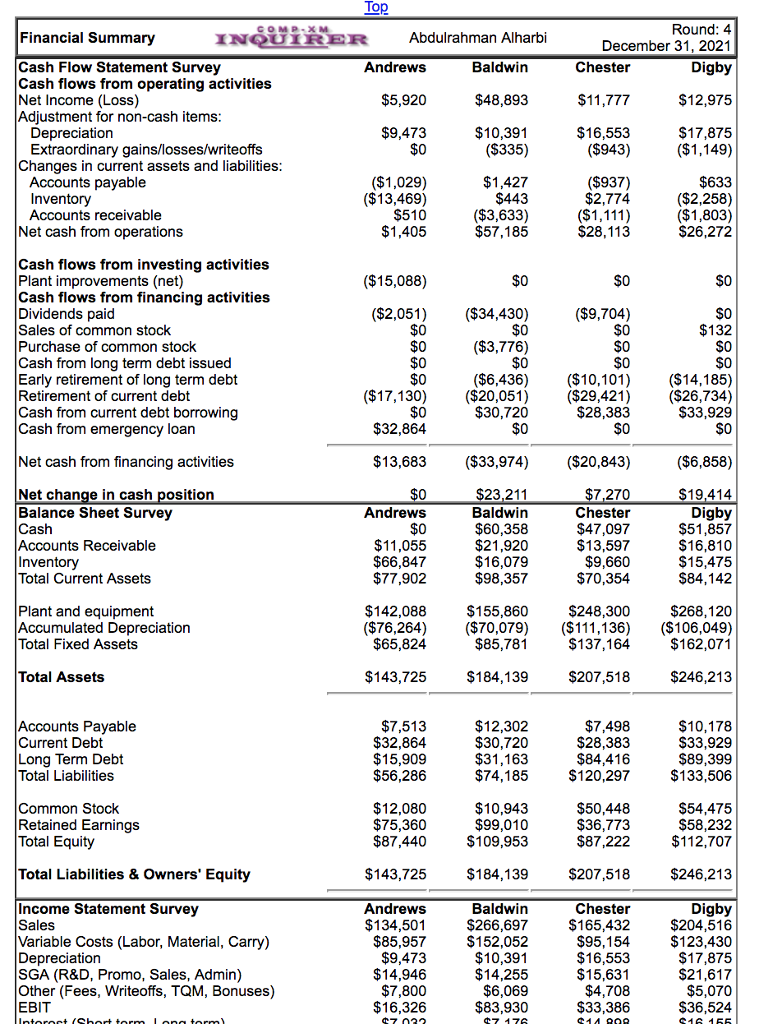

Solved Roun Financial Summary INQUIRER Abdulrahman Alharbi

Web depreciation is typically tracked one of two places: Accumulated depreciation is listed on the balance. On an income statement or balance sheet. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. On the balance sheet, it is listed as.

The Depreciation Reported On The Balance Sheet Is The Accumulated Or The Cumulative Total Amount Of Depreciation That Has Been Reported As Depreciation Expense On The.

For income statements, depreciation is listed as an expense. On an income statement or balance sheet. Web depreciation is typically tracked one of two places: It is reported on the income statement along with other normal business expenses.

On The Balance Sheet, It Is Listed As.

Web depreciation on the balance sheet. Accumulated depreciation appears in a contra asset. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. It accounts for depreciation charged to expense for the.

Depreciation Expense Is Not A Current Asset;

Accumulated depreciation is listed on the balance.