Depreciation Expense On A Balance Sheet

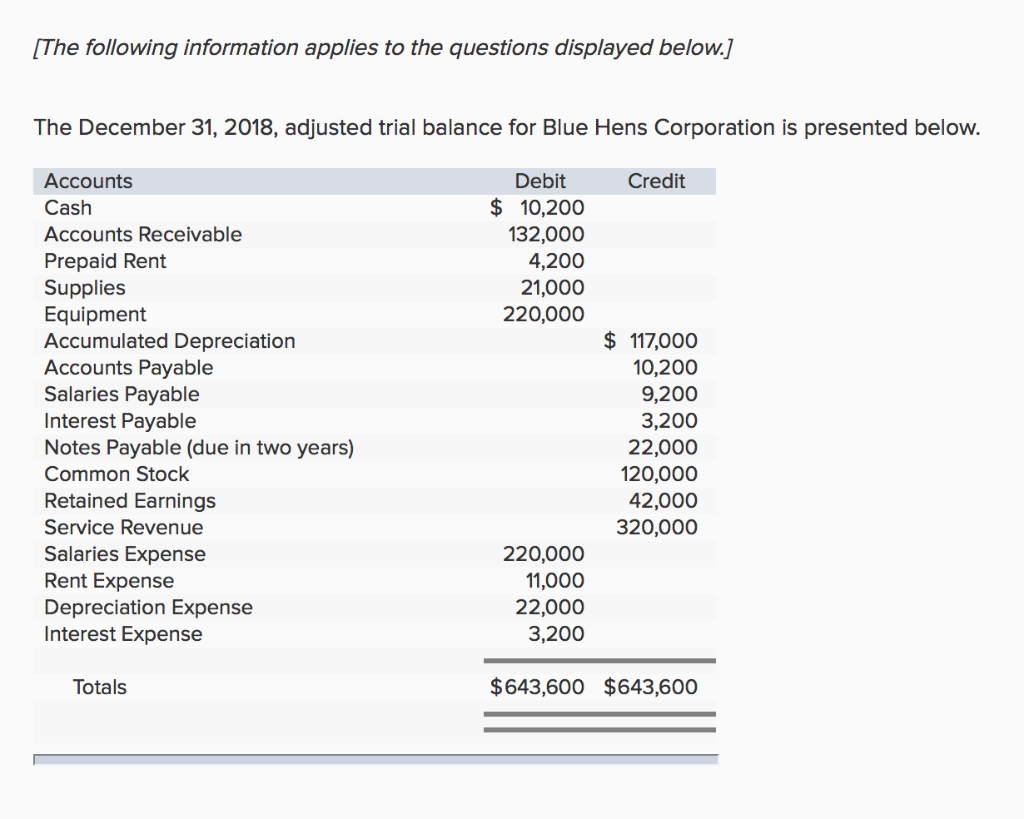

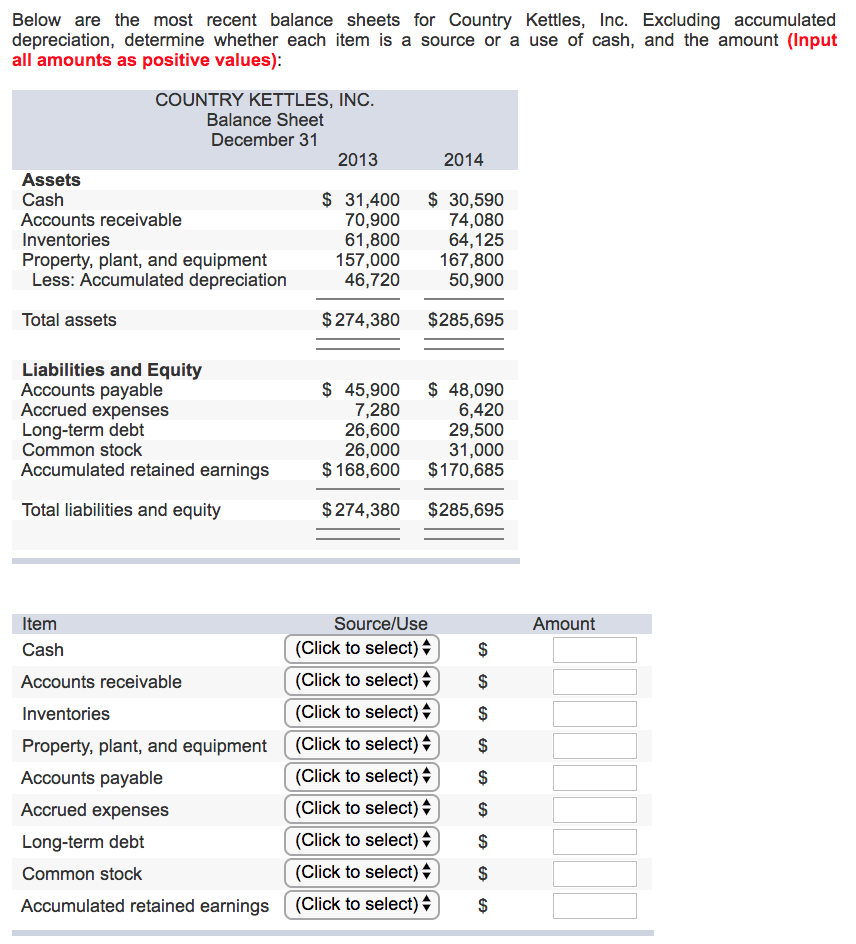

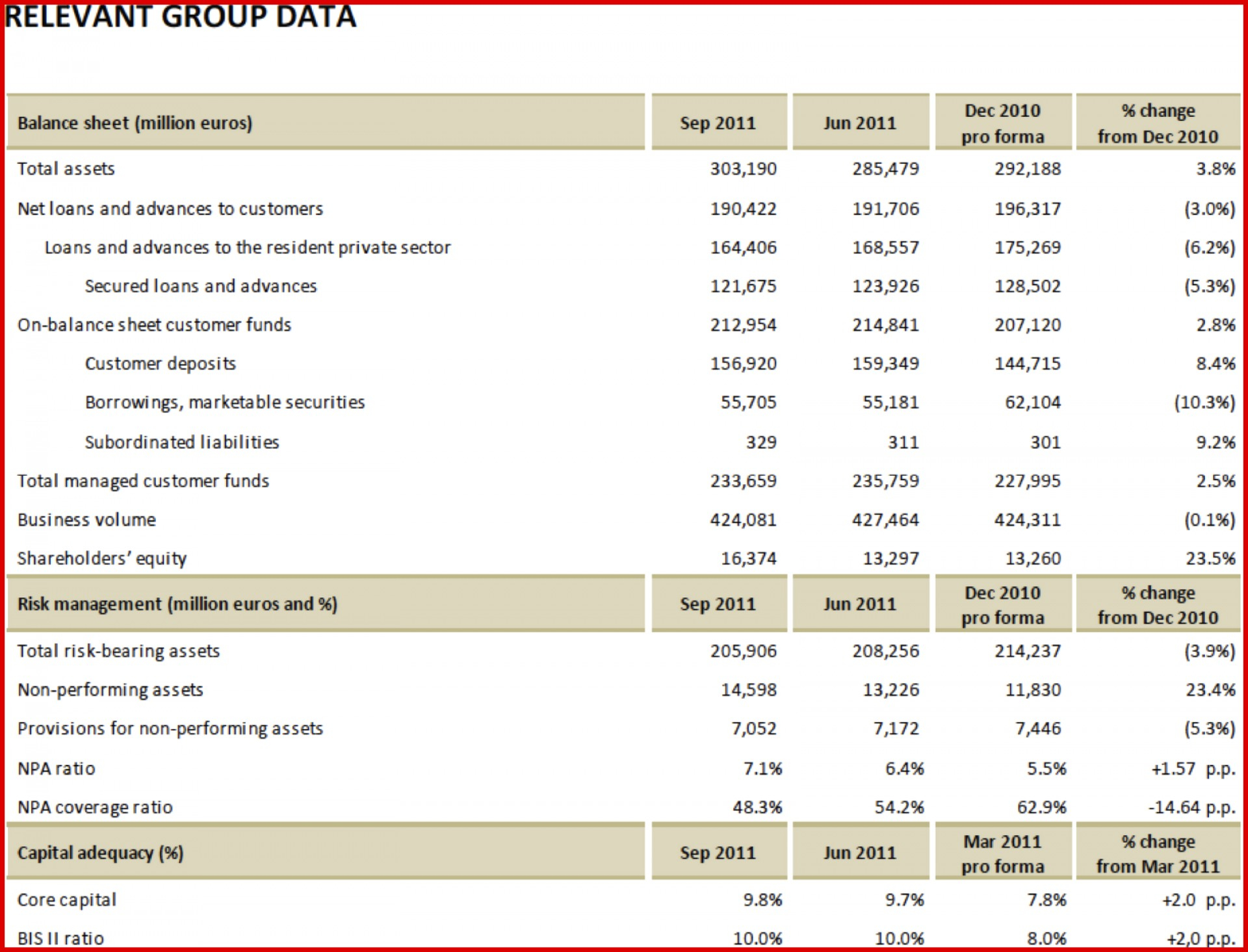

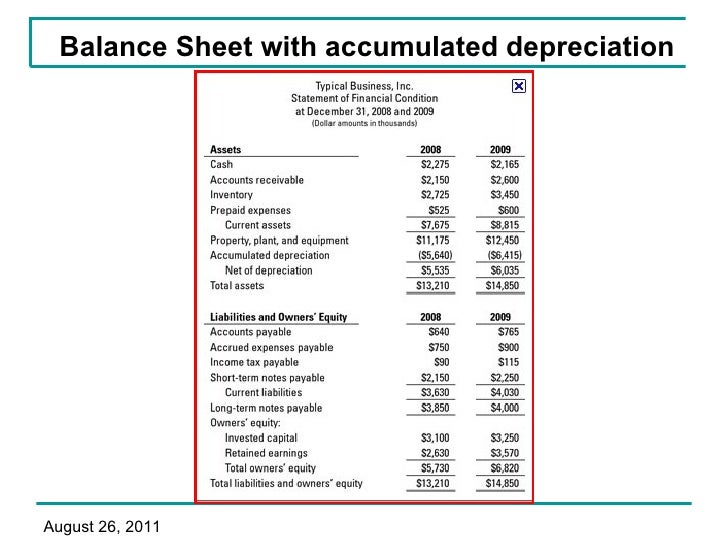

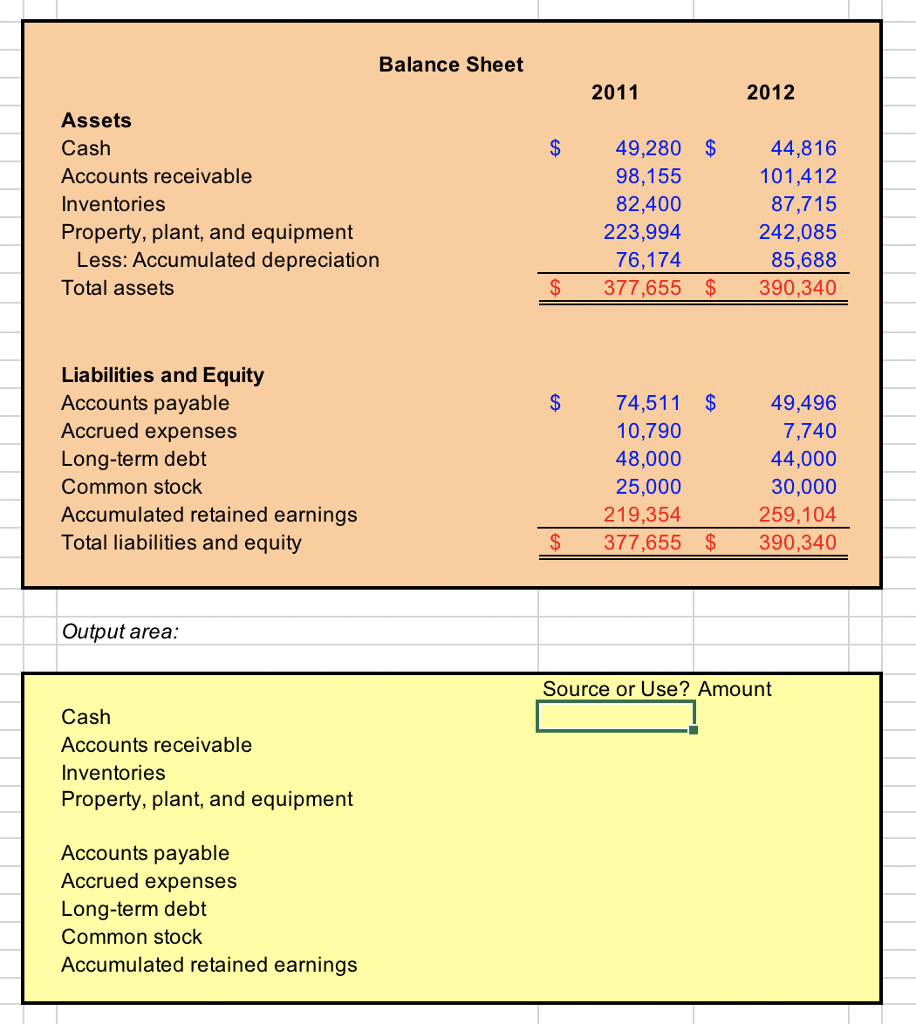

Depreciation Expense On A Balance Sheet - For income statements, depreciation is listed as an expense. On an income statement or balance sheet. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. Both depreciation and accumulated depreciation refer to the. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. It accounts for depreciation charged to expense for the. Web depreciation is typically tracked one of two places: Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance.

For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. It accounts for depreciation charged to expense for the. On an income statement or balance sheet. Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. Both depreciation and accumulated depreciation refer to the. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year.

Web depreciation is typically tracked one of two places: Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. Both depreciation and accumulated depreciation refer to the. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. For income statements, depreciation is listed as an expense. For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. It accounts for depreciation charged to expense for the. On an income statement or balance sheet.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. It accounts for depreciation charged to expense for the. Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. For income statements, depreciation is listed as an expense. Both depreciation and accumulated depreciation refer to the.

Why is accumulated depreciation a credit balance?

Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. For income statements, depreciation is listed as an expense. It accounts for depreciation charged to expense for the. Web depreciation expense is the cost.

Balance Sheet Depreciation Understanding Depreciation

Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. Both depreciation and accumulated depreciation refer to the. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. It accounts for.

balance sheet Expense Depreciation

Both depreciation and accumulated depreciation refer to the. It accounts for depreciation charged to expense for the. Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet.

How To Calculate Depreciation Balance Sheet Haiper

For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. For income statements, depreciation is listed as an expense. On an income statement or balance sheet. Web step 1 find the amount of accumulated depreciation on.

How To Calculate Depreciation Balance Sheet Haiper

On an income statement or balance sheet. For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. For income statements, depreciation is listed as an expense. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up.

Balance Sheet.pdf Depreciation Expense

For income statements, depreciation is listed as an expense. Both depreciation and accumulated depreciation refer to the. Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. On an income statement or balance sheet. Web depreciation is typically tracked one of two places:

template for depreciation worksheet

Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet. For income statements, depreciation is listed as an expense. Web key.

Depreciation

For income statements, depreciation is listed as an expense. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. Web depreciation is typically tracked one of two places: For example, assume a company lists $100,000 in accumulated depreciation.

What is Accumulated Depreciation? Formula + Calculator

Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. Both depreciation and accumulated depreciation refer to the. For income statements, depreciation is listed as an expense. Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's.

Web Depreciation Is Typically Tracked One Of Two Places:

Web key takeaways depreciation expense is reported on the income statement as any other normal business expense, while accumulated. On an income statement or balance sheet. For example, assume a company lists $100,000 in accumulated depreciation on its most recent balance. Both depreciation and accumulated depreciation refer to the.

It Accounts For Depreciation Charged To Expense For The.

Web depreciation expense is the cost of an asset that has been depreciated for a single period, and shows how much of the asset's value has been used up in that year. For income statements, depreciation is listed as an expense. Web step 1 find the amount of accumulated depreciation on the most recent accounting period's balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)