Does Your Business Need To File Form 720

Does Your Business Need To File Form 720 - Ad get ready for tax season deadlines by completing any required tax forms today. Form 720 is used by taxpayers to report. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. Ad businesses can receive up to $26k per eligible employee. This includes forms 720, 2290, 8849,. Web businesses that owe excise taxes might need to file form 720. Is electronic filing of form 720 required? June 2023) department of the treasury internal revenue service. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. *although form 720 is a quarterly return, for pcori,.

Is electronic filing of form 720 required? June 2023) department of the treasury internal revenue service. Web you must file form 720 if: Go out of business, or 2. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. Web does my business need to submit irs form 720? Form 2290, heavy highway vehicle use tax; If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Web for plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due july 31, 2023.

Web businesses that deal in goods and services that are subject to excise tax must prepare a form 720 on a quarterly basis to report the tax to the irs. Quarterly federal excise tax return. Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. Web if your expat business deals in those particular products, the irs requires that you file form 720 every quarter. Irs still accepts paper forms 720. Ad get ready for tax season deadlines by completing any required tax forms today. *although form 720 is a quarterly return, for pcori,. Ad businesses can receive up to $26k per eligible employee. This includes forms 720, 2290, 8849,. Is electronic filing of form 720 required?

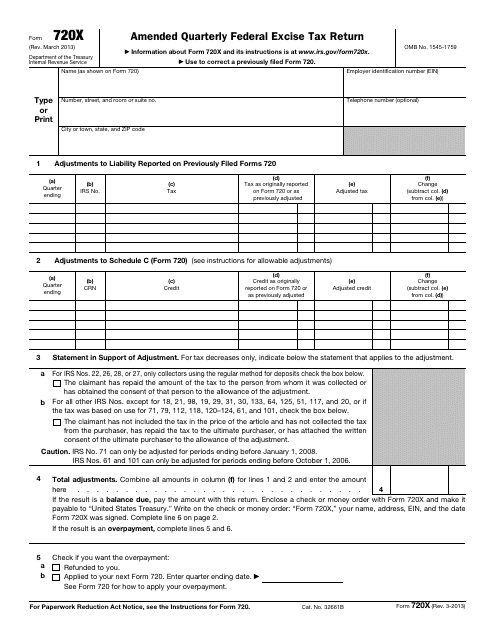

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

If you need to report excise taxes on tanning bed, fuel, or sport fishing equipment, we’ll show you. Irs still accepts paper forms 720. Is electronic filing of form 720 required? Quarterly federal excise tax return. Try it for free now!

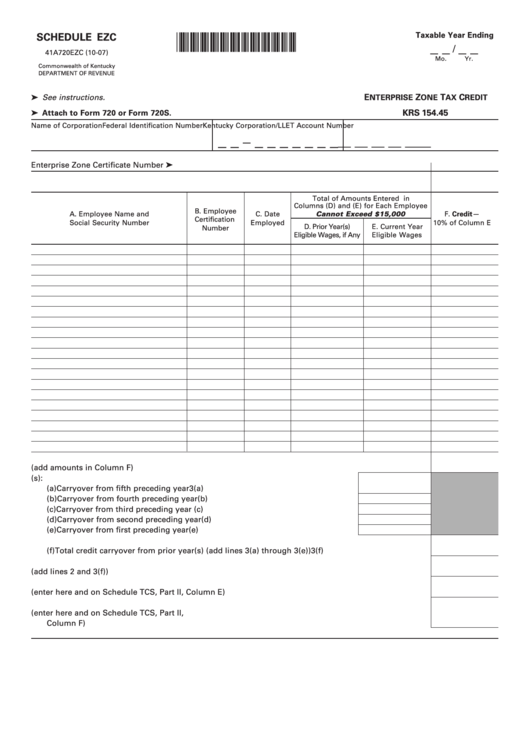

Form 720 Schedule Ezc Enterprise Zone Tax Credit printable pdf download

Web excise tax | internal revenue service excise tax don't file duplicate excise tax forms paper excise forms are taking longer to process. Web businesses that owe excise taxes might need to file form 720. Web does my business need to submit irs form 720? Get a payroll tax refund & receive up to $26k per employee even if you.

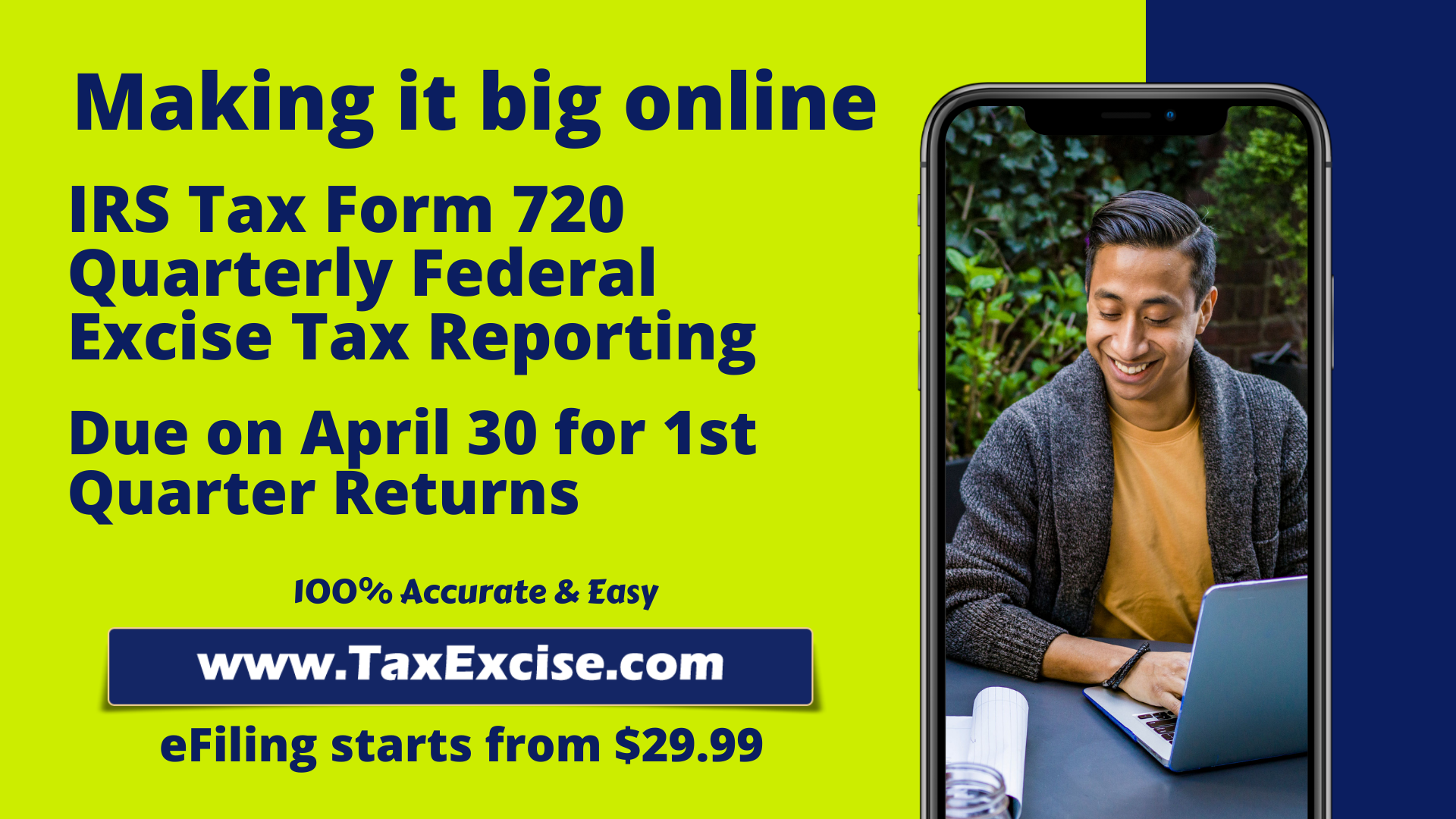

2018 Fourth Quarter Excise Tax Form 720 is DUE NOW! ThinkTrade Inc Blog

Irs still accepts paper forms 720. Web businesses that are subject to excise tax generally must file a form 720, quarterly federal excise tax return to report the tax to the irs. Is electronic filing of form 720 required? Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a.

TO AVOID PENALTIES, THE DEADLINE REMINDER ON TAXEXCISE FOR FILING YOUR

However, certain companies — such as those in farming, manufacturing,. This includes forms 720, 2290, 8849,. *although form 720 is a quarterly return, for pcori,. Future developments for the latest information. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds

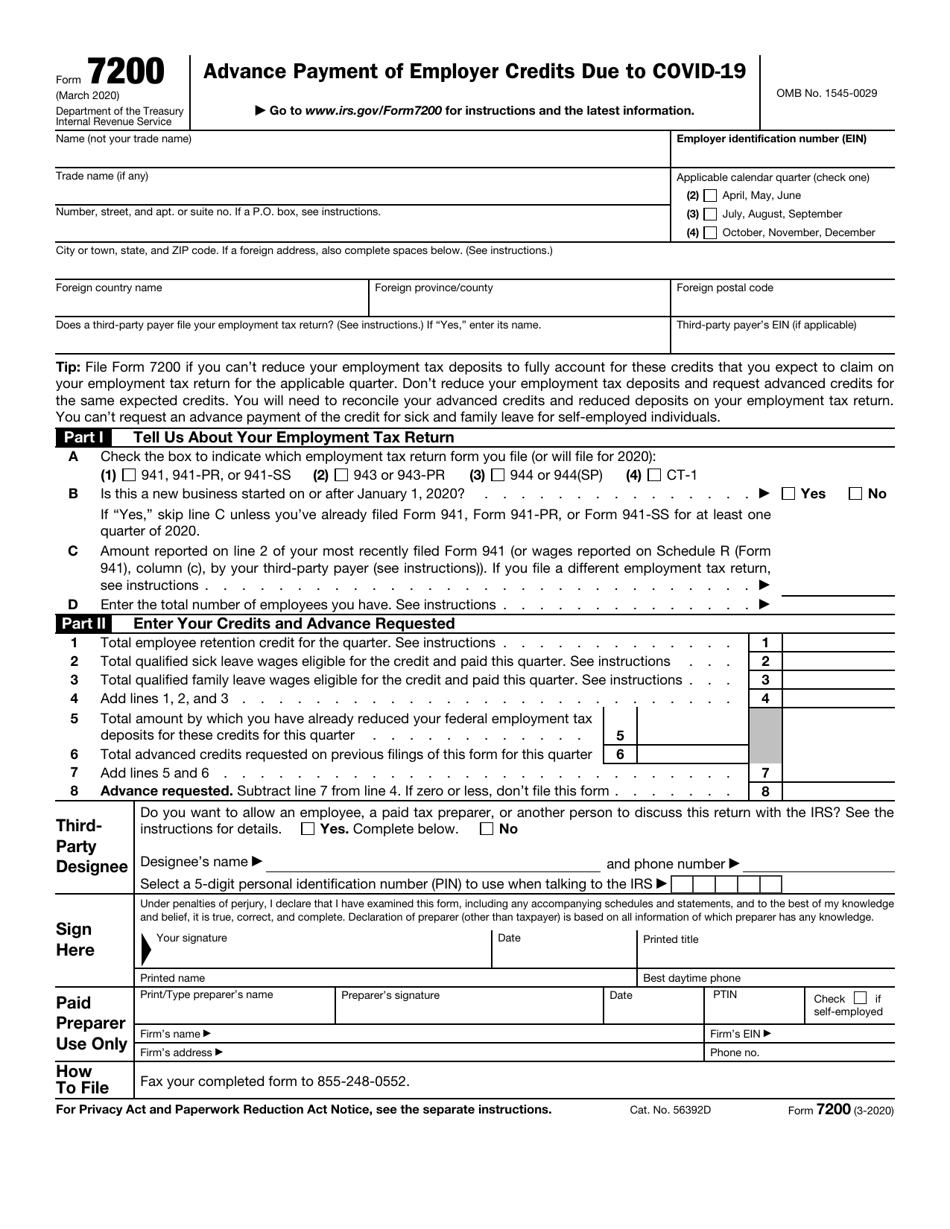

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Web you are liable to file form 720, the federal excise taxes every quarter when you offer a service, sell a product or goods that has an excise tax component. See the instructions for form 720. Web businesses that deal in goods and services that are subject to excise tax must prepare a form 720 on a quarterly basis to.

2019 Form IRS 720 Fill Online, Printable, Fillable, Blank pdfFiller

This is a different form than what is used to file business income tax returns. However, certain companies — such as those in farming, manufacturing,. File a final return if you have been filing form 720 and you: Upload, modify or create forms. Irs still accepts paper forms 720.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Form 2290, heavy highway vehicle use tax; See the instructions for form 720. Web you don't import gas guzzling automobiles in the course of your trade or business. Form 720, quarterly federal excise tax; Here’s what you need to know.

How to complete IRS Form 720 for the PatientCentered Research

You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Upload, modify or create forms. Form 720 is used by taxpayers to report. Web the irs form 720 is used by businesses to file a quarterly federal excise tax return. June 2023) department of the treasury internal revenue service.

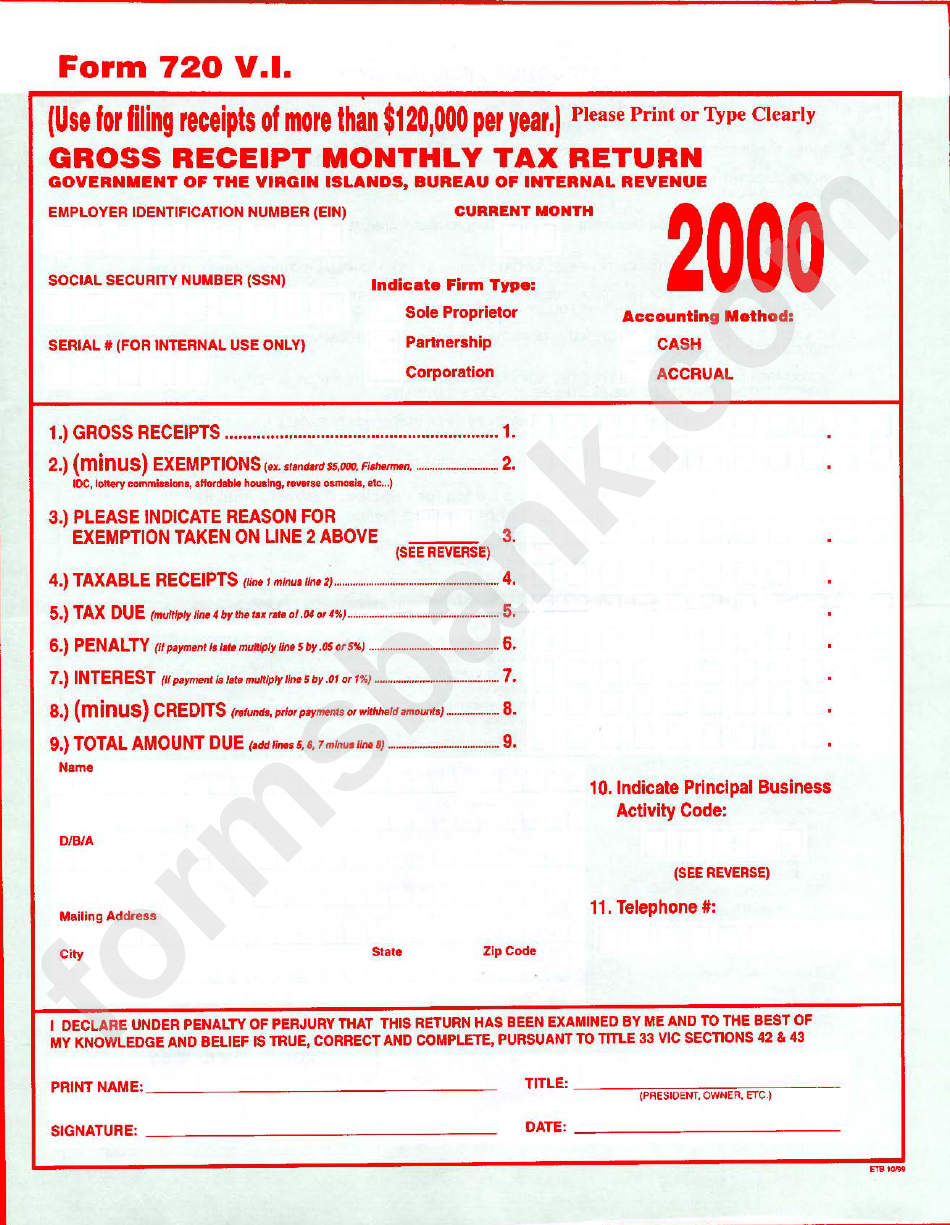

Form 720 Gross Receipt Monthly Tax Return 2000 printable pdf download

However, certain companies — such as those in farming, manufacturing,. Form 720 is used by taxpayers to report. This includes forms 720, 2290, 8849,. Will not owe excise taxes that are. Go out of business, or 2.

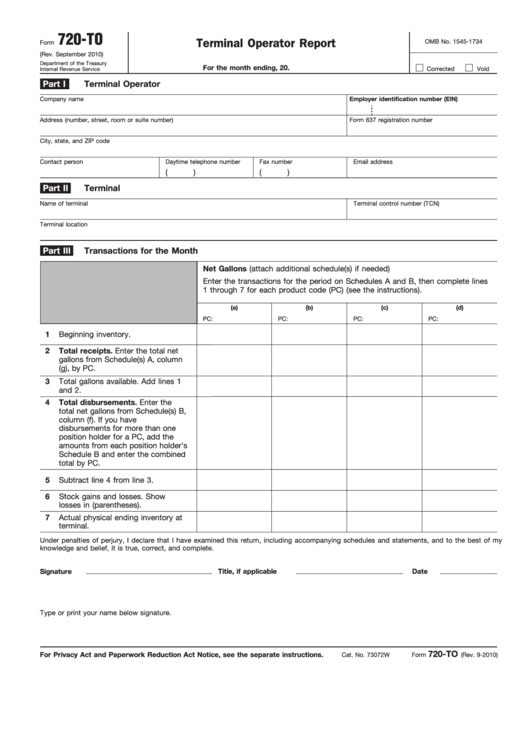

Fillable Form 720To Terminal Operator Report printable pdf download

*although form 720 is a quarterly return, for pcori,. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. This includes forms 720, 2290, 8849,. See the instructions for form 720. Web excise tax | internal revenue service excise tax don't file duplicate excise tax forms paper excise forms are taking longer to process.

File A Final Return If You Have Been Filing Form 720 And You:

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web a business that only purchases the excise goods does not need to file a form 720. Form 720 is used by taxpayers to report. Go out of business, or 2.

Web Businesses That Are Subject To Excise Tax Generally Must File A Form 720, Quarterly Federal Excise Tax Return To Report The Tax To The Irs.

Will not owe excise taxes that are. Web businesses that deal in goods and services that are subject to excise tax must prepare a form 720 on a quarterly basis to report the tax to the irs. If you owe a pcori fee, it must be paid using irs form 720 by july 31, following the last day of the plan year. Ad get ready for tax season deadlines by completing any required tax forms today.

See The Instructions For Form 720.

This includes forms 720, 2290, 8849,. Quarterly federal excise tax return. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web you must file form 720 if:

If You Need To Report Excise Taxes On Tanning Bed, Fuel, Or Sport Fishing Equipment, We’ll Show You.

Form 2290, heavy highway vehicle use tax; Future developments for the latest information. Web department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web for plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due july 31, 2023.