Erc Full Form

Erc Full Form - A reduction in pollution that is equal to one emission unit communications abbreviation for european radiocommunications committee: Complete our full eligibility questionnaire to help us learn about your business and verify your ability to. One of these programs was. The refundable tax credit is 50% of up to $10,000 in. Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Ad our team of experts determine exactly how much of a payroll tax refund you're entitled to. Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Web the employee retention credit (“erc”) continues to provide a wide variety of employers with lucrative refundable payroll tax credits for qualified wages paid to employees in 2020 and 2021. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed. Web abbreviation for emission reduction credit:

One of these programs was. Businesses can receive up to $26k per eligible employee. Web one option for employers is the employee retention credit (erc). Web abbreviation for emission reduction credit: Get started today to find out Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. A reduction in pollution that is equal to one emission unit communications abbreviation for european radiocommunications committee: The credit is 50% of up to $10,000 in wages paid by an employer whose business is fully or partially. Web the irs has observed a significant increase in false employee retention credit (erc) claims.

The refundable tax credit is 50% of up to $10,000 in. Is your business eligible for the employee retention credit? One of these programs was. Web examples of erc employee in a sentence. In the simplest terms, the erc is a refundable payroll tax credit for “qualified wages” paid to. Employee representative counsel shall be deemed to be a proxy holder in respect of each eligible voting claim of an erc employee that is an employee claim and shall vote such claims at the applicable meeting on all. Engineering research center (us nsf) erc: Web employee retention credit. Web the irs has observed a significant increase in false employee retention credit (erc) claims. Businesses can receive up to $26k per eligible employee.

What is the full form of ERC? ERC Full Form

Employee relocation council (usa) erc: Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Web abbreviation for emission reduction credit: Web employee retention credit. Is your business eligible for the employee retention credit?

What is the full form of ERC?ERC Full Form

Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Businesses can receive up to $26k per eligible employee. Employee relocation council (usa) erc: Businesses can receive up to $26k per eligible employee. Engineering research center (us nsf) erc:

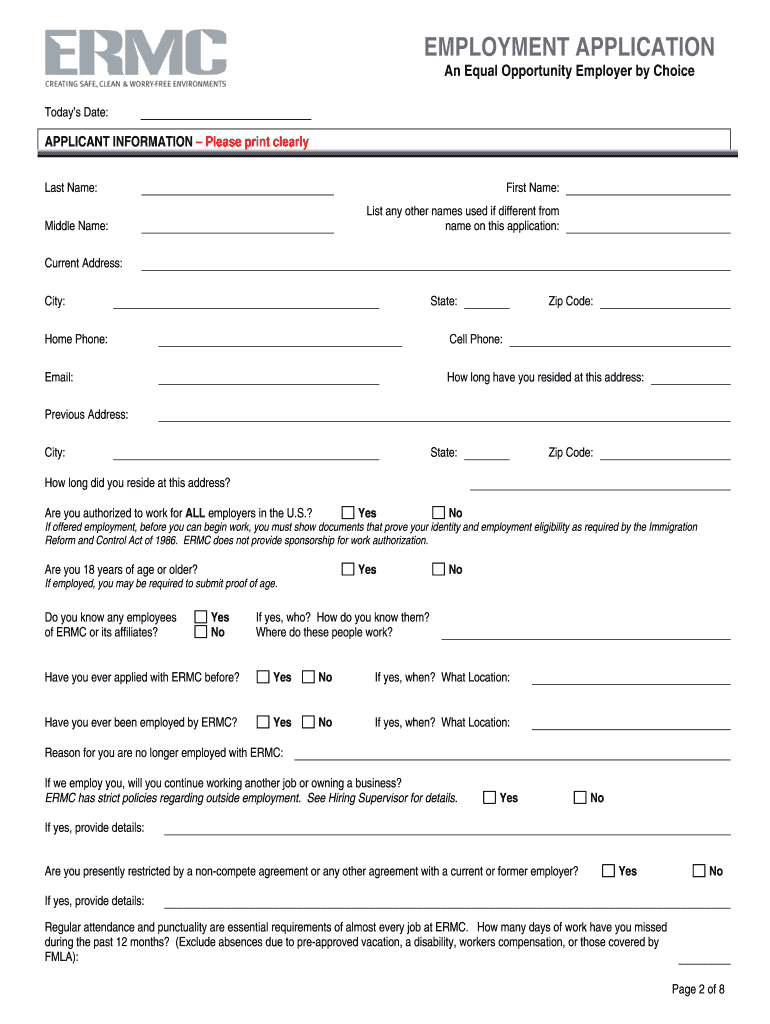

ERMC Employment Application Fill and Sign Printable Template Online

Businesses can receive up to $26k per eligible employee. In the simplest terms, the erc is a refundable payroll tax credit for “qualified wages” paid to. Web what does erc mean? Enlisted reserve corps (now us army reserve). Web employee retention credit.

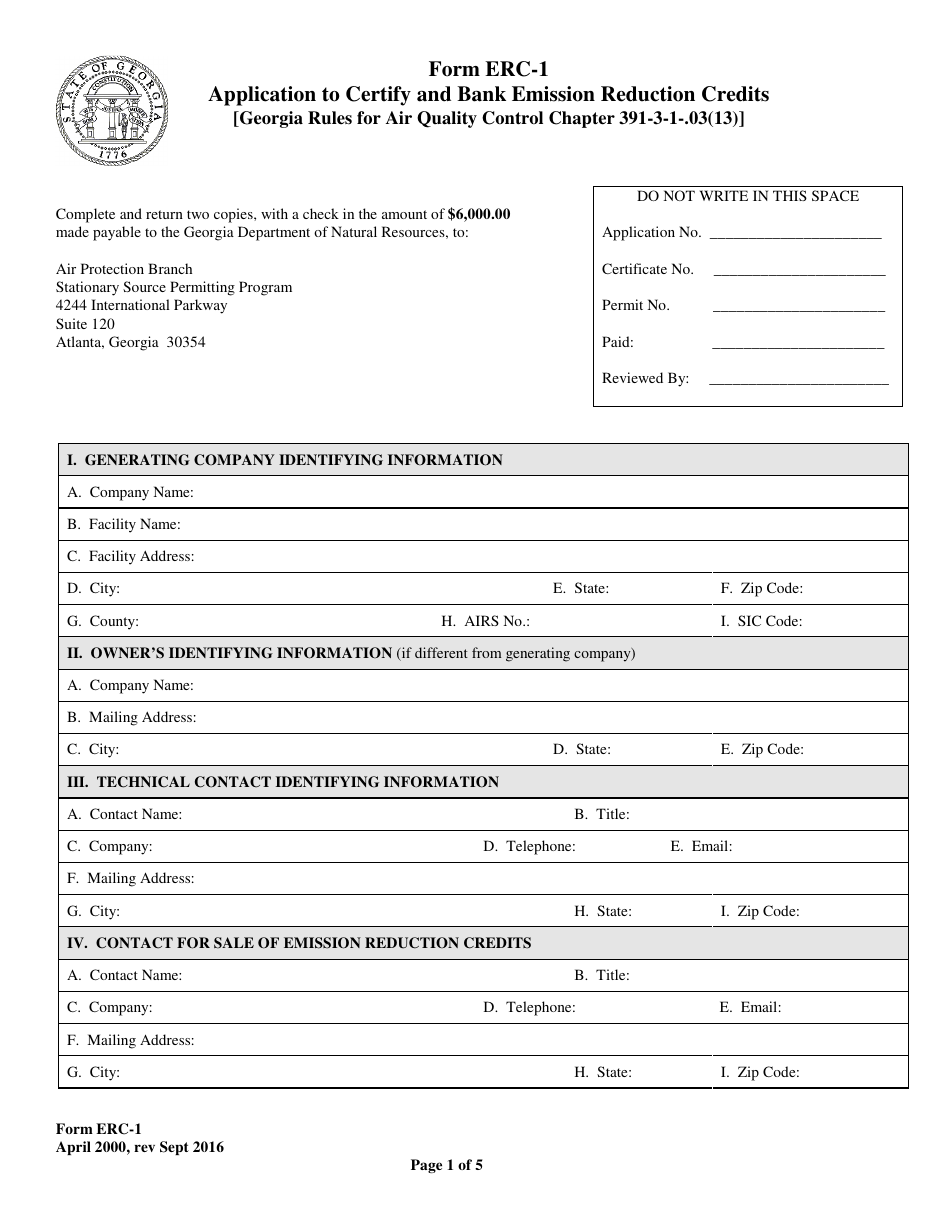

Form ERC1 Download Printable PDF or Fill Online Application to Certify

Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Web abbreviation for emission reduction credit: European resuscitation council (erc) is the european interdisciplinary council for resuscitation medicine and emergency medical care. Complete our full eligibility questionnaire to help us learn about your business and.

The ERC How do you claim it? IOOGO

Ad our team of experts determine exactly how much of a payroll tax refund you're entitled to. Employee relocation council (usa) erc: Enlisted reserve corps (now us army reserve). Employee representative counsel shall be deemed to be a proxy holder in respect of each eligible voting claim of an erc employee that is an employee claim and shall vote such.

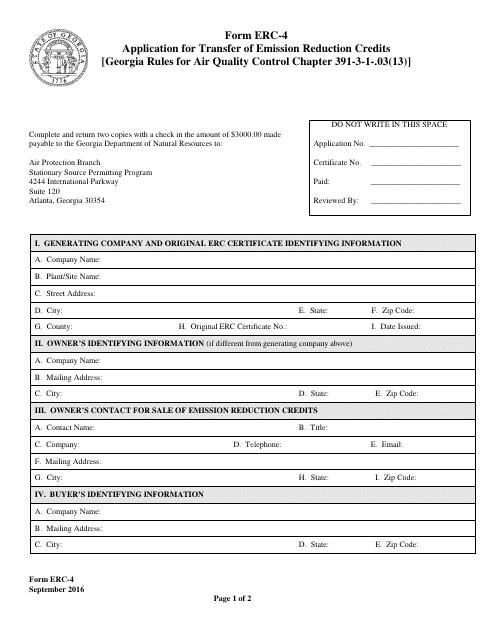

Form ERC4 Download Printable PDF or Fill Online Application for

The credit is 50% of up to $10,000 in wages paid by an employer whose business is fully or partially. Web washington — the treasury department and the internal revenue service today launched the employee retention credit, designed to encourage businesses to keep employees on their payroll. Businesses can receive up to $26k per eligible employee. Web the irs has.

ERCSelfAssessmentForm1JAZUL.docx Informed Consent Clinical Trial

Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. In the simplest terms, the erc is a refundable payroll tax credit for “qualified wages” paid to. European resuscitation council (erc) is the european interdisciplinary council for resuscitation medicine and emergency medical care. The credit is 50%.

Erc Bma The Basics

Employee representative counsel shall be deemed to be a proxy holder in respect of each eligible voting claim of an erc employee that is an employee claim and shall vote such claims at the applicable meeting on all. Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods.

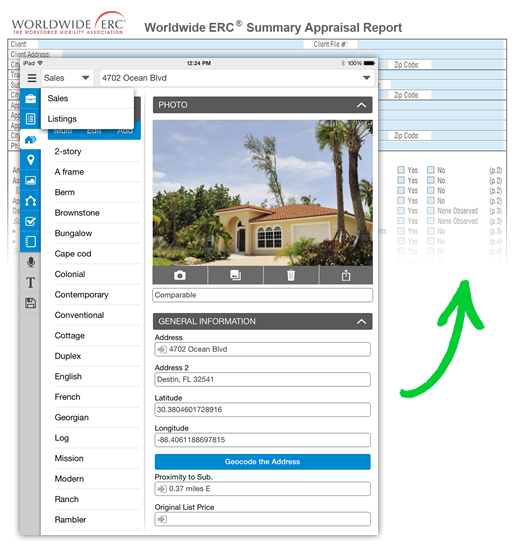

TOTAL for Mobile updated to support the ERC form Blog a la mode

Web the employee retention credit (“erc”) continues to provide a wide variety of employers with lucrative refundable payroll tax credits for qualified wages paid to employees in 2020 and 2021. Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Enlisted reserve corps (now us.

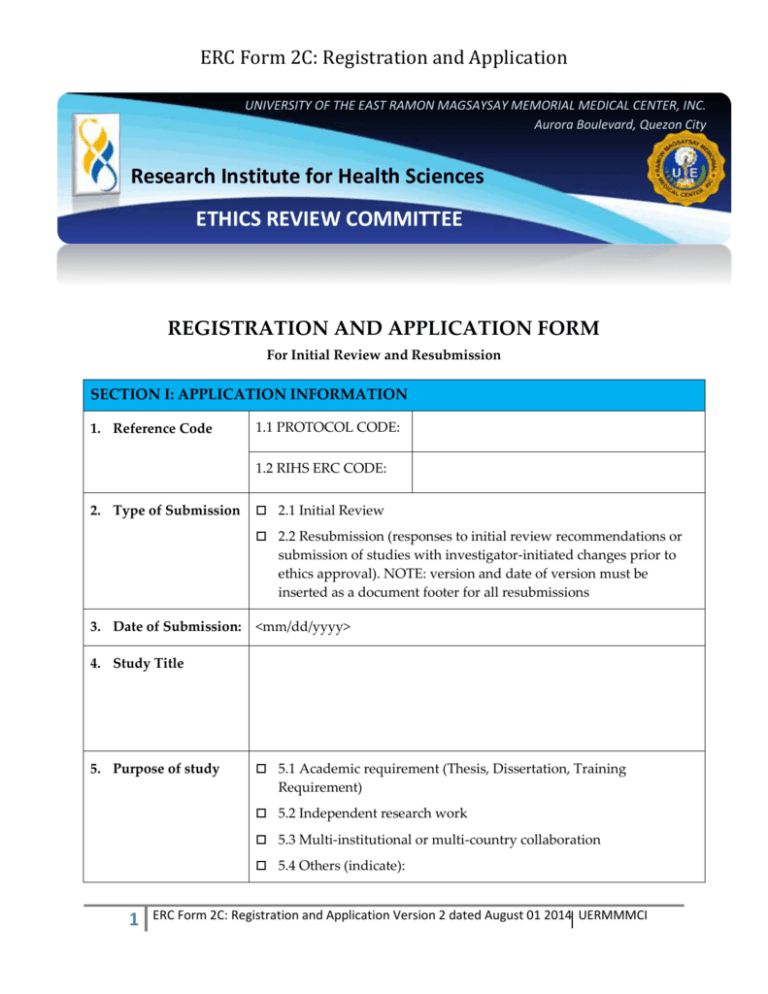

ERC Form 2C Registration and Application

Web the employee retention credit (erc) was created to reward a wide variety of eligible employers for retaining employees during specific periods of the pandemic. Web under the coronavirus aid, relief, and economic security (cares) act, p.l. Complete our full eligibility questionnaire to help us learn about your business and verify your ability to. Web the employee retention tax credit.

A Reduction In Pollution That Is Equal To One Emission Unit Communications Abbreviation For European Radiocommunications Committee:

Web abbreviation for emission reduction credit: Web under the coronavirus aid, relief, and economic security (cares) act, p.l. Web examples of erc employee in a sentence. Web section 206 of the taxpayer certainty and disaster tax relief act (the act) permits an eligible employer to take the employee retention credit (erc), even if the employer has received a paycheck protection program (ppp) loan.

Engineering Research Center (Us Nsf) Erc:

Get started today to find out Complete our full eligibility questionnaire to help us learn about your business and verify your ability to. Businesses can receive up to $26k per eligible employee. Web one option for employers is the employee retention credit (erc).

In The Simplest Terms, The Erc Is A Refundable Payroll Tax Credit For “Qualified Wages” Paid To.

Web washington — the treasury department and the internal revenue service today launched the employee retention credit, designed to encourage businesses to keep employees on their payroll. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff employed. Businesses can receive up to $26k per eligible employee. Employee relocation council (usa) erc:

Web Employee Retention Credit.

Ad our team of experts determine exactly how much of a payroll tax refund you're entitled to. Washington — the internal revenue service today issued a renewed warning urging people to carefully review the employee retention credit (erc) guidelines before trying to claim the credit as promoters continue pushing. Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Is your business eligible for the employee retention credit?