Estate Administration Expenses Deductible On Form 1041

Estate Administration Expenses Deductible On Form 1041 - Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Of the estate or trust. The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. Don’t complete for a simple trust or a pooled income fund. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. Income tax return for estates and trusts. This includes expenses that are common and accepted in the.

Income tax return for estates and trusts. Of the estate or trust. Web what expenses are deductible on a 1041? Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Web the irs on monday issued final regulations ( t.d. Web what expenses are deductible? Web what expenses are deductible on a 1041? On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. The income, deductions, gains, losses, etc.

Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. It requests information about income distributed to. Web form 1041 consists of three pages for basic information about the estate or trust, breaking down income and deductions, and then tallying everything to generate a. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. This includes expenses that are common and accepted in the. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. Web the first category of deductible expenses on form 1041 is ordinary and necessary expenses. The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web what expenses are deductible?

Estate Tax Return When is it due?

On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. The income, deductions, gains, losses, etc. Income tax return for estates and trusts. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. 9918) clarifying that certain expenses incurred by, and certain.

IRS Clarifies Deductibility of Administration Expenses for Estates and

Of the estate or trust. If you do not have to file an estate tax return because of the. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. If the estate or trust has final year deductions (excluding the. Web what expenses are deductible on a 1041?

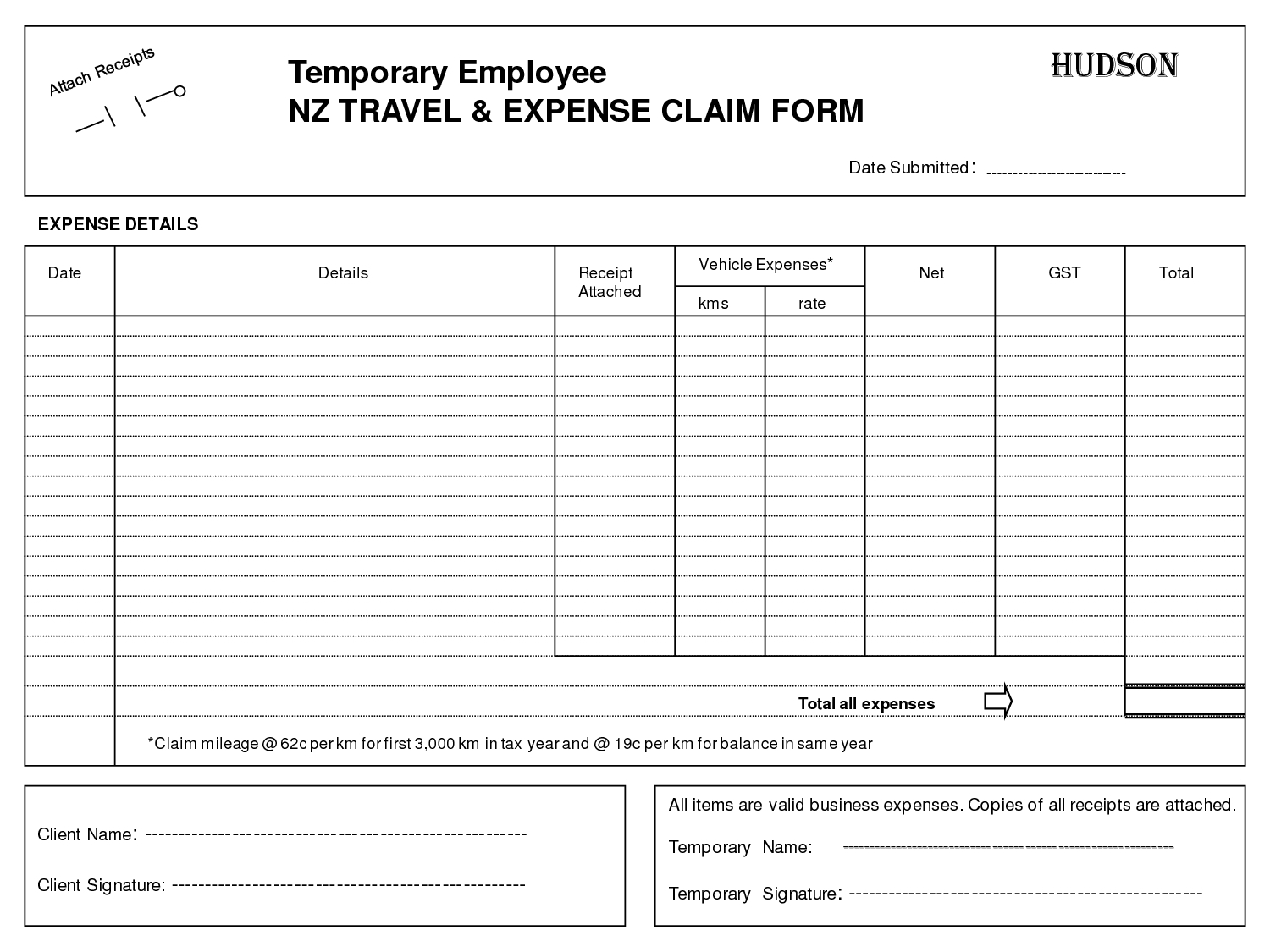

Expenses Claim Form Template Free Durun.ugrasgrup in Business

If you do not have to file an estate tax return because of the. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. These administrative expenses are related to disposal of furnishings from my. Web the irs on monday issued final regulations ( t.d. Web administrative expenses of the bankruptcy estate attributable.

What Expenses Are Deductible On Form 1041 Why Is

9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. Web what expenses are deductible on a 1041?.

Estate Administration Spreadsheet regarding Estate Plan Template Design

Income tax return for estates and trusts. Web this is an explanation by irs in deduction of administrative expenses on 1041. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web the administration costs of.

Form 8825 Rental Real Estate and Expenses of a Partnership or

On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web what expenses are deductible? Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. Web any expenses for the maintenance of assets held in the estate, are claimed on the estate tax return. It.

Rental Commercial Property expenses you can claim Infographic

Web this is an explanation by irs in deduction of administrative expenses on 1041. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Income tax return for estates and trusts. Web any expenses for the maintenance of.

Business Expense Spreadsheet For Taxes Rental Property Tax with

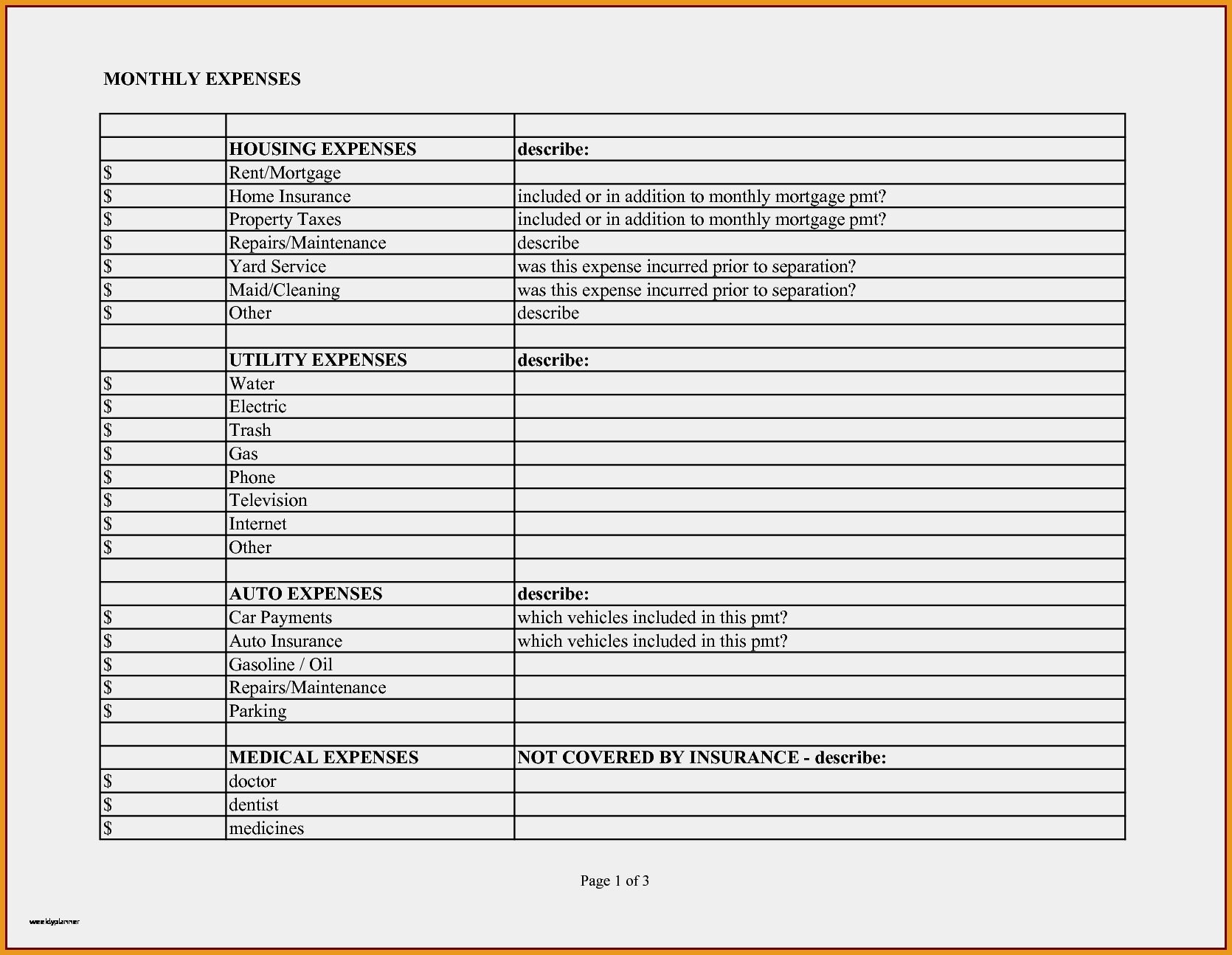

The income, deductions, gains, losses, etc. Web estate & trust administration for dummies. These administrative expenses are related to disposal of furnishings from my. Of the estate or trust. This includes expenses that are common and accepted in the.

USA Real Estate Agents Tax Deduction Cheat Sheet Are you claiming

Web the irs on monday issued final regulations ( t.d. Web administrative expenses of the bankruptcy estate attributable to conducting a trade or business or for the production of estate rents or royalties are deductible in arriving at. Income tax return for estates and trusts. Web 2 schedule a charitable deduction. Web the first category of deductible expenses on form.

What Expenses Are Deductible On Form 1041 Why Is

The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. Web the irs on monday issued final regulations ( t.d. Web form 1041 requires the preparer to list the trust or estate's income, available credits and.

Income Tax Return For Estates And Trusts.

Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Web 2 schedule a charitable deduction. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. If you do not have to file an estate tax return because of the.

If The Estate Or Trust Has Final Year Deductions (Excluding The.

When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. It requests information about income distributed to. Web what expenses are deductible? Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't.

The Executor Or Trustee Can Claim Deductions When Filing Form 1041 To Reduce The Estate Or Trust Taxable Income.

Web what expenses are deductible on a 1041? On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web the first category of deductible expenses on form 1041 is ordinary and necessary expenses. Web estate & trust administration for dummies.

Of The Estate Or Trust.

The income, deductions, gains, losses, etc. Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. Web what expenses are deductible on a 1041?