Fbar Sample Form

Fbar Sample Form - Web elements will depend on the number of fincen fbar documents being reported in the batch. Web fbar was created under the law called the bank secrecy act. Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse) a reportable foreign financial account that requires the filing. When (and how) to record cash in foreign bank accounts at a glance what can an fbar? March 2011) department of the treasury do not use previous editions of this form report of. Activity each fincen fbar document in the batch must begin with the. Web certified copies of fbar documents must be formally requested, in writing, through fincen. Fatca (form 8938) reporting threshold for expats. Fbar (form fincen 114) vs. Web fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the foreign financial accounts exceed $10,000 at any time during the.

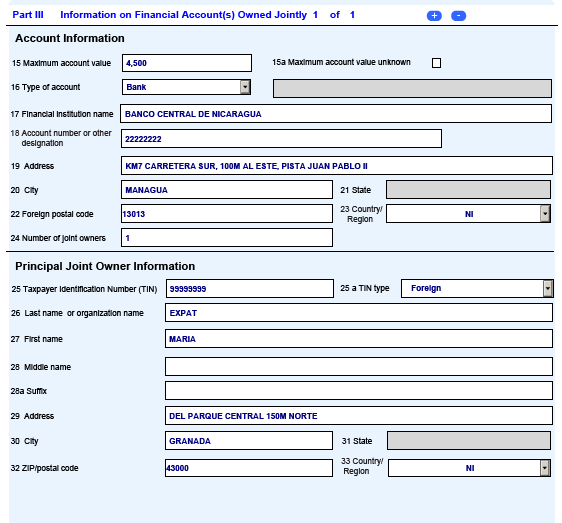

When (and how) to record cash in foreign bank accounts at a glance what can an fbar? Web elements will depend on the number of fincen fbar documents being reported in the batch. Web depending on a taxpayer's situation, they may need to file form 8938 or the fbar or both, and may need to report certain foreign accounts on both forms. $10,000 total in all accounts at any time during. Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse) a reportable foreign financial account that requires the filing. These users file multiple bsa forms in one electronic batch in accordance with the requirements outlined. Web what is an fbar, and when do i need to file it? Web april 10, 2023 resource center forms the fbar: Web april 10, 2023 resource center forms the fbar: When (and how) to report money in foreign bank accounts at a glance what is an fbar?

Web fbar was created under the law called the bank secrecy act. Page includes various formats of fbar form for pdf, word and excel. Web what is an fbar, and when do i need to file it? Web if you’re not working with a professional tax accountant or tax preparer you can file an fbar by submitting your foreign account information via the fincen 114. Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse) a reportable foreign financial account that requires the filing. The bank secrecy act was set up to detect and find money laundering or terrorist financing. Web depending on a taxpayer's situation, they may need to file form 8938 or the fbar or both, and may need to report certain foreign accounts on both forms. Web april 10, 2023 resource center forms the fbar: Web certified copies of fbar documents must be formally requested, in writing, through fincen. You must have a valid reason for requesting a certified copy, such as for a trial.

7+ Fbar Form Templates Free Word, PDF Designs

Page includes various formats of fbar form for pdf, word and excel. Web depending on a taxpayer's situation, they may need to file form 8938 or the fbar or both, and may need to report certain foreign accounts on both forms. Web sample fbar form free download and preview, download free printable template samples in pdf, word and excel formats.

Sample FBAR Form Edit, Fill, Sign Online Handypdf

Web if you’re not working with a professional tax accountant or tax preparer you can file an fbar by submitting your foreign account information via the fincen 114. Web april 10, 2023 resource center forms the fbar: Fbar (form fincen 114) vs. Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse).

Sample FBAR Form Free Download

Web fbar was created under the law called the bank secrecy act. Batch filer of bsa forms. Web these users file single bsa forms to fincen. Web april 10, 2023 resource center forms the fbar: Web april 10, 2023 resource center forms the fbar:

Sample FBAR Form Free Download

Web what is an fbar, and when do i need to file it? Web these users file single bsa forms to fincen. Web april 10, 2023 resource center forms the fbar: You must have a valid reason for requesting a certified copy, such as for a trial. These users file multiple bsa forms in one electronic batch in accordance with.

How To File Your FBAR

March 2011) department of the treasury do not use previous editions of this form report of. Activity each fincen fbar document in the batch must begin with the. Fatca (form 8938) reporting threshold for expats. Web april 10, 2023 resource center forms the fbar: Web certified copies of fbar documents must be formally requested, in writing, through fincen.

1+ FBAR Form Free Download

Activity each fincen fbar document in the batch must begin with the. Web fbar, or the foreign bank account report, is required for individuals who have foreign accounts that when combined equal to or exceeded $10,000 at any one time during the. The bank secrecy act was set up to detect and find money laundering or terrorist financing. March 2011).

FBAR Reporting Requirements for US Expats Living and Working Abroad

Activity each fincen fbar document in the batch must begin with the. Batch filer of bsa forms. When (and how) to record cash in foreign bank accounts at a glance what can an fbar? $10,000 total in all accounts at any time during. When (and how) to report money in foreign bank accounts at a glance what is an fbar?

Sample FBAR Form Free Download

Web april 10, 2023 resource center forms the fbar: Web depending on a taxpayer's situation, they may need to file form 8938 or the fbar or both, and may need to report certain foreign accounts on both forms. Batch filer of bsa forms. Web sample fbar form free download and preview, download free printable template samples in pdf, word and.

Download FBAR Form for Free Page 5 FormTemplate

March 2011) department of the treasury do not use previous editions of this form report of. When (and how) to report money in foreign bank accounts at a glance what is an fbar? Web fbar, or the foreign bank account report, is required for individuals who have foreign accounts that when combined equal to or exceeded $10,000 at any one.

Sample FBAR Form Free Download

Fbar (form fincen 114) vs. Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse) a reportable foreign financial account that requires the filing. When (and how) to record cash in foreign bank accounts at a glance what can an fbar? Web fbar, or the foreign bank account report, is required for.

These Users File Multiple Bsa Forms In One Electronic Batch In Accordance With The Requirements Outlined.

Web april 10, 2023 resource center forms the fbar: Web fbar, or the foreign bank account report, is required for individuals who have foreign accounts that when combined equal to or exceeded $10,000 at any one time during the. Web elements will depend on the number of fincen fbar documents being reported in the batch. Batch filer of bsa forms.

When (And How) To Record Cash In Foreign Bank Accounts At A Glance What Can An Fbar?

Web certified copies of fbar documents must be formally requested, in writing, through fincen. Page includes various formats of fbar form for pdf, word and excel. When (and how) to report money in foreign bank accounts at a glance what is an fbar? Web if you’re not working with a professional tax accountant or tax preparer you can file an fbar by submitting your foreign account information via the fincen 114.

Fatca (Form 8938) Reporting Threshold For Expats.

March 2011) department of the treasury do not use previous editions of this form report of. You must have a valid reason for requesting a certified copy, such as for a trial. Web april 10, 2023 resource center forms the fbar: Web an fbar filer is considered an individual when he/she personally owns (or jointly owns with a spouse) a reportable foreign financial account that requires the filing.

Web These Users File Single Bsa Forms To Fincen.

Activity each fincen fbar document in the batch must begin with the. Fbar (form fincen 114) vs. The bank secrecy act was set up to detect and find money laundering or terrorist financing. Web what is an fbar, and when do i need to file it?