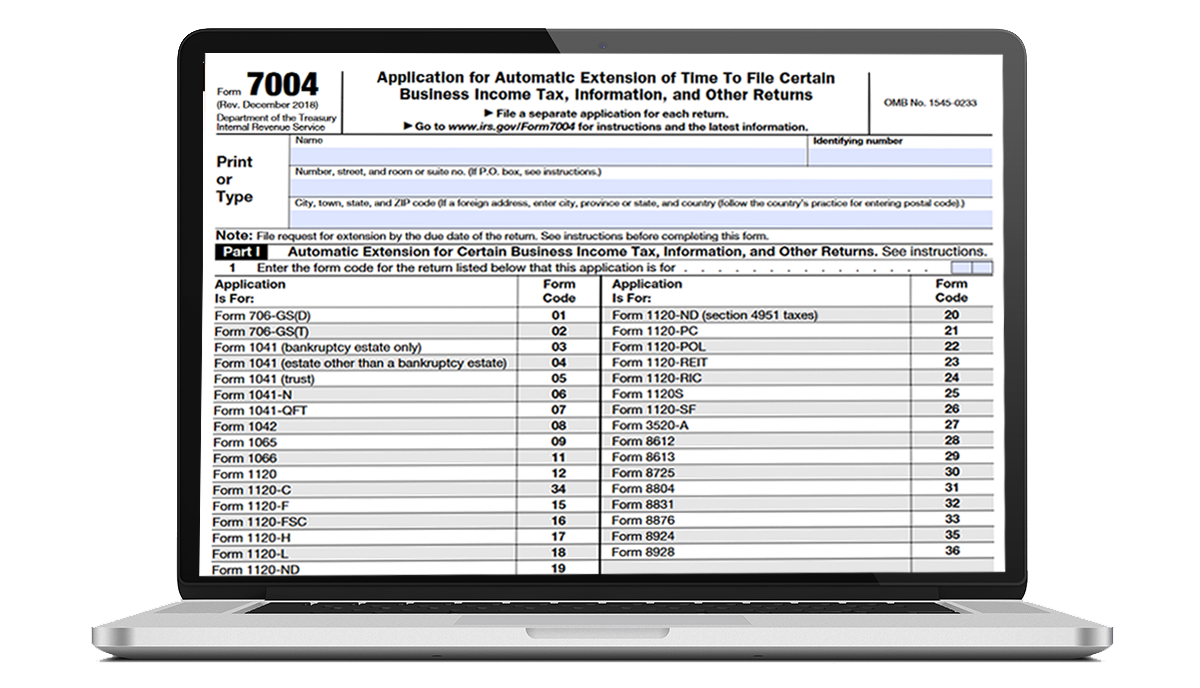

Federal Tax Form 7004

Federal Tax Form 7004 - Web it appears you don't have a pdf plugin for this browser. Web federal tax extension form 7004: Web this form spans a variety of tax returns and gives you extra wiggle room (up to six months) after the usual tax season to file your business’ federal income taxes. Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. Refer to the form 7004 instructions for additional information on payment of tax and balance. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for. A corporation that does not pay the tax when due generally may be. Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines. Web purpose of form. The irs uses the form to document the businesses that have.

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 7004 is a federal corporate income tax form. A corporation that does not pay the tax when due generally may be. Web this form spans a variety of tax returns and gives you extra wiggle room (up to six months) after the usual tax season to file your business’ federal income taxes. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for. Web attach form 7004 to the corporation’s tax return. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web the form 7004 does not extend the time for payment of tax. Web form 7004 can be filed electronically for most returns. Refer to the form 7004 instructions for additional information on payment of tax and balance.

Refer to the form 7004 instructions for additional information on payment of tax and balance. Web purpose of form. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The irs uses the form to document the businesses that have. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. A corporation that does not pay the tax when due generally may be. Web march 10, 2023.

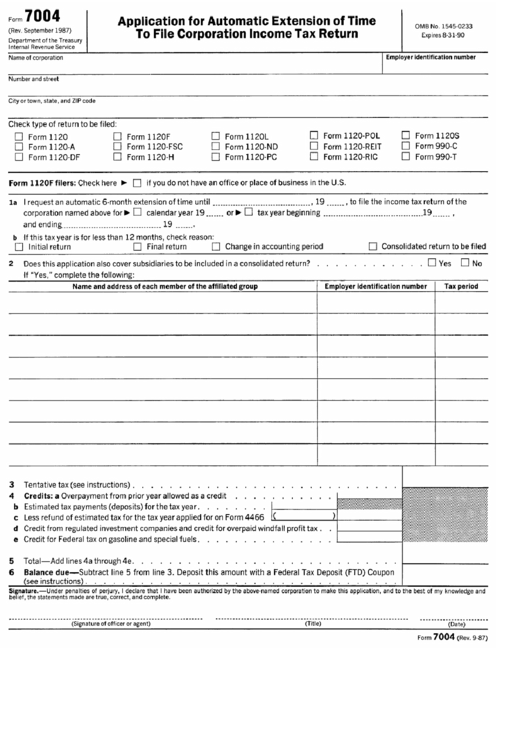

Business tax extension form 7004

Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. Web this form spans a variety of tax returns and gives you extra wiggle room (up to six months) after the usual tax season to file your business’ federal income taxes. The irs uses the form to document the businesses.

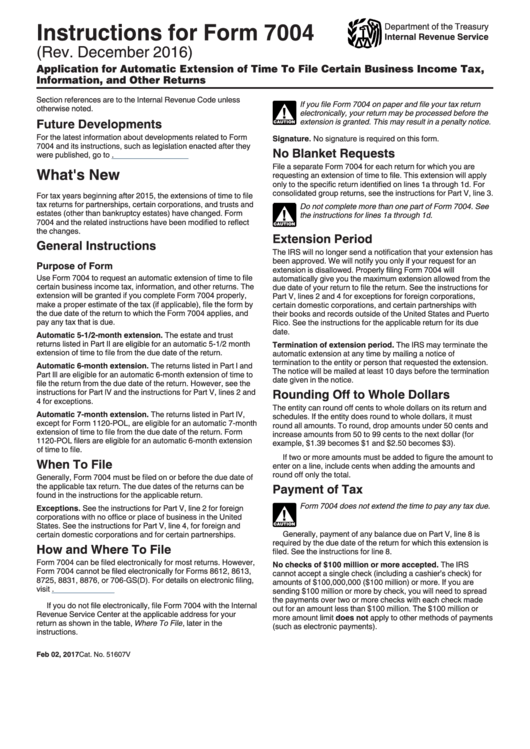

Instructions For Form 7004 Application For Automatic Extension Of

Web this form spans a variety of tax returns and gives you extra wiggle room (up to six months) after the usual tax season to file your business’ federal income taxes. Complete, edit or print tax forms instantly. More about the federal form 7004 extension we last. Web federal tax extension form 7004: Web form 7004 is a document that.

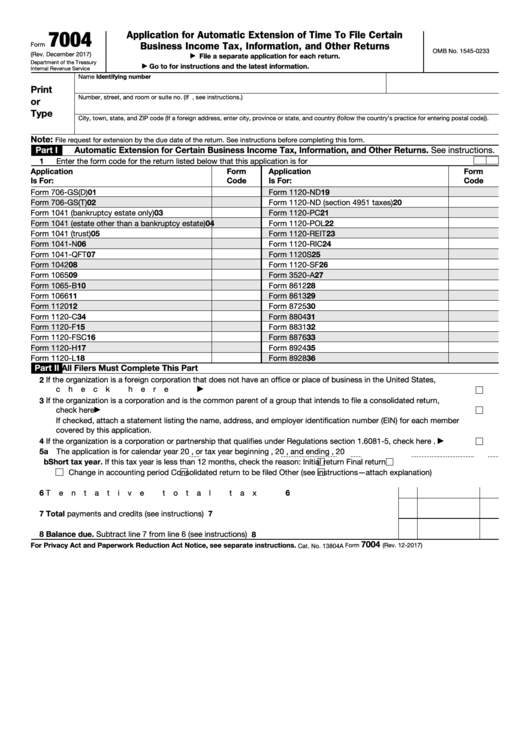

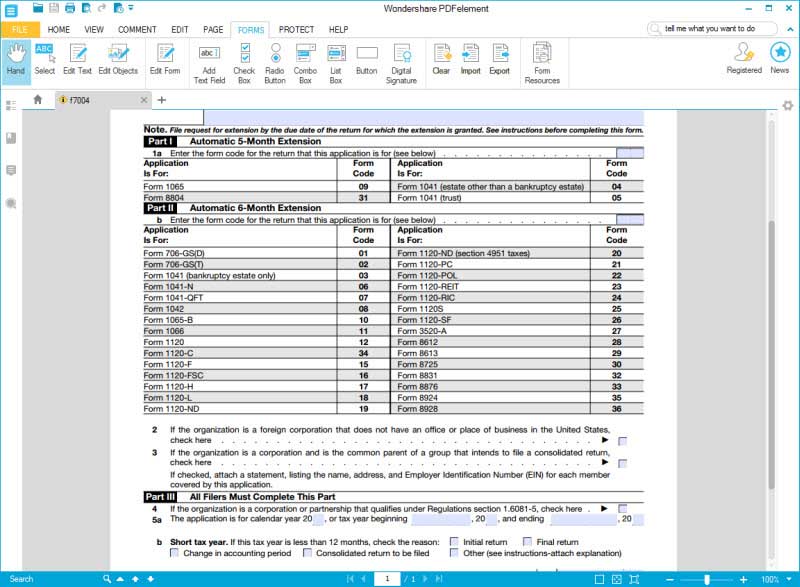

Fillable Form 7004 Application For Automatic Extension Of Time To

Web purpose of form. Web this form spans a variety of tax returns and gives you extra wiggle room (up to six months) after the usual tax season to file your business’ federal income taxes. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is.

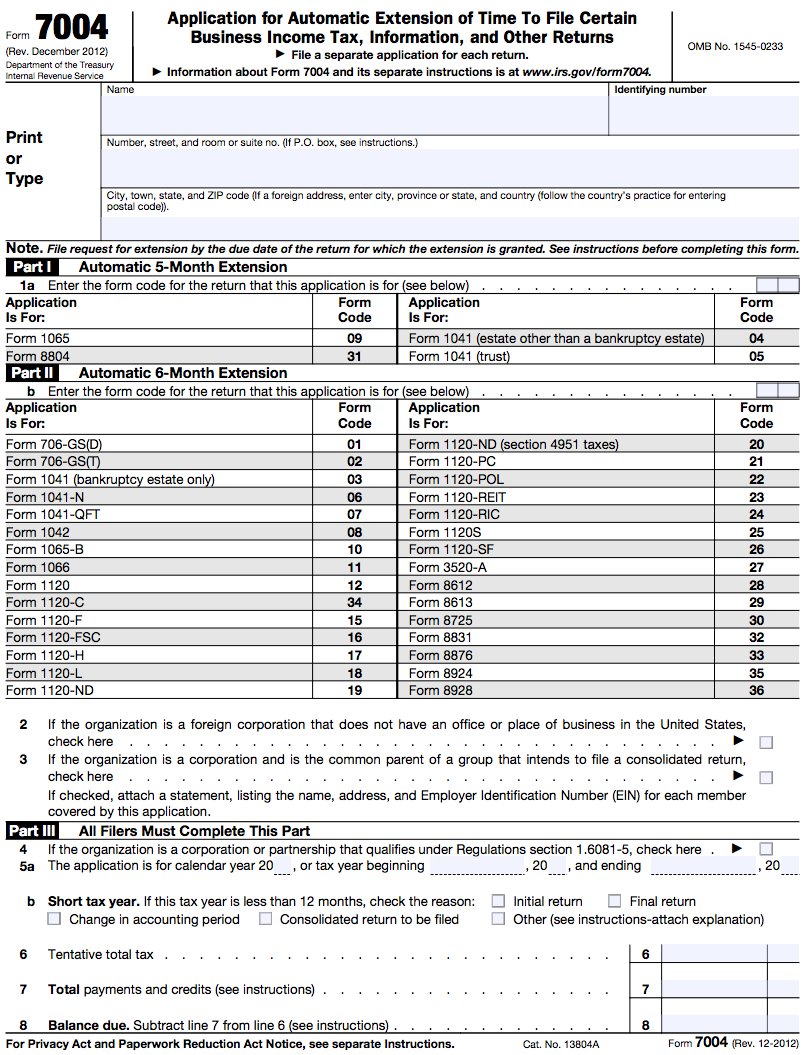

How to Fill Out Tax Form 7004 tax department of india

Web form 7004 can be filed electronically for most returns. Complete, edit or print tax forms instantly. Web the form 7004 does not extend the time for payment of tax. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. A corporation that does not pay the tax when due.

TAX EXTENSION FORM 7004 by Express Extension Issuu

Web form 7004 is a federal corporate income tax form. Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns,.

EFile 7004 Online 2022 File Business Tax extension Form

Web form 7004 is a federal corporate income tax form. Web march 10, 2023. Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request.

Form 7004 Application For Automatic Extension Of Time To File

Refer to the form 7004 instructions for additional information on payment of tax and balance. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web march 10, 2023. Ad access irs tax forms. Web form 7004 is a document that enables business.

Cheapest Way to File IRS Business Tax Extension With Form 7004 ONLINE

Web attach form 7004 to the corporation’s tax return. Web march 10, 2023. Web form 7004 can be filed electronically for most returns. Web purpose of form. Ad access irs tax forms.

Tax extension form 7004

Ad get ready for tax season deadlines by completing any required tax forms today. Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web.

Instructions for How to Fill in IRS Form 7004

Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. A corporation that does not pay the tax when due generally may be. Web federal tax extension form 7004: Web purpose of form. Terms to fill it out in 2023 the application for a time extension to file business income.

More About The Federal Form 7004 Extension We Last.

A corporation that does not pay the tax when due generally may be. Web form 7004 can be filed electronically for most returns. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for.

Use Form 7004 To Request An Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. Form 7004 does not extend the time for payment of tax. Web the form 7004 does not extend the time for payment of tax. Web purpose of form.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web it appears you don't have a pdf plugin for this browser. The irs uses the form to document the businesses that have. Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. Web federal tax extension form 7004:

Web Irs Form 7004 Is The Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns. It's Used To Request More.

Complete, edit or print tax forms instantly. Ad access irs tax forms. Refer to the form 7004 instructions for additional information on payment of tax and balance. Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines.