File Form 944

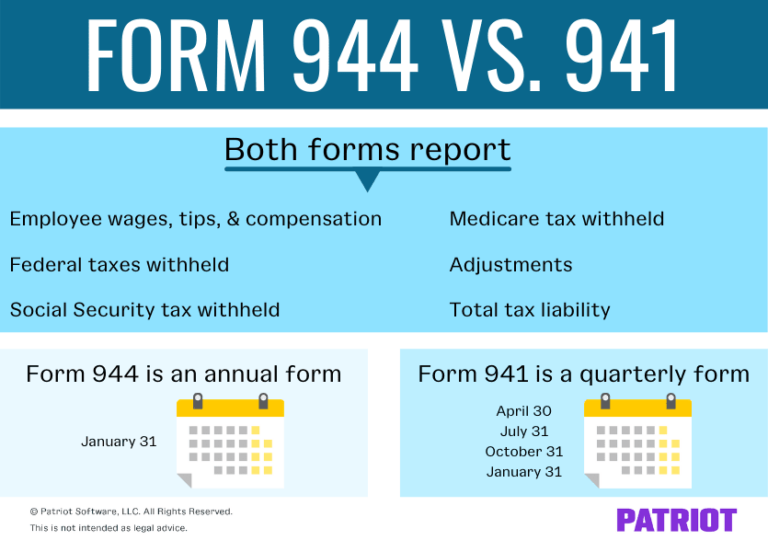

File Form 944 - Web form 944 must be filed by january 31. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay. Follow the easy steps of filing form. You can find your states local irs office by going onto irs.gov or contacting a tax professional who can better walk you. The first step in filing form 944 is to collect all relevant payroll data and records. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Connecticut, delaware, district of columbia, georgia,. Ad access irs tax forms. Gathering necessary information and records. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax return used for employers with higher estimated tax.

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. The form helps both the employer and the irs keep track of how much income tax and. Ready to file form 944 for 2022? Get ready for tax season deadlines by completing any required tax forms today. Web simply put, form 944 is a document the irs requires some employers to file annually. Web irs form 944 is the employer's annual federal tax return. Web form 944 allows smaller employers whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less, to file and pay. Web your form 944 can be mailed to your states irs office. However, some of the content may still be useful, so we have. Follow the easy steps of filing form.

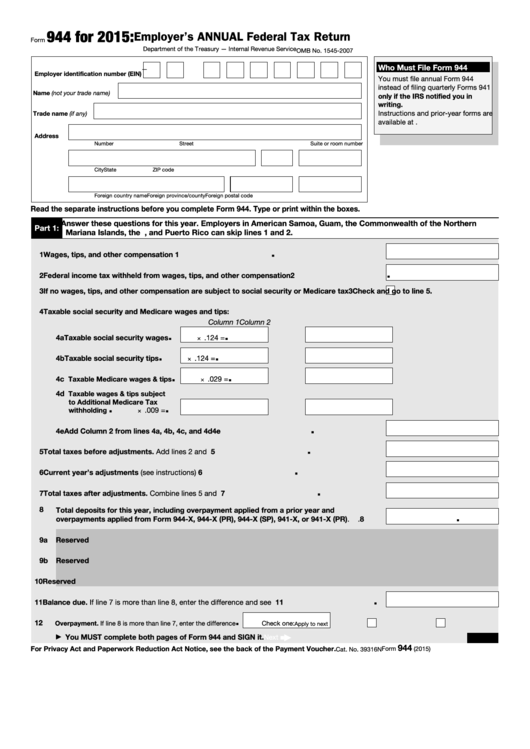

Web mailing addresses for forms 944. Web irs form 944 is the employer's annual federal tax return. Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 for 2020: Gathering necessary information and records. Web simply put, form 944 is a document the irs requires some employers to file annually. Get ready for tax season deadlines by completing any required tax forms today. Web your form 944 can be mailed to your states irs office. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax return used for employers with higher estimated tax.

Who is Required to File Form I944 for a Green Card? CitizenPath

Web irs form 944 is the employer's annual federal tax return. Web form 944 for 2021: 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web your form 944 can be mailed to your states irs office. Ad access irs tax forms.

File Form 944 Online EFile 944 Form 944 for 2021

Connecticut, delaware, district of columbia, georgia,. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Paper filers and efilers must file form 944 to the irs by january 31, 2023..

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

You can find your states local irs office by going onto irs.gov or contacting a tax professional who can better walk you. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax.

944 Form 2021 2022 IRS Forms Zrivo

Complete, edit or print tax forms instantly. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. The form was introduced by the irs to give smaller employers a break in filing and paying federal. You.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Gathering necessary information and records. Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 for 2021: Ad access irs tax forms. Employer’s annual federal tax return department of the treasury — internal revenue service.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Get ready for tax season deadlines by completing any required tax forms today. Web this being said, the deadline to file form 944 is jan. Ad access irs tax forms. Web.

File Form 944 Online EFile 944 Form 944 for 2022

Web your form 944 can be mailed to your states irs office. Paper filers and efilers must file form 944 to the irs by january 31, 2023. Ad access irs tax forms. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. The first step in filing form 944 is to collect.

do i have to file form 944 if i have no employees Fill Online

Web form 944 must be filed by january 31. Web simply put, form 944 is a document the irs requires some employers to file annually. Who must file form 944. Get ready for tax season deadlines by completing any required tax forms today. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Gathering necessary information and records. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. You can find your states local irs office by going onto irs.gov or contacting a tax professional who can better walk you. Complete, edit or print tax forms instantly. Web form 944 for 2021:

File Form 944 Online EFile 944 Form 944 for 2021

Follow the easy steps of filing form. Paper filers and efilers must file form 944 to the irs by january 31, 2023. Ready to file form 944 for 2022? The first step in filing form 944 is to collect all relevant payroll data and records. You can find your states local irs office by going onto irs.gov or contacting a.

Paper Filers And Efilers Must File Form 944 To The Irs By January 31, 2023.

Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Ad access irs tax forms. The form helps both the employer and the irs keep track of how much income tax and. Web form 944 for 2021:

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. Employer’s annual federal tax return department of the treasury — internal revenue service. Ready to file form 944 for 2022? Web mailing addresses for forms 944.

Complete, Edit Or Print Tax Forms Instantly.

Employer’s annual federal tax return department of the treasury — internal revenue service. Connecticut, delaware, district of columbia, georgia,. Web form 944 for 2020: The form was introduced by the irs to give smaller employers a break in filing and paying federal.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web form 944 must be filed by january 31. Web irs form 944 is the employer's annual federal tax return. Web simply put, form 944 is a document the irs requires some employers to file annually.