Filing Deadline For Form 5500

Filing Deadline For Form 5500 - Form 5500 must be filed by the last day of the seventh month following the end of the. Web form 5500 filing deadline. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. The form 5500 must be filed electronically as noted. Web form 5500 filing deadlines and extensions standard filing deadline. Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. For an explanation of how to file your form 5500 return, in. Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. The normal due date is. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain.

Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web form 5500 filing deadline. The form 5500 must be filed electronically as noted. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. The filing due date for a form 5500 is seven months after the end of the. Web form 5500, annual return/report of employee benefit plan; The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. 15th, but if the filing due date falls on a saturday, sunday or.

Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Form 5500 must be filed by the last day of the seventh month following the end of the. For an explanation of how to file your form 5500 return, in. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Web form 5500, annual return/report of employee benefit plan; Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form 5500 filing deadline.

Form 5500 Deadline Coming Up In August! MyHRConcierge

Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. The normal due date is. The filing due date for a form 5500 is seven months after the end of the. Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit.

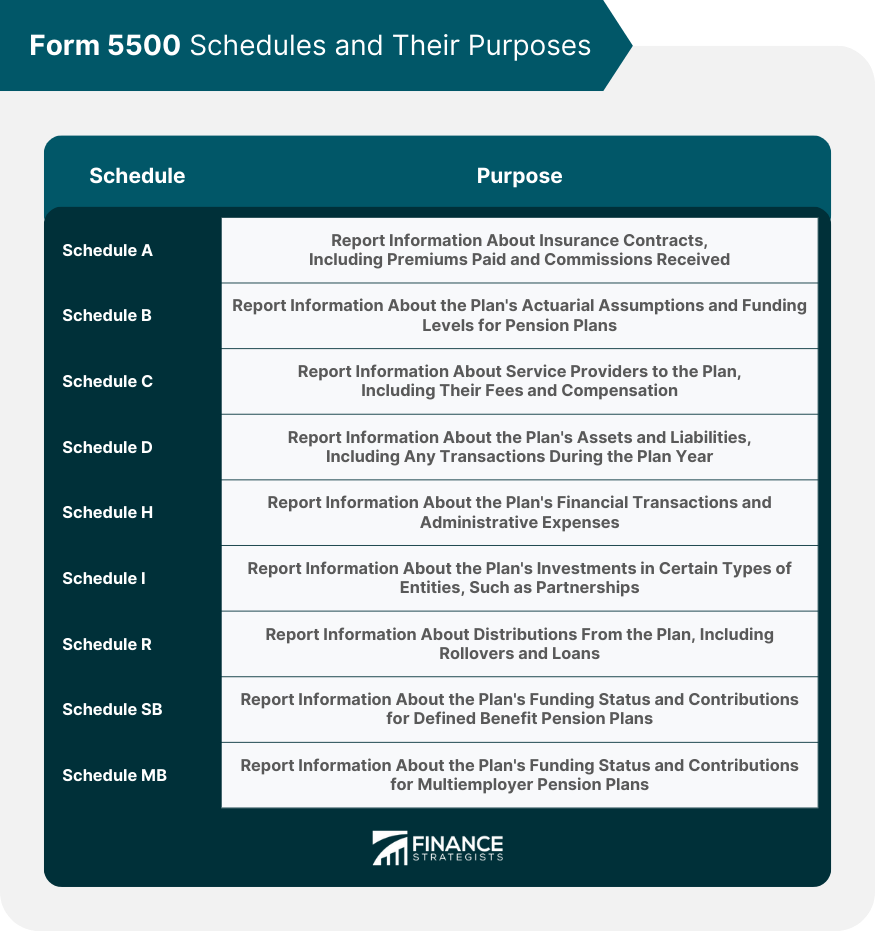

Form 5500 Definition, Components, Schedules, and Deadlines

The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Form 5500 must be filed by the last day of the seventh month following the end of.

What is Form 5500 & What Plan Sponsors Need to Know About It? NESA

Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; 15th, but if the filing due date falls on a saturday, sunday or. Web form 5500 filing deadlines and extensions standard filing deadline. If you’re unable to meet the. The form 5500 must be filed electronically as.

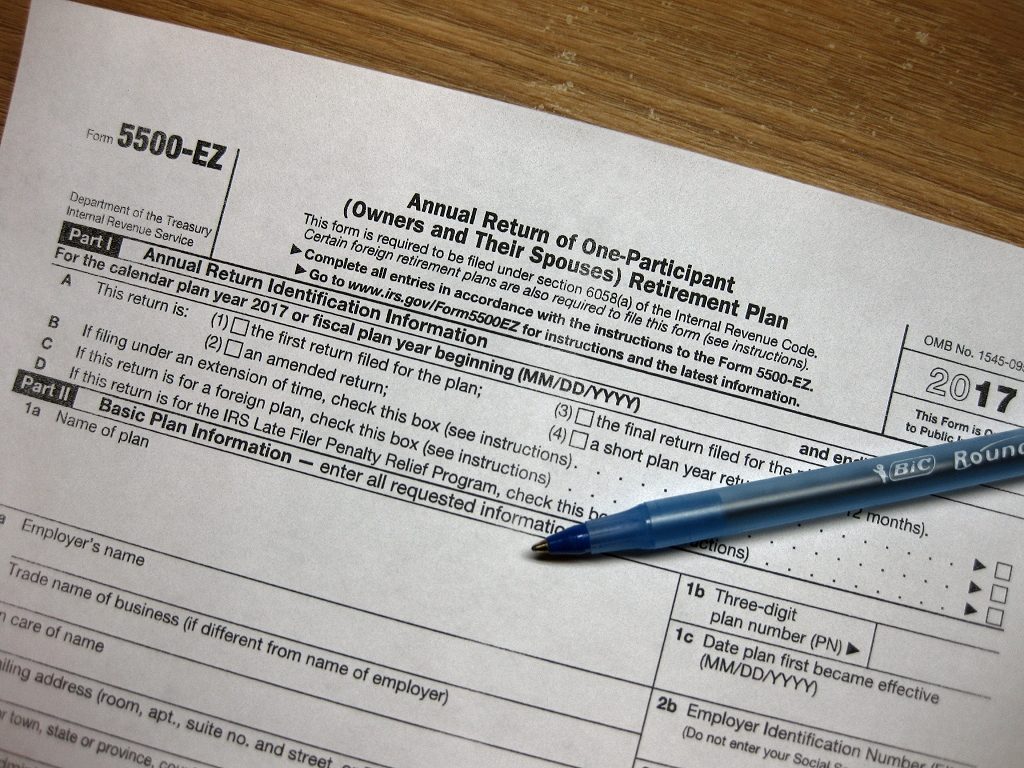

Solo 401k Reporting Requirements Solo 401k

Web form 5500 filing deadline. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Web posted on june 14, 2021 form 5500 filing deadline is july.

Form 5500 Instructions 5 Steps to Filing Correctly

Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Web form 5500 filing deadlines and extensions standard filing deadline. Web form 5500, annual return/report of employee benefit plan;.

Form 5500 Instructions 5 Steps to Filing Correctly

Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. For an explanation of how to file your form.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web form 5500 filing deadline. Posting on the web does not constitute acceptance of the filing by the. The filing due date for a form 5500 is seven months after the end of the. Web distribute all plan assets as.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web form 5500 filing deadline. If you’re unable to meet the. The normal due date is. Web form 5500, annual return/report of employee benefit plan;

Form 5500 Is Due by July 31 for Calendar Year Plans

The form 5500 must be filed electronically as noted. The filing due date for a form 5500 is seven months after the end of the. Posting on the web does not constitute acceptance of the filing by the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form.

DOL Tips on Filing Form 5500 PNC Insights

15th, but if the filing due date falls on a saturday, sunday or. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Posting on the web.

The Normal Due Date Is.

Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. The filing due date for a form 5500 is seven months after the end of the. Web form 5500 filing deadlines and extensions standard filing deadline.

The Form 5500 Must Be Filed Electronically As Noted.

Web form 5500 filing deadline. 15th, but if the filing due date falls on a saturday, sunday or. Posting on the web does not constitute acceptance of the filing by the. If you’re unable to meet the.

Web This Search Tool Allows You To Search For Form 5500 Series Returns/Reports Filed Since January 1, 2010.

Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. For an explanation of how to file your form 5500 return, in. Web form 5500, annual return/report of employee benefit plan; Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

Form 5500 Must Be Filed By The Last Day Of The Seventh Month Following The End Of The.

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend.