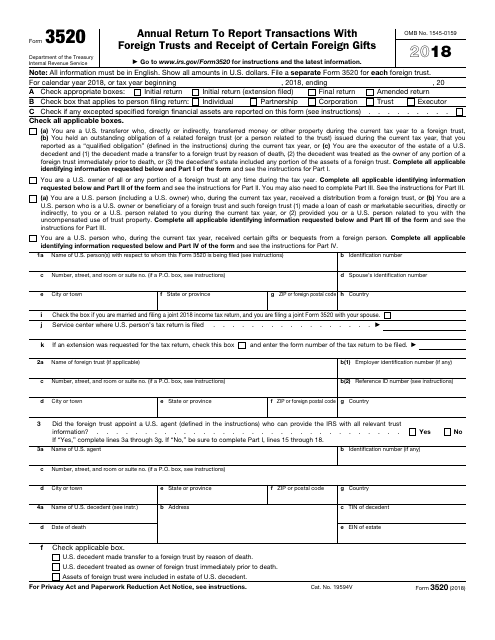

Fillable Form 3520

Fillable Form 3520 - Web this form must be submitted to the u.s. Web form 3520 filing requirements. You need to have the irs form 3520 on your computer hence you need to download it. The word “certain” in the form’s title. Persons (and executors of estates of u.s. Web you held an outstanding obligation of a related foreign trust (or a person related to the trust) issued during the current tax year, that you reported as a “qualified obligation” (defined in. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. Identify the type of highway, nonroad, or stationary engine, vehicle, or equipment you are importing from. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

You need to have the irs form 3520 on your computer hence you need to download it. Web press the blue button above to get a fillable form template and conveniently complete it online. This form does not apply to aircraft engines. Complete, edit or print tax forms instantly. Here is the direct download link for form 3520 from irs website. Web this form must be submitted to the u.s. Enter the initial and final returns. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Talk to our skilled attorneys by scheduling a free consultation today.

Certain transactions with foreign trusts, ownership of foreign trusts under the. Talk to our skilled attorneys by scheduling a free consultation today. Enter the initial and final returns. Decedents) file form 3520 to report: Web form 3520’s full designation is a mouthful: Web you held an outstanding obligation of a related foreign trust (or a person related to the trust) issued during the current tax year, that you reported as a “qualified obligation” (defined in. Complete, edit or print tax forms instantly. Download or email irs 3520 & more fillable forms, register and subscribe now! Ad access irs tax forms. You need to have the irs form 3520 on your computer hence you need to download it.

form 3520a 2021 Fill Online, Printable, Fillable Blank

Enter the initial and final returns. Here is the direct download link for form 3520 from irs website. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Persons (and executors of estates of u.s. Decedents) file form 3520 to report:

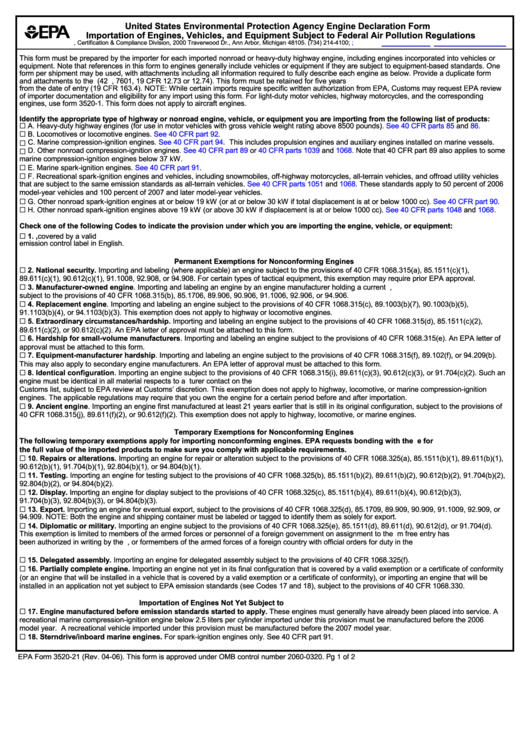

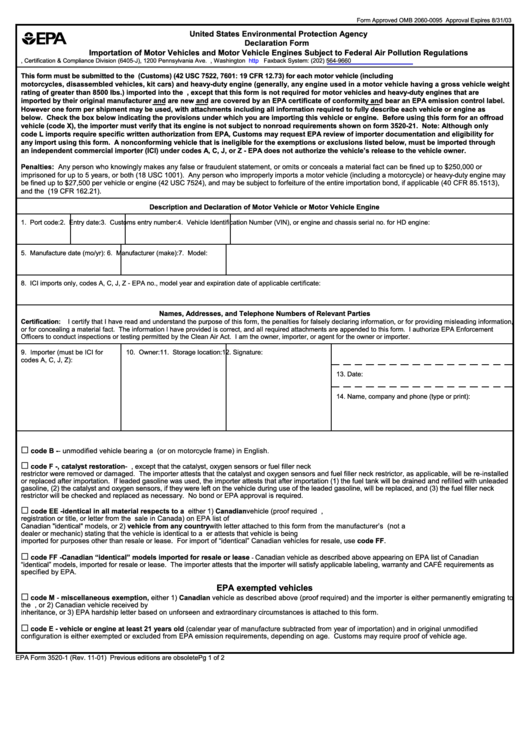

Fillable Epa Form 352021 United States Environmental Protection

Enter the initial and final returns. Web form 3520’s full designation is a mouthful: Download or email irs 3520 & more fillable forms, register and subscribe now! Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end.

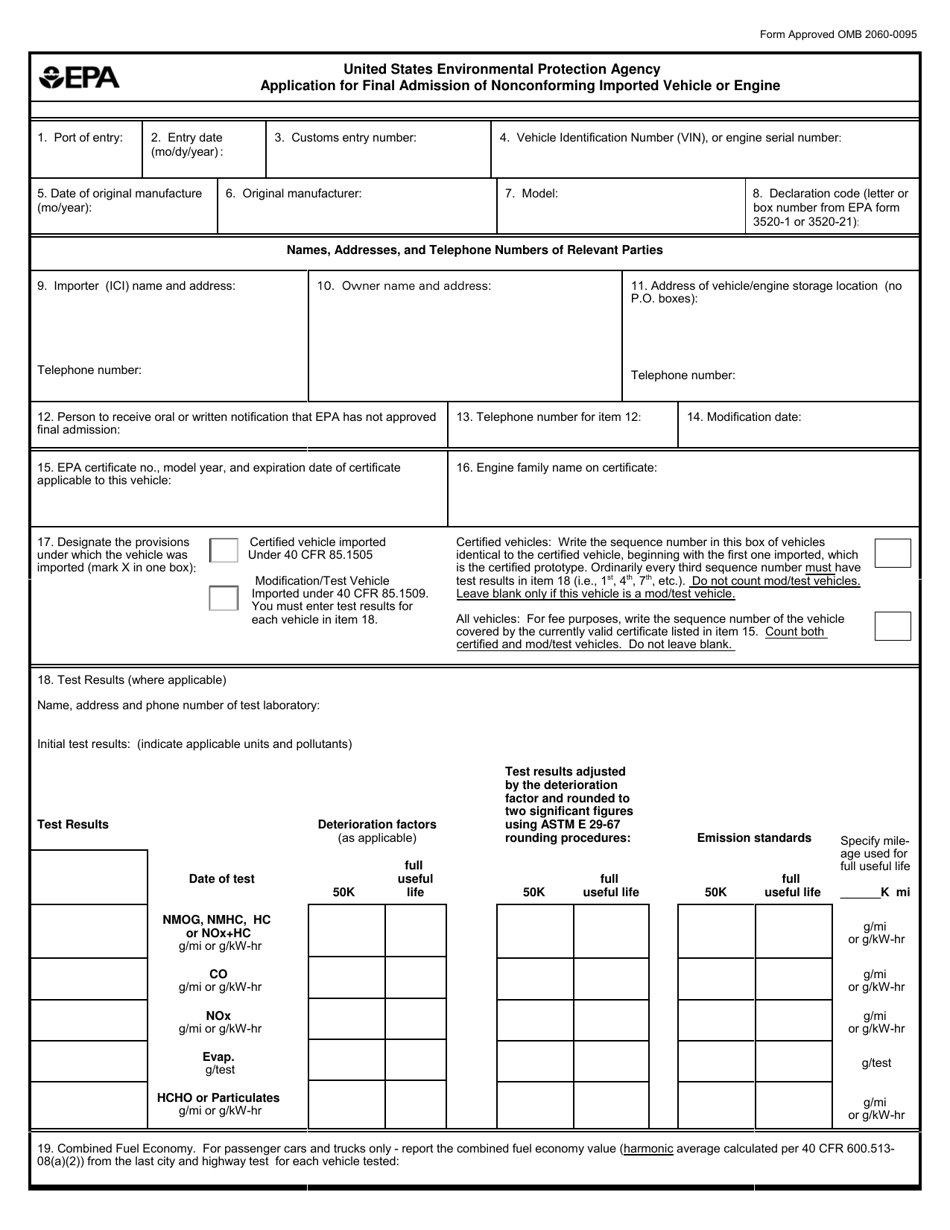

EPA Form 35208 Download Fillable PDF or Fill Online Application for

Download or email irs 3520 & more fillable forms, register and subscribe now! Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of.

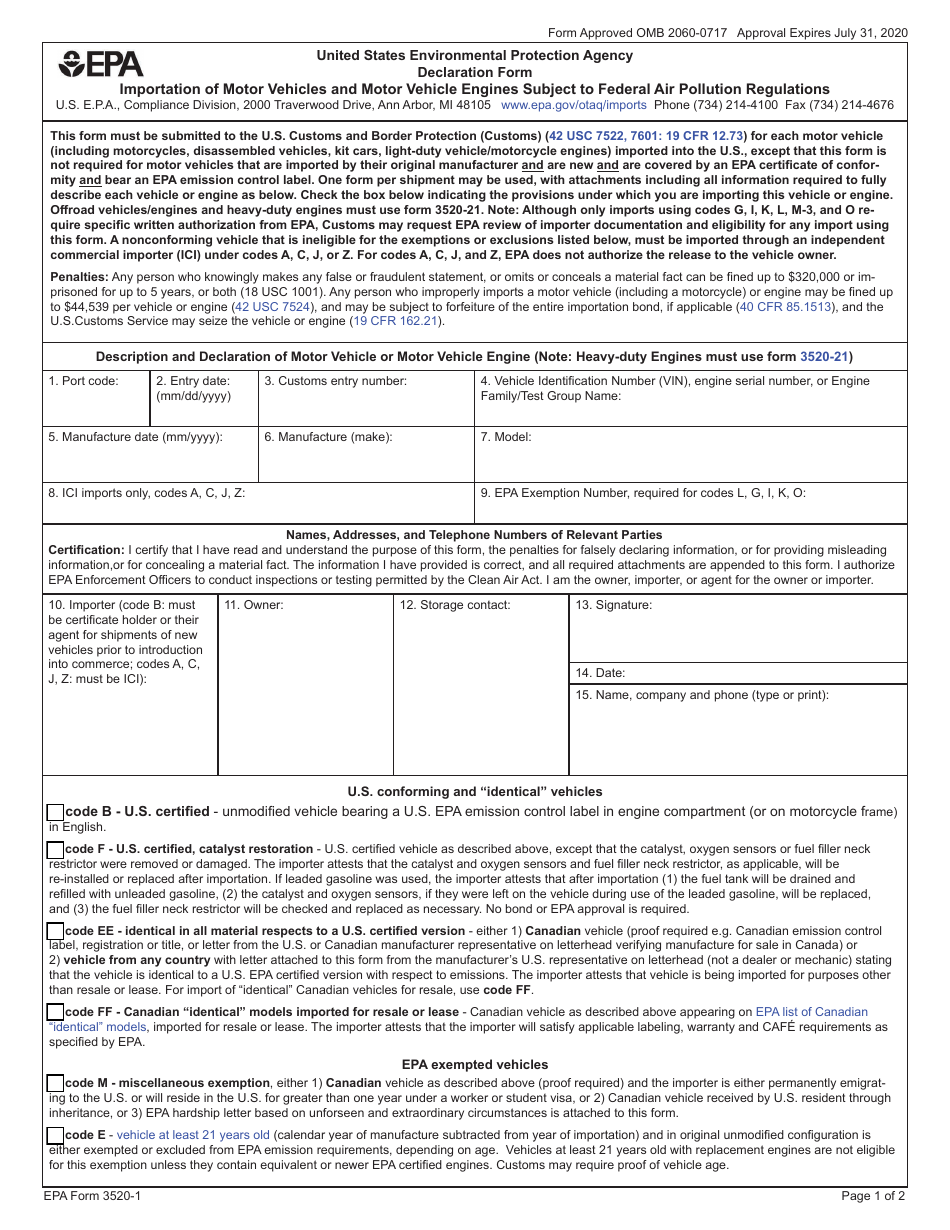

EPA Form 35201 Download Fillable PDF or Fill Online Declaration Form

Here is the direct download link for form 3520 from irs website. Persons (and executors of estates of u.s. Certain transactions with foreign trusts. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Enter the initial and final returns.

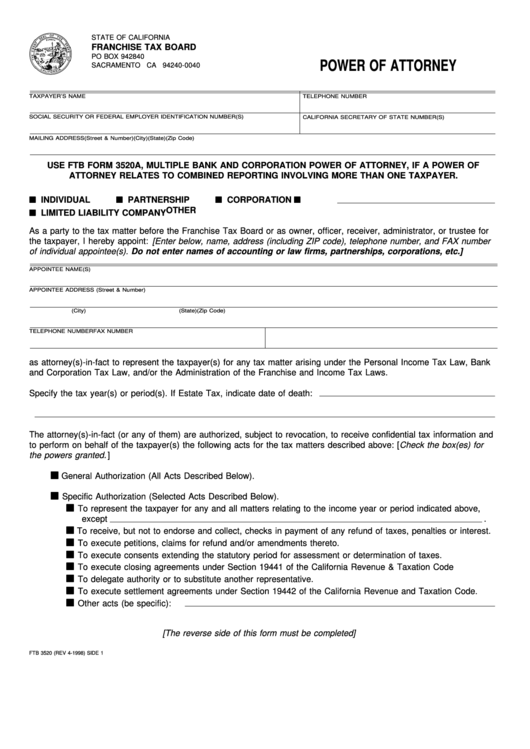

Fillable Form Ftb 3520 Power Of Attorney 1998 printable pdf download

Complete, edit or print tax forms instantly. Ad access irs tax forms. Ad complete irs tax forms online or print government tax documents. Identify the type of highway, nonroad, or stationary engine, vehicle, or equipment you are importing from. Persons (and executors of estates of u.s.

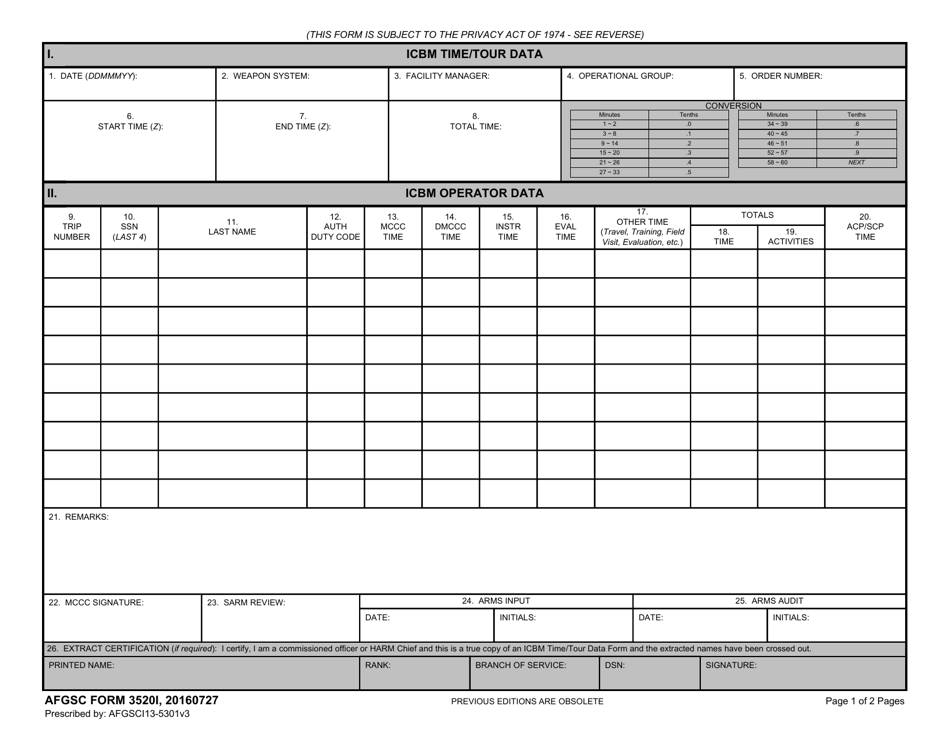

AFGSC Form 3520I Download Fillable PDF or Fill Online Icbm Time/Tour

Ownership of foreign trusts under the rules of sections. Web this form must be submitted to the u.s. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Complete, edit or print tax forms instantly. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is.

20202023 Form EPA 352021 Fill Online, Printable, Fillable, Blank

Ad access irs tax forms. Here is the direct download link for form 3520 from irs website. Ownership of foreign trusts under the rules of sections. Persons (and executors of estates of u.s. Identify the type of highway, nonroad, or stationary engine, vehicle, or equipment you are importing from.

Fillable Epa Form 35201 U.s. Environmental Protection Agency

Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 filing requirements. Download or email irs 3520 & more fillable forms, register and subscribe now! Ad complete irs tax forms online or print government tax documents. Web form 3520’s full designation is a mouthful:

IRS Form 3520 Download Fillable PDF or Fill Online Annual Return to

Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: Form 3520 is technically referred to as the annual.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Web press the blue button above to get a fillable form template and conveniently complete it online. Certain transactions with foreign trusts. Certain transactions with foreign trusts, ownership of foreign trusts under the. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 filing requirements.

Complete, Edit Or Print Tax Forms Instantly.

Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Decedents) file form 3520 to report: Web form 3520’s full designation is a mouthful: Identify the type of highway, nonroad, or stationary engine, vehicle, or equipment you are importing from.

This Form Does Not Apply To Aircraft Engines.

Enter the initial and final returns. Ownership of foreign trusts under the rules of sections. Certain transactions with foreign trusts. Web this form must be submitted to the u.s.

Persons (And Executors Of Estates Of U.s.

Certain transactions with foreign trusts, ownership of foreign trusts under the. Complete, edit or print tax forms instantly. Put down the tax year. The word “certain” in the form’s title.

Ad Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

Download or email irs 3520 & more fillable forms, register and subscribe now! Ad access irs tax forms. Decedents) file form 3520 with the irs to report: Talk to our skilled attorneys by scheduling a free consultation today.