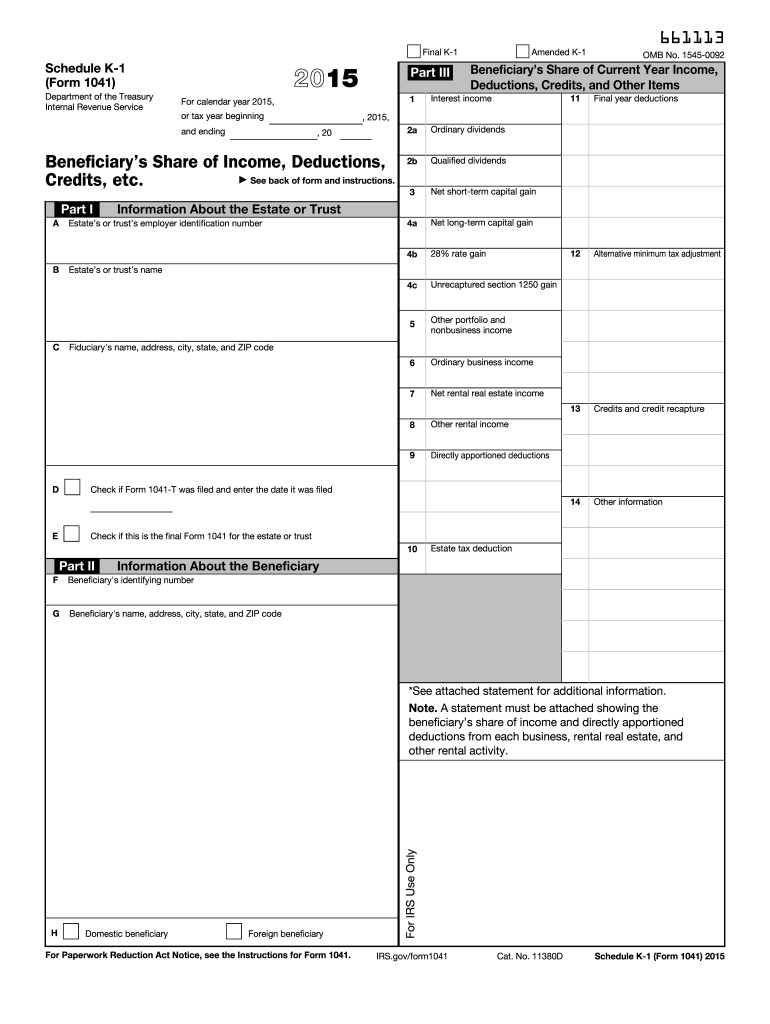

Fillable K 1 Form

Fillable K 1 Form - Keep it for your records. Ending / / partner’s share of income, deductions, credits, etc. Part i information about the partnership. For calendar year 2020, or tax year beginning / / 2020. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of income, deductions, credits, etc. Department of the treasury internal revenue service. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Citizen sponsor within 90 days of. Part i information about the partnership.

For calendar year 2020, or tax year beginning / / 2020. Part i information about the partnership. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. For calendar year 2022, or tax year beginning / / 2022. For detailed reporting and filing information, see the instructions for schedule Department of the treasury internal revenue service. Department of the treasury internal revenue service. Ending / / partner’s share of income, deductions, credits, etc. Citizen sponsor within 90 days of. Part i information about the partnership.

Ending / / partner’s share of income, deductions, credits, etc. For calendar year 2020, or tax year beginning / / 2020. Department of the treasury internal revenue service. For detailed reporting and filing information, see the instructions for schedule Department of the treasury internal revenue service. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Part i information about the partnership. Part i information about the partnership. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of income, deductions, credits, etc.

K1 Form Basics to Help You Meet the Tax Deadline The TurboTax Blog

Ending / / partner’s share of income, deductions, credits, etc. Part i information about the partnership. Department of the treasury internal revenue service. Citizen sponsor within 90 days of. For calendar year 2022, or tax year beginning / / 2022.

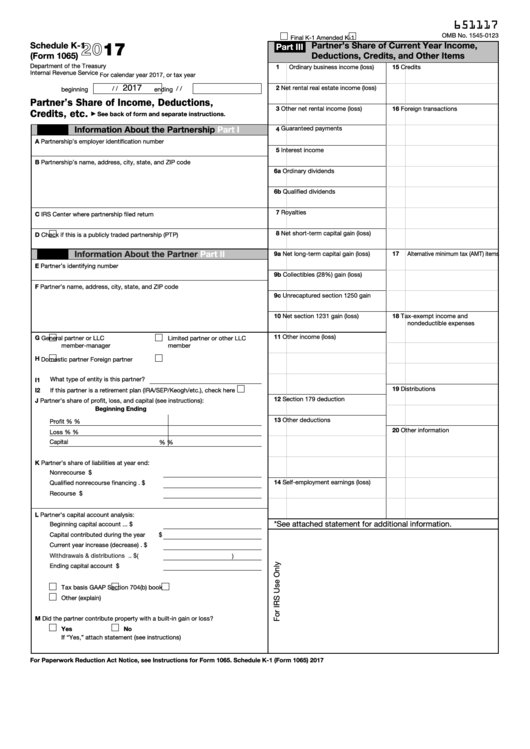

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Ending / / partner’s share of income, deductions, credits, etc. For detailed reporting and filing information, see the instructions for schedule Ending / / partner’s share of income, deductions, credits, etc. Part i information about the partnership.

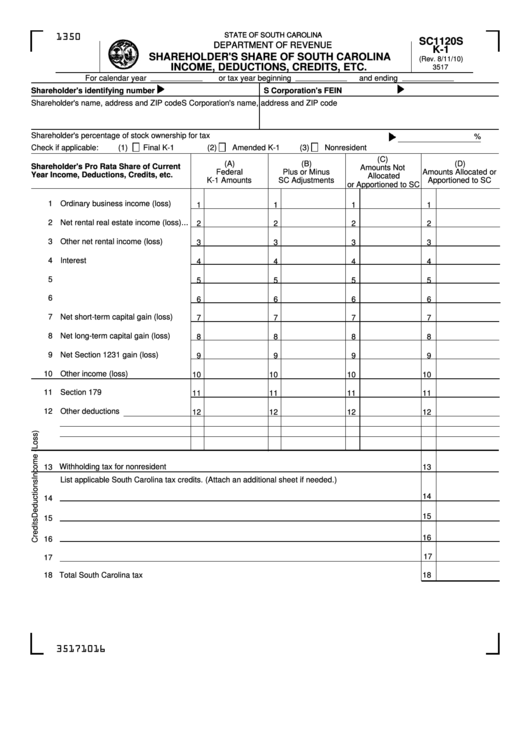

Fillable Schedule K1 (Form Sc1120s) Shareholder'S Share Of South

Citizen sponsor within 90 days of. For calendar year 2022, or tax year beginning / / 2022. For calendar year 2020, or tax year beginning / / 2020. Ending / / partner’s share of income, deductions, credits, etc. Keep it for your records.

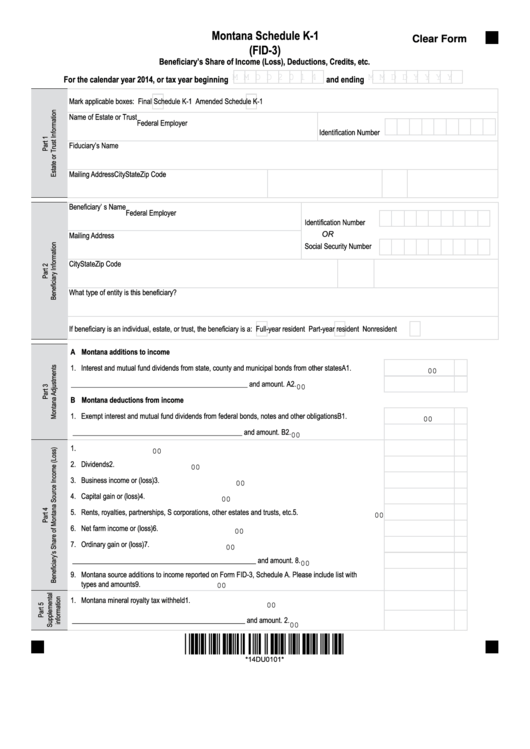

Fillable Montana Schedule K1 (Form Fid3) Beneficiary'S Share Of

Ending / / partner’s share of income, deductions, credits, etc. Ending / / partner’s share of income, deductions, credits, etc. Keep it for your records. Part i information about the partnership. Department of the treasury internal revenue service.

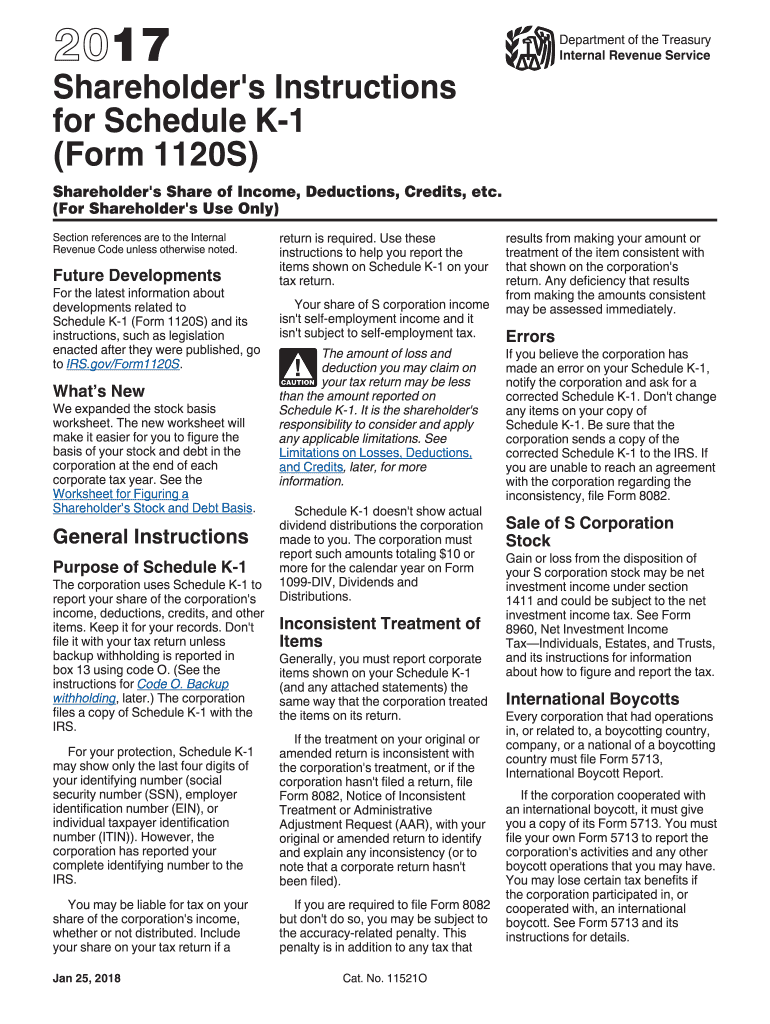

Form K 1 2017 Fill Out and Sign Printable PDF Template signNow

Ending / / partner’s share of income, deductions, credits, etc. Part i information about the partnership. Part i information about the partnership. Citizen sponsor within 90 days of. Ending / / partner’s share of income, deductions, credits, etc.

K 1 Form Fill Out and Sign Printable PDF Template signNow

Part i information about the partnership. For calendar year 2022, or tax year beginning / / 2022. For detailed reporting and filing information, see the instructions for schedule Part i information about the partnership. Department of the treasury internal revenue service.

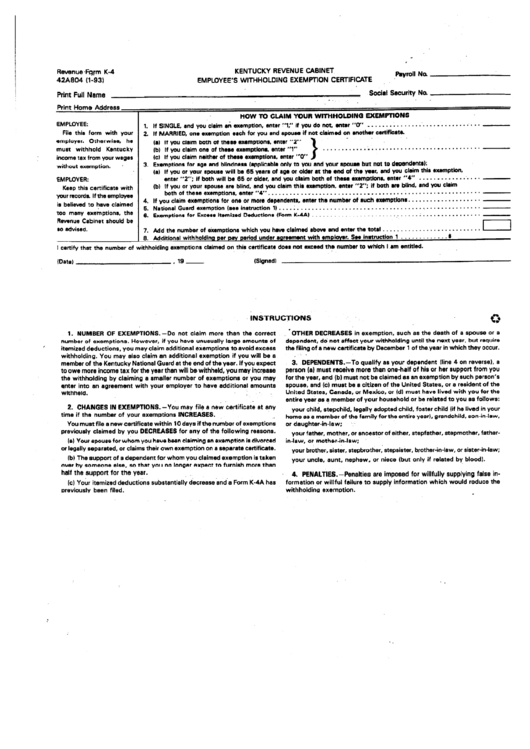

Fillable Form K4 (193) Employee'S Withholding Exemption Certificate

Part i information about the partnership. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Department of the treasury internal revenue service. Ending / / partner’s share of income, deductions, credits, etc. Citizen sponsor within 90 days of.

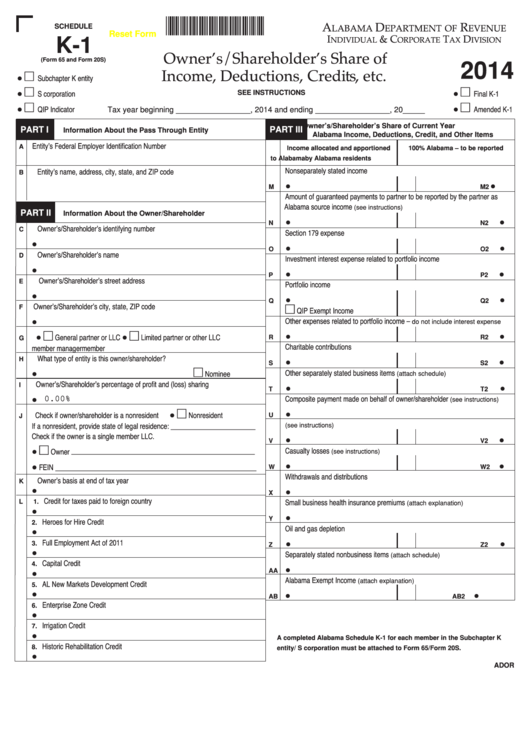

Fillable Schedule K1 (Form 65 And Form 20s) Alabama Owner'S

Citizen sponsor within 90 days of. Part i information about the partnership. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. For calendar year 2020, or tax year beginning / / 2020. Department of the treasury internal revenue service.

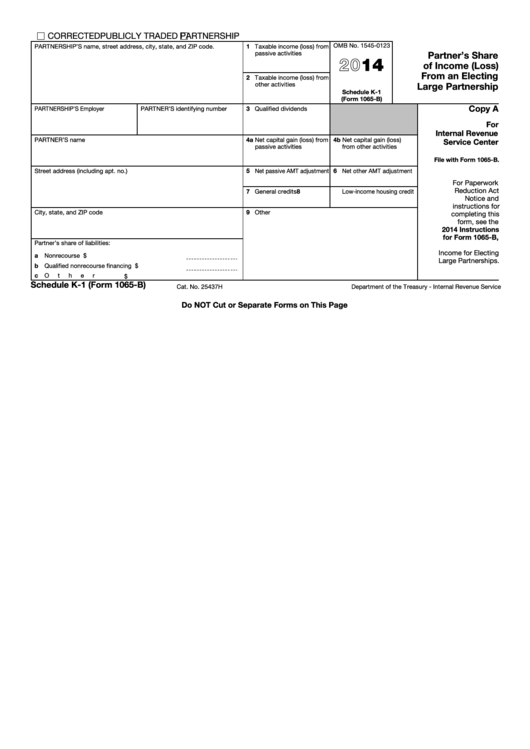

Fillable Schedule K1 (Form 1065B) Partner'S Share Of (Loss

Ending / / partner’s share of income, deductions, credits, etc. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022. Citizen sponsor within 90 days of. Keep it for your records.

Don’t File It With Your Tax Return, Unless Backup Withholding Was Reported In Box 13, Code B.

Department of the treasury internal revenue service. Part i information about the partnership. Citizen sponsor within 90 days of. Department of the treasury internal revenue service.

For Calendar Year 2022, Or Tax Year Beginning / / 2022.

For calendar year 2020, or tax year beginning / / 2020. Part i information about the partnership. Keep it for your records. Ending / / partner’s share of income, deductions, credits, etc.

For Detailed Reporting And Filing Information, See The Instructions For Schedule

Ending / / partner’s share of income, deductions, credits, etc.