Final Year Deductions Form 1041

Final Year Deductions Form 1041 - The exemption (1041 line 21) isn't generating for a final year trust or estate. The due date is april 18,. Web the income, deductions, gains, losses, etc. In an intial/final year, both columns may be used. An estate or trust that generates. On form 1041, you can claim. If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Web form 1041 is an income tax return for estates and trusts. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest.

If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Web (form 1041) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1041. Of the estate or trust. Estate tax deduction including certain. On form 1041, you can claim. Web what happens to carryovers and unused deductions on a final return? Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as an. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts.

If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Answer when an estate or trust terminates, the following items are available to pass through to. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Reminders excess deductions on termination. Web form 1041 department of the treasury—internal revenue service u.s. The exemption (1041 line 21) isn't generating for a final year trust or estate. Web (form 1041) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1041. Web the income, deductions, gains, losses, etc. Web form 1041 is an income tax return for estates and trusts. Estate tax deduction including certain.

Publication 559 (2021), Survivors, Executors, and Administrators

Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest. If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Web claim the exemption on a final year estate on form 1041 in lacerte. Web what happens to carryovers and unused deductions on a final return? However,.

Question Based on (a) through (c), complete

Web what happens to carryovers and unused deductions on a final return? Web the income, deductions, gains, losses, etc. Web claim the exemption on a final year estate on form 1041 in lacerte. Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as.

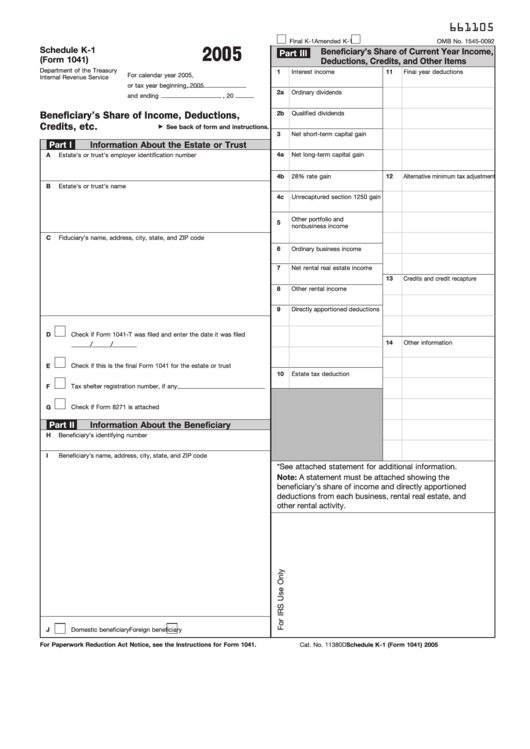

2014 Form 1041 (Schedule K1)

On form 1041, you can claim. Calendar year estates and trusts must file form 1041 by april 18, 2023. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. The due date is april 18,. Web form 1041 is an income tax return for estates and trusts.

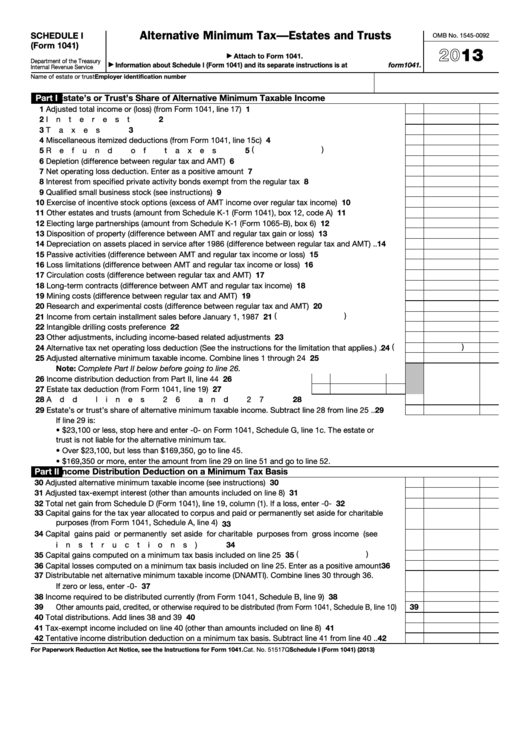

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Answer when an estate or trust terminates, the following items are available to pass through to. On form 1041, you can claim. Web the income, deductions, gains, losses, etc. However, the combined total shouldn't exceed 100%.

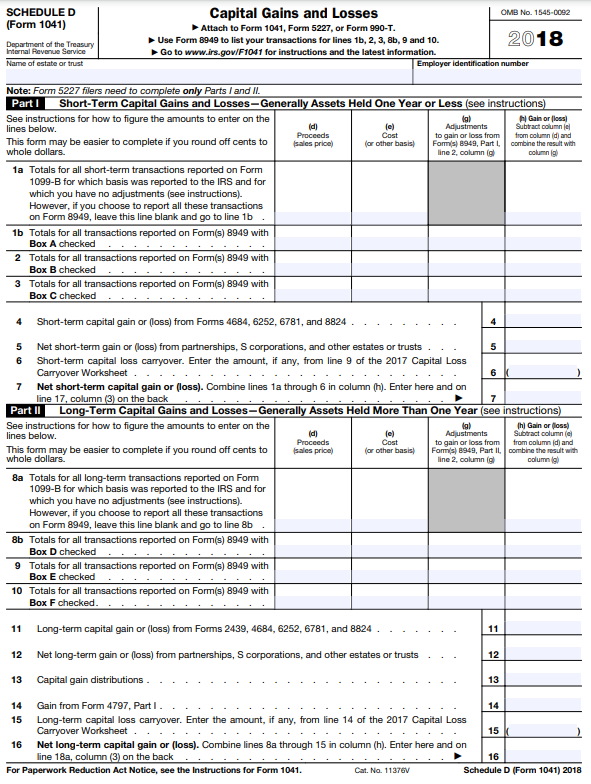

IRS Form 1041 Download Printable PDF 2018, Beneficiary's Share of

Web what happens to carryovers and unused deductions on a final return? Of the estate or trust. Estate tax deduction including certain. Reminders excess deductions on termination. Web the income, deductions, gains, losses, etc.

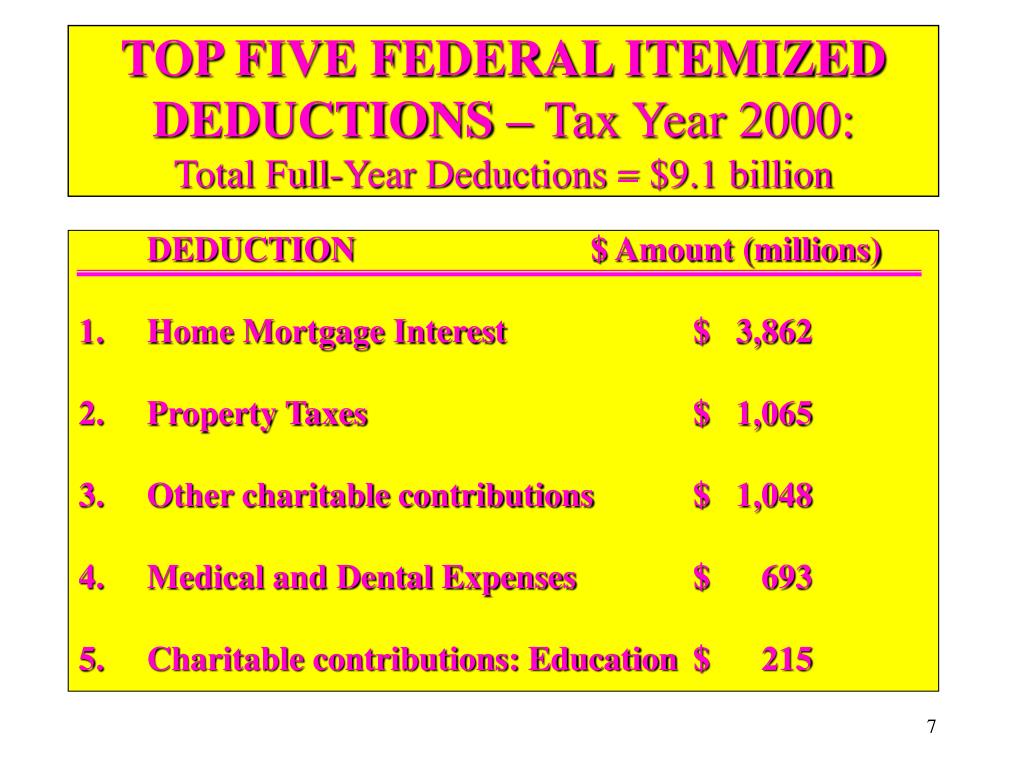

PPT OREGON TAXES PowerPoint Presentation, free download ID69643

The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. The exemption (1041 line 21) isn't generating for a final year trust or estate. Web form 1041 department of the treasury—internal revenue service u.s. Web what happens to carryovers and unused deductions on a final return? Calendar year estates and trusts must file.

2019 2020 IRS Instructions 1041 Fill Out Digital PDF Sample

Web what happens to carryovers and unused deductions on a final return? Web form 1041 department of the treasury—internal revenue service u.s. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. On form 1041, you can claim. Web form 1041 is an income tax return for estates and trusts.

Section 179 Tax Deduction LEAF Commercial Capital, Inc.

Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest. Web deductions entered in the estates and trusts 1041 program that may be allocable to the estate/trust and/or to the beneficiary are entered under the estate/trust column and/or. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries..

Form 1041 Schedule K1 2005 printable pdf download

Web claim the exemption on a final year estate on form 1041 in lacerte. Reminders excess deductions on termination. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Web form 1041 is an income tax return for estates and trusts. Web if the estate or trust has final year deductions (excluding the.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

An estate or trust that generates. Estate tax deduction including certain. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Web the income, deductions, gains, losses, etc.

Income Distribution Deduction (From Schedule B, Line 15).

On form 1041, you can claim. Web form 1041 department of the treasury—internal revenue service u.s. Web deductions entered in the estates and trusts 1041 program that may be allocable to the estate/trust and/or to the beneficiary are entered under the estate/trust column and/or. Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as an.

Web Claim The Exemption On A Final Year Estate On Form 1041 In Lacerte.

In the final return that is filed by an estate or trust (form 1041), certain items that normally may not be reported on the. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Web check if this is the final form 1041 for the estate or trust part ii information about the beneficiary f beneficiary’s identifying number g beneficiary’s name, address, city, state,. An estate or trust that generates.

Web The Income, Deductions, Gains, Losses, Etc.

Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. However, the combined total shouldn't exceed 100%. In an intial/final year, both columns may be used.

Web Form 1041 Is An Income Tax Return For Estates And Trusts.

The exemption (1041 line 21) isn't generating for a final year trust or estate. Estate tax deduction including certain. Answer when an estate or trust terminates, the following items are available to pass through to. Calendar year estates and trusts must file form 1041 by april 18, 2023.