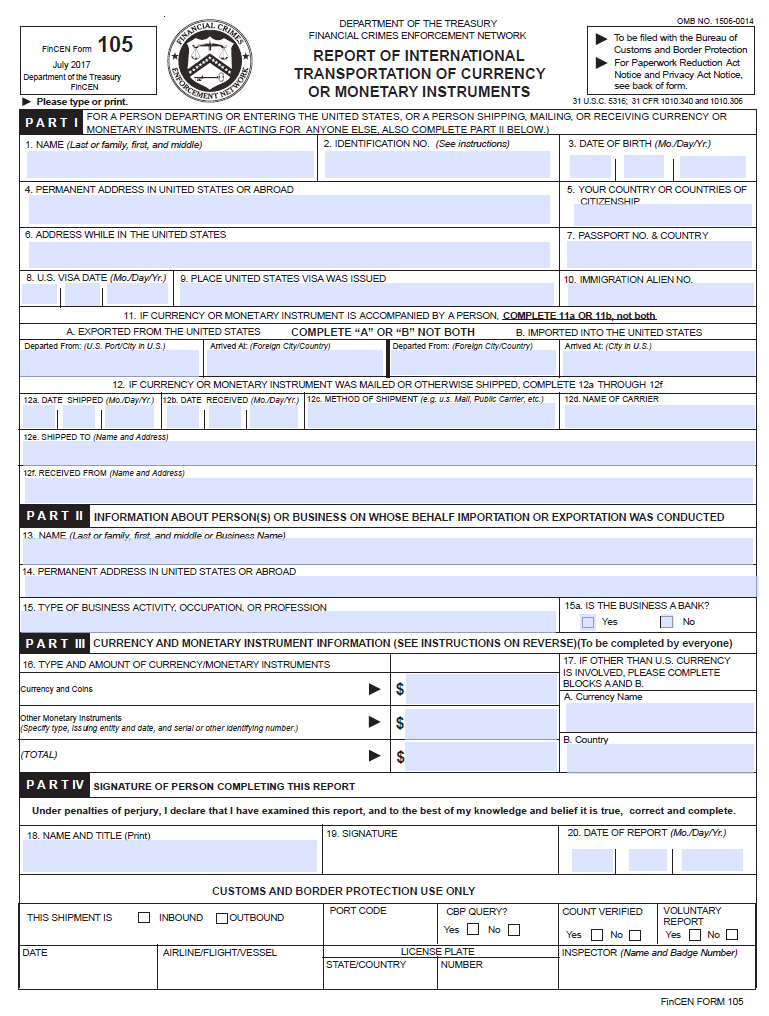

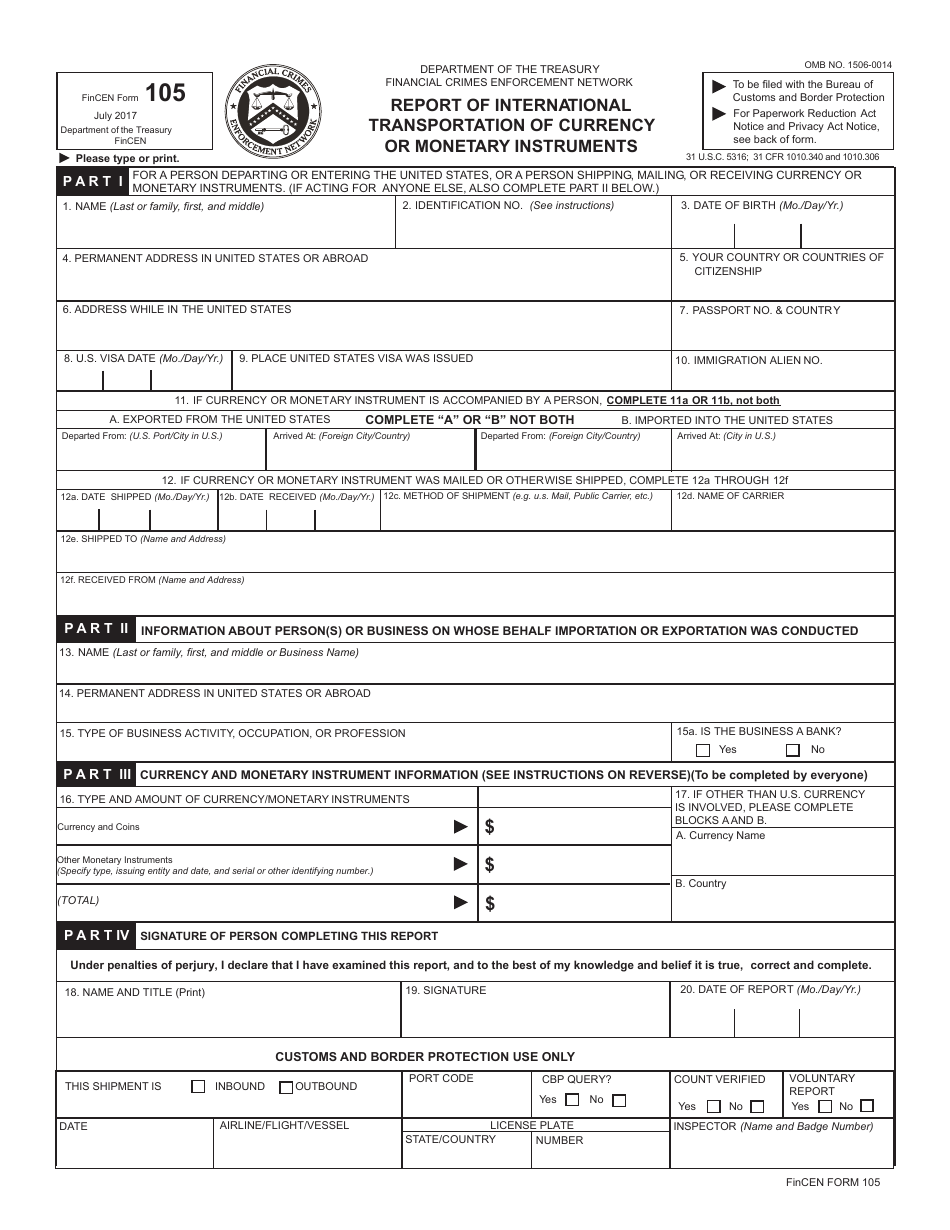

Fincen 105 Form

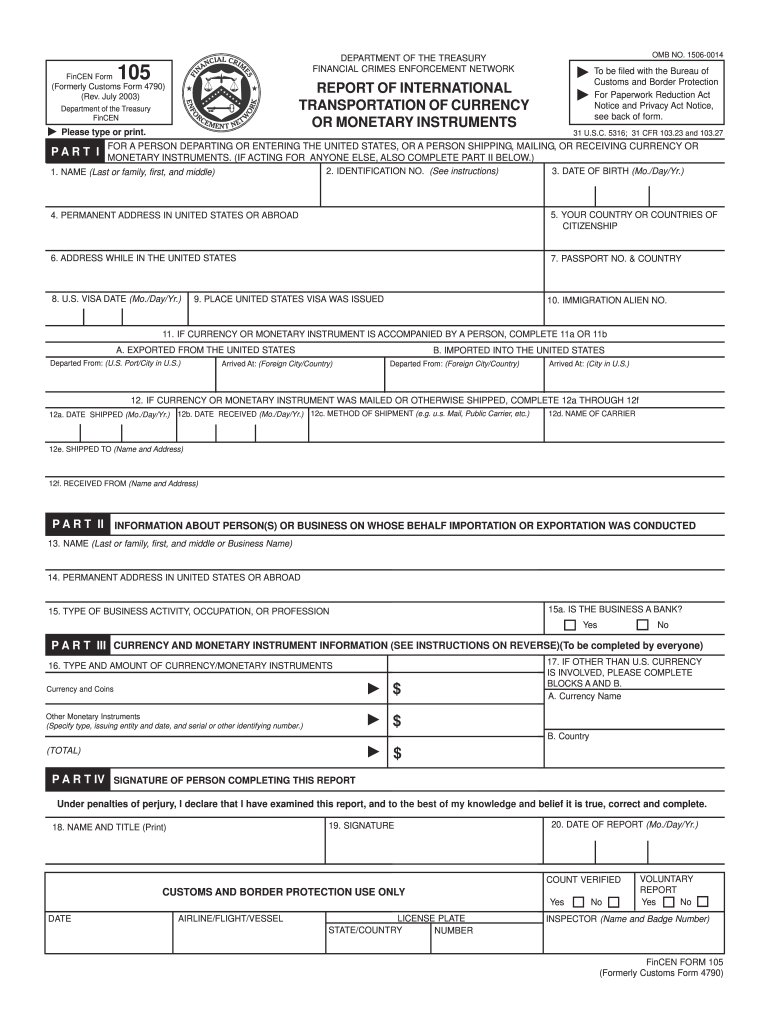

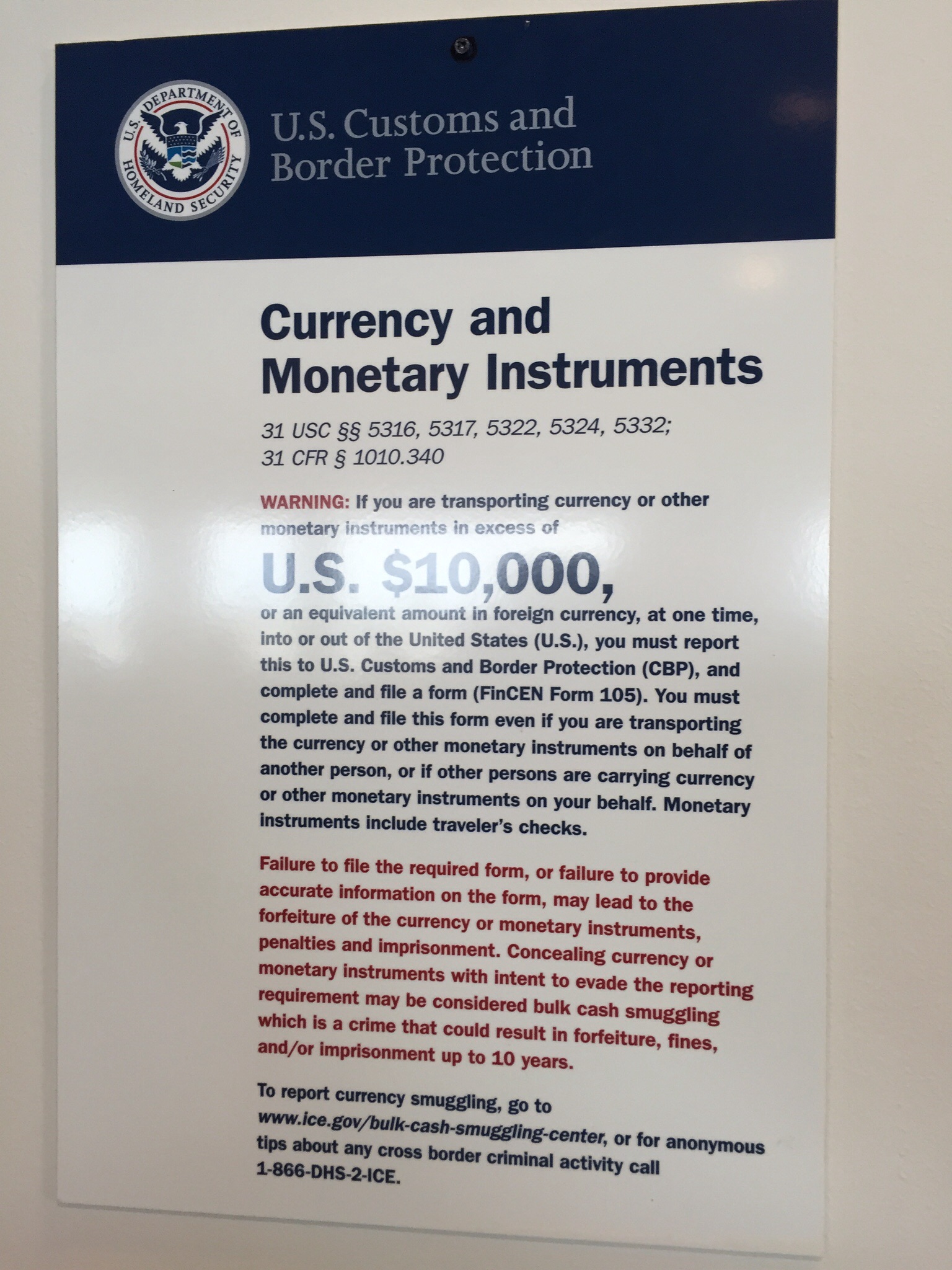

Fincen 105 Form - International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Customs and border protection (dhs.gov). Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. Web this form can be obtained at all u.s. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Gold coins, valued over $10,000. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Or foreign coins and currency; Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web you need to enable javascript to run this app.

You may bring into or take out of the country, including by mail, as much money as you wish. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web please note a fincen 105 form must be completed at the time of entry for monetary instruments over $10,000. Customs and border protection (dhs.gov). Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. Or foreign coins and currency; International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers of currency, 1 including armored car services, with the filing requirements of fincen 105, report of international transportation of currency or monetary instruments (“cmir”).

You may bring into or take out of the country, including by mail, as much money as you wish. Traveler checks in any form; Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers of currency, 1 including armored car services, with the filing requirements of fincen 105, report of international transportation of currency or monetary instruments (“cmir”). Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Customs and border protection (dhs.gov). Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Web please note a fincen 105 form must be completed at the time of entry for monetary instruments over $10,000.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Gold coins, valued over $10,000. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. You may bring into or take out of the country, including by mail, as much money as you wish. Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. Web the financial crimes enforcement network (“fincen”) is issuing.

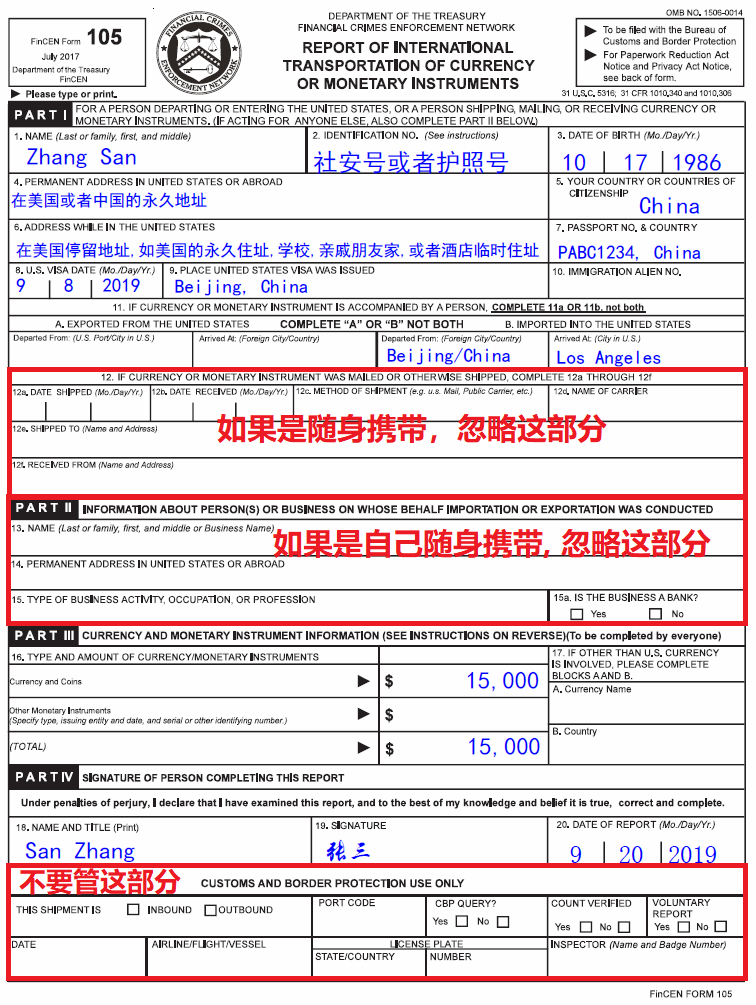

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers of currency, 1 including armored car services, with the filing requirements of fincen 105, report of international transportation of currency or monetary instruments (“cmir”). Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Web you need to.

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers.

Fincen Form 105 Report Of International Transportation Of Currency Or

Web this form can be obtained at all u.s. Traveler checks in any form; Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Gold coins, valued over $10,000. Web you.

Fincen Form 105 Report Of International Transportation Of Currency Or

Web you need to enable javascript to run this app. You may bring into or take out of the country, including by mail, as much money as you wish. Or foreign coins and currency; International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration.

FinCEN Form 105, Currency and Instrument Report (CMIR

Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Traveler checks in any form; Or foreign coins and currency; Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Traveler checks in any form; Gold coins, valued over $10,000. Web you need to enable javascript to run this app. Web the financial crimes enforcement network (“fincen”) is.

Formulario Fincen 105 Fill Out and Sign Printable PDF Template signNow

Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer.

FinCEN Form 105 Download Fillable PDF or Fill Online Report of

International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. You may bring into or take out of the country, including by mail, as much money as you wish. Gold coins, valued over $10,000. Web you may file.

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Or foreign coins and currency; Traveler checks in any form; Web you need to enable javascript to run this app. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Web use the online fincen 105 currency reporting.

Gold Coins, Valued Over $10,000.

Web this form can be obtained at all u.s. Web you need to enable javascript to run this app. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure.

Web Please Note A Fincen 105 Form Must Be Completed At The Time Of Entry For Monetary Instruments Over $10,000.

Or foreign coins and currency; Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. Customs and border protection (dhs.gov). You may bring into or take out of the country, including by mail, as much money as you wish.

Web Use The Online Fincen 105 Currency Reporting Site Or Ask A Cbp Officer For The Paper Copy Of The Currency Reporting Form (Fincen 105).

Traveler checks in any form; Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers of currency, 1 including armored car services, with the filing requirements of fincen 105, report of international transportation of currency or monetary instruments (“cmir”).