Firpta Withholding Form

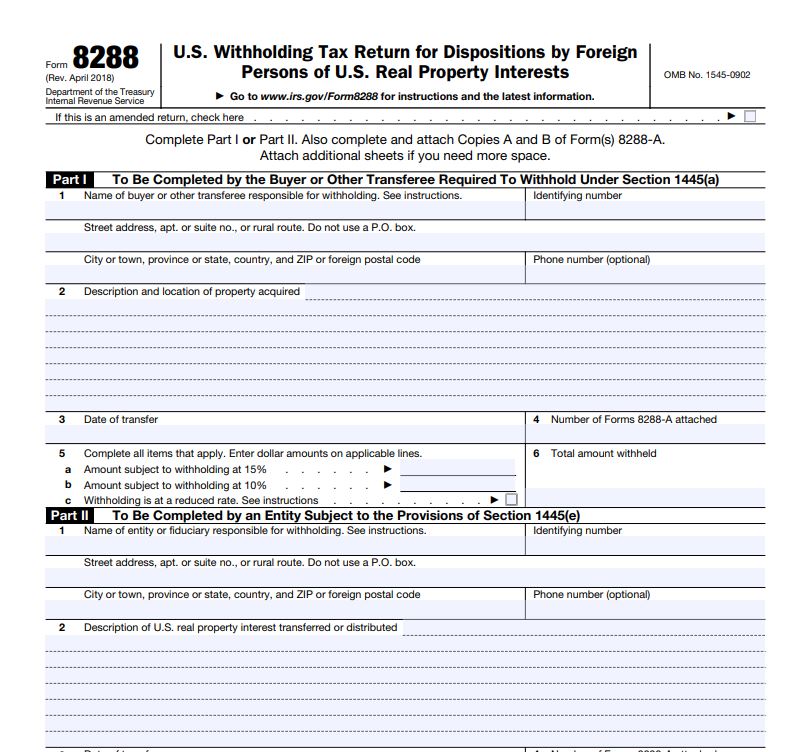

Firpta Withholding Form - Real property interest by a foreign person. What firpta is and how it works. This form does not need to be. Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s. Withholding of the funds is required at the time of sale, and. Employee's withholding certificate form 941; Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Web generally, the transferee must withhold a tax on the total amount that the foreign person realizes on the disposition. Web 1a name of buyer or other party responsible for withholding. Use this address if you are not enclosing a payment use this.

Withholding tax return for disposition by foreign. Issues, and sends you, a final tax slip. Web generally, the transferee must withhold a tax on the total amount that the foreign person realizes on the disposition. The withholding rate is generally 15% (10% for dispositions. Or suite no., or rural route. Employers engaged in a trade or business who. Withholding tax return for dispositions by foreign persons of u.s. Under firpta, if you buy u.s. A withholding certificate is an application for a reduced withholding. Web applies the withholding tax to your existing itin.

Taxpayer identification number (tin) street address, apt. Under firpta, if you buy u.s. Web 1a name of buyer or other party responsible for withholding. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Such transactions are subject to the foreign. What firpta is and how it works. A withholding certificate is an application for a reduced withholding. Or suite no., or rural route. The withholding rate is generally 15% (10% for dispositions. Web by kunal patel firpta witholding rules may apply to a disposition of a u.s.

Firpta withholding certificate 90 days Fill online, Printable

The withholding rate is generally 15% (10% for dispositions. Form 8288 also serves as the transmittal form for. The buyer must fill out the firpta form 8288, which is the “u.s. Issues, and sends you, a final tax slip. Real property interest by a foreign person.

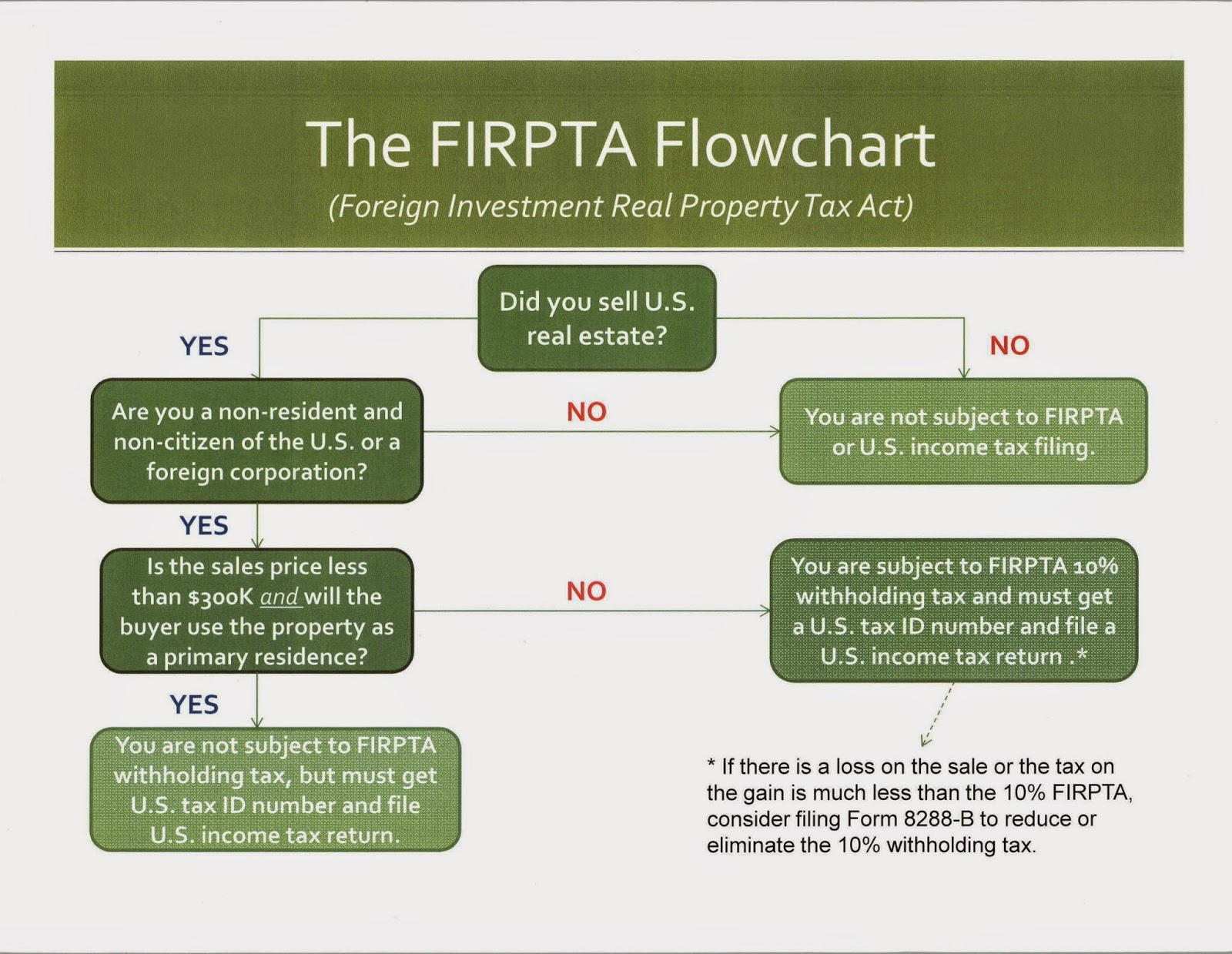

What is FIRPTA and How to Avoid It

Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s. What firpta is and how it works. Real property interest from a foreign person is reported and paid using form 8288. Web 1a name of buyer or other party responsible for withholding. Employers engaged in a trade.

Buyer's Affidavit FIRPTA Withholding Exemption PRINTABLES

Web the tax withheld on the acquisition of a u.s. This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s. Web 1a name of buyer or other party responsible for withholding. Real estate from a foreign person,.

FIRPTA Withholdings and Exceptions First Integrity Title Company

Web 1a name of buyer or other party responsible for withholding. What firpta is and how it works. Use this address if you are not enclosing a payment use this. Web firpta is a tax law that imposes u.s. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how.

FIRPTA Rules

Web applies the withholding tax to your existing itin. Web complete the firpta forms. The buyer must fill out the firpta form 8288, which is the “u.s. Web firpta is a tax law that imposes u.s. Withholding tax return for disposition by foreign.

What is FIRPTA and how do I avoid it? Sarasota/Manatee Area Real

Web firpta is a tax law that imposes u.s. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s. Withholding of the funds is required at the time of sale, and..

What Realtors Need to Know About the FIRPTA Withholding Certificate

Withholding of the funds is required at the time of sale, and. Or suite no., or rural route. Withholding tax return for disposition by foreign. Issues, and sends you, a final tax slip. A withholding certificate is an application for a reduced withholding.

FIRPTA Update Advanced American Tax

Web by kunal patel firpta witholding rules may apply to a disposition of a u.s. Withholding of the funds is required at the time of sale, and. Real property interest from a foreign person is reported and paid using form 8288. Web the tax withheld on the acquisition of a u.s. Employee's withholding certificate form 941;

Why Oregon Realtors® Have No Business Being Involved in FIRPTA

Taxpayer identification number (tin) street address, apt. Withholding of the funds is required at the time of sale, and. Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s. Web firpta imposes a tax on capital gains derived by foreign persons from the dispositions of u.s. Web information about form 843, claim for refund.

What the Change to FIRPTA Withholding Means for You IPX1031

The buyer must fill out the firpta form 8288, which is the “u.s. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Income tax on foreign persons selling u.s. Withholding of the funds is required at the time of sale, and. Web applies the withholding tax.

Web Firpta Withholding Is Required To Be Submitted To The Irs Within 20 Days Of The Closing Together With Irs Form 8288, U.s.

Withholding tax return for disposition by foreign. Web by kunal patel firpta witholding rules may apply to a disposition of a u.s. Taxpayer identification number (tin) street address, apt. What firpta is and how it works.

Web The Tax Withheld On The Acquisition Of A U.s.

Such transactions are subject to the foreign. Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Use this address if you are not enclosing a payment use this.

Web Complete The Firpta Forms.

Web 1a name of buyer or other party responsible for withholding. Employers engaged in a trade or business who. The buyer must fill out the firpta form 8288, which is the “u.s. Issues, and sends you, a final tax slip.

Web Information About Form 843, Claim For Refund And Request For Abatement, Including Recent Updates, Related Forms And Instructions On How To File.

Withholding of the funds is required at the time of sale, and. A withholding certificate is an application for a reduced withholding. Web firpta imposes a tax on capital gains derived by foreign persons from the dispositions of u.s. It is based on the actual gain of a sale instead of the selling price.