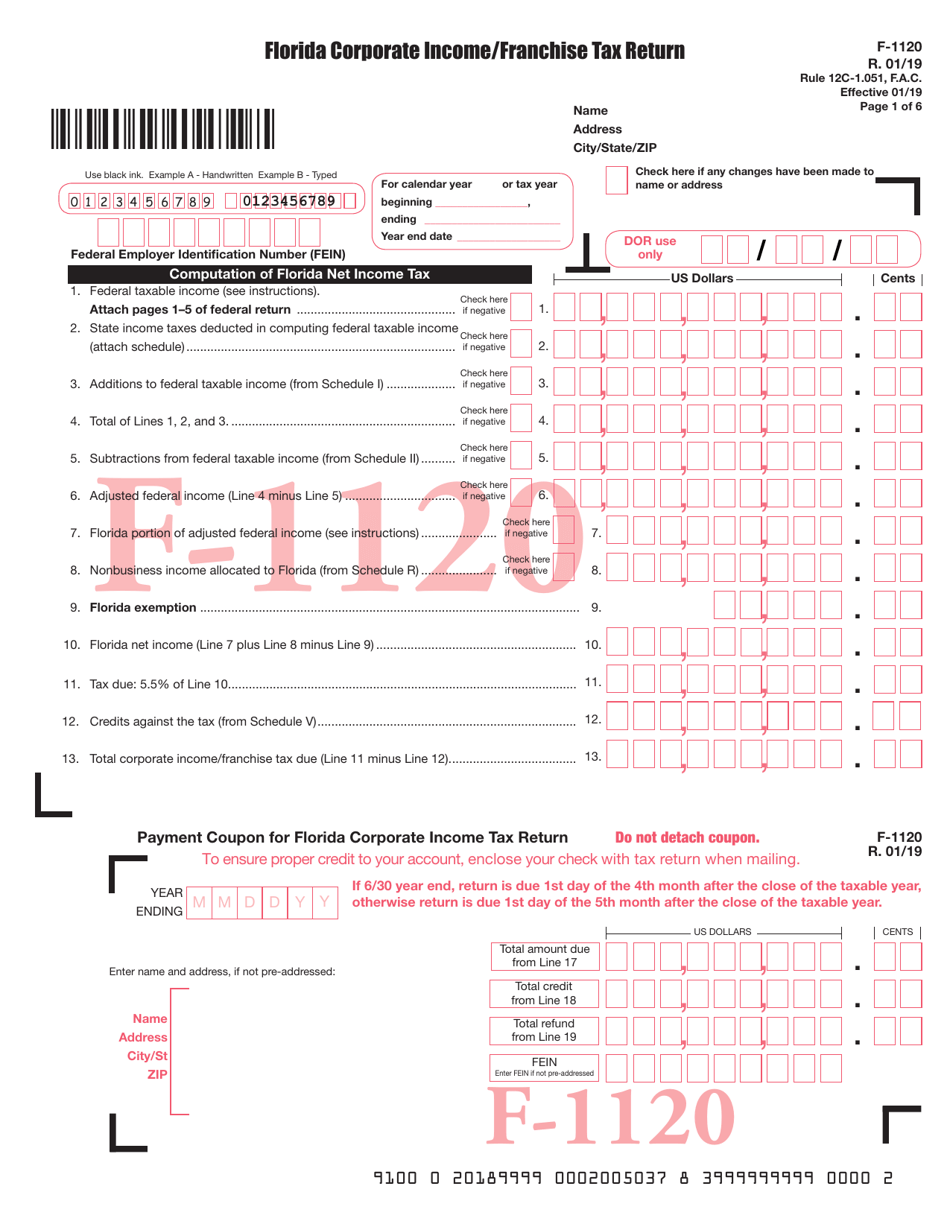

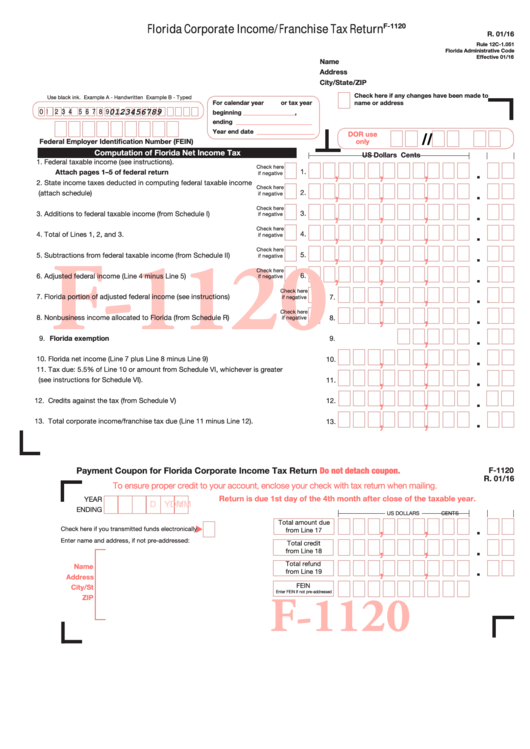

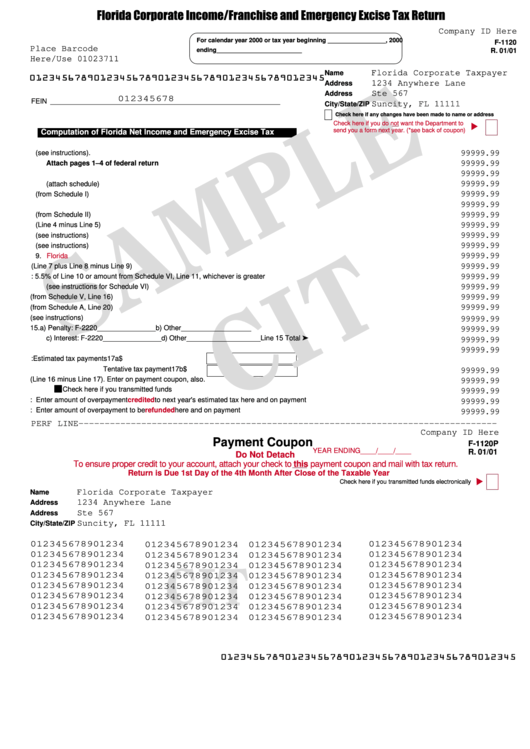

Florida Form 1120

Florida Form 1120 - It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate short form income tax return. Florida corporate income/franchise tax return for 2014 tax year: Florida law does not allow net operating loss carrybacks Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It conducts 100% of its business in florida. It has florida net income of $45,000 or less. Links are provided for both options. Florida corporate income/franchise tax return for 2013 tax year: You can print other florida tax forms here.

Florida corporate income/franchise tax return for 2022 tax year. Florida corporate income/franchise tax return for 2014 tax year: It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida law does not allow net operating loss carrybacks Florida corporate income/franchise tax return for 2013 tax year: It conducts 100 percent of its business in florida (does not apportion income). Links are provided for both options. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It conducts 100% of its business in florida. Florida corporate short form income tax return.

It conducts 100 percent of its business in florida (does not apportion income). It conducts 100% of its business in florida. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, You can print other florida tax forms here. Links are provided for both options. It has florida net income of $45,000 or less. Florida corporate short form income tax return. Florida corporate income/franchise tax return for 2022 tax year. Florida corporate income/franchise tax return for 2013 tax year: It has florida net income of $45,000 or less.

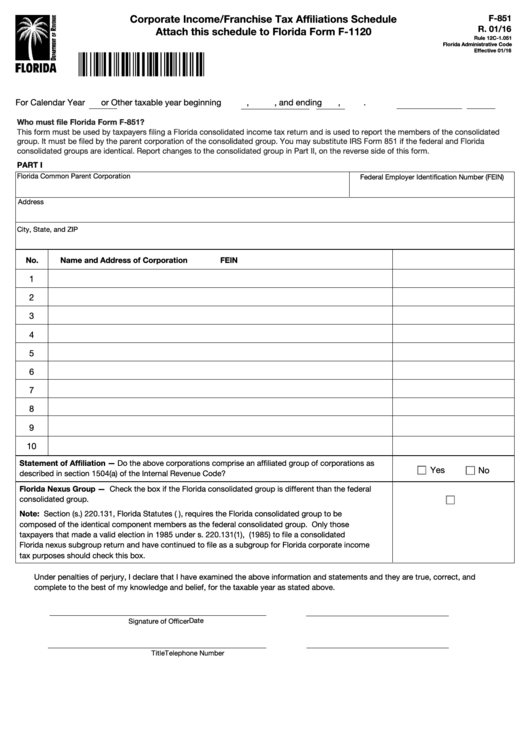

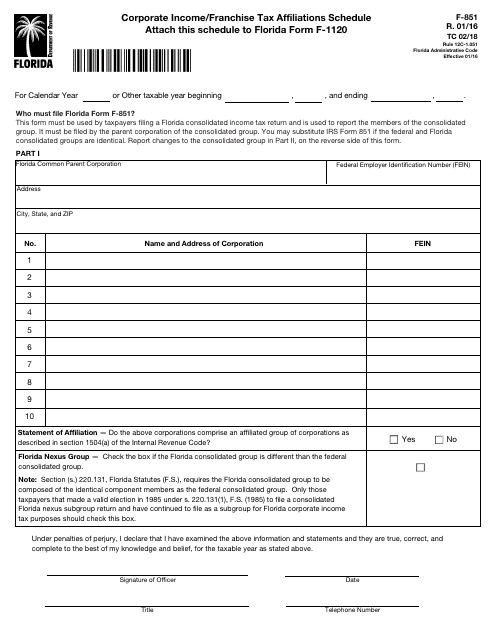

Fillable Form F851 Florida Department Of Revenue Corporate

It conducts 100% of its business in florida. Florida corporate income/franchise tax return for 2022 tax year. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, It has florida net income of $45,000 or less. Florida corporate short form income tax return.

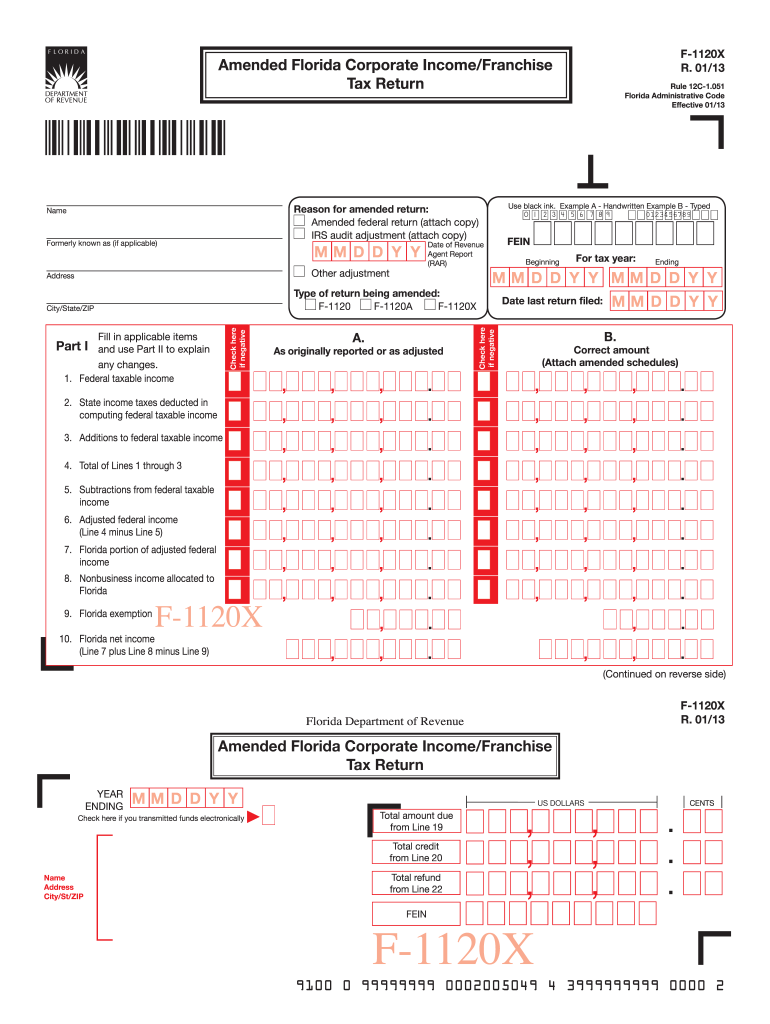

Form F 1120 Fill Out and Sign Printable PDF Template signNow

Florida corporate income/franchise tax return for 2013 tax year: You can print other florida tax forms here. Florida law does not allow net operating loss carrybacks Florida corporate short form income tax return. Florida corporate income/franchise tax return for 2014 tax year:

Form F1120 Download Printable PDF or Fill Online Florida Corporate

Florida corporate short form income tax return. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate income/franchise tax return for 2022 tax year. Florida corporate income/franchise tax return for 2014 tax year: It has florida net income of $45,000 or less.

Form F1120 Schedule F851 Download Fillable PDF or Fill Online

It conducts 100 percent of its business in florida (does not apportion income). Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It has florida net income of $45,000 or less. Florida corporate income/franchise tax return for 2014 tax year: It has florida net income of $45,000 or less.

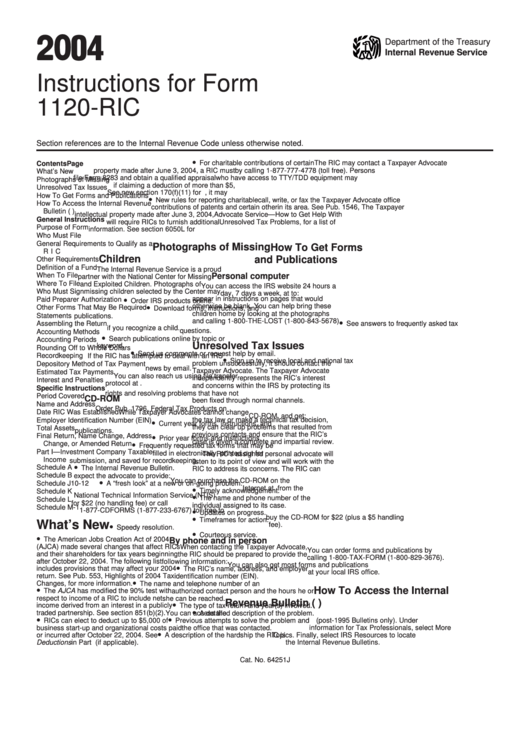

Instructions For Form 1120Ric U.s. Tax Return For Regulated

It conducts 100% of its business in florida. Florida corporate short form income tax return. It has florida net income of $45,000 or less. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, You can print other florida tax forms here.

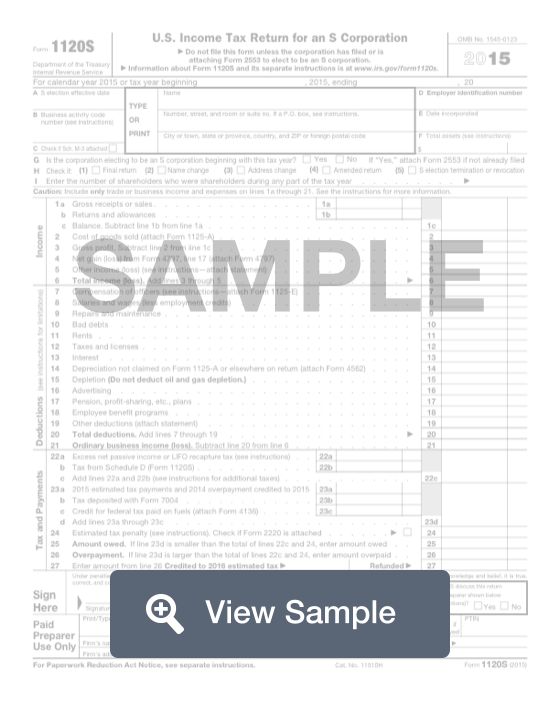

Form 1120S S Corporation Tax Return Fill Out Online PDF FormSwift

Florida corporate income/franchise tax return for 2022 tax year. You can print other florida tax forms here. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, It has florida net income of $45,000 or less. It has florida net income of $45,000 or less.

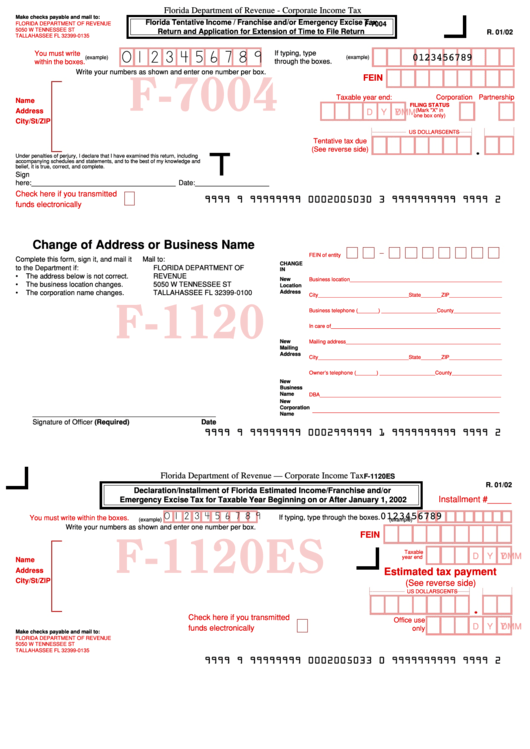

Form F7004 Corporate Tax, Form F1120 Change Of Address Or

Florida corporate income/franchise tax return for 2022 tax year. You can print other florida tax forms here. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate income/franchise tax return for 2013 tax year: Florida corporate short form income tax return.

Fillable Form F1120 Florida Corporate Tax Return

Florida corporate income/franchise tax return for 2013 tax year: Florida corporate income/franchise tax return for 2022 tax year. It conducts 100% of its business in florida. Florida corporate income/franchise tax return for 2014 tax year: Florida corporate short form income tax return.

Instructions for Preparing Form F1120 for 2008 Tax Year R.01/09

It has florida net income of $45,000 or less. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate income/franchise tax return for 2014 tax year: Florida law does not allow net.

Form F1120 Florida Corporate And Emergency Excise

Florida corporate income/franchise tax return for 2014 tax year: Florida corporate income/franchise tax return for 2022 tax year. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Efective 01/23 name page 1 of 6 address city/state/zip use black ink. It conducts 100% of its business.

Efective 01/23 Name Page 1 Of 6 Address City/State/Zip Use Black Ink.

Links are provided for both options. You can print other florida tax forms here. Florida corporate income/franchise tax return for 2022 tax year. It conducts 100 percent of its business in florida (does not apportion income).

It Has Florida Net Income Of $45,000 Or Less.

Florida corporate income/franchise tax return for 2013 tax year: Florida corporate short form income tax return. It does not report any additions to and/or subtractions from federal taxable income other than a net operating loss deduction and/or state income taxes, Florida corporate income/franchise tax return for 2014 tax year:

Florida Law Does Not Allow Net Operating Loss Carrybacks

It conducts 100% of its business in florida. It has florida net income of $45,000 or less.