Form 05 158 Instructions

Form 05 158 Instructions - Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Texas franchise tax reports for 2022 and prior years. Choose the correct version of the editable pdf form from the list and get started filling it out. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Print or type name area code and phone number date. Enter dividends for the period upon which the tax is based. Tax adjustments (dollars and cents) 32. Web revenue gross receipts or sales: Tax due before discount (item 31 minus item 32) 33. 2022 report year forms and instructions;

Web revenue gross receipts or sales: Choose the correct version of the editable pdf form from the list and get started filling it out. Click on the get form button to open the document and move to editing. Pick the template you require from the collection of legal form samples. 2022 report year forms and instructions; (if may 15th falls on a weekend, the due date will be the following business day.) the. Tax adjustments (dollars and cents) 32. Print or type name area code and phone number date. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Tax due before discount (item 31 minus item 32) 33.

Texas franchise tax reports for 2022 and prior years. Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Click on the get form button to open the document and move to editing. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Choose the correct version of the editable pdf form from the list and get started filling it out. Print or type name area code and phone number date. Enter dividends for the period upon which the tax is based. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Tax adjustments (dollars and cents) 32.

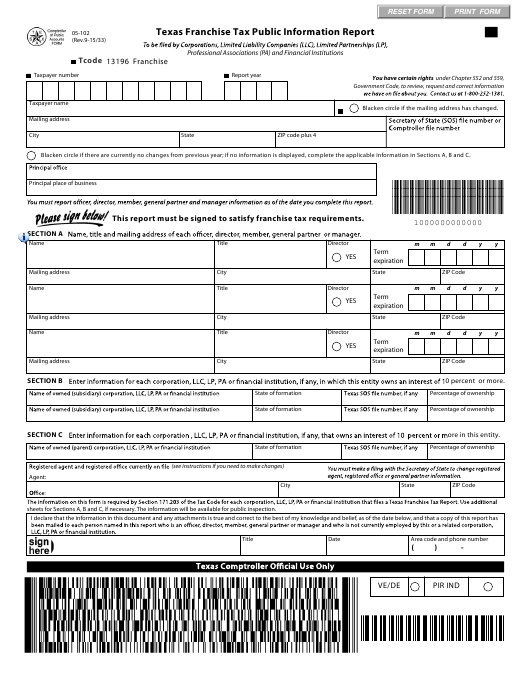

TX Comptroller 05391 2009 Fill out Tax Template Online US Legal Forms

Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Texas franchise tax reports for 2022 and prior years. Print or type name area code and phone number date. Pick the template you require from the collection of legal form samples. (if may 15th falls on a weekend, the due date will be the following business.

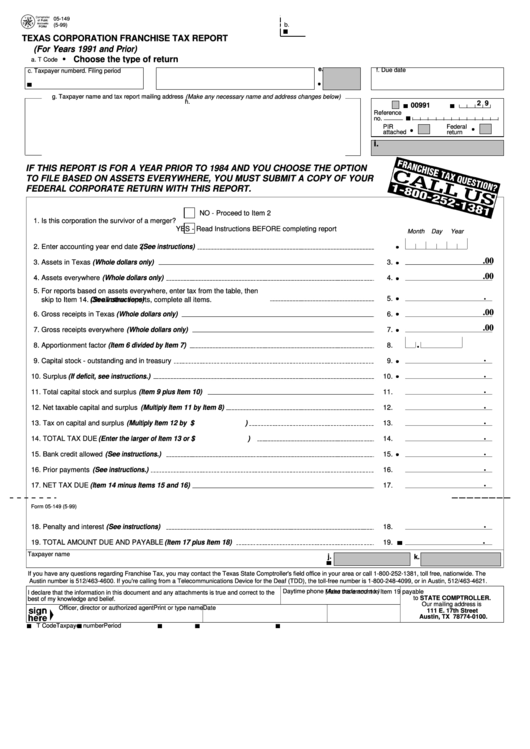

Fillable Form 05364 Texas Corporation Franchise Tax Report printable

Print or type name area code and phone number date. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Tax due before discount (item 31 minus item 32) 33. Tax adjustments (dollars and cents) 32. (if may 15th falls on a weekend, the due date will be the following business day.) the.

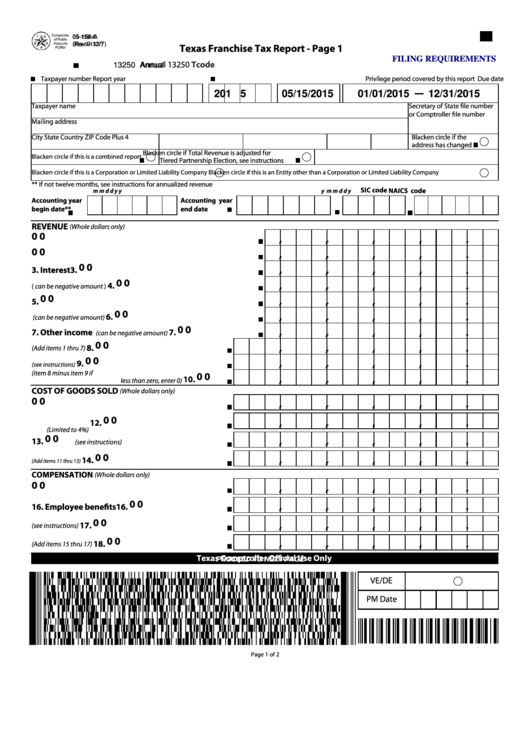

Fillable 05158A, 2015, Texas Franchise Tax Report printable pdf download

Texas franchise tax reports for 2022 and prior years. Web find and fill out the correct form 05 158 a instructions. 2022 report year forms and instructions; Choose the correct version of the editable pdf form from the list and get started filling it out. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent.

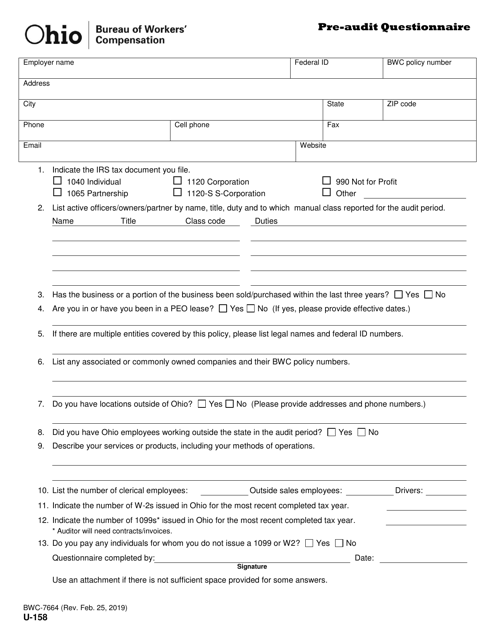

Form U158 (BWC7664) Download Printable PDF or Fill Online Preaudit

Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Web find and fill out the correct form 05 158 a instructions. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31..

Form 05 158 a Fill out & sign online DocHub

Tax due before discount (item 31 minus item 32) 33. Tax adjustments (dollars and cents) 32. Enter dividends for the period upon which the tax is based. Texas franchise tax reports for 2022 and prior years. Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due.

Texas Franchise Tax Report Forms For 2022

Enter dividends for the period upon which the tax is based. Print or type name area code and phone number date. Tax adjustments (dollars and cents) 32. Tax due before discount (item 31 minus item 32) 33. Web 2023 report year forms and instructions;

Form 05 163 For 2016 Fill Online, Printable, Fillable, Blank PDFfiller

Tax due before discount (item 31 minus item 32) 33. Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Enter gross receipts or sales for the period upon which the tax is based. Web follow the simple instructions below: Tax form filling out can become a serious obstacle and severe headache if.

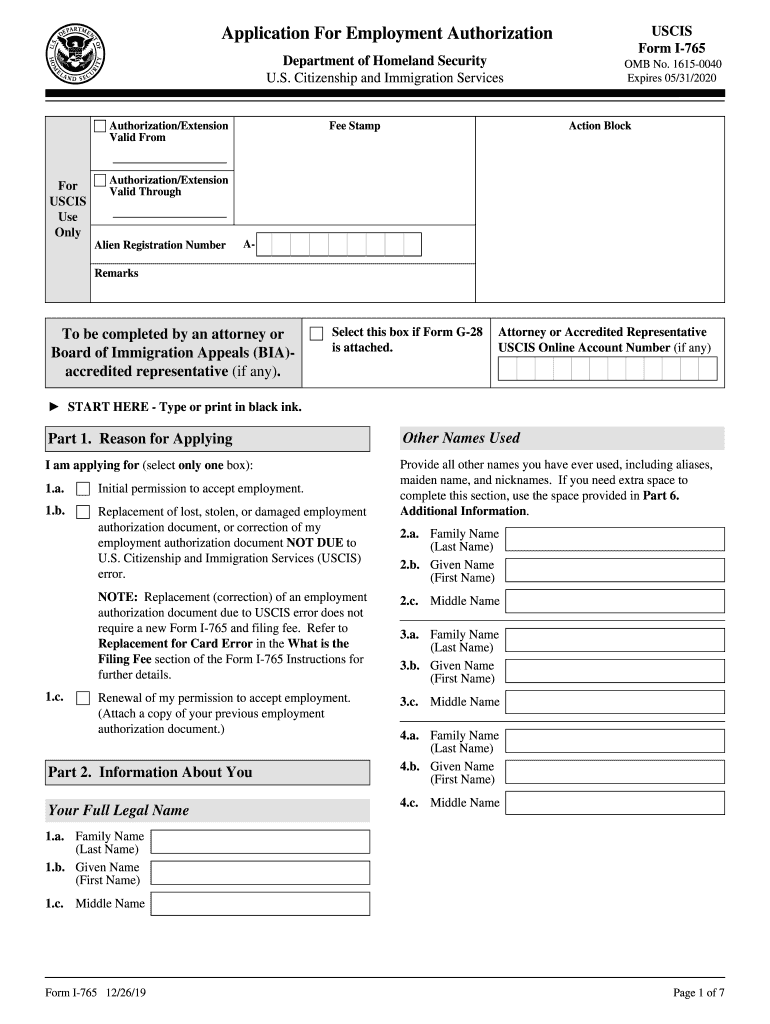

USCIS Notice On Form I 765 Application For Employment Fill Out and

Tax adjustments (dollars and cents) 32. Web follow the simple instructions below: Web 2023 report year forms and instructions; 2022 report year forms and instructions; Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report.

Form DS158 Edit, Fill, Sign Online Handypdf

Web fill out texas 05 158 in just a few moments by using the recommendations listed below: Enter dividends for the period upon which the tax is based. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Print.

Revista Colombiana de Bioética by Universidad El Bosque Issuu

Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Web find and fill out the correct form 05 158 a instructions. Tax form filling out can become a serious obstacle and severe headache if no appropriate guidance offered. Tax due before discount (item 31 minus item 32) 33. Pick the template you require from the.

Web 2023 Report Year Forms And Instructions;

Web find and fill out the correct form 05 158 a instructions. Web follow the simple instructions below: (if may 15th falls on a weekend, the due date will be the following business day.) the. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31.

Web Revenue Gross Receipts Or Sales:

Click on the get form button to open the document and move to editing. Print or type name area code and phone number date. Texas franchise tax reports for 2022 and prior years. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30.

Enter Dividends For The Period Upon Which The Tax Is Based.

Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Enter gross receipts or sales for the period upon which the tax is based. Tax adjustments (dollars and cents) 32. Pick the template you require from the collection of legal form samples.

Web Fill Out Texas 05 158 In Just A Few Moments By Using The Recommendations Listed Below:

Tax due before discount (item 31 minus item 32) 33. 2022 report year forms and instructions; Choose the correct version of the editable pdf form from the list and get started filling it out. No matter which form you file, your texas franchise tax report is due may 15th each year.