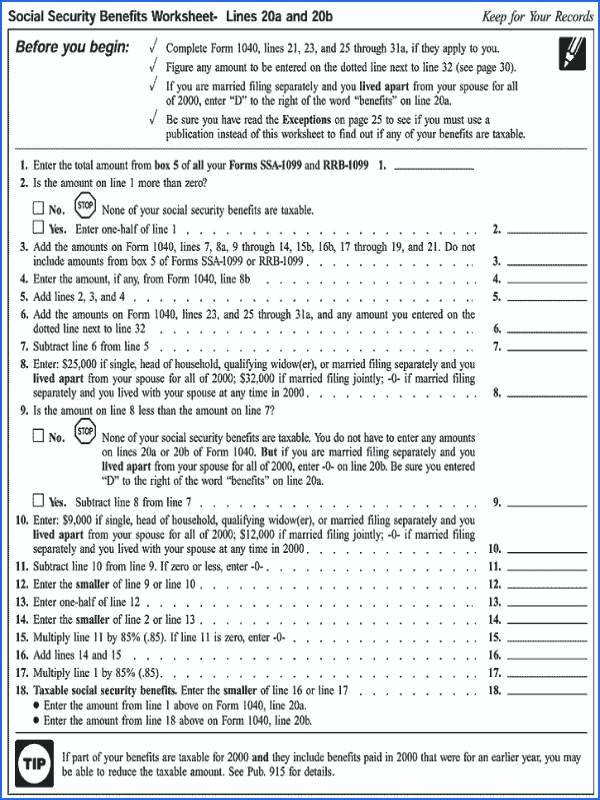

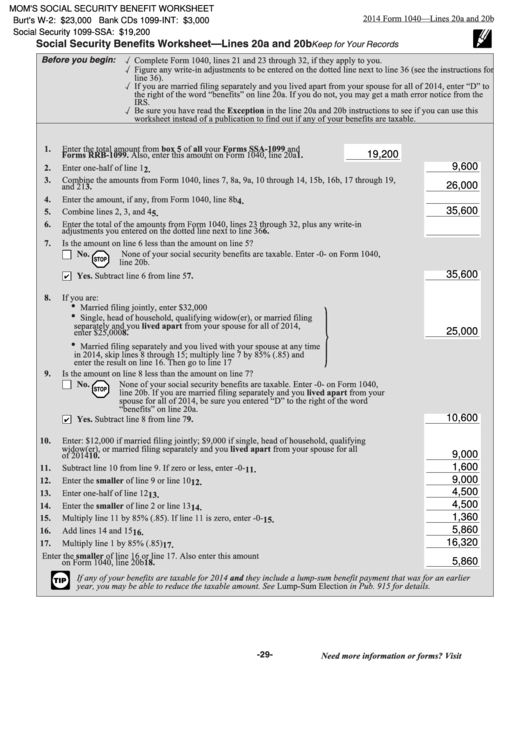

Form 1040 Social Security Worksheet 2022

Form 1040 Social Security Worksheet 2022 - Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Enter the amount from the credit limit worksheet in the instructions. Web modification for taxable social security income worksheet step 1: Web maximum income subject to social security tax for 2022. Married filing separately head of household qualifying child. 11 12 11 eligible percentage. Tax return for seniors 2022. Enter the percentage from line 10, or 1.0000, whichever applies. Web 1040 tax calculator enter your filing status, income, deductions and credits and we will estimate your total taxes. Ask the taxpayer about the receipt of either of these benefits.

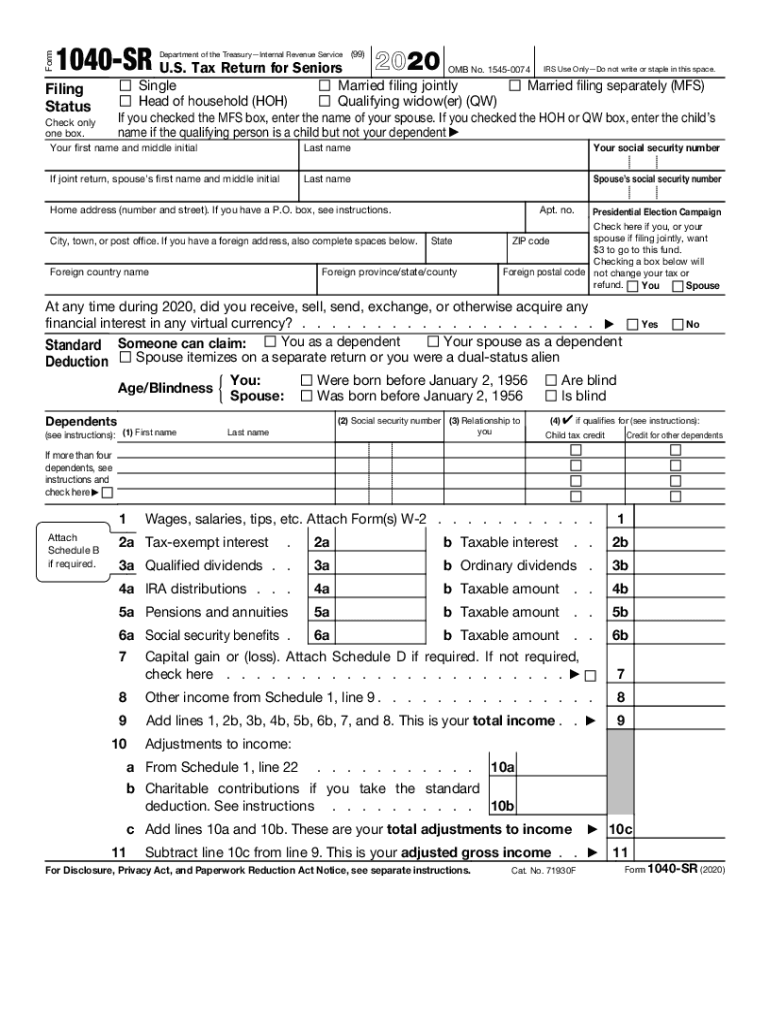

If you download, print and complete a paper form, please mail or take it to your local social. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don't live in the district of columbia. If you filed a joint federal return, enter the totals for both spouses. Tax return for seniors keywords: Do not use the worksheet below if any of the following apply to you; You may be able to take this credit and reduce your tax if by the end of 2022: Enter the amount from the credit limit worksheet in the instructions. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Combine the amounts from form 1040, lines 1, 2b, 3b, 4b, and schedule 1, line 22 3. Click file from the main menu.

Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Easily fill out pdf blank, edit, and sign them. Web 2022 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Tax return for seniors keywords: Web modification for taxable social security income worksheet step 1: Calculating taxable benefits before filling out this worksheet: Web jul 27, 2023 11:00 am edt. Click file from the main menu. Also, enter this amount on form 1040, line 5a. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don't live in the district of columbia.

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

Web jul 27, 2023 11:00 am edt. Ask the taxpayer about the receipt of either of these benefits. Instead, go directly to irs pub. If you download, print and complete a paper form, please mail or take it to your local social. Click file from the main menu.

Social Security Benefits Worksheet 2019 Calculator Worksheet Jay Sheets

Click file from the main menu. Web (form 1040) 2022 credit for the elderly or the disabled department of the treasury. If joint return, spouse’s first name and middle initial. Web complete fillable social security benefits worksheet online with us legal forms. Web jul 27, 2023 11:00 am edt.

2018 1040 Social Security Worksheet « Easy Math Worksheets

Combine lines 2, 3, and 4 5. You may be able to take this credit and reduce your tax if by the end of 2022: If you download, print and complete a paper form, please mail or take it to your local social. Web maximum income subject to social security tax for 2022. Fill in lines a through e.

Social Security Benefits Worksheet 2019 Semesprit

Enter the amount from the credit limit worksheet in the instructions. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Tax return for seniors keywords: Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you.

Social Security Benefits Worksheet 2016 —

You may be able to take this credit and reduce your tax if by the end of 2022: Tax return for seniors keywords: Enter the percentage from line 10, or 1.0000, whichever applies. Easily fill out pdf blank, edit, and sign them. Married filing separately head of household qualifying child.

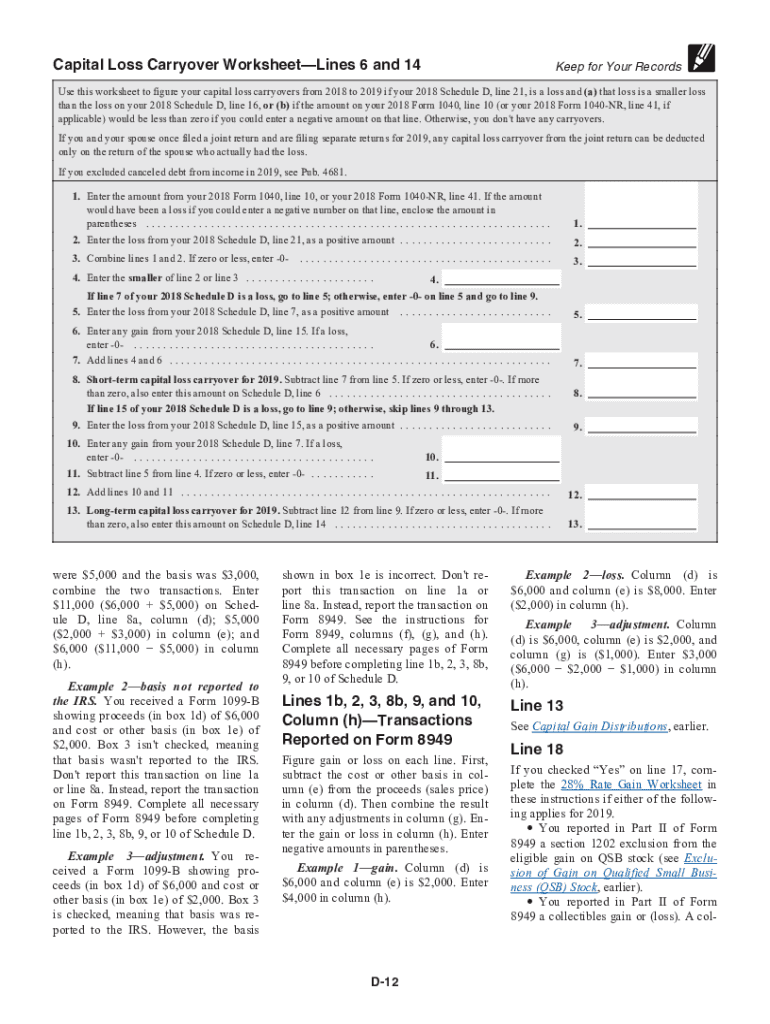

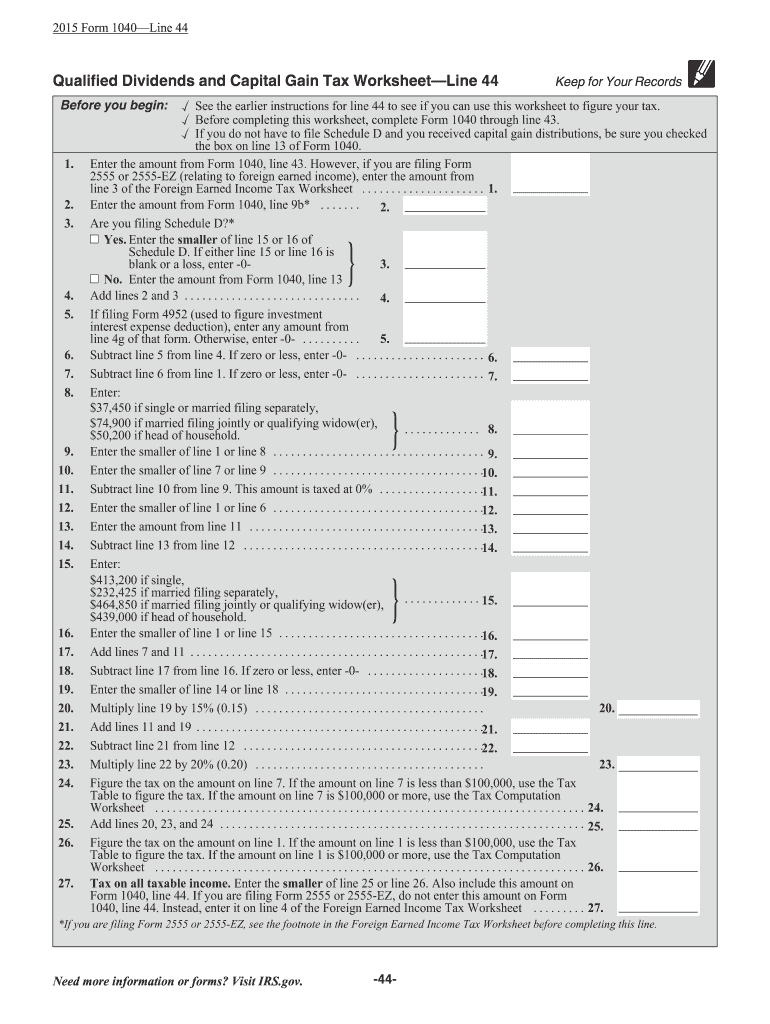

IRS 1040 Schedule D Instructions 2020 Fill out Tax Template Online

Line 2 line 3 line 4 line 5 line 6 Qualifying surviving spouse qualifying child. Multiply line 1 by 50% (0.50) 2. Married filing separately head of household qualifying child. Web (form 1040) 2022 credit for the elderly or the disabled department of the treasury.

2019 1040 Sr Fill Out and Sign Printable PDF Template signNow

Enter the percentage from line 10, or 1.0000, whichever applies. Also, enter this amount on form 1040, line 5a. Web maximum income subject to social security tax for 2022. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Married persons who live apart.

Fillable Form 1040 Social Security Benefits Worksheet 1040 Form Printable

Married filing separately head of household qualifying child. Save or instantly send your ready documents. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Calculating taxable benefits before filling out this worksheet: Combine the amounts from form 1040, lines 1, 2b, 3b, 4b, and schedule 1, line 22.

2015 2020 Form IRS Instruction 1040 Line 44 Fill Online 1040 Form

Fill in lines a through e. Web social security taxable benefits worksheet (2022) worksheet 1. You may be able to take this credit and reduce your tax if by the end of 2022: Line 2 line 3 line 4 line 5 line 6 Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal.

1040 social security worksheet

Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april. Web 1040 tax calculator enter your filing status, income, deductions and credits and we will estimate your total taxes. Instead, go directly to irs pub. Enter the amount, if any, from form 1040, line 2a.

Not All Forms Are Listed.

If you download, print and complete a paper form, please mail or take it to your local social. Web (form 1040) 2022 credit for the elderly or the disabled department of the treasury. Web maximum income subject to social security tax for 2022. Ask the taxpayer about the receipt of either of these benefits.

915, Social Security And Equivalent Railroad Retirement Benefits.

Tax payments to report include federal income tax withholding, excess social security tax paid, estimated tax payments, and. Also, enter this amount on form 1040, line 5a. Click file from the main menu. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040.

Virgin Islands, Guam, American Samoa, The Commonwealth Of The Northern Mariana Islands, Or Puerto Rico Omb No.

Multiply line 1 by 50% (0.50) 2. Web jul 27, 2023 11:00 am edt. If joint return, spouse’s first name and middle initial. Enter the amount, if any, from form 1040, line 2a 4.

Married Persons Who Live Apart.

Check the forms to print. Easily fill out pdf blank, edit, and sign them. Enter the percentage from line 10, or 1.0000, whichever applies. Web modification for taxable social security income worksheet step 1: