Form 1041-A Instructions

Form 1041-A Instructions - Distributions of principal for charitable. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Print suppressed lines on form. Web go to www.irs.gov/form1041 for instructions and the latest information. Citizenship and immigration services (uscis) historical records. If you do not have. When to file form 1041 table of contents form 1041 is an income tax return for estates and trusts. Upload, modify or create forms. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Distributions of income set aside for charitable purposes; Income tax return for estates and trusts along with. Print suppressed lines on form. Ad download, print or email irs 1041 tax form on pdffiller for free. Below is information from the irs regarding the filing requirements for form 1041 u.s. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Income tax return for estates and trusts. Try it for free now! When to file form 1041 table of contents form 1041 is an income tax return for estates and trusts. Complete, edit or print tax forms instantly.

What is estate and trust income? Distributions of principal for charitable. Web solved•by intuit•1•updated may 03, 2023. Ad access irs tax forms. Complete, edit or print tax forms instantly. Print suppressed lines on form. Income tax return for estates and trusts along with. Web how to fill out form 1041 for 2021. Knott 10.3k subscribers join subscribe 158 share save 17k views 1 year ago 2021 tax. Web go to www.irs.gov/form1041 for instructions and the latest information.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Web irs form 1041 is used to report income taxes for both trusts and estates (not to be confused with form 706, used when filing an estate tax return). Upload, modify or create forms. Try it for free now! Web solved•by intuit•1•updated may 03, 2023. When to file form 1041 table of contents form 1041 is an income tax return.

1041 A Printable PDF Sample

Income tax return for estates and trusts. Complete, edit or print tax forms instantly. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. If you do not have. What is estate and trust income?

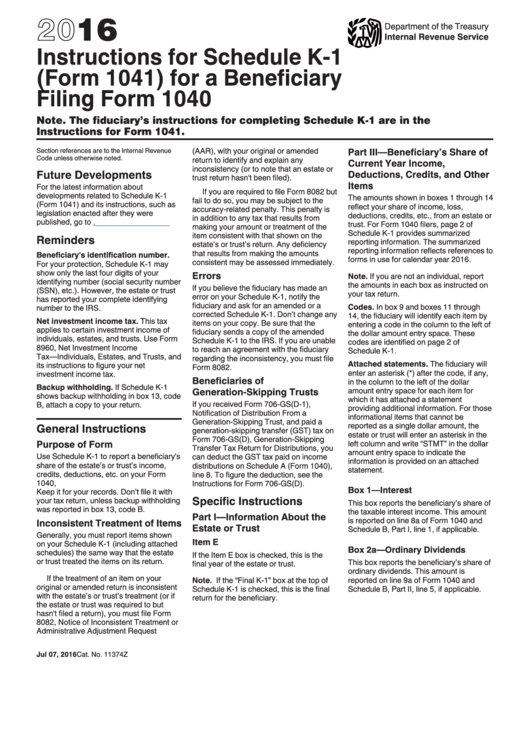

Instructions For Schedule K1 (Form 1041) 2016 printable pdf download

Knott 10.3k subscribers join subscribe 158 share save 17k views 1 year ago 2021 tax. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Web how to fill out form 1041 for 2021. Ad access irs tax forms. Web irs form 1041 is used to report income taxes for both trusts and estates.

Form 1041 filing instructions

What is estate and trust income? Web how to fill out form 1041 for 2021. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Income tax return for estates and trusts. Try it for free now!

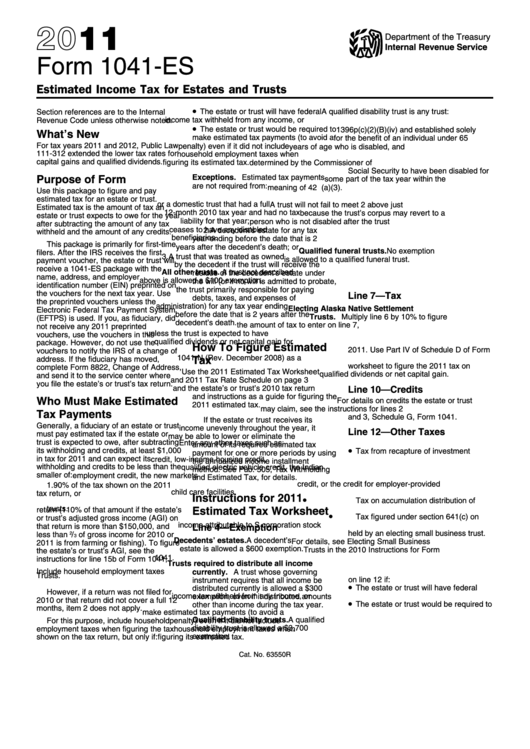

Form 1041Es Instructions 2011 printable pdf download

Web how to fill out form 1041 for 2021. Web go to www.irs.gov/form1041 for instructions and the latest information. What is estate and trust income? Income tax return for estates and trusts along with. Irs form 1041, get ready for tax deadlines by filling online any tax form for free.

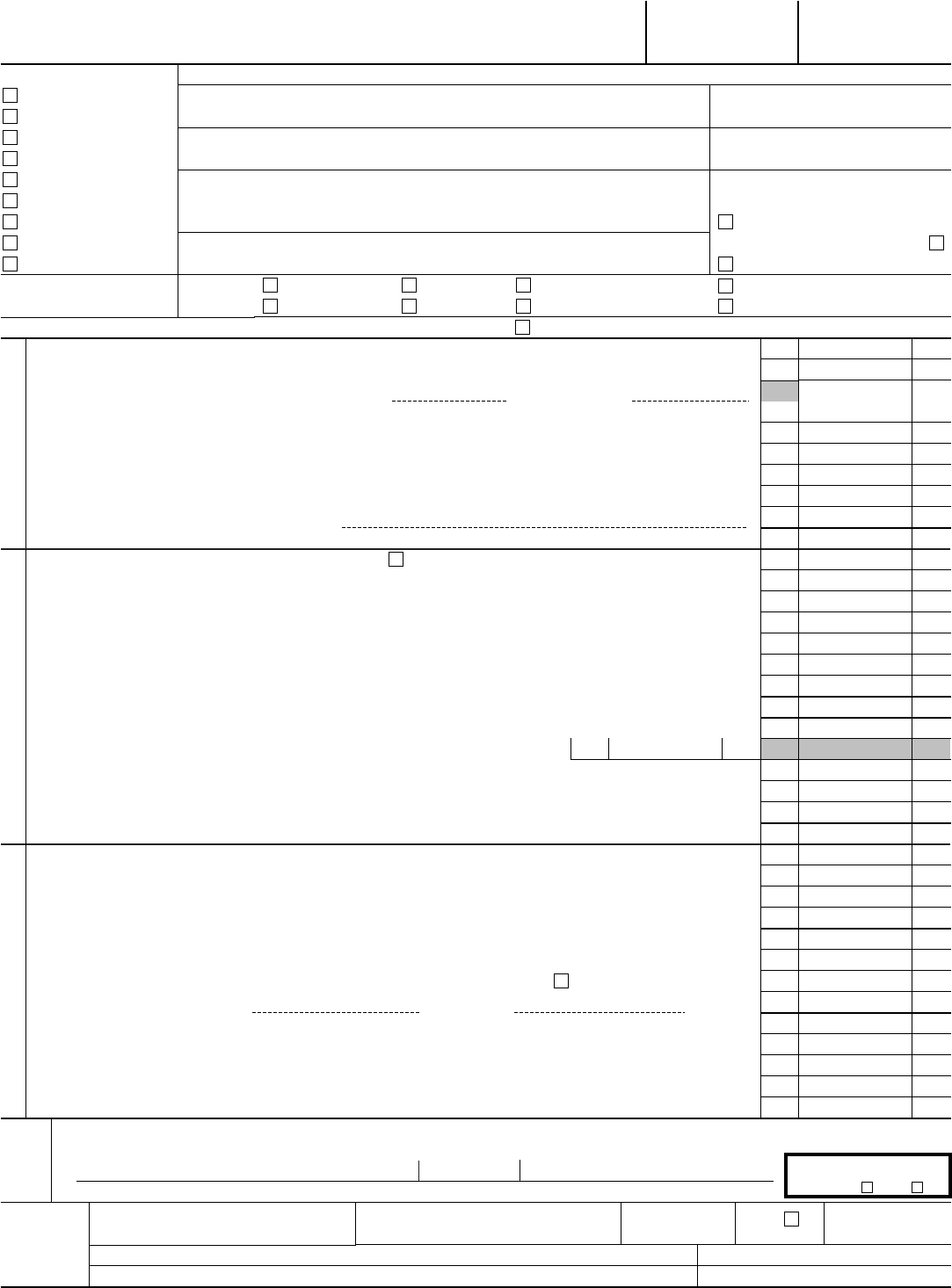

form 1041 sch b instructions Fill Online, Printable, Fillable Blank

Complete, edit or print tax forms instantly. Citizenship and immigration services (uscis) historical records. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Ad download, print or email irs 1041 tax form on pdffiller for free. If you do not have.

Form 1041 Edit, Fill, Sign Online Handypdf

Knott 10.3k subscribers join subscribe 158 share save 17k views 1 year ago 2021 tax. Distributions of principal for charitable. Below is information from the irs regarding the filing requirements for form 1041 u.s. Distributions of income set aside for charitable purposes; Complete, edit or print tax forms instantly.

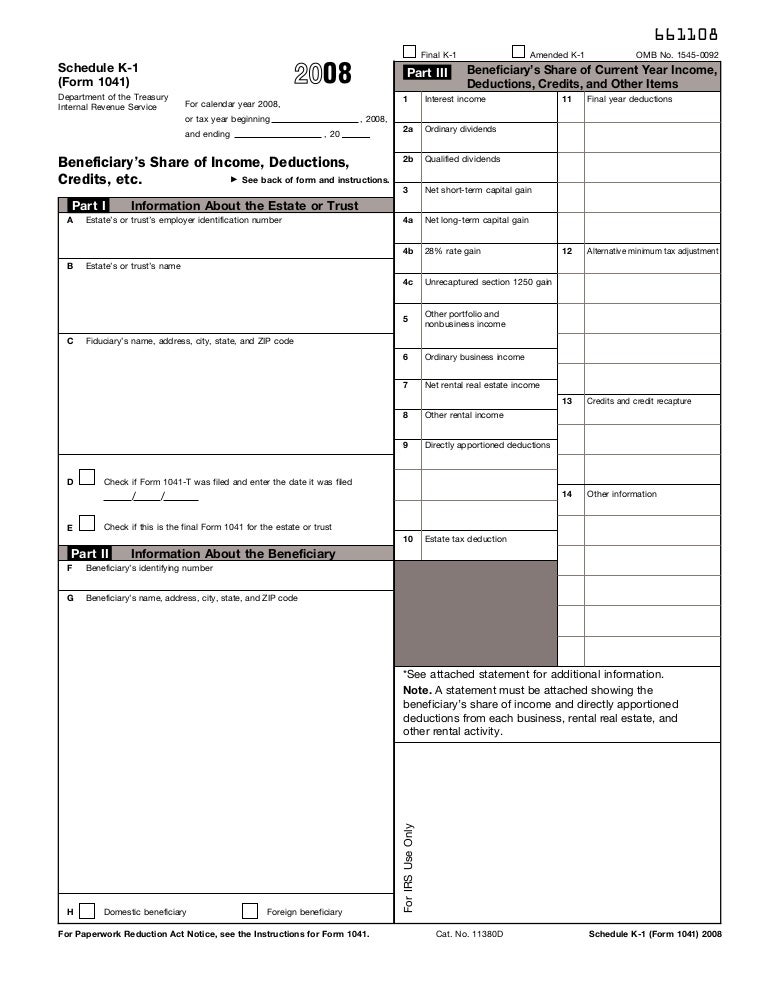

Form 104 Schedule K1 Beneficiary’s Share of Deductions,

Web solved•by intuit•1•updated may 03, 2023. Complete, edit or print tax forms instantly. Web how to fill out form 1041 for 2021. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. When to file form 1041 table of contents form 1041 is an income tax return for estates and trusts.

Download Instructions for Form IL1041X Amended Fiduciary and

Try it for free now! Upload, modify or create forms. When to file form 1041 table of contents form 1041 is an income tax return for estates and trusts. Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Web how to fill out form 1041 for 2021.

Web How To Fill Out Form 1041 For 2021.

Web irs form 1041 is used to report income taxes for both trusts and estates (not to be confused with form 706, used when filing an estate tax return). Distributions of principal for charitable. Try it for free now! Income tax return for estates and trusts along with.

Below Is Information From The Irs Regarding The Filing Requirements For Form 1041 U.s.

Irs form 1041, get ready for tax deadlines by filling online any tax form for free. Complete, edit or print tax forms instantly. If you do not have. Web solved•by intuit•1•updated may 03, 2023.

Distributions Of Income Set Aside For Charitable Purposes;

Income tax return for estates and trusts. Ad access irs tax forms. Web go to www.irs.gov/form1041 for instructions and the latest information. What is estate and trust income?

When To File Form 1041 Table Of Contents Form 1041 Is An Income Tax Return For Estates And Trusts.

Knott 10.3k subscribers join subscribe 158 share save 17k views 1 year ago 2021 tax. Print suppressed lines on form. Ad download, print or email irs 1041 tax form on pdffiller for free. Upload, modify or create forms.