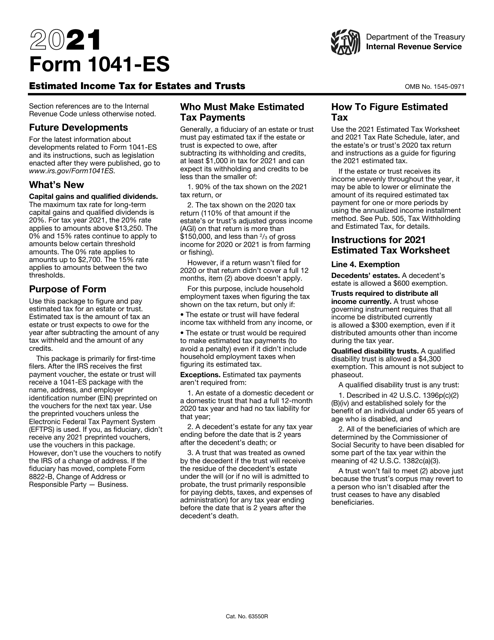

Form 1041-Es 2021

Form 1041-Es 2021 - Get ready for tax season deadlines by completing any required tax forms today. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web the 2021 form ct‑1041 return or 100% of the connecticut income tax shown on the 2020 form ct‑1041 if a 2020 form ct‑1041 was filed and it covered a 12‑month period. Web we last updated ohio form it 1041es from the department of taxation in march 2021. Ad access irs tax forms. Web 2 schedule a charitable deduction. Web internal revenue code section 6654 (1) imposes a penalty on trusts, and in certain circumstances, a decedent's estate, for underpayment of estimated tax. Information return trust accumulation of charitable amounts. Use get form or simply click on the template preview to open it in the editor. Of the estate or trust.

Ad irs form 1041, get ready for tax deadlines by filling online any tax form for free. Complete, edit or print tax forms instantly. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings. Web every entity required to file a business profits tax return and/or business enterprise tax return must also make estimated tax payments for each individual tax for its subsequent. Ad access irs tax forms. Web we last updated ohio form it 1041es from the department of taxation in march 2021. Web 2 schedule a charitable deduction. Use get form or simply click on the template preview to open it in the editor. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Start completing the fillable fields and carefully.

Web the tax shown on the 2021 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. Complete, edit or print tax forms instantly. Web we last updated ohio form it 1041es from the department of taxation in march 2021. Use get form or simply click on the template preview to open it in the editor. Web internal revenue code section 6654 (1) imposes a penalty on trusts, and in certain circumstances, a decedent's estate, for underpayment of estimated tax. Complete, edit or print tax forms instantly. Ad access irs tax forms. The income, deductions, gains, losses, etc. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings.

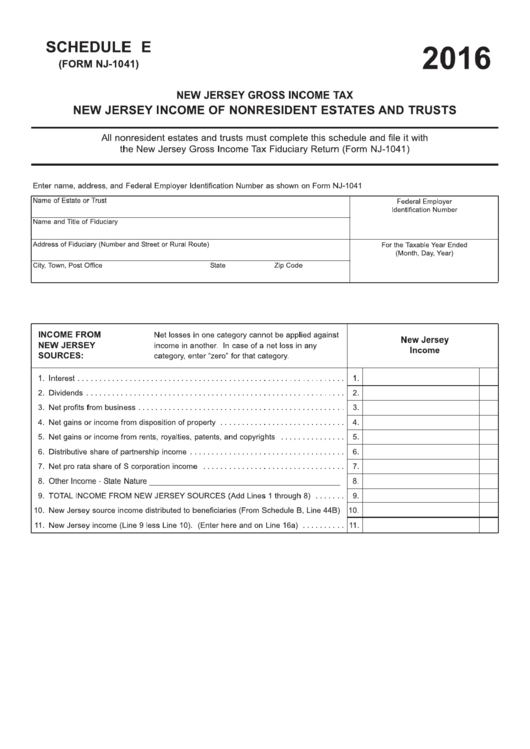

Fillable Form Nj1041 New Jersey Of Nonresident Estates And

Start completing the fillable fields and carefully. Web every entity required to file a business profits tax return and/or business enterprise tax return must also make estimated tax payments for each individual tax for its subsequent. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Estimated tax is the method used.

Form 2018 Estimated Fill Out and Sign Printable PDF Template signNow

Web 2 schedule a charitable deduction. The tax shown on the 2019 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web internal revenue code section 6654 (1) imposes a penalty on trusts, and.

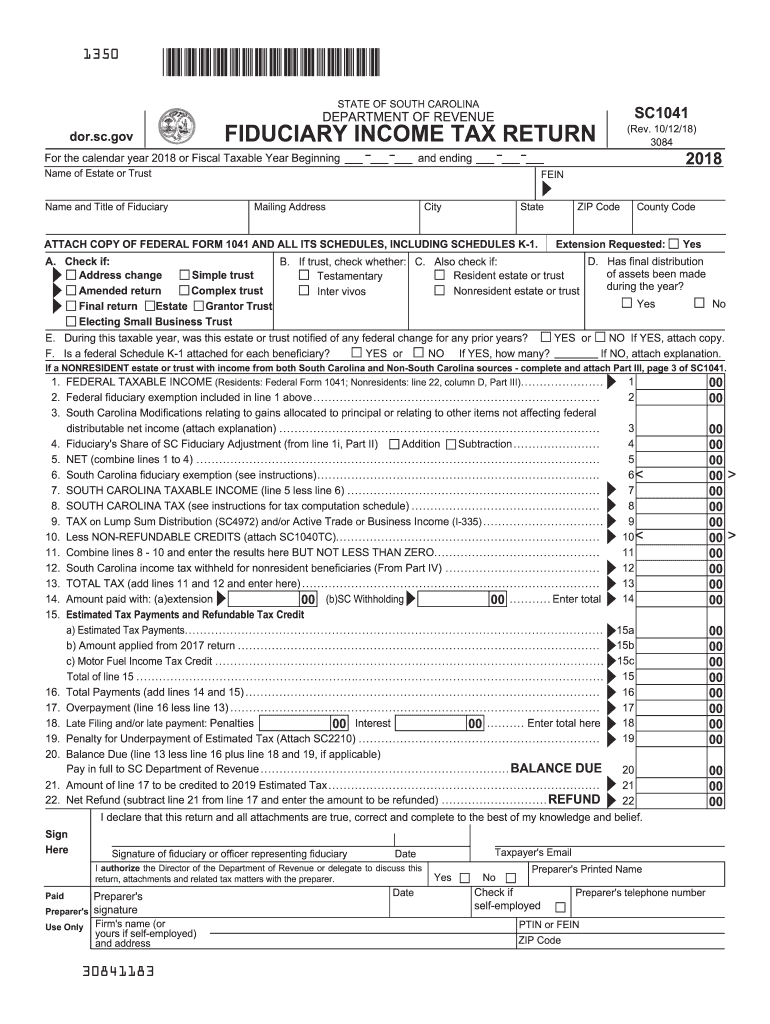

Sc 1041 Fill Out and Sign Printable PDF Template signNow

Estimated tax is the amount of tax an estate or trust expects to owe for the year after. Web internal revenue code section 6654 (1) imposes a penalty on trusts, and in certain circumstances, a decedent's estate, for underpayment of estimated tax. Estimated payments should only be. 90% of the tax shown on the 2020 tax return, or 2. Of.

IRS Form 1041ES Download Fillable PDF or Fill Online Estimated

Estimated payments should only be. While the 1040 relates to the previous year, the estimated tax form. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings. Of the estate or trust. Complete, edit or print tax forms instantly.

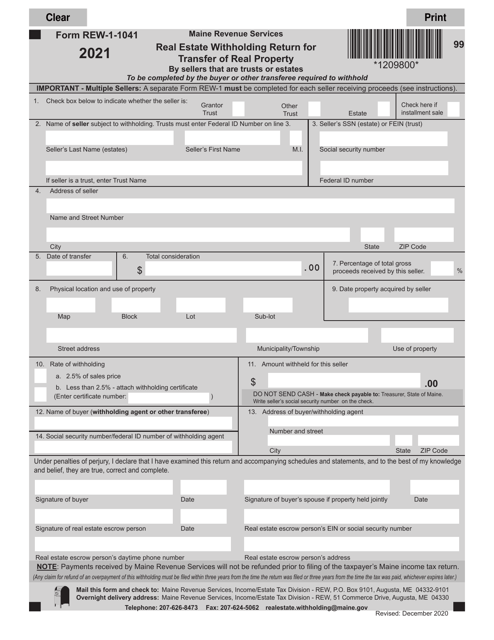

Form REW11041 Download Fillable PDF or Fill Online Real Estate

Web every entity required to file a business profits tax return and/or business enterprise tax return must also make estimated tax payments for each individual tax for its subsequent. Ad irs form 1041, get ready for tax deadlines by filling online any tax form for free. The tax shown on the 2019 tax return (110% of that amount if the.

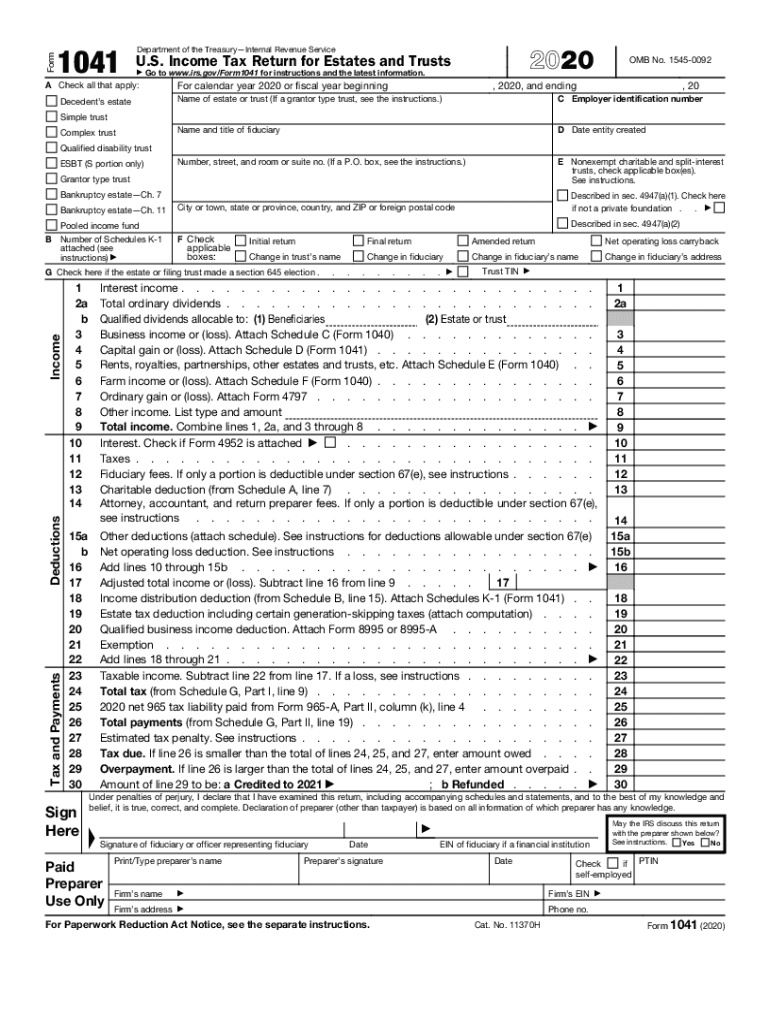

U.S. Tax Return for Estates and Trusts, Form 1041

Web 2 schedule a charitable deduction. Estimated tax is the amount of tax an estate or trust expects to owe for the year after. Don’t complete for a simple trust or a pooled income fund. Get ready for tax season deadlines by completing any required tax forms today. Information return trust accumulation of charitable amounts.

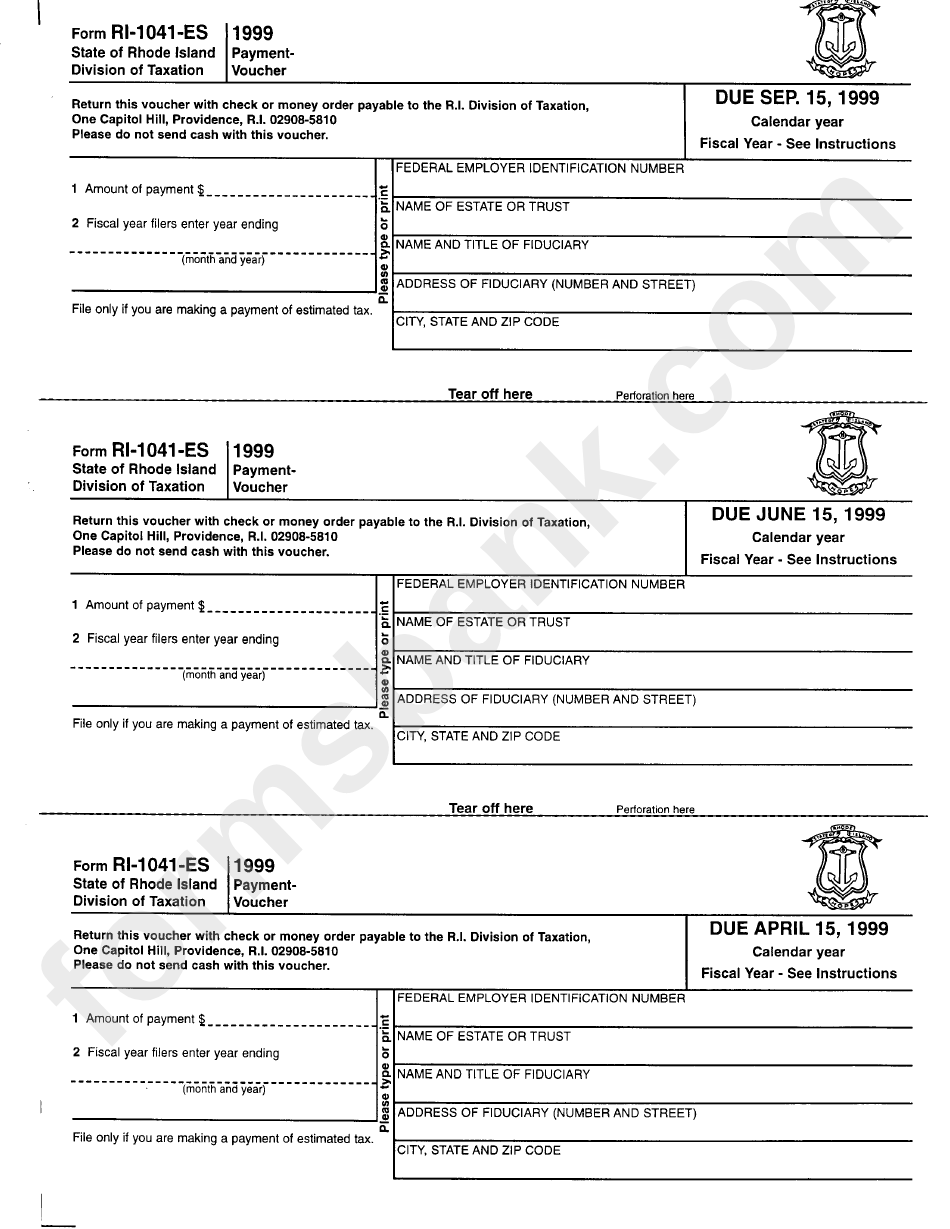

Fillable Form Ri1041Es 1999 Payment Voucher printable pdf download

Web the tax shown on the 2021 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return is more than $150,000, and less than 2 3 of gross. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings. Web every entity required to.

1041 Fill Out and Sign Printable PDF Template signNow

Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings. Estimated payments should only be. Web the 2021 form ct‑1041 return or 100% of the connecticut income tax shown on the 2020 form ct‑1041 if a 2020 form ct‑1041 was filed and it covered a 12‑month period. Information return trust accumulation.

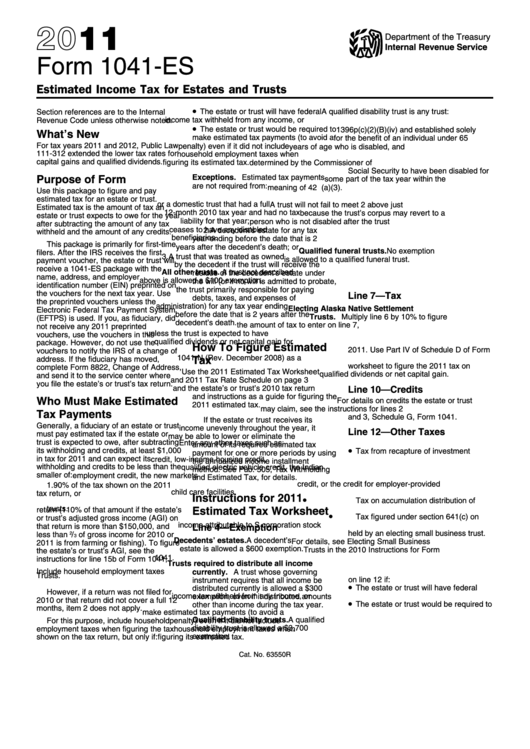

Form 1041Es Instructions 2011 printable pdf download

Get ready for tax season deadlines by completing any required tax forms today. The income, deductions, gains, losses, etc. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings. Web the tax shown on the 2021 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi).

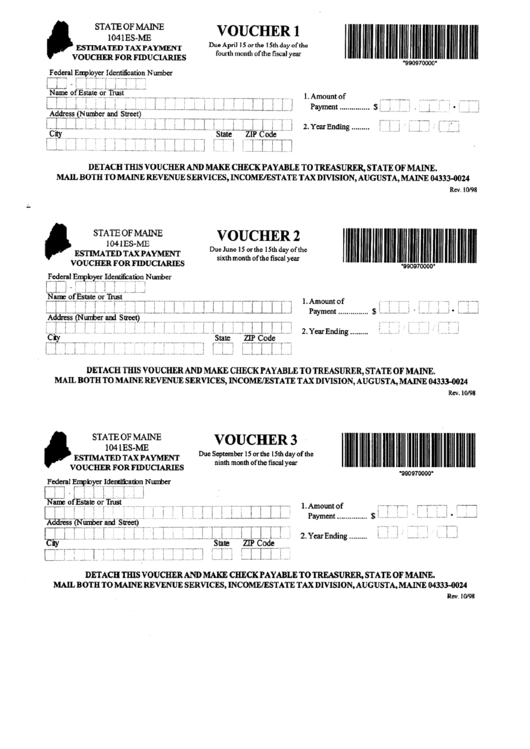

Form 1041esMe Estimated Tax Payment Voucher For Individuals

90% of the tax shown on the 2020 tax return, or 2. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated ohio form it 1041es from the department of taxation in march 2021. Don’t complete for a simple trust or a pooled income fund. Show sources > form it 1041es is an.

Estimated Tax Is The Method Used To Pay Tax On Income That Isn't Subject To Withholding (For Example, Earnings.

Start completing the fillable fields and carefully. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The income, deductions, gains, losses, etc.

Web 2 Schedule A Charitable Deduction.

Complete, edit or print tax forms instantly. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web every entity required to file a business profits tax return and/or business enterprise tax return must also make estimated tax payments for each individual tax for its subsequent. The tax shown on the 2019 tax return (110% of that amount if the estate’s or trust’s adjusted gross income (agi) on that return.

Web The Tax Shown On The 2021 Tax Return (110% Of That Amount If The Estate’s Or Trust’s Adjusted Gross Income (Agi) On That Return Is More Than $150,000, And Less Than 2 3 Of Gross.

Information return trust accumulation of charitable amounts. Estimated payments should only be. Don’t complete for a simple trust or a pooled income fund. While the 1040 relates to the previous year, the estimated tax form.

Income Tax Return For Estates And Trusts.

Estimated tax is the amount of tax an estate or trust expects to owe for the year after. Web we last updated ohio form it 1041es from the department of taxation in march 2021. Web the 2021 form ct‑1041 return or 100% of the connecticut income tax shown on the 2020 form ct‑1041 if a 2020 form ct‑1041 was filed and it covered a 12‑month period. Of the estate or trust.