Form 1065 Sch K Instructions

Form 1065 Sch K Instructions - Web where to file your taxes for form 1065. The draft instructions also include instructions for schedule k. Form 1065 includes information about the partnership income, expenses, credits, and. Web the american institute of cpas (aicpa) is pleased to submit suggestions on draft form 1065, u.s. Web the irs has released draft instructions for the 2019 form 1065 (u.s. Rental activity income (loss) and. If “yes,” enter the name of the foreign country. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web key takeaways form 1065 is the income tax return for partnerships. This code will let you know if you should.

This code will let you know if you should. Web the irs has released draft instructions for the 2019 form 1065 (u.s. Rental activity income (loss) and. Form 1065 indicates net income (loss) is computed by combining schedule k, lines 1 through 11 and subtracting from the result schedule k,. The draft instructions also include instructions for schedule k. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. [1] the draft contains a new. If the partnership's principal business, office, or agency is located in: An executor is responsible to notify the partnership of the name and tax identification. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065.

This code will let you know if you should. If “yes,” enter the name of the foreign country. Form 1065 indicates net income (loss) is computed by combining schedule k, lines 1 through 11 and subtracting from the result schedule k,. [1] the draft contains a new. Web key takeaways form 1065 is the income tax return for partnerships. Web the american institute of cpas (aicpa) is pleased to submit suggestions on draft form 1065, u.s. The draft instructions also include instructions for schedule k. If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year. Domestic partnerships treated as aggregates for.

IRS Form 1065 (Schedule K1) 2019 Fill out and Edit Online PDF Template

If the partnership's principal business, office, or agency is located in: Form 1065 indicates net income (loss) is computed by combining schedule k, lines 1 through 11 and subtracting from the result schedule k,. Web the irs has released draft instructions for the 2019 form 1065 (u.s. Web developments related to form 1065 and its instructions, such as legislation enacted.

Sch A Form / Instructions Form 1040 Schedule 1 Schedule A Form Chegg

[1] the draft contains a new. The draft instructions also include instructions for schedule k. This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. On october 29, 2019, the irs released draft instructions for 2019 form.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

This code will let you know if you should. Web key takeaways form 1065 is the income tax return for partnerships. Get ready for tax season deadlines by completing any required tax forms today. Web the irs has released draft instructions for the 2019 form 1065 (u.s. Web the american institute of cpas (aicpa) is pleased to submit suggestions on.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Form 1065 includes information about the partnership income, expenses, credits, and. The draft instructions also include instructions for schedule k. Web the irs has released draft instructions for the 2019 form 1065 (u.s. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. An executor is.

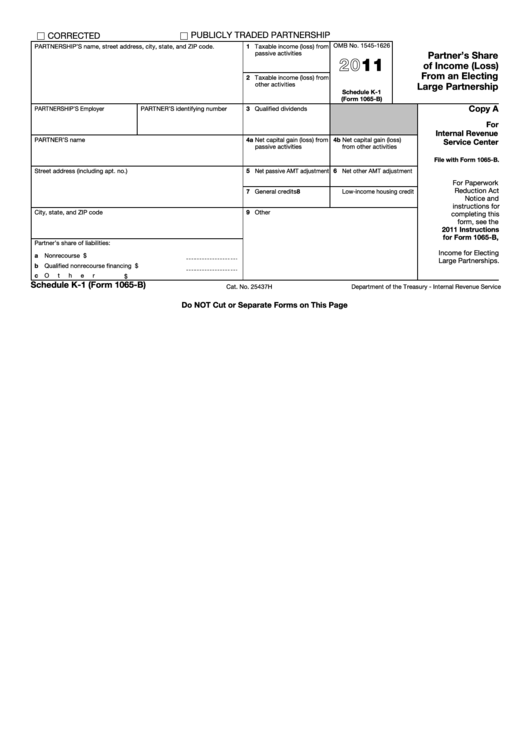

Fillable Schedule K1 (Form 1065B) Partner'S Share Of (Loss

The draft instructions also include instructions for schedule k. And the total assets at the end of the tax year. Web where to file your taxes for form 1065. Form 1065 indicates net income (loss) is computed by combining schedule k, lines 1 through 11 and subtracting from the result schedule k,. Web the american institute of cpas (aicpa) is.

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. If “yes,” enter the name of the foreign country. Complete, edit or print tax forms instantly. And the total assets at the end of the tax year. Web key takeaways form 1065 is the income tax.

Irs Form 1065 K 1 Instructions Universal Network

If “yes,” enter the name of the foreign country. Form 1065 includes information about the partnership income, expenses, credits, and. If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/.

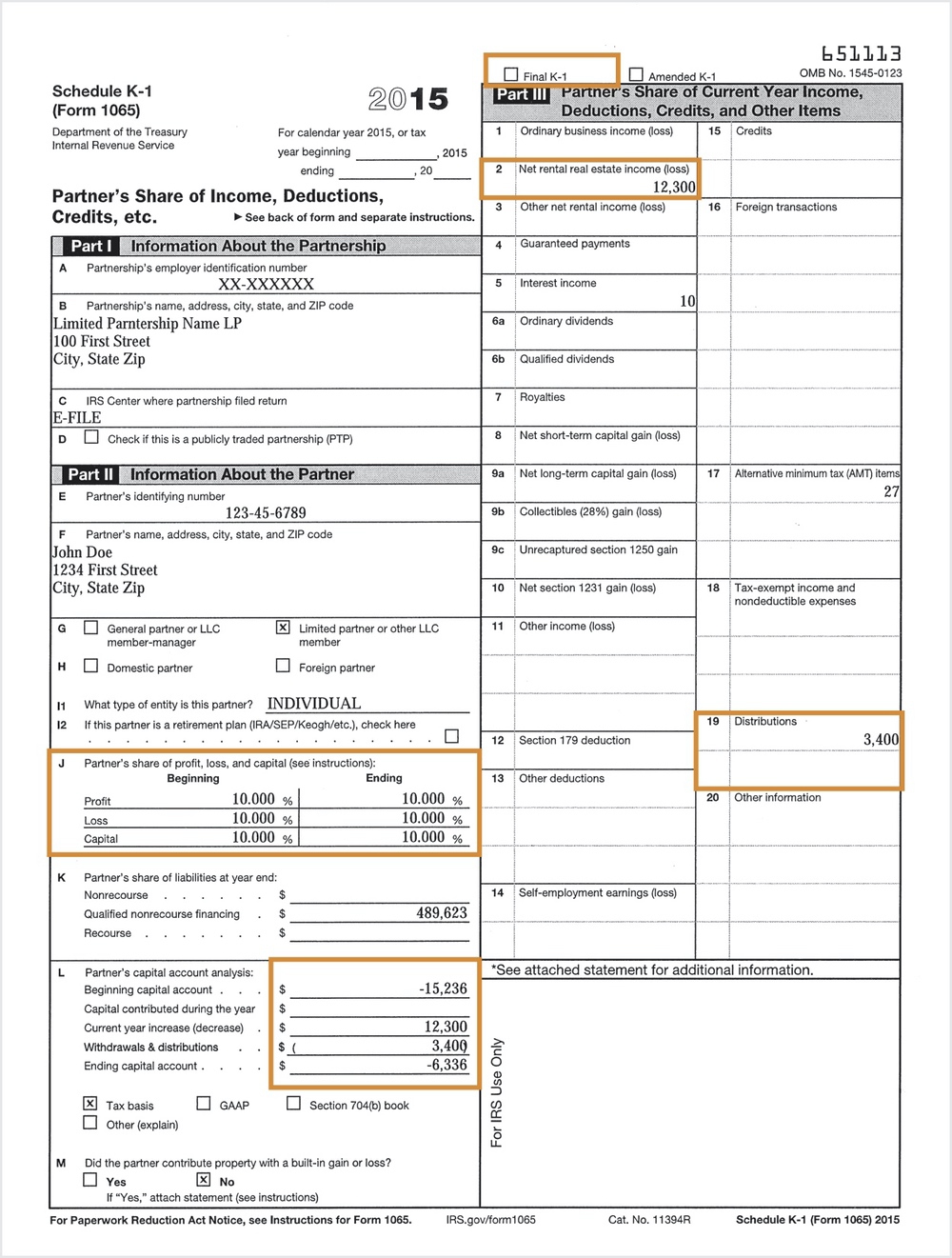

Schedule K1 / 1065 Tax Form Guide LP Equity

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. [1] the draft contains a new. Form 1065 indicates net income (loss) is computed by combining schedule k, lines 1 through 11 and subtracting from the result schedule k,. And the total assets at the end.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The draft instructions also include instructions for schedule k. This code will let you know if you should. On october 29, 2019, the irs released draft instructions for 2019 form 1065, u.s. If “yes,” enter the name of the foreign country.

2017 Federal Tax Forms Fill Out and Sign Printable PDF Template signNow

Rental activity income (loss) and. If “yes,” enter the name of the foreign country. An executor is responsible to notify the partnership of the name and tax identification. Complete, edit or print tax forms instantly. [1] the draft contains a new.

Complete, Edit Or Print Tax Forms Instantly.

Web the american institute of cpas (aicpa) is pleased to submit suggestions on draft form 1065, u.s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. If “yes,” enter the name of the foreign country. On october 29, 2019, the irs released draft instructions for 2019 form 1065, u.s.

Web Developments Related To Form 1065 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/ Form1065.

The draft instructions also include instructions for schedule k. Web where to file your taxes for form 1065. [1] the draft contains a new. If the partnership's principal business, office, or agency is located in:

And The Total Assets At The End Of The Tax Year.

Web the irs has released draft instructions for the 2019 form 1065 (u.s. Domestic partnerships treated as aggregates for. An executor is responsible to notify the partnership of the name and tax identification. Rental activity income (loss) and.

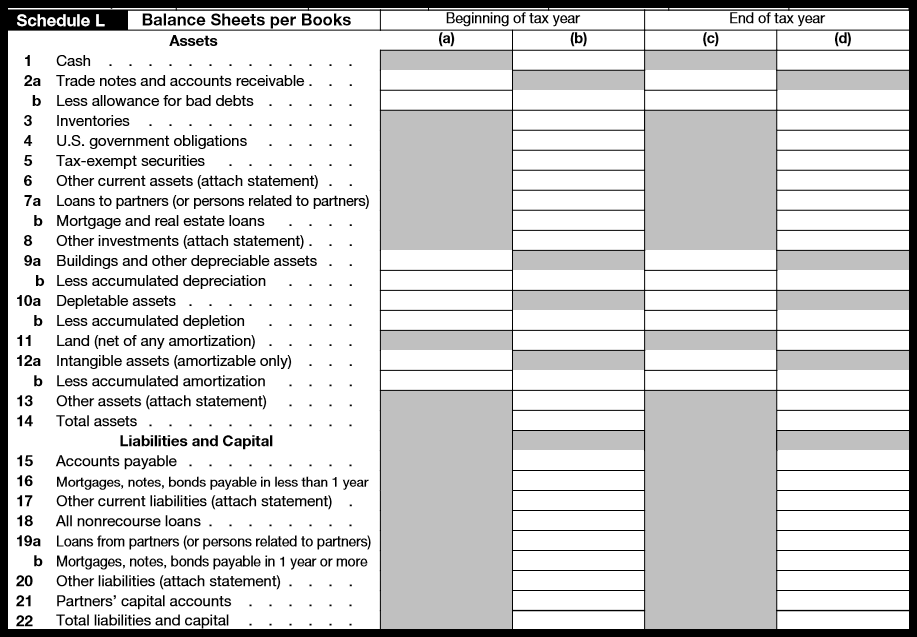

Form 1065 Indicates Net Income (Loss) Is Computed By Combining Schedule K, Lines 1 Through 11 And Subtracting From The Result Schedule K,.

This code will let you know if you should. Web key takeaways form 1065 is the income tax return for partnerships. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Get ready for tax season deadlines by completing any required tax forms today.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)