Form 1096 Correction

Form 1096 Correction - *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. File form 1096 and copy a of the return with. If you want to update. Fill out and include form 1096 to indicate how many of which type of form you’re correcting. Click on employer and information returns, and. Choose the icon, enter 1096 forms, and then choose the related link. Upload, modify or create forms. Web printing a corrected 1096. Ad access irs tax forms. Web check the box at the top of the form to indicate the filing is a corrected form.

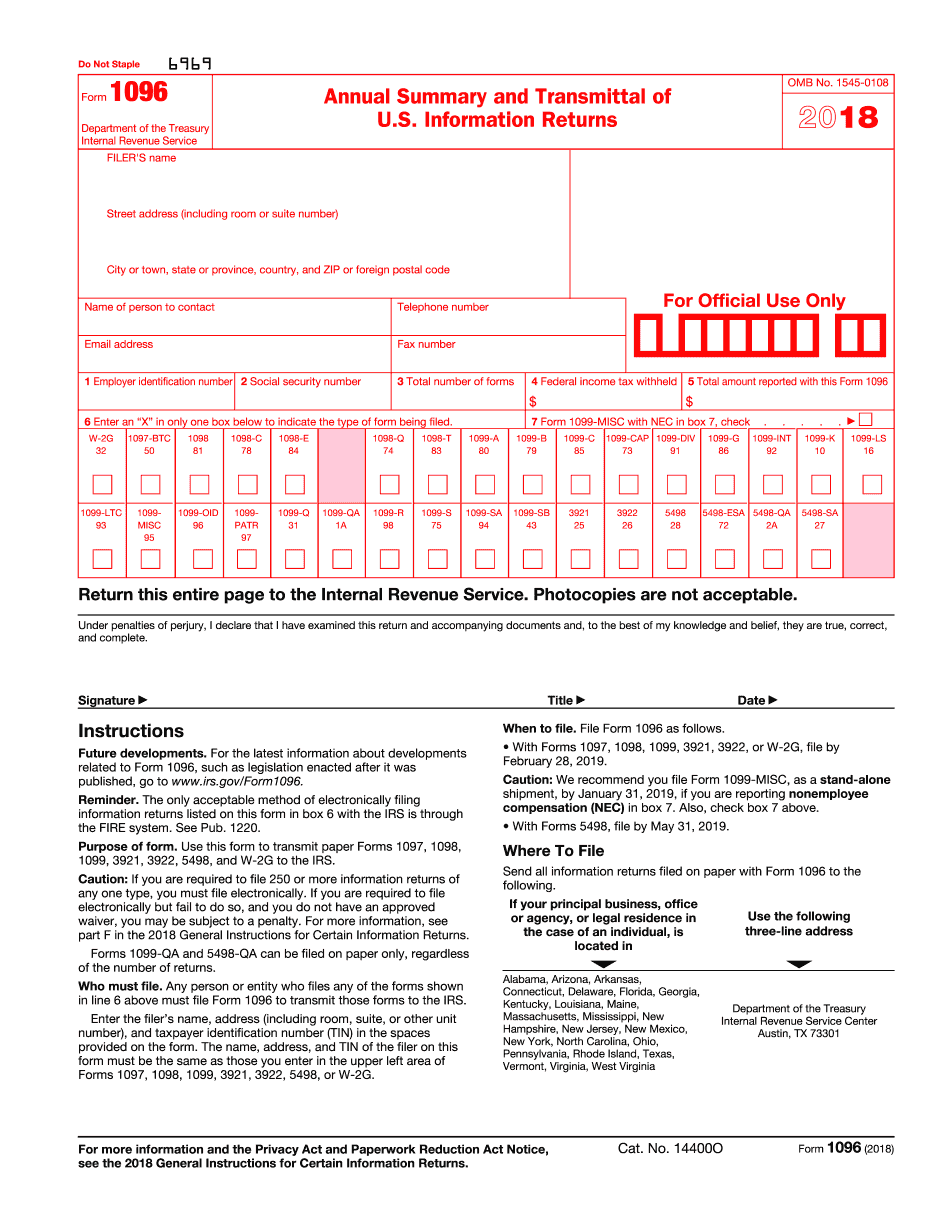

Upload, modify or create forms. Web form 1096 (officially the annual summary and transmittal of u.s. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web if you have made a minor mistake on your form 1096, the irs may correct it or simply overlook it. File form 1096 and copy a of the return with. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Go to the drop down box and select your 1099. Web posted on january 26, 2021. Minor inconsistencies are often picked up by irs software.

Click on employer and information returns, and. Unlike other corrections, a 1099 with wrong amount does not require a notation at the bottom. All you have to do is make the corrections and send. Web learn more once you’ve determined that you’ve hired an independent contractor, or have a need to prepare a 1099 form, the correct filing of the form 1099 is incredibly. Web prepare a new transmittal form 1096 provide all requested information on the form as it applies to part a, 1 and 2. File form 1096 and copy a of the return with. Open the form you want to edit. Complete, edit or print tax forms instantly. If you want to update. Choose the icon, enter 1096 forms, and then choose the related link.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Unlike other corrections, a 1099 with wrong amount does not require a notation at the bottom. Try it for free now! Web if you have made a minor mistake on your form 1096, the irs may correct it or simply overlook it. Web prepare a new transmittal form 1096 enter the words “filed to correct tin,” “filed to correct name.

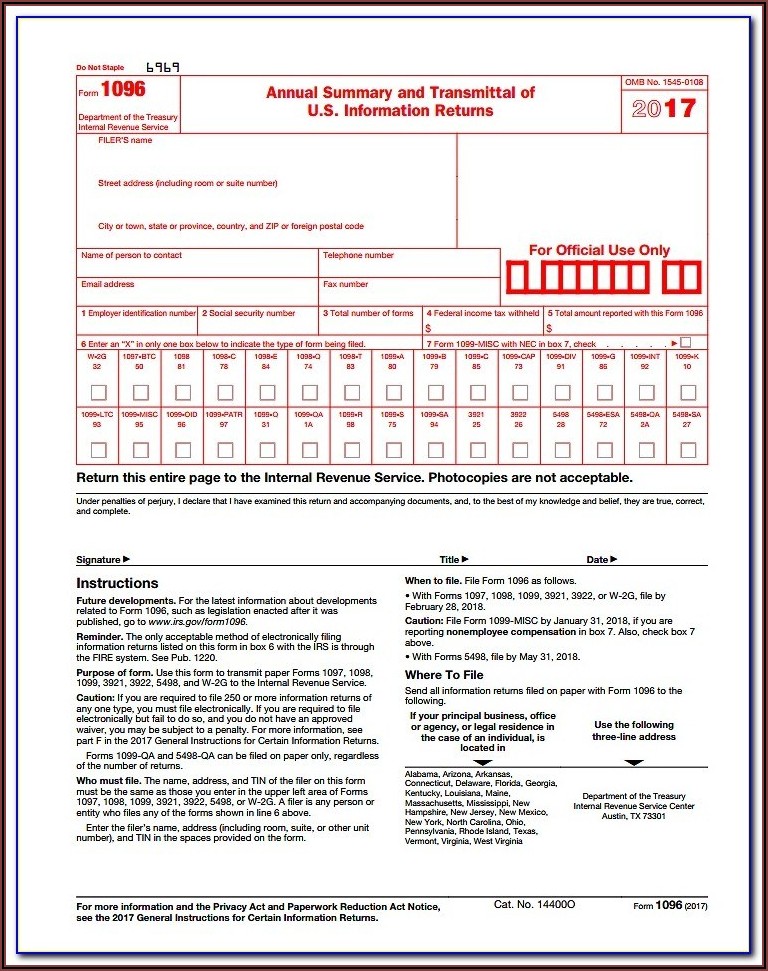

Forms & Record Keeping Supplies Year 2017 IRS Tax Forms 14 1099MISC

Web printing a corrected 1096. Web a 1096 form, summarizing the amounts from the corrected 1099. Web prepare a new transmittal form 1096 provide all requested information on the form as it applies to part a, 1 and 2. Web form 1096 (officially the annual summary and transmittal of u.s. Web posted on january 26, 2021.

Microsoft Dynamics GP Year End Release 2015 Payables Management

If you want to update. Information returns [1]) is an internal revenue service (irs) tax form used in the united states used to. Ad access irs tax forms. Web form 1096 (officially the annual summary and transmittal of u.s. Web learn more once you’ve determined that you’ve hired an independent contractor, or have a need to prepare a 1099 form,.

Correcting Your HSA Reporting Two Steps, Two Forms — Ascensus

January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. All you have to do is make the corrections and send. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web prepare a new transmittal form 1096 enter the words “filed to correct tin,” “filed to correct name and address,” or “filed.

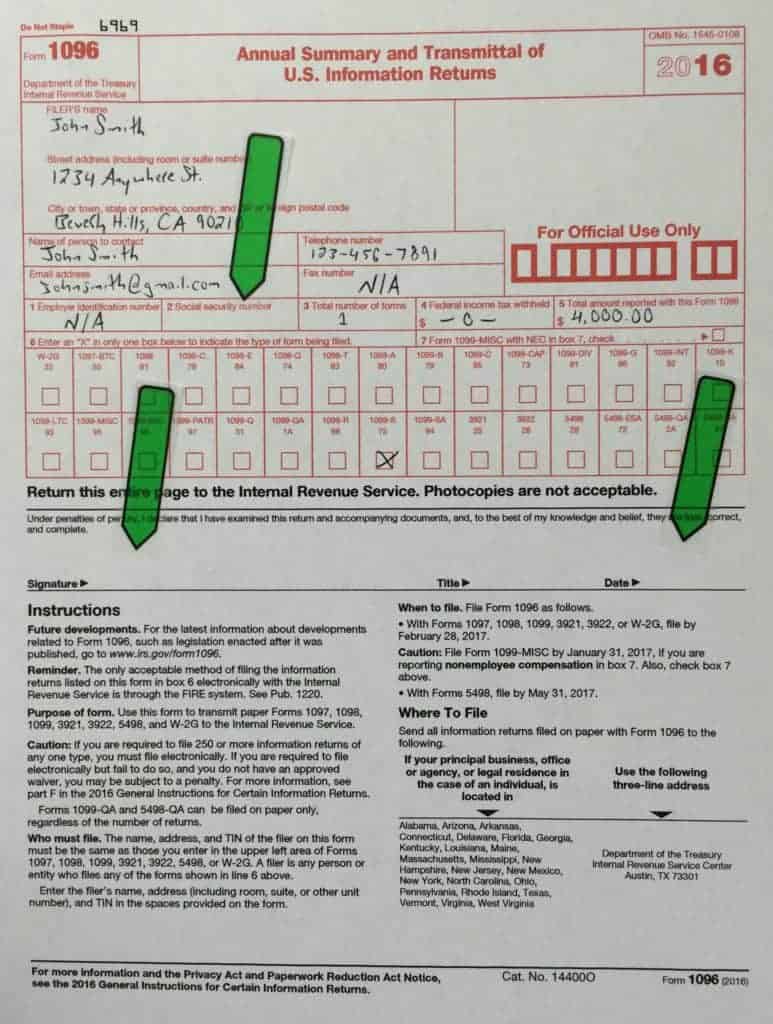

What Does A Completed 1096 Form Look Like Form Resume Examples

Try it for free now! If you want to update. Web use form 1096 to send paper forms to the irs. Go to the drop down box and select your 1099. Information returns [1]) is an internal revenue service (irs) tax form used in the united states used to.

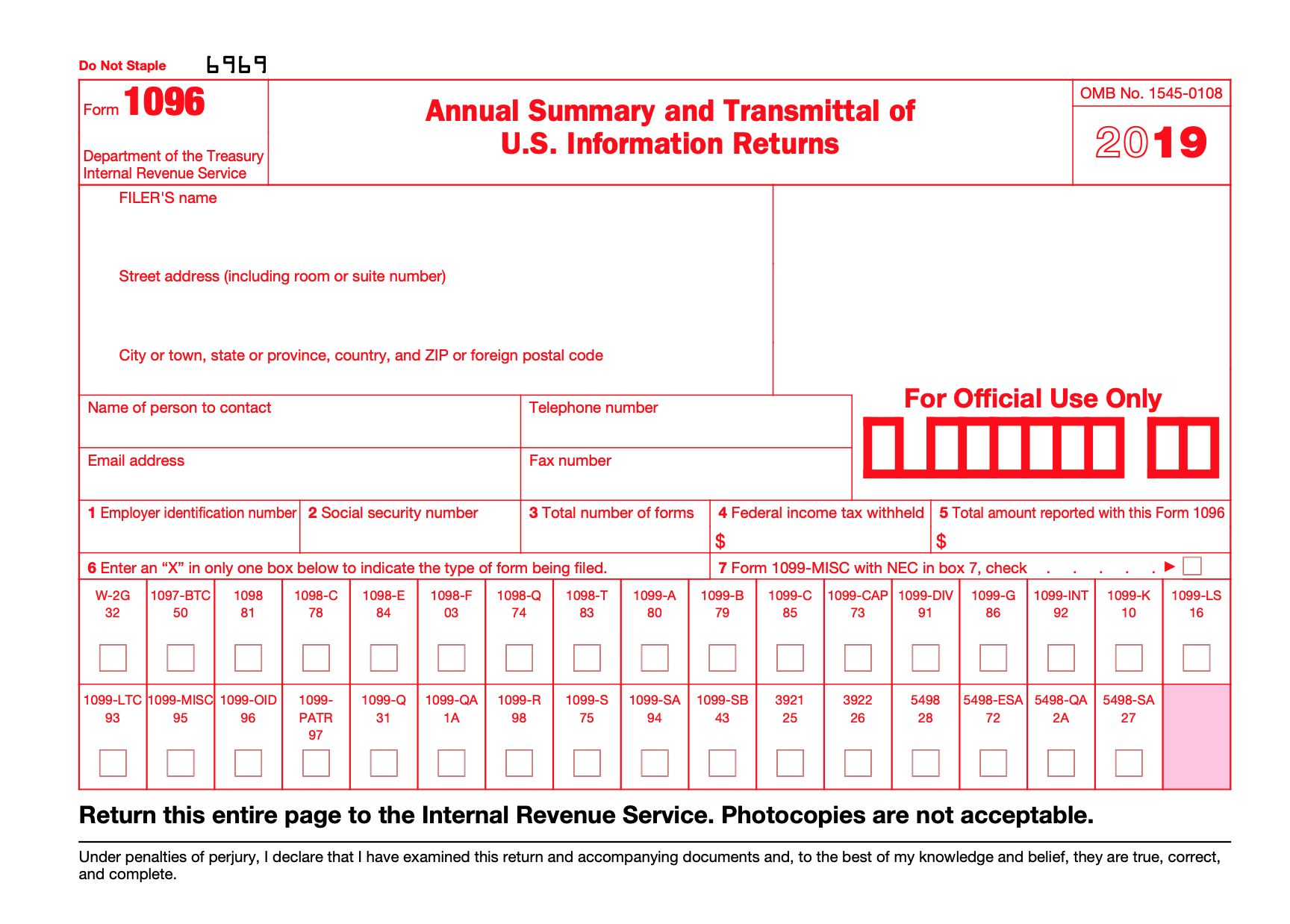

Printable Form 1096 2021 Printable Form 2021

Information returns [1]) is an internal revenue service (irs) tax form used in the united states used to. Minor inconsistencies are often picked up by irs software. *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. January 2021) department of the treasury internal revenue service annual summary and transmittal.

Form 1096 YouTube

Fill out and include form 1096 to indicate how many of which type of form you’re correcting. Open the form you want to edit. Web if you have made a minor mistake on your form 1096, the irs may correct it or simply overlook it. Web printing a corrected 1096. Web check the box at the top of the form.

Paper Products Go with MISC 1099 3 IRS Tax Forms 1096 Annual Summary

Web if you have made a minor mistake on your form 1096, the irs may correct it or simply overlook it. Web a 1096 form, summarizing the amounts from the corrected 1099. Go to the drop down box and select your payer. File form 1096 and copy a of the return with. All you have to do is make the.

Printable Form 1096 1096 Tax Form Due Date Universal Network What

Web a 1096 form, summarizing the amounts from the corrected 1099. January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Information returns [1]) is an internal revenue service (irs) tax form used in the united states used to. In your software, go into print forms. Web use form 1096 to send paper forms to.

1099 Nec Form 2020 Printable Customize and Print

*for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. If you want to update. For the same type of return, you may use one form 1096 for both originals and corrections. Web learn more once you’ve determined that you’ve hired an independent contractor, or have a need to prepare.

Information Returns [1]) Is An Internal Revenue Service (Irs) Tax Form Used In The United States Used To.

Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Go to the drop down box and select your 1099. Fill out and include form 1096 to indicate how many of which type of form you’re correcting. Choose the icon, enter 1096 forms, and then choose the related link.

In Your Software, Go Into Print Forms.

Web to make corrections in a 1096 form. Web prepare a new transmittal form 1096 enter the words “filed to correct tin,” “filed to correct name and address,” or “filed to correct return” in the bottom. Web learn more once you’ve determined that you’ve hired an independent contractor, or have a need to prepare a 1099 form, the correct filing of the form 1099 is incredibly. Upload, modify or create forms.

Open The Form You Want To Edit.

Web use form 1096 to send paper forms to the irs. Web printing a corrected 1096. Ad access irs tax forms. *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year.

Web Form 1096 (Officially The Annual Summary And Transmittal Of U.s.

January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Use a separate form 1096 for each type of return you are correcting. If you want to update. Minor inconsistencies are often picked up by irs software.