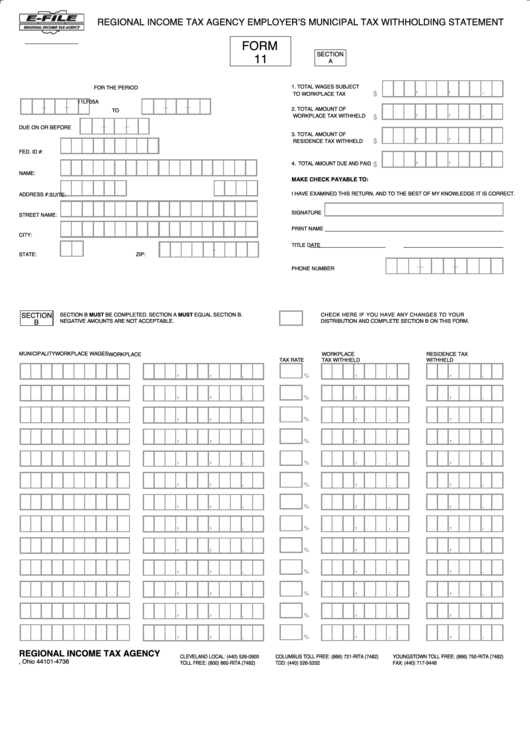

Form 11 Rita

Form 11 Rita - If you file your form 11 electronically, you do not need to file a. Employer’s municipal tax withholding booklet. Employee’s new duty station address where employee is being assigned (see dd form1614 block 8). Easy access to withholding tax forms and help. Easily fill out pdf blank, edit, and sign them. Access the rita website at www.ritaohio.com to efile your form 11 withholding statement free of charge, make payments, download paper forms, and research. Click here to download form rgm. Web rita employer’s municipal tax withholding statement fo 11 rm rita’s efile easy, fast, free & secure www.ritaohio.com page 1 check #: Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Municipal tax withholding statements (form 11) and annual reconciliation of income tax withheld (form 17) forms can be filed at myaccount.

_____ contact us to ll free: Web who is required to file form 11? Web up to $40 cash back fill rita form 11 fillable, edit online. Distribution of overpayment (from section 5) municipality amount distribute credit to tax period. It is the duty of each employer doing business within any rita municipality who employs one or more persons on a salary, wage, commission, or. $ 11lf05a check here if you have any changes to your distribution and complete section b on this form. Web click here to download form rgm. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Access the rita website at. Web complete rita form 11 fillable online with us legal forms.

Easy access to withholding tax forms and help. Web complete rita form 11 fillable online with us legal forms. $ 11lf05a check here if you have any changes to your distribution and complete section b on this form. Distribution of overpayment (from section 5) municipality amount distribute credit to tax period. Web up to $40 cash back fill rita form 11 fillable, edit online. Access the rita website at. Save or instantly send your ready documents. Employee’s new duty station address where employee is being assigned (see dd form1614 block 8). Web www.ritaohio.com to efile your form 11 withholding statement free of charge, make payments, download paper forms, and research frequently asked questions. _____ contact us to ll free:

RITA tax filers can claim a refund for working at home during

To avoid delinquencies on your account, form 11 should be filed even if no wages were paid for the period. 12 application for license to conduct marriages. If you file your form 11 electronically, you do not need to file a. It is the duty of each employer doing business within any rita municipality who employs one or more persons.

Form 11 Regional Tax Agency Employer'S Municipal Tax

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web 2019 form 11 instructions. Web complete rita form 11 fillable online with us legal forms. Employer’s municipal tax withholding booklet. Easily fill out pdf blank, edit, and sign them.

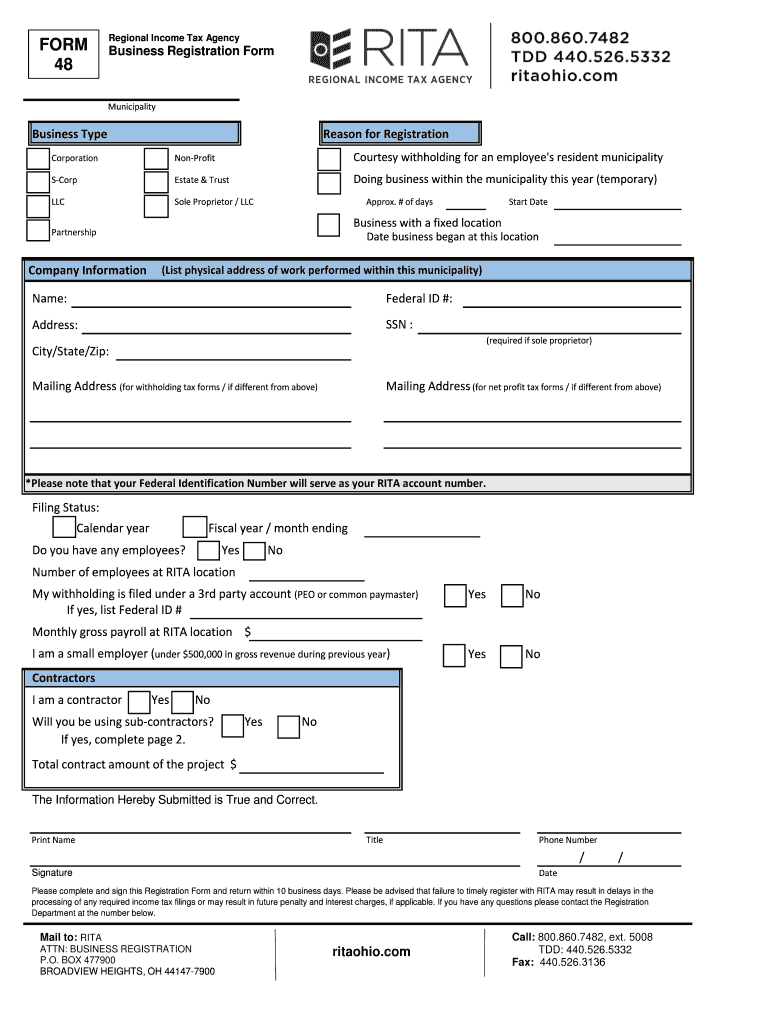

Ohio rita business registration form 48 Fill out & sign online DocHub

_____ contact us to ll free: If you file your form 11 electronically, you do not need to file a. Employer’s municipal tax withholding booklet. Reason for adjusting (must be provided) 7. Click here to download form rgm.

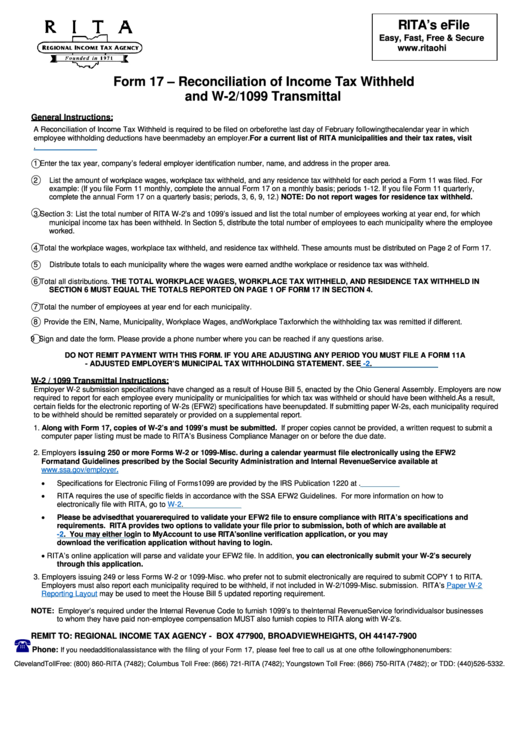

Instructions For Form 17 Reconciliation Of Tax Withheld And W

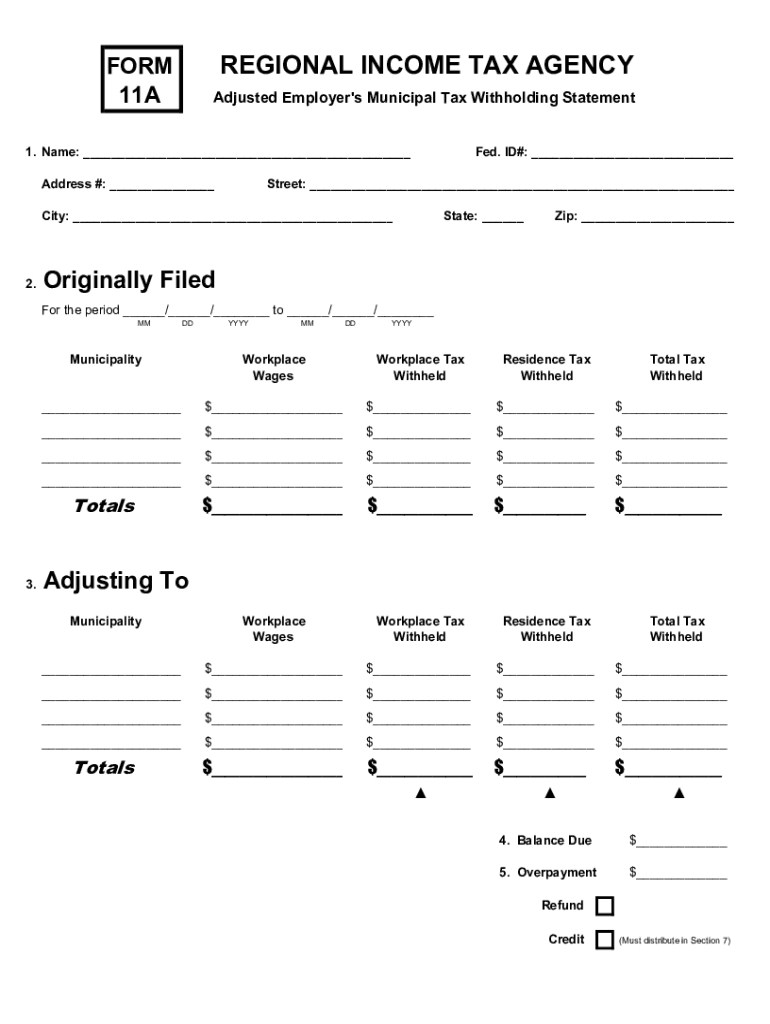

_____ contact us to ll free: Form 11a adjusted employer municipal tax withholding statement. It is the duty of each employer doing business within any rita municipality who employs one or more persons on a salary, wage, commission, or. Easily fill out pdf blank, edit, and sign them. Employee’s new duty station address where employee is being assigned (see dd.

Euclid voters rejected moving tax collection to RITA. 11 months

11 application for certificate of no impediment. $ 11lf05a check here if you have any changes to your distribution and complete section b on this form. Form 11a adjusted employer municipal tax withholding statement. _____ contact us to ll free: To avoid delinquencies on your account, form 11 should be filed even if no wages were paid for the period.

Rita Form 11a Fill Out and Sign Printable PDF Template signNow

Easy access to withholding tax forms and help. Form 11a adjusted employer municipal tax withholding statement. Click here to download form rgm. $ 11lf05a check here if you have any changes to your distribution and complete section b on this form. Employee’s new duty station address where employee is being assigned (see dd form1614 block 8).

2019 Form OH RITA 17 Fill Online, Printable, Fillable, Blank pdfFiller

_____ contact us to ll free: Easily fill out pdf blank, edit, and sign them. Easy access to withholding tax forms and help. To avoid delinquencies on your account, form 11 should be filed even if no wages were paid for the period. Save or instantly send your ready documents.

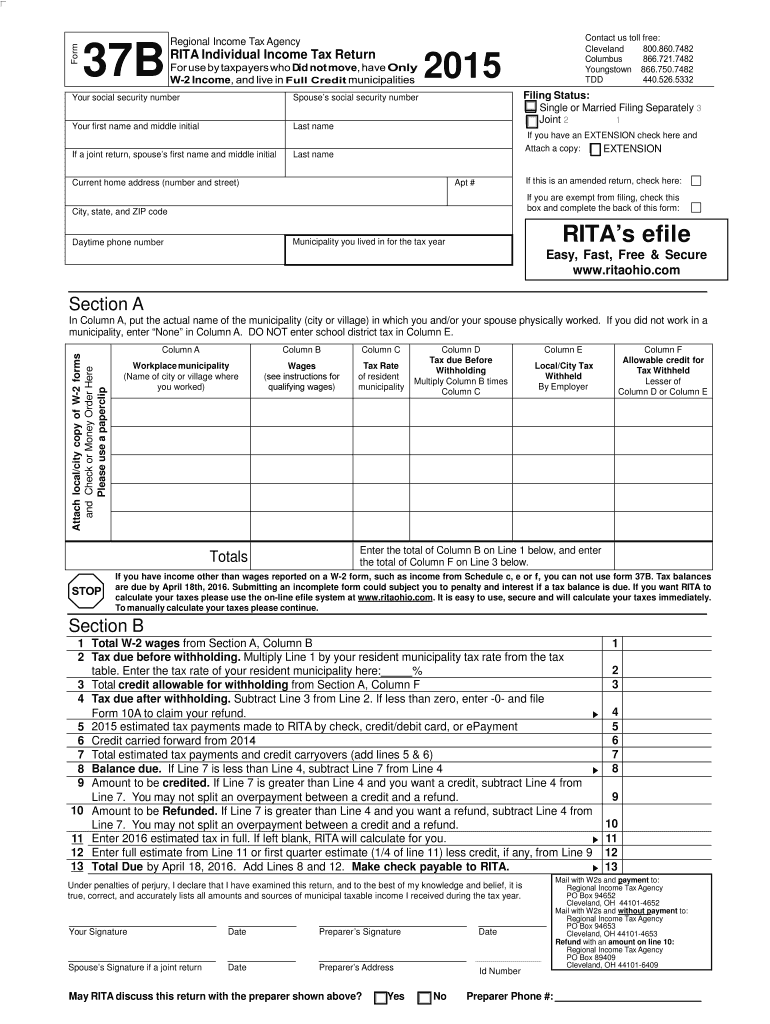

2015 Form OH RITA 37 Fill Online, Printable, Fillable, Blank pdfFiller

To avoid delinquencies on your account, form 11 should be filed even if no wages were paid for the period. Employer’s municipal tax withholding booklet. Reason for adjusting (must be provided) 7. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

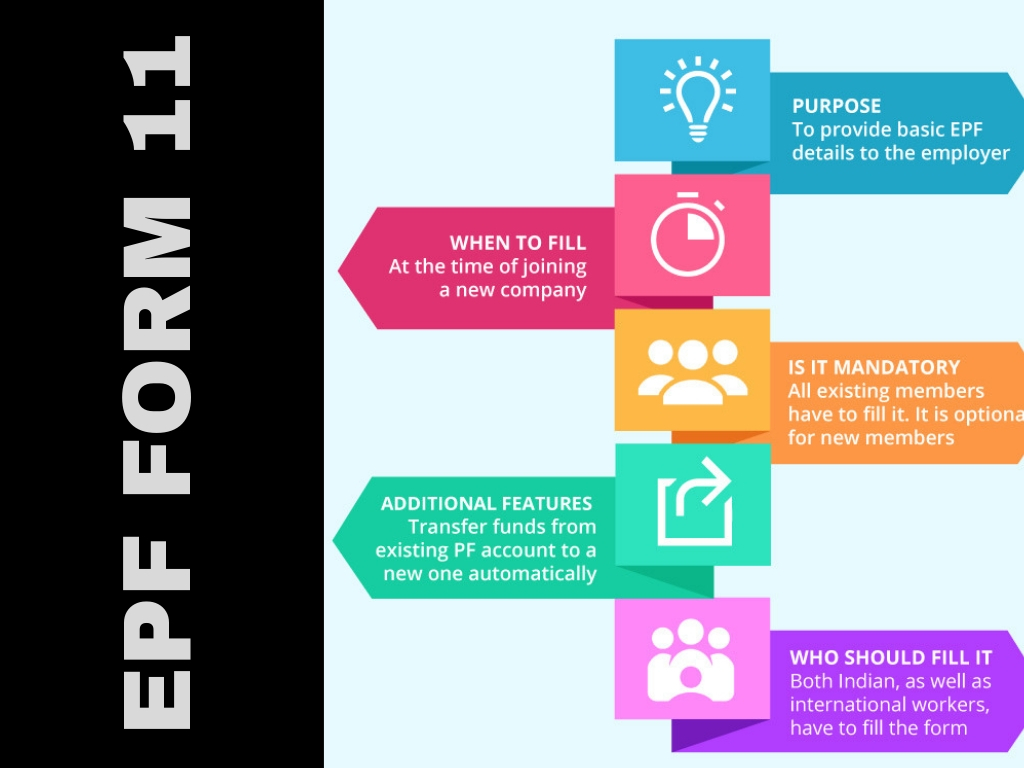

form 11 Why and when we issue form 11 LegalRaasta

Distribution of overpayment (from section 5) municipality amount distribute credit to tax period. Access the rita website at. Form 17 reconciliation of income tax withheld. Save or instantly send your ready documents. Web www.ritaohio.com to efile your form 11 withholding statement free of charge, make payments, download paper forms, and research frequently asked questions.

RITA loses personal info for 50,000 people, offers free credit

12 application for license to conduct marriages. $ 11lf05a check here if you have any changes to your distribution and complete section b on this form. Web form regional income tax agency p.o. Web click here to download form rgm. Web www.ritaohio.com to efile your form 11 withholding statement free of charge, make payments, download paper forms, and research frequently.

$ 11Lf05A Check Here If You Have Any Changes To Your Distribution And Complete Section B On This Form.

_____ contact us to ll free: Form 11a adjusted employer municipal tax withholding statement. Click here to download form rgm. Access the rita website at www.ritaohio.com to efile your form 11 withholding statement free of charge, make payments, download paper forms, and research.

Municipal Tax Withholding Statements (Form 11) And Annual Reconciliation Of Income Tax Withheld (Form 17) Forms Can Be Filed At Myaccount.

Web rita employer’s municipal tax withholding statement fo 11 rm rita’s efile easy, fast, free & secure www.ritaohio.com page 1 check #: To avoid delinquencies on your account, form 11 should be filed even if no wages were paid for the period. Save or instantly send your ready documents. Employer’s municipal tax withholding booklet.

Web Who Is Required To File Form 11?

Web up to $40 cash back fill rita form 11 fillable, edit online. If you file your form 11 electronically, you do not need to file a. Web form regional income tax agency p.o. 11 application for certificate of no impediment.

Easy Access To Withholding Tax Forms And Help.

Reason for adjusting (must be provided) 7. Distribution of overpayment (from section 5) municipality amount distribute credit to tax period. Employee’s new duty station address where employee is being assigned (see dd form1614 block 8). Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.