Form 1120 Pol

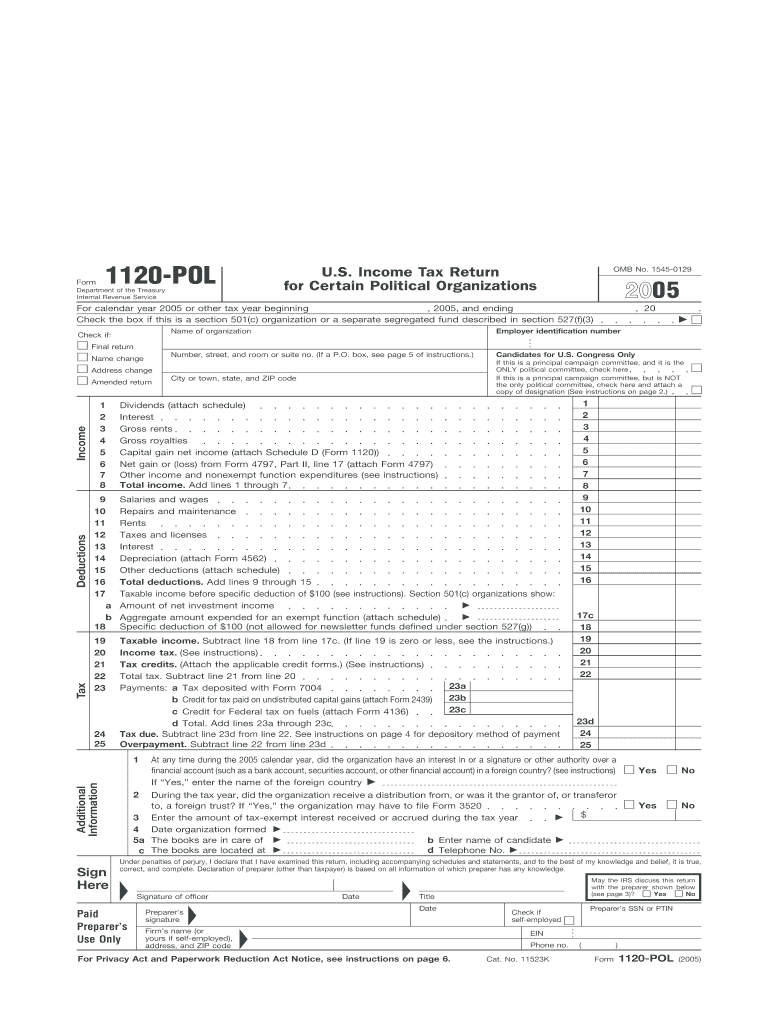

Form 1120 Pol - It applies to organizations that pay the federal income tax, with particular attention to. However, if you continue to make installment payments of tax based on a prior year section 965(a). Web if the organization is the principal campaign committee of a candidate for u.s. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Faqs about the annual form filing requirements; Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Income tax return for certain political organizations pdf. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group.

It applies to organizations that pay the federal income tax, with particular attention to. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Congress, the tax is calculated using the graduated rates specified in §11 (b). Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Faqs about the annual form filing requirements; Income tax return for certain political organizations pdf. Web if the organization is the principal campaign committee of a candidate for u.s. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group.

Web if the organization is the principal campaign committee of a candidate for u.s. However, if you continue to make installment payments of tax based on a prior year section 965(a). Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. It applies to organizations that pay the federal income tax, with particular attention to. Faqs about the annual form filing requirements; Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Congress, the tax is calculated using the graduated rates specified in §11 (b). Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527.

Form 1120POL U.S. Tax Return for Certain Political

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web if the organization is the principal campaign committee of a candidate for u.s. Congress, the tax is.

Form 1120POL U.S. Tax Return for Certain Political

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Income tax.

Form 1120POL U.S. Tax Return for Certain Political

It applies to organizations that pay the federal income tax, with particular attention to. Faqs about the annual form filing requirements; Congress, the tax is calculated using the graduated rates specified in §11 (b). Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Income tax return for.

An overview of Form 1120POL

It applies to organizations that pay the federal income tax, with particular attention to. Faqs about the annual form filing requirements; Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Web if the organization is the principal campaign committee.

File Form 1120POL Online Efile Political Organization Return

Faqs about the annual form filing requirements; It applies to organizations that pay the federal income tax, with particular attention to. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Congress, the tax is calculated using the graduated rates specified in §11 (b). However,.

Editable IRS Form 1120POL 2018 2019 Create A Digital Sample in PDF

Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Faqs about the annual form filing requirements; Attach consolidated balance sheets and a reconciliation of consolidated retained earnings..

Form 1120POL U.S. Tax Return for Certain Political

Faqs about the annual form filing requirements; It applies to organizations that pay the federal income tax, with particular attention to. However, if you continue to make installment payments of tax based on a prior year section 965(a). Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527..

1120POL Instructions 2022 2023 IRS Forms Zrivo

Section 965(a) inclusion amounts from form 965 are not applicable for tax year 2022 and later years. Faqs about the annual form filing requirements; Web if the organization is the principal campaign committee of a candidate for u.s. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527..

Irs Form 1120 Pol Fill Out and Sign Printable PDF Template signNow

Income tax return for certain political organizations pdf. Income tax return for certain political organizations, is due by the 15th day of the 3rd month after the end of the organization’s taxable year. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within.

Form 1120POL U.S. Tax Return for Certain Political

Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Income tax return for certain political organizations pdf. Faqs about the annual form filing requirements; Attach consolidated balance sheets and a reconciliation of consolidated retained earnings. Section 965(a) inclusion amounts from form 965 are not applicable for tax.

Attach Consolidated Balance Sheets And A Reconciliation Of Consolidated Retained Earnings.

Income tax return for certain political organizations pdf. Political organizations and certain exempt organizations file this form to report their political organization taxable income and income tax liability section 527. Faqs about the annual form filing requirements; However, if you continue to make installment payments of tax based on a prior year section 965(a).

Section 965(A) Inclusion Amounts From Form 965 Are Not Applicable For Tax Year 2022 And Later Years.

For the organizations operating under the calendar year, the deadline will be april 15th (unless it falls. It applies to organizations that pay the federal income tax, with particular attention to. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Web if the organization is the principal campaign committee of a candidate for u.s.

Income Tax Return For Certain Political Organizations, Is Due By The 15Th Day Of The 3Rd Month After The End Of The Organization’s Taxable Year.

Congress, the tax is calculated using the graduated rates specified in §11 (b).