Form 14135 Irs

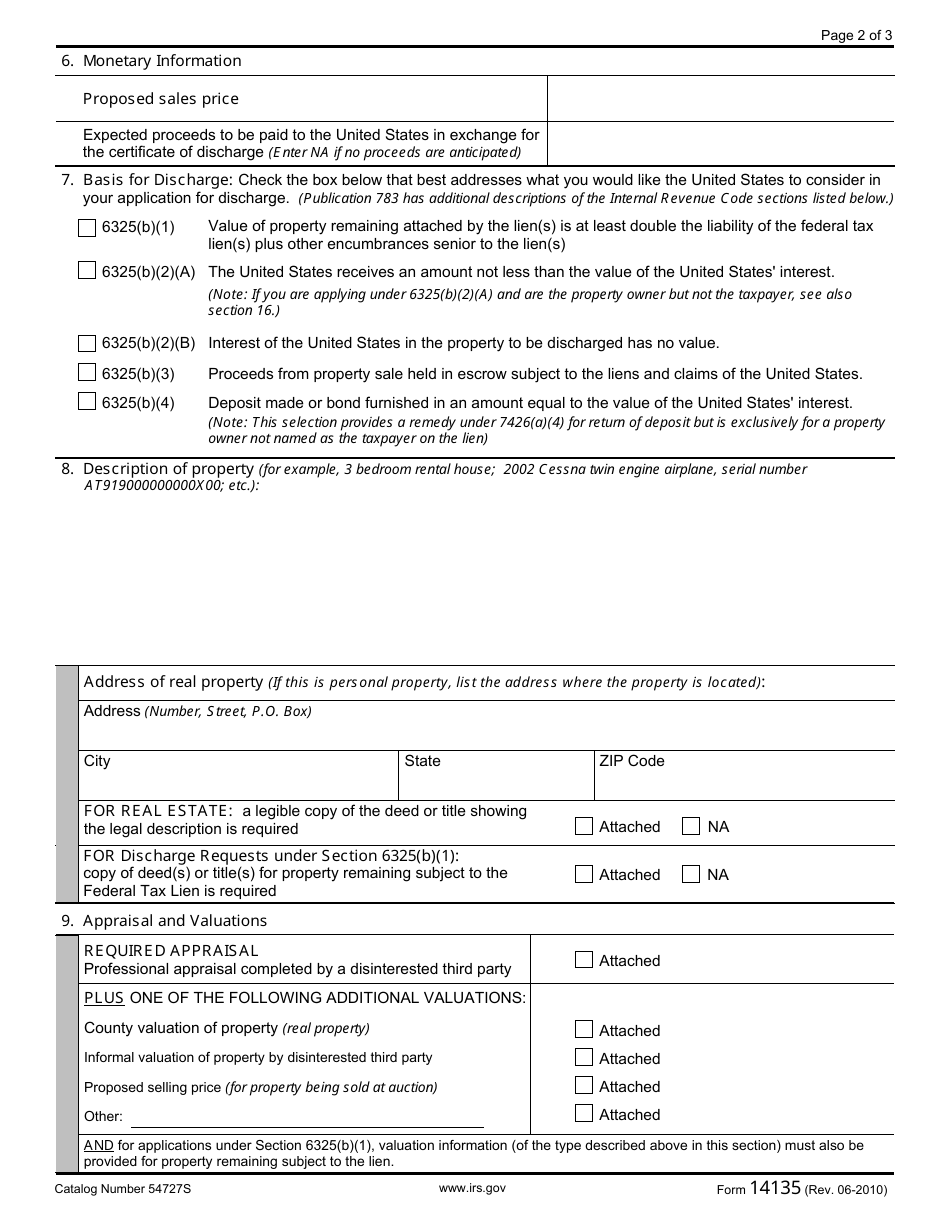

Form 14135 Irs - Check one of the following boxes on form 14135 that best describes your situation: Web for section 9 of form 14135, when you are selling property, the irs requires a professional appraisal, which is generally part of the closing package and a second type of value. What is withdrawal of federal tax lien? Download or email irs 14135 & more fillable forms, register and subscribe now! What is included in a notice of sale? Complete, edit or print tax forms instantly. Web you need to submit form 14135, application for certificate of discharge of property from federal tax lien at least 45 days before the sale or settlement meeting. Web file form 14135 what is subordination of federal tax lien? Web to request irs consider discharge, complete form 14135, application for certificate of discharge of property from federal tax lien. Before sharing sensitive information, make sure you’re on a federal government site.

Web let’s start with discharge. What’s the difference between a tax lien and a tax. Web department of the treasury — internal revenue service application for certificate of subordination of federal tax lien complete the entire application. Subordination means the irs gives another. Subordination means the irs gives another. Web to apply, you should file form 14135 and explain why you want the tax lien discharged. A tax expert online is ready to assist. Web for the sale of real property of a deceased person, if the proceeds will not fully pay the tax liability, you’ll need to apply for a lien discharge with form 14135, application. Federal government websites often end in.gov or.mil. Web filing of irs form 14135, application for discharge of property from federal tax lien.

Web see publication 783, application form 14135, and the video selling or refinancing when there is an irs lien. If you own more property than is being sold and the property not. What is withdrawal of federal tax lien? Web to request irs consider discharge, complete form 14135, application for certificate of discharge of property from federal tax lien. Mail the completed form 14135 and the appropriate. Subordination means the irs gives another. What is included in a notice of sale? Web let’s start with discharge. Web to apply, you should file form 14135 and explain why you want the tax lien discharged. Check one of the following boxes on form 14135 that best describes your situation:

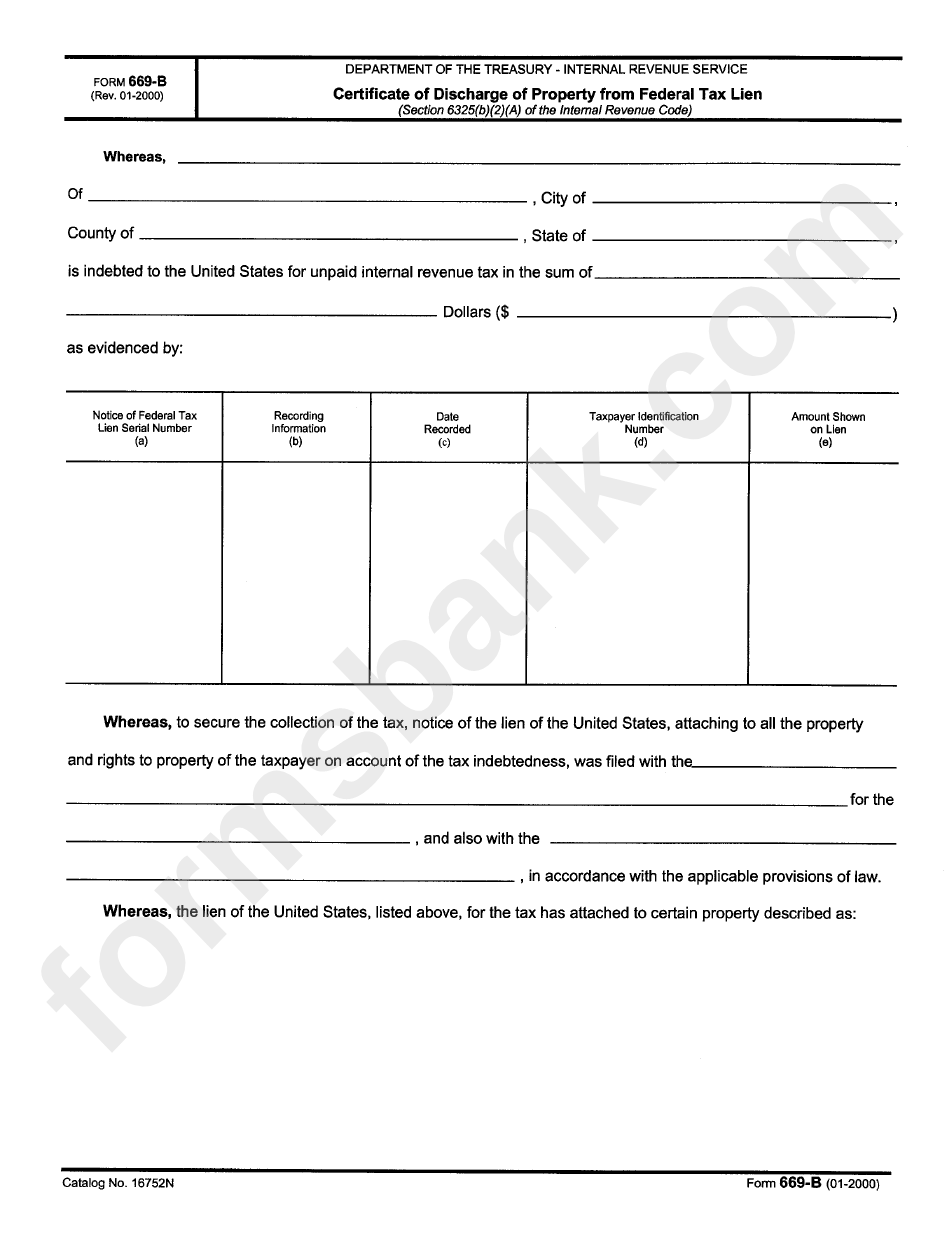

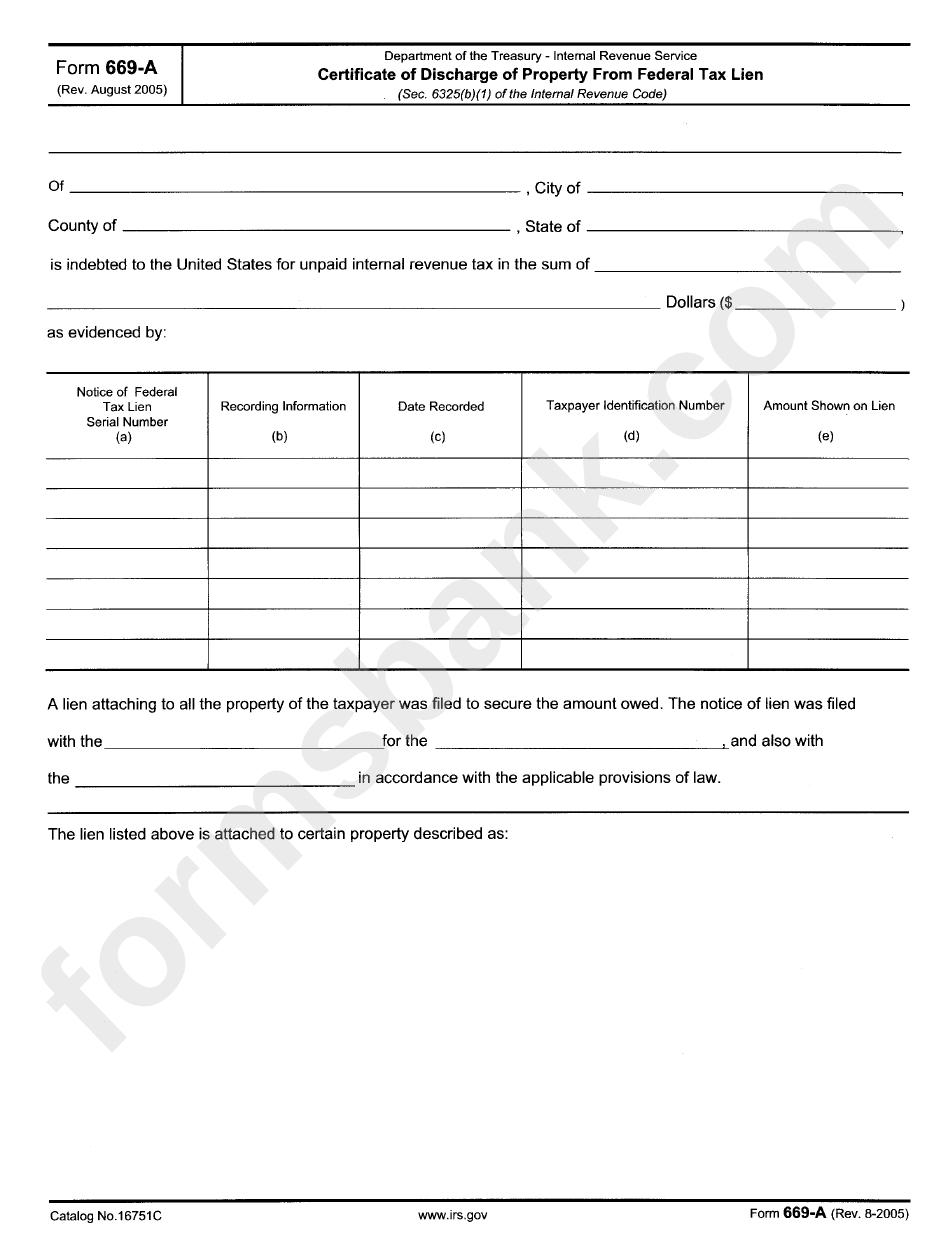

Form 669b Certificate Of Discharge Of Property From Federal Tax Lien

Web file form 14135 what is subordination of federal tax lien? Web discharge means the irs removes the lien from property so that it may transfer to the new owner free of the lien. Before sharing sensitive information, make sure you’re on a federal government site. Check one of the following boxes on form 14135 that best describes your situation:.

IRS Form 14135 Download Fillable PDF or Fill Online Application for

The irs calls your lien removal a “discharge,” the legal terminology under. Web for section 9 of form 14135, when you are selling property, the irs requires a professional appraisal, which is generally part of the closing package and a second type of value. Web filing of irs form 14135, application for discharge of property from federal tax lien. Check.

IRS Form 14135 Discharging Property From a Federal Tax Lien

Web irs form 14135, application for certificate of discharge of property from federal tax lien, is the tax form that a taxpayer might use when requesting that a. If you own more property than is being sold and the property not. Check one of the following boxes on form 14135 that best describes your situation: Federal government websites often end.

Form 14135 Application for Certificate of Discharge of Property from

Web for the sale of real property of a deceased person, if the proceeds will not fully pay the tax liability, you’ll need to apply for a lien discharge with form 14135, application. Subordination means the irs gives another. Web general instructions filling out the sf 135 item 1: Web filing of irs form 14135, application for discharge of property.

Bedienungsanleitung STADLER FORM 14135 Anna Little KeramikHeizlüfter

Subordination means the irs gives another. Web the.gov means it’s official. Web you need to submit form 14135, application for certificate of discharge of property from federal tax lien at least 45 days before the sale or settlement meeting. How to find irs info online for tax questions? Web let’s start with discharge.

14135 Editable Online Blank in PDF

Web for section 9 of form 14135, when you are selling property, the irs requires a professional appraisal, which is generally part of the closing package and a second type of value. Web to request irs consider discharge, complete form 14135, application for certificate of discharge of property from federal tax lien. If you own more property than is being.

Federal Tax Lien February 2017

Before sharing sensitive information, make sure you’re on a federal government site. Web for the sale of real property of a deceased person, if the proceeds will not fully pay the tax liability, you’ll need to apply for a lien discharge with form 14135, application. Web to request irs consider discharge, complete form 14135, application for certificate of discharge of.

1/12 Yamaha XV1600 Road Star Custom

Web file form 14135 what is subordination of federal tax lien? The irs calls your lien removal a “discharge,” the legal terminology under. Web form 14135 (june 2010) application for certificate of discharge of property from federal tax lien 0mb no. Web see publication 783, application form 14135, and the video selling or refinancing when there is an irs lien..

Form 669A Certificate Of Discharge Of Property From Federal Tax Lien

Web form 14135 (june 2010) application for certificate of discharge of property from federal tax lien 0mb no. Web the.gov means it’s official. Enter the name and address of the frc to which you are submitting records. Web you need to submit form 14135, application for certificate of discharge of property from federal tax lien at least 45 days before.

IRS Form 14135 Discharging Property From a Federal Tax Lien

Web see publication 783, application form 14135, and the video selling or refinancing when there is an irs lien. See the frc directors page for. Keep in mind that the irs only discharges liens if you meet strict criteria,. Web for section 9 of form 14135, when you are selling property, the irs requires a professional appraisal, which is generally.

Ad Get Help Accessing Irs Website For Questions.

Before sharing sensitive information, make sure you’re on a federal government site. Web for section 9 of form 14135, when you are selling property, the irs requires a professional appraisal, which is generally part of the closing package and a second type of value. Web general instructions filling out the sf 135 item 1: Federal government websites often end in.gov or.mil.

Web Filing Of Irs Form 14135, Application For Discharge Of Property From Federal Tax Lien.

Web for the sale of real property of a deceased person, if the proceeds will not fully pay the tax liability, you’ll need to apply for a lien discharge with form 14135, application. A notice of sale must contain. Web discharge means the irs removes the lien from property so that it may transfer to the new owner free of the lien. Web department of the treasury — internal revenue service application for certificate of subordination of federal tax lien complete the entire application.

Web To Apply, You Should File Form 14135 And Explain Why You Want The Tax Lien Discharged.

Download or email irs 14135 & more fillable forms, register and subscribe now! Mail the completed form 14135 and the appropriate. Web you need to submit form 14135, application for certificate of discharge of property from federal tax lien at least 45 days before the sale or settlement meeting. See the frc directors page for.

Web Application For Certificate Of Discharge Of Federal Tax Lien:

What is withdrawal of federal tax lien? Keep in mind that the irs only discharges liens if you meet strict criteria,. Web to request irs consider discharge, complete form 14135, application for certificate of discharge of property from federal tax lien. Web see publication 783, application form 14135, and the video selling or refinancing when there is an irs lien.