Form 14157-A

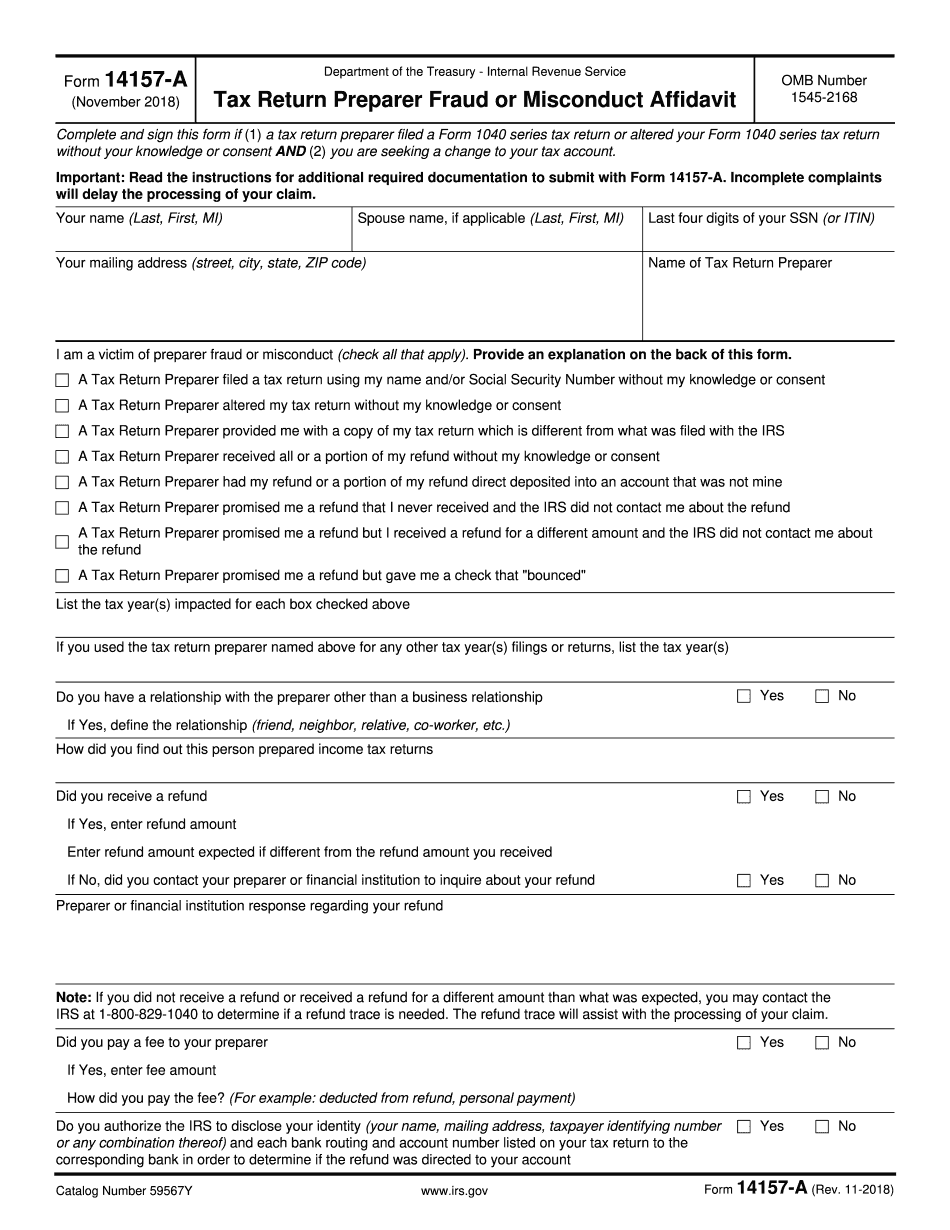

Form 14157-A - A signed copy of the tax return as you intended it to be filed. Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. This tax form allows a taxpayer to complain about a variety of tax preparer acts. Send this form in addition to form 14157. If your filing status is married filing joint, at least one signature is required. Web form 14157, complaint: Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Si su estado civil para efectos de la declaración es casado con presentación conjunta, se requiere al menos una firma.

Send this form in addition to form 14157. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Return preparer’s name and address: Ad download or email irs 14157 & more fillable forms, register and subscribe now! If your filing status is married filing joint, at least one signature is required. A signed copy of the tax return as you intended it to be filed. Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. This tax form allows a taxpayer to complain about a variety of tax preparer acts. Form completed and signed by the taxpayer.

This form will outline the other documents you need to submit to the irs, which include: Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Si su estado civil para efectos de la declaración es casado con presentación conjunta, se requiere al menos una firma. A copy of the tax return provided to you by the return preparer. Form completed and signed by the taxpayer. A signed copy of the tax return as you intended it to be filed. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Mail them with all supporting documentation to the address where you would normally mail your form 1040. Return preparer’s name and address:

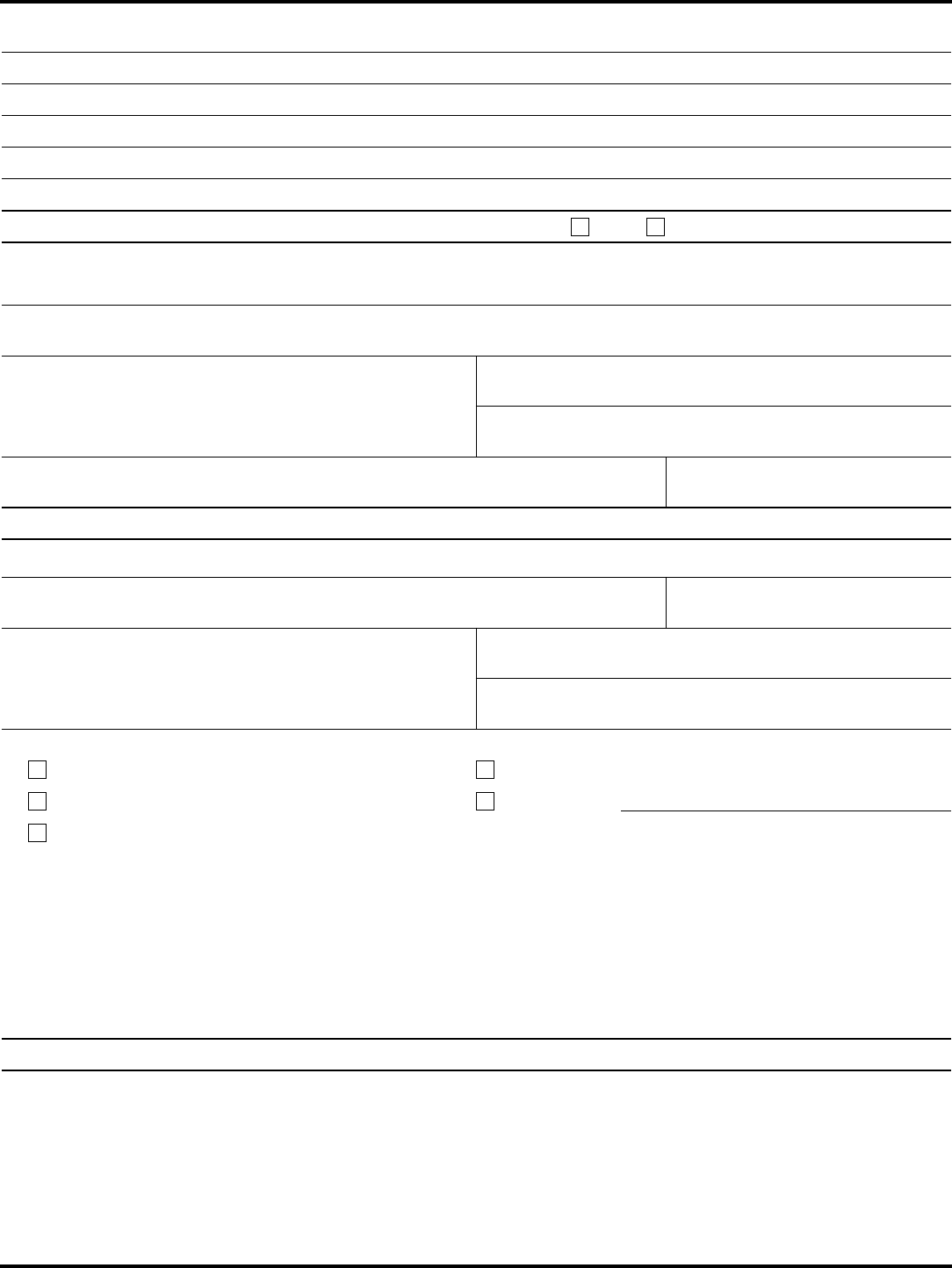

Form 14157 Edit, Fill, Sign Online Handypdf

Send this form in addition to form 14157. Ad download or email irs 14157 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. This tax form allows a taxpayer to complain about a variety of tax preparer acts. Form completed by the taxpayer.

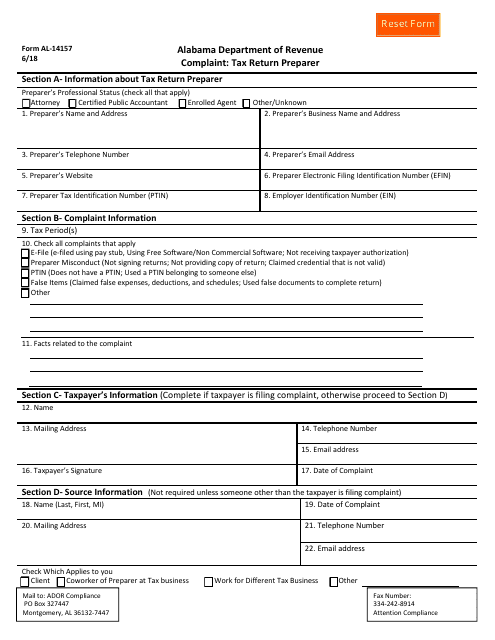

Form AL14157 Download Fillable PDF or Fill Online Tax Return Preparer

Si su estado civil para efectos de la declaración es casado con presentación conjunta, se requiere al menos una firma. A copy of the tax return provided to you by the return preparer. Ad download or email irs 14157 & more fillable forms, register and subscribe now! Read the instructions before completing this form. Get ready for tax season deadlines.

Form 14157 Edit, Fill, Sign Online Handypdf

If your tax return and/or refund have not been impacted. If married filing jointly then at least one taxpayer must sign. Get ready for tax season deadlines by completing any required tax forms today. Read the instructions before completing this form. Mail them with all supporting documentation to the address where you would normally mail your form 1040.

Form 14157A Tax Return Preparer Fraud or Misconduct Affidavit (2012

Get ready for tax season deadlines by completing any required tax forms today. A copy of the tax return provided to you by the return preparer. Ad download or email irs 14157 & more fillable forms, register and subscribe now! If your filing status is married filing joint, at least one signature is required. Web form 14157, complaint:

IRS Form 14157 Reporting Tax Preparer Misconduct

Return preparer’s name and address: Ad access irs tax forms. Form completed by the taxpayer. A copy of the tax return provided to you by the return preparer. Complete, edit or print tax forms instantly.

Form 14157a Tax Return Preparer Fraud or Misconduct Affidavit Stock

Get ready for tax season deadlines by completing any required tax forms today. Return preparer’s name and address: A copy of the tax return provided to you by the return preparer. Get ready for tax season deadlines by completing any required tax forms today. If your tax return and/or refund have not been impacted.

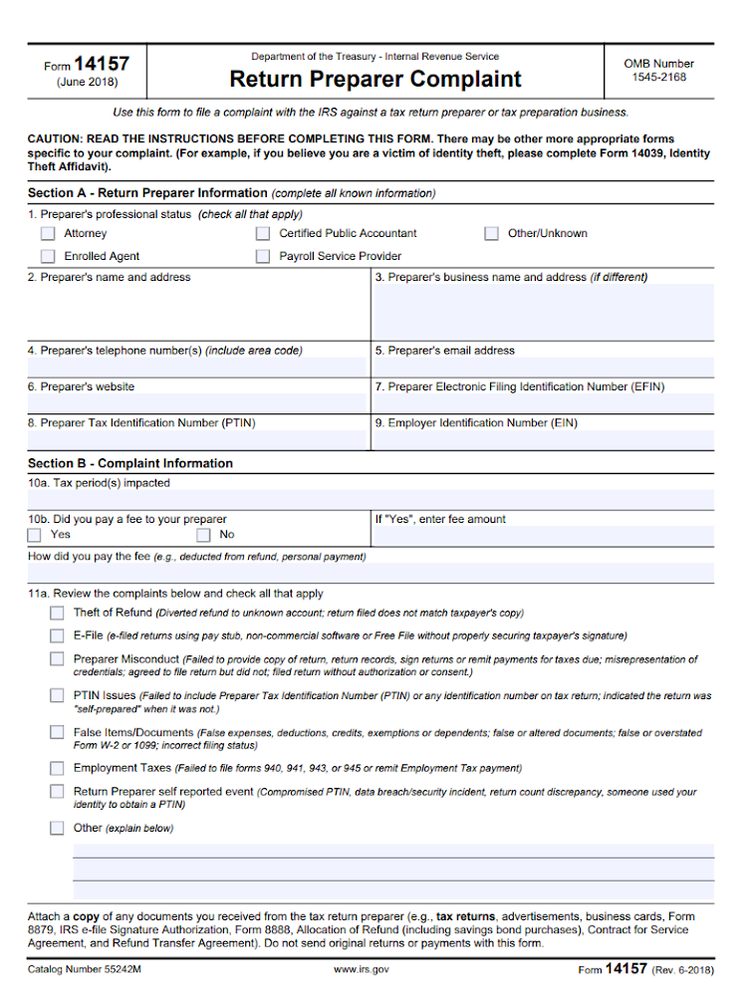

Fillable Form Dor 82620 Government Property Lease Excise Tax (Gplet

Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. If your tax return and/or refund have not been impacted. This form will outline the other documents you need to submit to the irs, which include: If married filing jointly then at least one taxpayer must sign. Web.

14157 A Irs Printable & Fillable Sample in PDF

If married filing jointly then at least one taxpayer must sign. Ad access irs tax forms. Mail them with all supporting documentation to the address where you would normally mail your form 1040. Ad download or email irs 14157 & more fillable forms, register and subscribe now! Form completed by the taxpayer.

Form 14157A Tax Return Preparer Fraud or Misconduct Affidavit (2012

A signed copy of the tax return as you intended it to be filed. This form will outline the other documents you need to submit to the irs, which include: If your filing status is married filing joint, at least one signature is required. Tax return preparer filed a return or altered your return without your consent and you are.

Form 14157a Tax Return Preparer Fraud or Misconduct Affidavit Stock

Get ready for tax season deadlines by completing any required tax forms today. If your tax return and/or refund have not been impacted. Return preparer’s name and address: Mail them with all supporting documentation to the address where you would normally mail your form 1040. If married filing jointly then at least one taxpayer must sign.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad access irs tax forms. If your tax return and/or refund have not been impacted. Form completed by the taxpayer. A copy of the tax return provided to you by the return preparer.

Read The Instructions Before Completing This Form.

Return preparer’s name and address: Form completed and signed by the taxpayer. This tax form allows a taxpayer to complain about a variety of tax preparer acts. This form will outline the other documents you need to submit to the irs, which include:

Si Su Estado Civil Para Efectos De La Declaración Es Casado Con Presentación Conjunta, Se Requiere Al Menos Una Firma.

Ad download or email irs 14157 & more fillable forms, register and subscribe now! Tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Mail them with all supporting documentation to the address where you would normally mail your form 1040. Send this form in addition to form 14157.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

A signed copy of the tax return as you intended it to be filed. Complete, edit or print tax forms instantly. If married filing jointly then at least one taxpayer must sign. If your filing status is married filing joint, at least one signature is required.