Form 14900 Worksheet

Form 14900 Worksheet - Part i contains general information on home mortgage interest, including points. If you require additional forms or information concerning the completion of this form, contact: Use the balances off the monthly servicer statements. Web full audit representation by a licensed tax professional, including representation in front of the irs. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web 2017 mortgage interst deduction worksheet. Treasury international capital (tic) forms and instructions. Web use the monthly balance for the 12 months to strike a 12 point average. Department of labor, division of research and. Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936 pdf irs mortgage interest deduction irs form 14900.

Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web 2017 mortgage interst deduction worksheet. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Example your clients want to buy a house with a mortgage of. Web up to $40 cash back 2. Web additional forms and information: Web dd form 2900, oct 2015. Page 1 of 10 pages. See the instructions for line 16 for details.

Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web 2017 mortgage interst deduction worksheet. Web so if you had a $500k mortgage at the beginning of 2020 and refinanced it twice, the worksheet calculates your average balance as $1.5m which of course. Savings bonds and treasury securities forms. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web full audit representation by a licensed tax professional, including representation in front of the irs. Treasury international capital (tic) forms and instructions. Web dd form 2900, oct 2015. Receipt for relief at source, or up to.

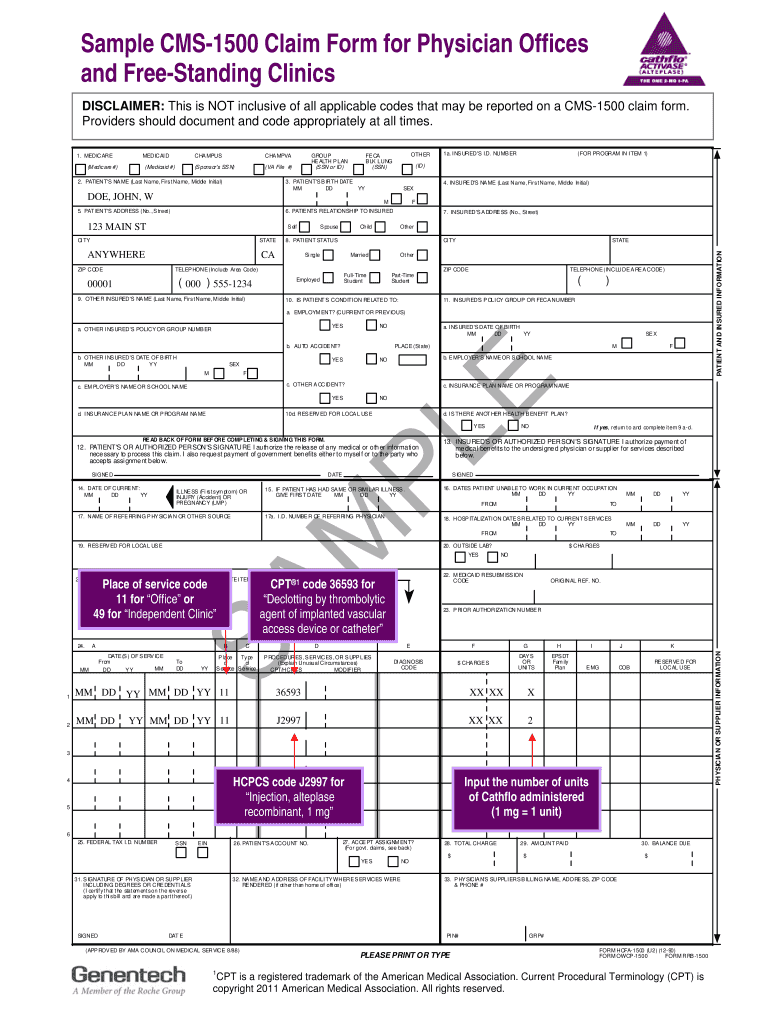

Cms 1500 Claim Form Worksheet Fill Online, Printable, Fillable, Blank

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Use the balances off the monthly servicer statements. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web about publication 936,.

[Solved] Norah, the sole shareholder of Mad Dog Food Truck, runs a food

Page 1 of 10 pages. Web 2017 mortgage interst deduction worksheet. Savings bonds and treasury securities forms. Web dd form 2790 checklist page 1 customer echecklist this form is used to identify the custodian of an unmarried minor child, incapacitated minor child, or child at least age 18. Web use the monthly balance for the 12 months to strike a.

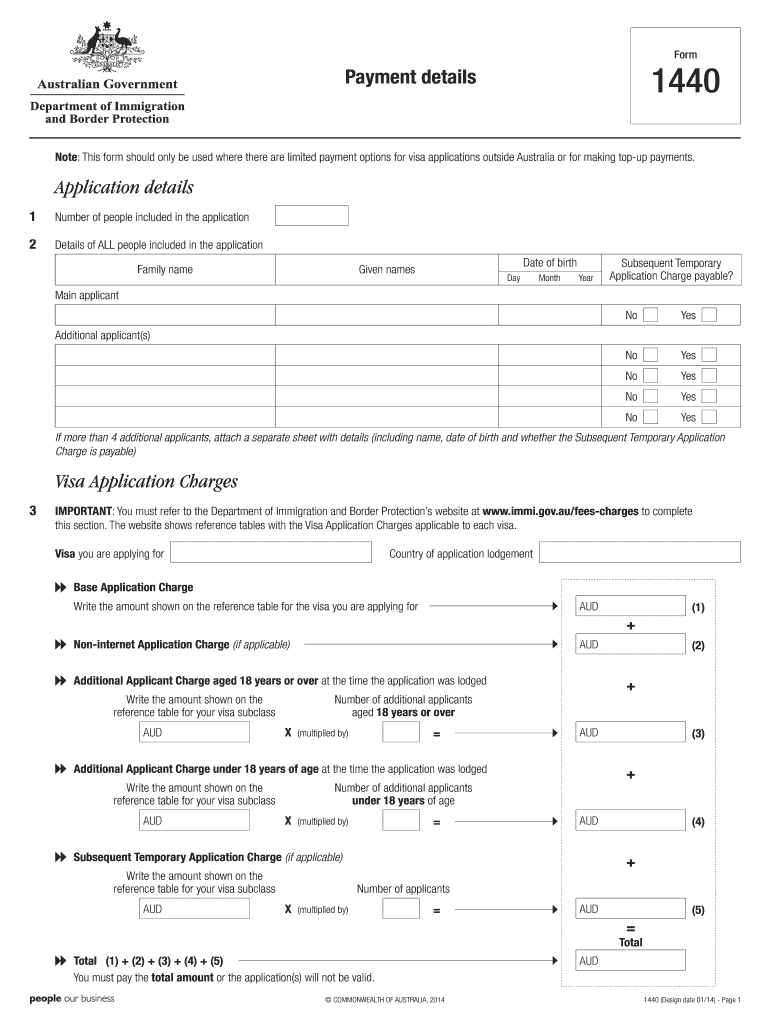

Australia form 1440 Fill out & sign online DocHub

Web dd form 2900, oct 2015. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web full audit representation by a licensed tax professional, including representation in front of the irs. Web about publication 936, home mortgage interest deduction. Publication 936 discusses the.

40+ Mortgage calculator for 10 year mortgage CassiusAdela

Receipt for relief at source, or up to. Web about publication 936, home mortgage interest deduction. Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936 pdf irs mortgage interest deduction irs form 14900. January would just use the old. Select add new from your dashboard and import a file into the system.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Web 2017 mortgage interst deduction worksheet. Web up to $40 cash back 2. Example your clients want to buy a house with a mortgage of. Web additional forms and information: Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home.

What Is Irs Cancellation Of Debt

Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Page 1 of 10 pages. If you require additional forms or information concerning the completion of this form, contact: Web this publication discusses the rules for deducting home mortgage interest. Example your clients want to.

Sample Forms Paying for College Without Going Broke Princeton

Web dd form 2790 checklist page 1 customer echecklist this form is used to identify the custodian of an unmarried minor child, incapacitated minor child, or child at least age 18. If you require additional forms or information concerning the completion of this form, contact: Web full audit representation by a licensed tax professional, including representation in front of the.

el presente progresivo worksheet

Web this publication discusses the rules for deducting home mortgage interest. Treasury international capital (tic) forms and instructions. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Page 1 of 10 pages. Use the balances off the monthly servicer statements.

Printable Schedule C Form 1 Seven Printable Schedule C Form 1 Rituals

It also explains how to. Web 2017 mortgage interst deduction worksheet. Web additional forms and information: Page 1 of 10 pages. Department of labor, division of research and.

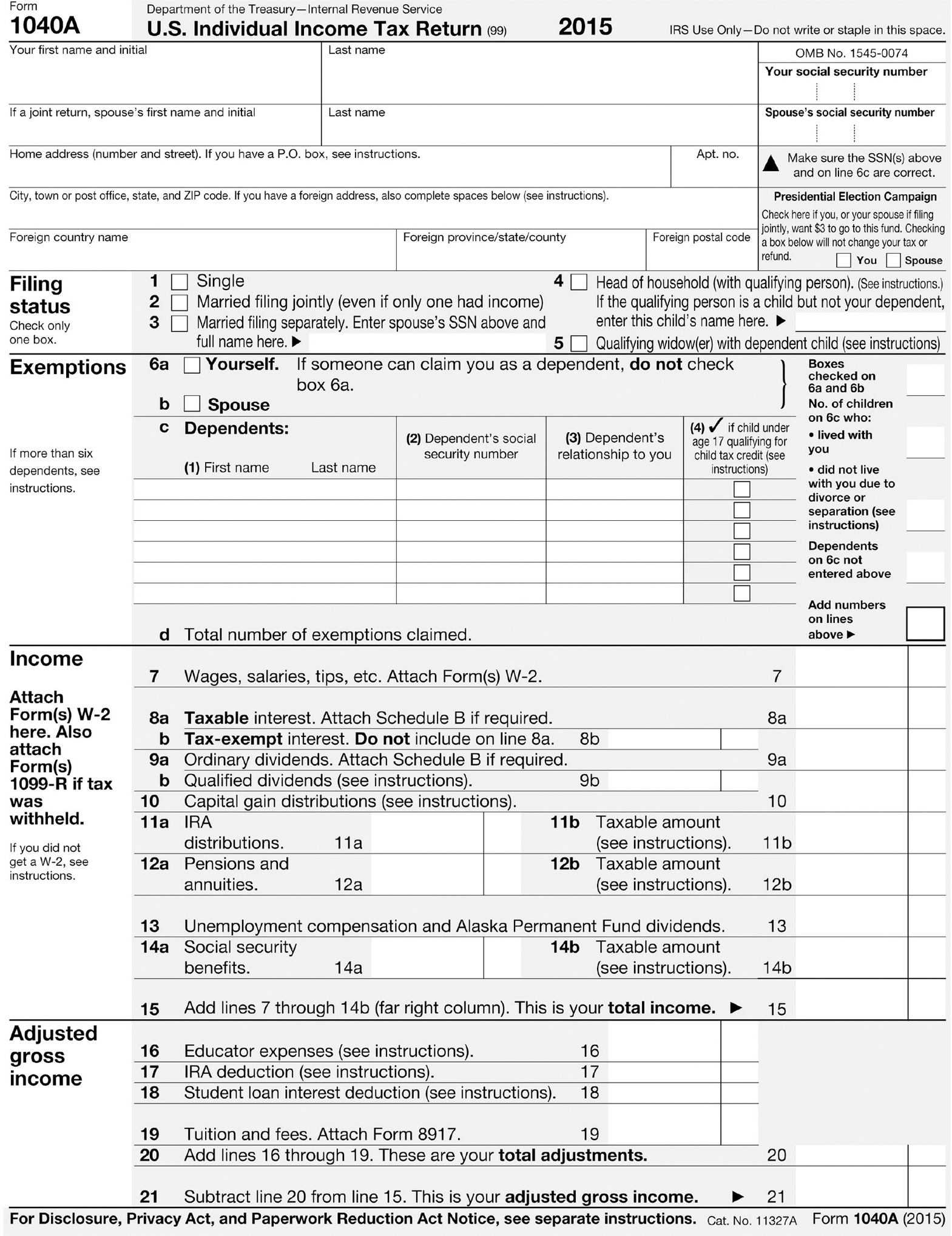

Fill Free fillable IRS PDF forms

Department of labor, division of research and. Web use the monthly balance for the 12 months to strike a 12 point average. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by.

Web Full Audit Representation By A Licensed Tax Professional, Including Representation In Front Of The Irs.

Web 2017 mortgage interst deduction worksheet. Publication 936 discusses the rules for deducting home mortgage interest. Web additional forms and information: Example your clients want to buy a house with a mortgage of.

Irs Publication 936 2020 Irs Publication 936 For 2021 Mortgage Interest Deduction Limit 2020 Irs Pub 936 Pdf Irs Mortgage Interest.

Web 2017 mortgage interst deduction worksheet. Web so if you had a $500k mortgage at the beginning of 2020 and refinanced it twice, the worksheet calculates your average balance as $1.5m which of course. Web up to $40 cash back 2. Department of labor, division of research and.

Web Use The Monthly Balance For The 12 Months To Strike A 12 Point Average.

Page 1 of 10 pages. It also explains how to. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Web dd form 2900, oct 2015.

Irs Publication 936 For 2021 Irs Publication 936 2020 Irs Pub 936 For 2019 Irs Pub 936 Pdf Irs Mortgage Interest Deduction Irs Form 14900.

See the instructions for line 16 for details. Web dd form 2790 checklist page 1 customer echecklist this form is used to identify the custodian of an unmarried minor child, incapacitated minor child, or child at least age 18. Web generally, home interest is deductible on a form 1040 schedule a attachment if it's interest paid on debt secured by your main or second home. Web you file form 1040 and itemize deductions on schedule a (form 1040).