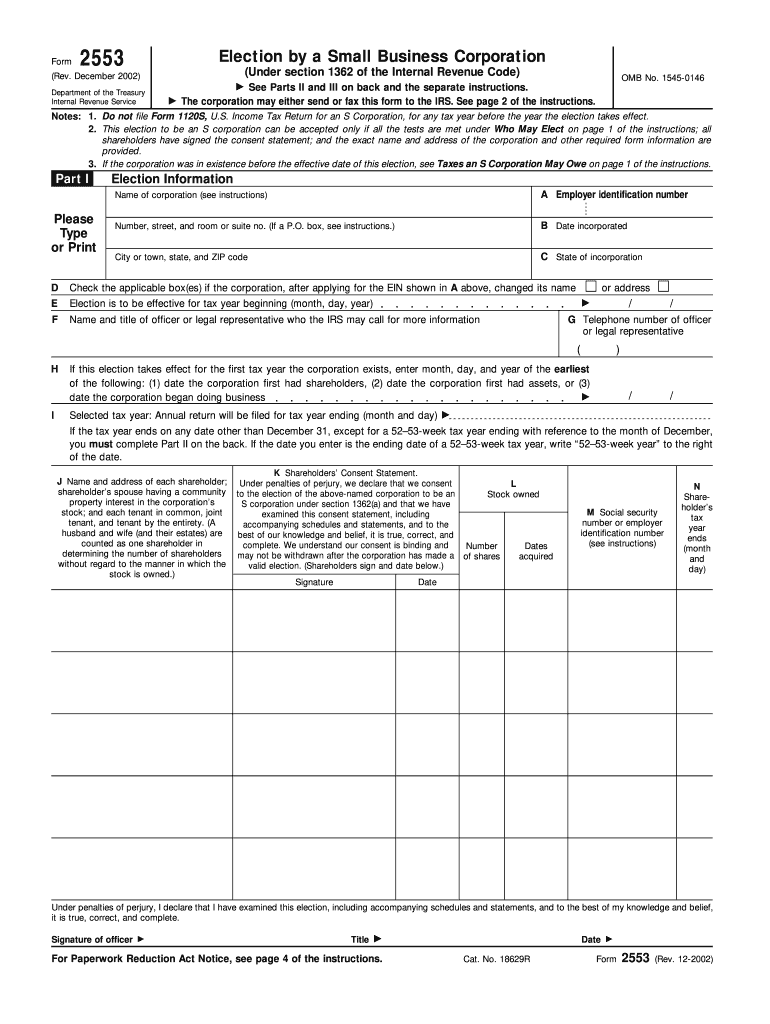

Form 2553 Fill In

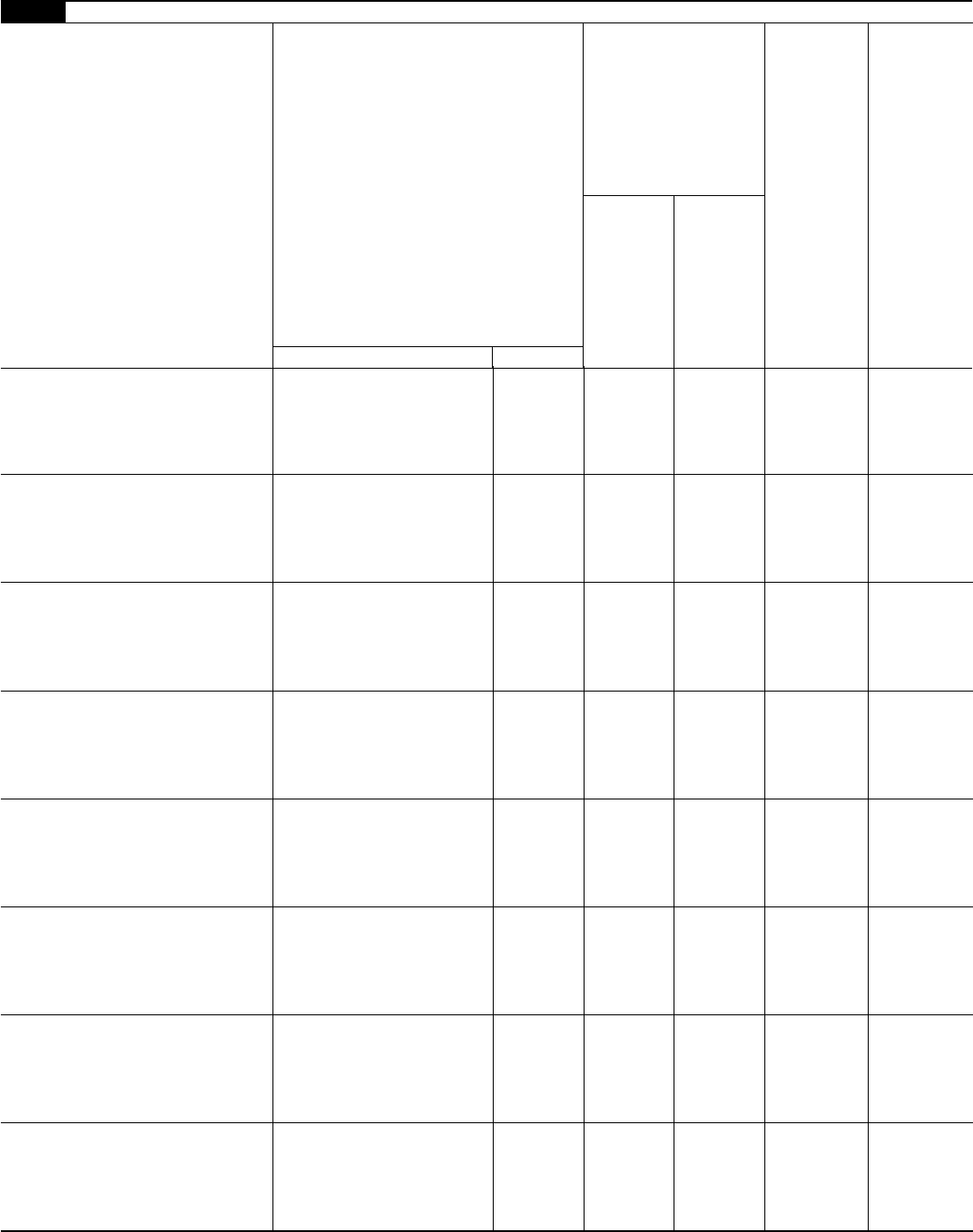

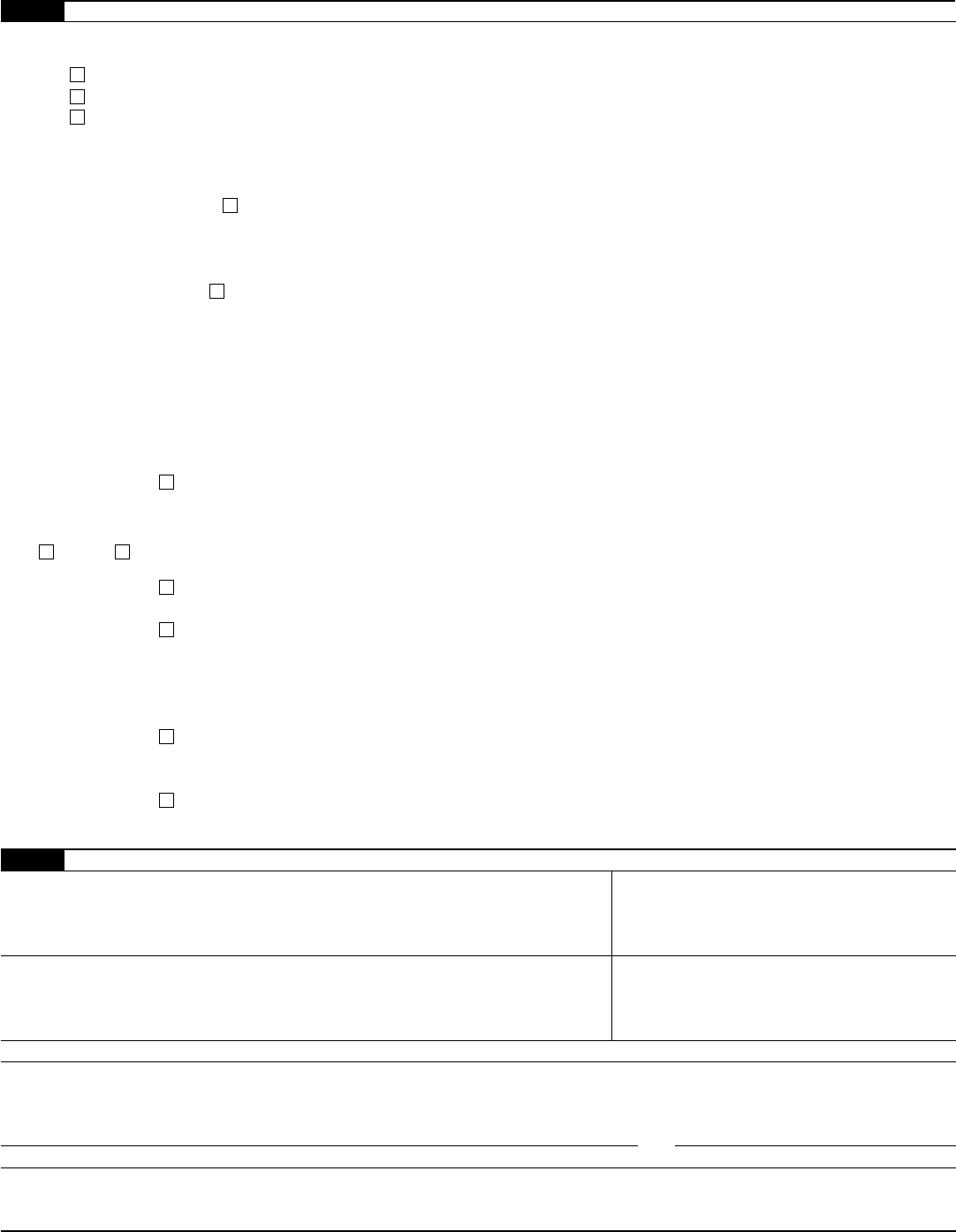

Form 2553 Fill In - Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. We know the irs from the inside out. December 2017) department of the treasury internal revenue service. Web where to file irs form 2553? It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. If the corporation's principal business, office, or agency is located in. Election by a small business corporation (under section 1362 of the internal revenue. If your tax year starts on january 1, you have until march 15 to. Web find mailing addresses by state and date for filing form 2553.

Ad access irs tax forms. Web find mailing addresses by state and date for filing form 2553. A corporation or other entity. Web instructions for form 2553 department of the treasury internal revenue service (rev. Complete, edit or print tax forms instantly. Web where to get form 2553 an interactive form 2553 is available on the irs website. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web how to file the irs form 2553. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. December 2017) department of the treasury internal revenue service.

Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Complete irs tax forms online or print government tax documents. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Web form 2553 is an irs form. You can complete it online and download a finished copy to print out. December 2017) department of the treasury internal revenue service. (see, irc section 1362(a)) toggle navigation. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Election by a small business corporation (under section 1362 of the internal revenue. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation.

Form 2553 (Rev December 2007) Edit, Fill, Sign Online Handypdf

Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web.

Irs form 2553 fill in 2002 Fill out & sign online DocHub

Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Web instructions for form 2553 department of the treasury internal revenue service (rev. Currently, an online filing option does not exist for this form. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Currently, an online filing option does not exist for this form. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 2553 department of the treasury internal revenue service (rev. Election by.

Form 2553 Instructions How and Where To File

A corporation or other entity. If your tax year starts on january 1, you have until march 15 to. Complete irs tax forms online or print government tax documents. Top 13mm (1⁄2), center sides.prints: December 2020) (for use with the december 2017 revision of form 2553, election by a.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Businesses can file form 2553 either by fax or by mail. If the corporation's principal business, office, or agency is located in. Ad access irs tax forms. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Under election information, fill in the corporation's name and address, along with your ein number and date.

Form 2553 Edit, Fill, Sign Online Handypdf

December 2020) (for use with the december 2017 revision of form 2553, election by a. Complete, edit or print tax forms instantly. Top 13mm (1⁄2), center sides.prints: Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as.

Ssurvivor Form 2553 Irs Phone Number

Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. Ad access irs tax forms. Complete, edit or print tax forms instantly. If your tax year starts on january 1, you have until march 15 to..

Form 2553 Edit, Fill, Sign Online Handypdf

Specifications to be removed before printing instructions to printers form 2553, page 1 of 4 margins: Ad access irs tax forms. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web form 2553 must be filed either during the tax year that precedes the tax year for which.

IRS Form 2553 No Error Anymore If Following the Instructions

Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. If your tax year starts on january 1, you have until march 15 to. Complete, edit or print tax forms instantly. Election by a small business corporation.

Ssurvivor Form 2553 Irs Fax Number

Web the best way for businesses to be taxed varies widely. Complete irs tax forms online or print government tax documents. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. December 2020) (for use with the december 2017 revision of form 2553, election by a. Web find mailing.

A Corporation Or Other Entity.

Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web the best way for businesses to be taxed varies widely. Complete, edit or print tax forms instantly.

Web Form 2553 Is Used By Qualifying Small Business Corporations And Limited Liability Companies To Make The Election Prescribed By Sec.

Complete, edit or print tax forms instantly. Web instructions for form 2553 department of the treasury internal revenue service (rev. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15.

Businesses Can File Form 2553 Either By Fax Or By Mail.

Web form 2553 must be filed before the 16th day of the third month of your corporation’s tax year. (see, irc section 1362(a)) toggle navigation. December 2017) department of the treasury internal revenue service. Currently, an online filing option does not exist for this form.

Web Where To File Irs Form 2553?

Web how to file the irs form 2553. The irs web site provides a list that details the appropriate address or fax. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Complete irs tax forms online or print government tax documents.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)