Form 26As Vs Form 16

Form 26As Vs Form 16 - Introduction form 26as is a consolidated tax statement issued to the pan holders. Such errors should be corrected by income tax. It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Even provisional form 16 from traces website shows salary from sep 2020 only. Web form 26as is showing the salary amount from sep 2020 onwards. Web know about form 26as and form 16the due date for filing your income tax return is approaching, and you wonder how you can simplify your tax filing process? This is where form 26as comes into the picture. Web if you find a mismatch of tds in form 26as and form 16/16a, you may first want to find out why the mistake happened. Web salary in form 16 is annual salary, 26as shows salary on which tds paid * tax deducted from salary has been filled in tds 1 but my gross salary is more than. As we have seen above, form 16 and form 16a are used by the employer for tds deduction.

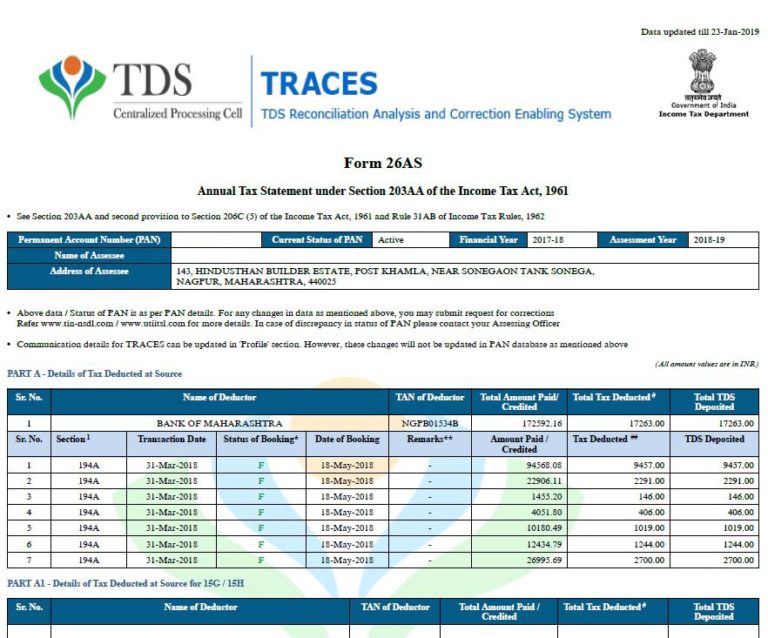

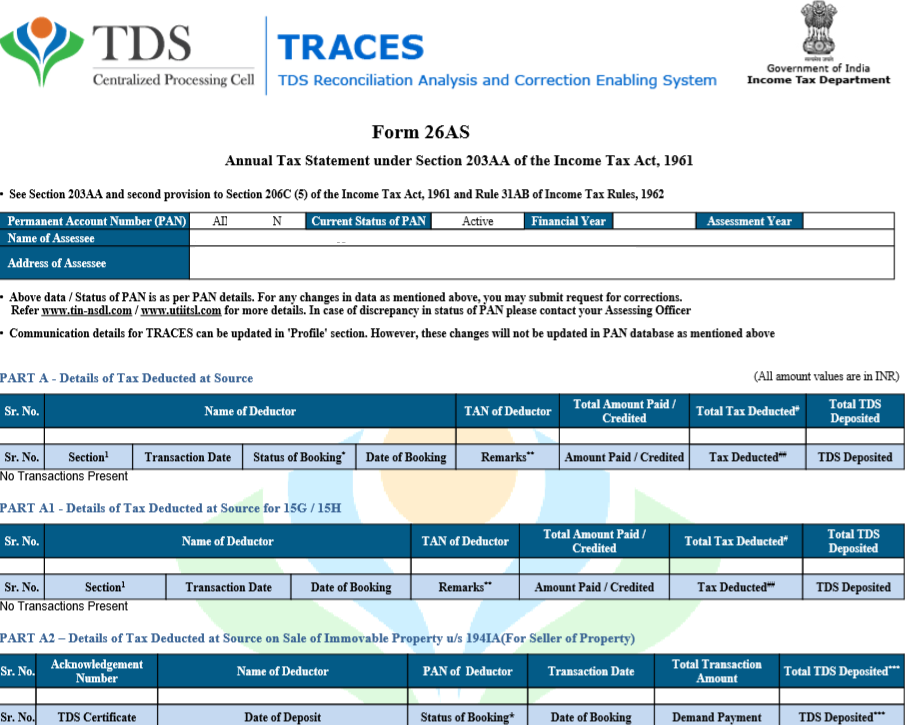

Web around the middle of june employee gets form 16 from their companies to file a tax return and comparing form 26as with form 16 is the first step in submitting an itr. Both the forms are explained with the help of real example for the clarit. Web what you should see in form 26as prior to filing tax return? Web difference between form 16 and form 26as is due to errors in system of reporting and compiling tds details. As we have seen above, form 16 and form 16a are used by the employer for tds deduction. Introduction form 26as is a consolidated tax statement issued to the pan holders. One of the key bits of information available from form 16 part a is a detailed record of the tds deposits. If there are discrepancies in the figures quoted in the two documents, they need to be rectified. Towards the pan the form 26 as is a yearly consolidated credit statement. It is also known as tax credit statement or annual tax statement.

It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Web know about form 26as and form 16the due date for filing your income tax return is approaching, and you wonder how you can simplify your tax filing process? Web form 26as is showing the salary amount from sep 2020 onwards. Web around the middle of june employee gets form 16 from their companies to file a tax return and comparing form 26as with form 16 is the first step in submitting an itr. Can be verified online in the traces to check if the deductions by the employer or tax deductor are reflected in form. If there are discrepancies in the figures quoted in the two documents, they need to be rectified. Form 26as is a consolidated tax. Introduction form 26as is a consolidated tax statement issued to the pan holders. Even provisional form 16 from traces website shows salary from sep 2020 only. It is also known as tax credit statement or annual tax statement.

Importance of Form 16 and Form 26AS While Filing a Return ITR Filing

Introduction form 26as is a consolidated tax statement issued to the pan holders. Web what you should see in form 26as prior to filing tax return? Web around the middle of june employee gets form 16 from their companies to file a tax return and comparing form 26as with form 16 is the first step in submitting an itr. Web.

No Form 16, TDS certificates? You can file ITR using Form 26AS, AIS

Web if you find a mismatch of tds in form 26as and form 16/16a, you may first want to find out why the mistake happened. It is also known as tax credit statement or annual tax statement. Both the forms are explained with the help of real example for the clarit. Towards the pan the form 26 as is a.

Form 26ASDetails about the Form,Features and Procedure to Download

Towards the pan the form 26 as is a yearly consolidated credit statement. Both the forms are explained with the help of real example for the clarit. Web form 26as reflects all details mentioned in form 16; This will help you make the right steps. Web what you should see in form 26as prior to filing tax return?

Form 26AS Tax Credit Statement Help Center Quicko

Web in this video we have explained everything about form 26 as and form 16 / form 16a. Web the first step in filing itr is to reconcile form 26as with form 16. Towards the pan the form 26 as is a yearly consolidated credit statement. Web around the middle of june employee gets form 16 from their companies to.

Perfect Form 26as Sbi Is Trial Balance Same As Sheet Making A

Web what you should see in form 26as prior to filing tax return? Form 26as is a consolidated tax. Introduction form 26as is a consolidated tax statement issued to the pan holders. It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Can be verified online in.

Annual Information Statement vs Form 26AS Now get more information at

Web form 26as reflects all details mentioned in form 16; Web salary in form 16 is annual salary, 26as shows salary on which tds paid * tax deducted from salary has been filled in tds 1 but my gross salary is more than. Can be verified online in the traces to check if the deductions by the employer or tax.

Revised Form 26AS (Annual Information Statement) Yadnya Investment

Towards the pan the form 26 as is a yearly consolidated credit statement. One of the key bits of information available from form 16 part a is a detailed record of the tds deposits. Web around the middle of june employee gets form 16 from their companies to file a tax return and comparing form 26as with form 16 is.

You Must Verify Form 26AS Before Filing IT Return Sanjay Matai, The

Web what you should see in form 26as prior to filing tax return? Web form 26as is showing the salary amount from sep 2020 onwards. Even provisional form 16 from traces website shows salary from sep 2020 only. Web salary in form 16 is annual salary, 26as shows salary on which tds paid * tax deducted from salary has been.

Amount Disclosed In Chargeable Under The Head Salaries Is Less

Towards the pan the form 26 as is a yearly consolidated credit statement. Form 26as vs form 16. Such errors should be corrected by income tax. Web recommended read all about income tax form 16 all about tds form 16a form 26as is basically a form which indicates that the tax that has been deducted has also been. Web around.

Nsdl Form 26as Financial Statement Alayneabrahams

It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Both the forms are explained with the help of real example for the clarit. This will help you make the right steps. It is also known as tax credit statement or annual tax statement. Form 26as is.

Web Form 26As Is An Annual Consolidated Tax Statement Recording All Transactions Where Various Taxes On Your Income Have Been Deducted At Source Like Tax Deducted On.

Even provisional form 16 from traces website shows salary from sep 2020 only. It is also known as tax credit statement or annual tax statement. Web what you should see in form 26as prior to filing tax return? Web difference between form 16 and form 26as is due to errors in system of reporting and compiling tds details.

Introduction Form 26As Is A Consolidated Tax Statement Issued To The Pan Holders.

Web if you find a mismatch of tds in form 26as and form 16/16a, you may first want to find out why the mistake happened. Web know about form 26as and form 16the due date for filing your income tax return is approaching, and you wonder how you can simplify your tax filing process? Web form 26as is showing the salary amount from sep 2020 onwards. This is where form 26as comes into the picture.

Form 26As Vs Form 16.

If there are discrepancies in the figures quoted in the two documents, they need to be rectified. Web form 26as reflects all details mentioned in form 16; Form 26as is a consolidated tax. As we have seen above, form 16 and form 16a are used by the employer for tds deduction.

Web The First Step In The Income Tax Return Filing Process Is To Gather All The Required Documents.

One of the key bits of information available from form 16 part a is a detailed record of the tds deposits. Towards the pan the form 26 as is a yearly consolidated credit statement. Web recommended read all about income tax form 16 all about tds form 16a form 26as is basically a form which indicates that the tax that has been deducted has also been. Both the forms are explained with the help of real example for the clarit.