Form 3115 Depreciation

Form 3115 Depreciation - This guidance is welcome for taxpayers that wish to. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Web change available for limited period: In either case, the taxpayer may be required to. The form is required for both changing. Unclaimed depreciation of $11,773 on. Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate copy was filed. The irs on june 17, 2021. Applying a cost segregation study on a tax return 17 comments in this article we will discuss how to apply a cost segregation study on a tax. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods.

Residential rental property purchased in 2010. In either case, the taxpayer may be required to. Web kbkg tax insight: Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Form 3115 for the new automatic change may only be filed on or after may 11, 2021, for a tax year of a cfc ending before jan. Web change available for limited period: Web up to 10% cash back taking action: Form 3115 and amended return options. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115.

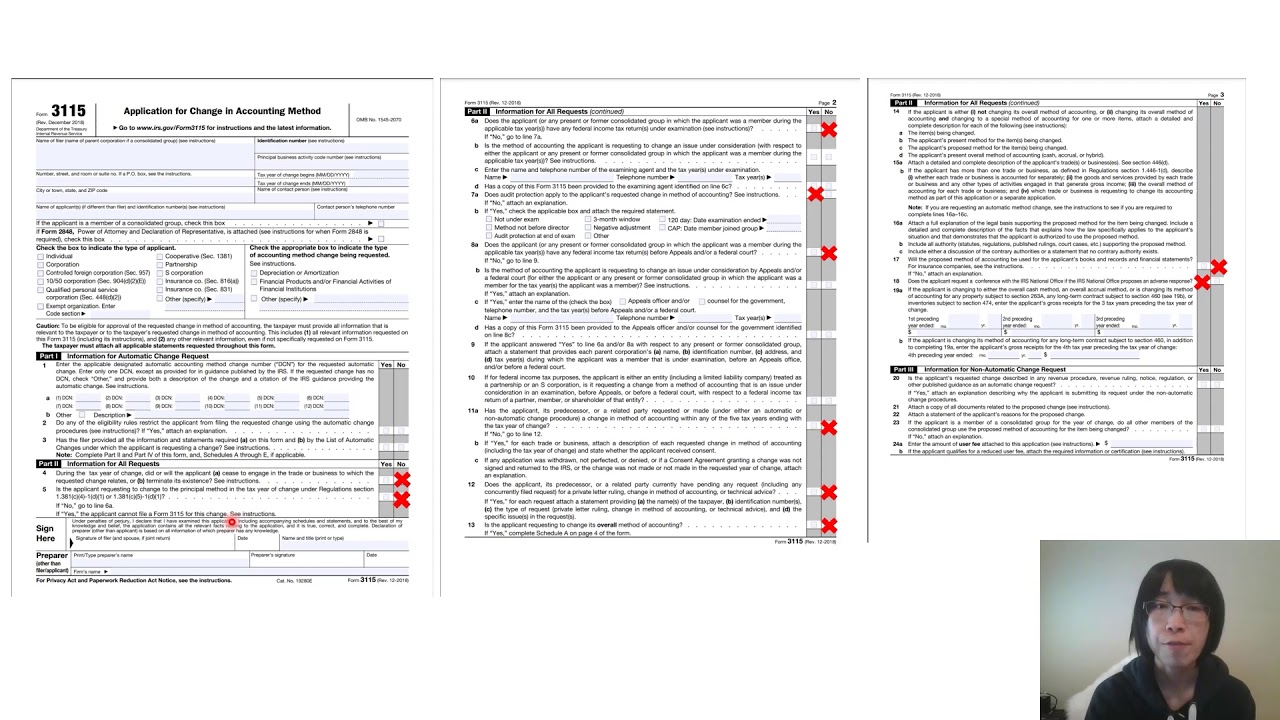

Line 12 (a) item being changed: Web have you ever had a client who was not depreciating their rental property? Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual. Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Web up to 10% cash back taking action: The form 3115 is the way you must make. Form 3115 and amended return options. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Unclaimed depreciation of $11,773 on. Web part ii of form 3115.

Tax Accounting Methods

Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Form 3115 may be used for changing to ads depreciation for.

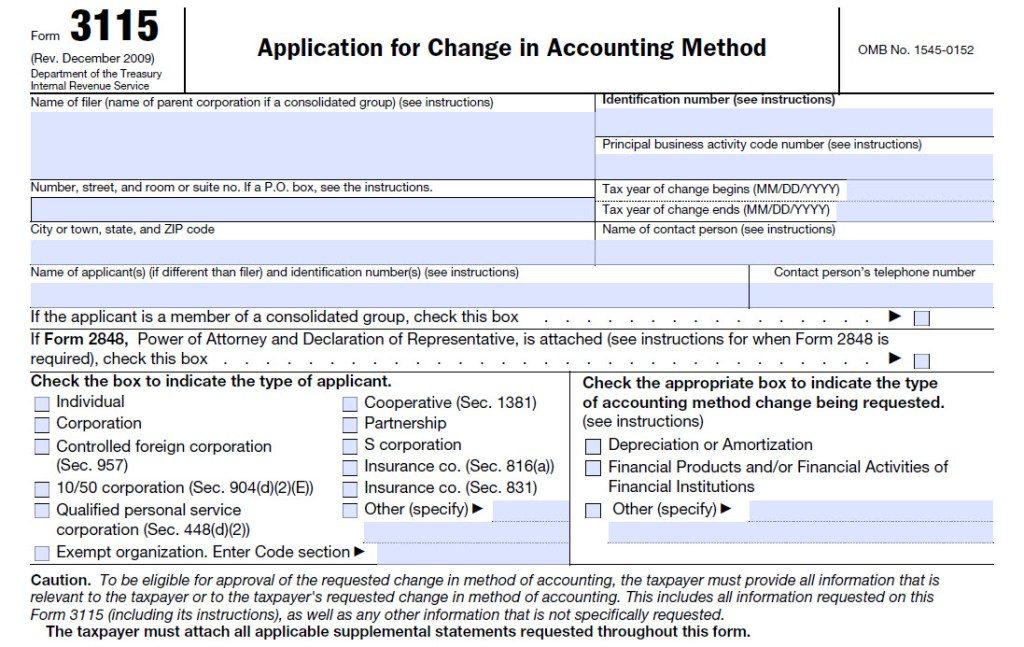

Form 3115 Definition, Who Must File, & More

Residential rental property purchased in 2010. Unclaimed depreciation of $11,773 on. The form 3115 is the way you must make. Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate copy was filed. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no.

Form 3115 Edit, Fill, Sign Online Handypdf

Web have you ever had a client who was not depreciating their rental property? Web we would like to show you a description here but the site won’t allow us. Or one who was depreciating the land as well as the building? Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Form 3115 and amended return options. The form 3115 is the way you must make. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Residential rental property purchased in 2010. Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate.

How to catch up missed depreciation on rental property (part I) filing

Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. The irs on june 17, 2021. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Line 12 (a) item being.

Form 3115 Missed Depreciation printable pdf download

Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web change available for limited period: Form 3115 may be used for changing to ads depreciation for residential rental property. Web form 3115, otherwise known as the application for change in accounting method, allows business owners.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Web kbkg tax insight: Web have you ever had a client who was not depreciating their rental property? Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate copy was filed..

Form 3115 App for change in acctg method Capstan Tax Strategies

The form 3115 is the way you must make. This guidance is welcome for taxpayers that wish to. Residential rental property purchased in 2010. The form is required for both changing. Web up to 10% cash back taking action:

Correcting Depreciation Form 3115 LinebyLine

Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Form 3115 and amended return options. Line 12 (a) item being changed: Web we would like to show you a description here but the site won’t allow us. The irs on june 17, 2021.

Form 3115 Depreciation Guru

Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual. Web kbkg tax insight: The irs on june 17, 2021. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the.

This Guidance Is Welcome For Taxpayers That Wish To.

Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web up to 10% cash back taking action: The form is required for both changing.

Applying A Cost Segregation Study On A Tax Return 17 Comments In This Article We Will Discuss How To Apply A Cost Segregation Study On A Tax.

Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual. Web have you ever had a client who was not depreciating their rental property? Residential rental property purchased in 2010. Web part ii of form 3115.

Web Form 3115, Otherwise Known As The Application For Change In Accounting Method, Allows Business Owners To Switch Accounting Methods.

Form 3115 and amended return options. Web kbkg tax insight: Unclaimed depreciation of $11,773 on. Form 3115 for the new automatic change may only be filed on or after may 11, 2021, for a tax year of a cfc ending before jan.

In Either Case, The Taxpayer May Be Required To.

Web with respect to qip placed in service by the taxpayer after december 31, 2017, the revenue procedure allows taxpayers to correct their depreciation expense by either amending. Or one who was depreciating the land as well as the building? Web we would like to show you a description here but the site won’t allow us. The irs on june 17, 2021.