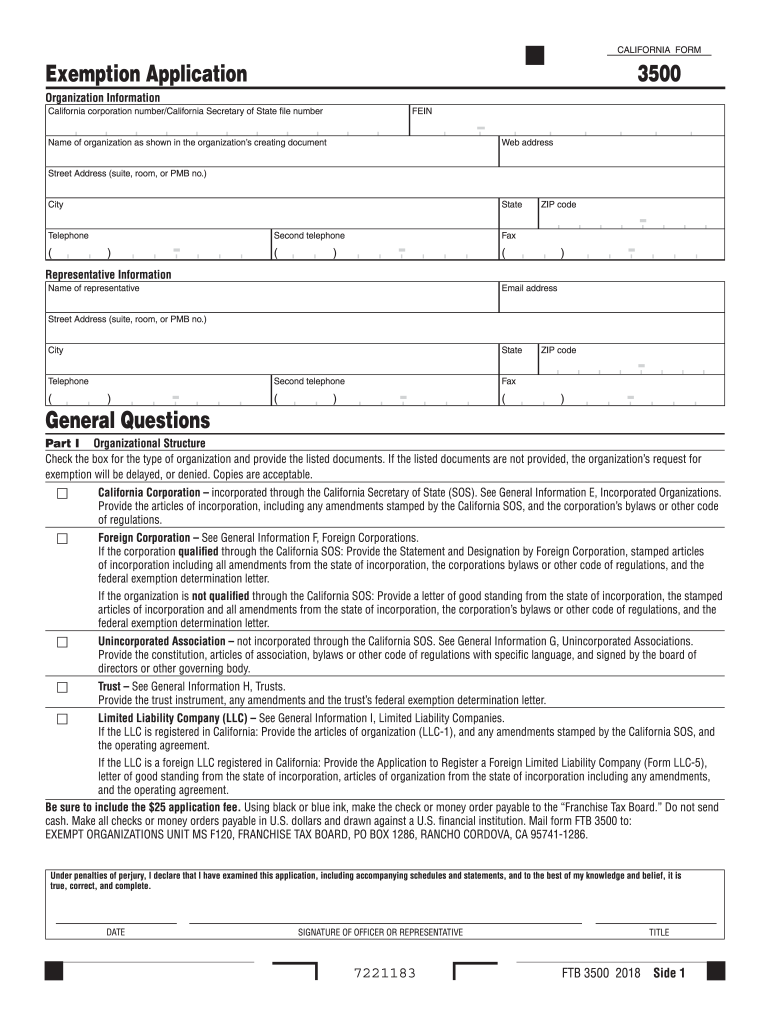

Form 3500 California

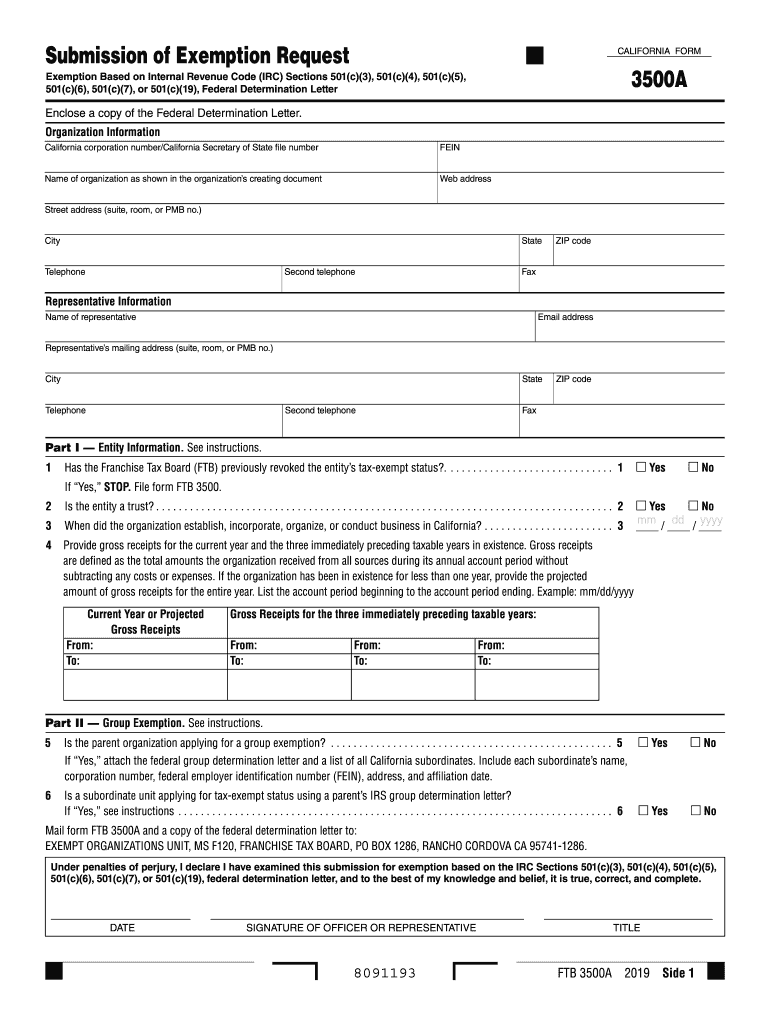

Form 3500 California - Web form 3500 is a california corporate income tax form. Web ftb 3500a 2022 side 1 part iii purpose and activity exemption based on irc section 501(c)(3) federal determination letter 2 enter the california revenue. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others. Web mail form ftb 3500a and a copy of the federal determination letter to: For more information, get form ftb 3500a. Web we last updated california form 3500 in february 2023 from the california franchise tax board. Web mail form ftb 3500 to: Complete, edit or print tax forms instantly. Do you have to pay the $800 california c corp fee the first year?

Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: For more information, get form ftb 3500a. Web we last updated california form 3500 in february 2023 from the california franchise tax board. California law generally imposes a minimum. However, with our predesigned web templates, everything gets. This form is for income earned in tax year 2022, with tax returns due in april. Web mail form ftb 3500 to: Date signature of officer or representative title yes no. Web if “no,” the organization may qualify to file form ftb 3500a, submission of exemption request. Ad download or email ftb 3500 & more fillable forms, register and subscribe now!

Web if “no,” the organization may qualify to file form ftb 3500a, submission of exemption request. Side 2 form 3500 c1 (rev. 2 enter the california revenue. Web form 3500 is a california corporate income tax form. Web california tax exemption request and application process included in this package is a completed sample california submission of exemption request (ftb. Related searches form 3500 a form 3500 vs 3500a. This form is for income earned in tax year 2022, with tax returns due in april. However, with our predesigned web templates, everything gets. Web this form requires general information of the organization and representative along with the reason for exemption. Complete, edit or print tax forms instantly.

Treasury FS 3500 20202021 Fill and Sign Printable Template Online

Web mail form ftb 3500 to: 2 enter the california revenue. 2 if yes complete the information below and provide a copy. Under penalties of perjury, i declare that i have. For more information, get form ftb 3500a.

2018 Form CA FTB 3500 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april. Date signature of officer or representative title yes no. Web follow the simple instructions below: Complete, edit or print tax forms instantly. Related searches form 3500 a form 3500 vs 3500a.

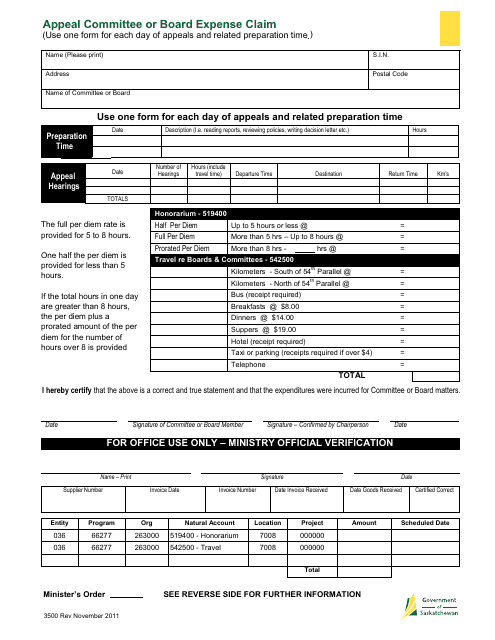

Form 3500 Download Fillable PDF or Fill Online Appeal Committee or

Exempt organizations unit, ms f120, franchise tax board, po box 1286,. Date signature of officer or representative title yes no. Web mail form ftb 3500 to: However, with our predesigned web templates, everything gets. Do you have to pay the $800 california c corp fee the first year?

Navy 3500 Training Muster Pdf Fill Online, Printable, Fillable, Blank

Web if “no,” the organization may qualify to file form ftb 3500a, submission of exemption request. This form is for income earned in tax year 2022, with tax returns due in april. However, with our predesigned web templates, everything gets. Web mail form ftb 3500a and a copy of the federal determination letter to: Do you have to pay the.

Gmc 3500 cars for sale in Santa Ana, California

Web california form 3500 a, submission of exemption request. Web form 3500 is a california corporate income tax form. Related searches form 3500 a form 3500 vs 3500a. Web mail form ftb 3500 to: However, with our predesigned web templates, everything gets.

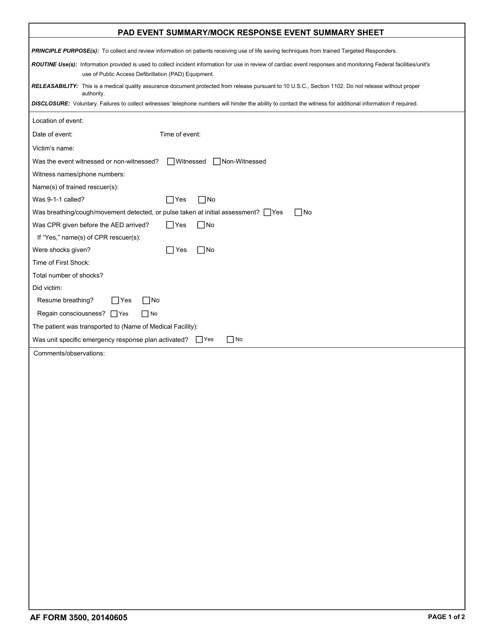

AF Form 3500 Download Fillable PDF or Fill Online Pad Event Summary

Web california form 3500 a, submission of exemption request. Web form 3500 is a california corporate income tax form. Date signature of officer or representative title yes no. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Side 2 form 3500 c1 (rev.

CA FTB 3500 20202022 Form Printable Blank PDF Online

Side 2 form 3500 c1 (rev. Exempt organizations unit, ms f120, franchise tax board, po box 1286,. Web california tax exemption request and application process included in this package is a completed sample california submission of exemption request (ftb. 2 enter the california revenue. We last updated the submission of exemption request and.

2019 Form CA FTB 3500A Fill Online, Printable, Fillable, Blank pdfFiller

Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: Web california form 3500 attach check money order here. Web california tax exemption request and application process included in this package is a completed sample california submission of exemption request (ftb. This form is for income earned in tax year 2022, with tax returns due in april. Web even.

2013 Form Treasury FS 3500 Fill Online, Printable, Fillable, Blank

Web we last updated california form 3500 in february 2023 from the california franchise tax board. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others. This form is for income earned in tax year 2022, with tax returns due in april. Effective 01/01/2021, senate bill 934 eliminates filing fees for.

FDA 3500A 2009 Fill and Sign Printable Template Online US Legal Forms

Web ftb 3500a 2022 side 1 part iii purpose and activity exemption based on irc section 501(c)(3) federal determination letter Web mail form ftb 3500 to: Web if “no,” the organization may qualify to file form ftb 3500a, submission of exemption request. Web form 3500 is a california corporate income tax form. However, with our predesigned web templates, everything gets.

Web Mail Form Ftb 3500 To:

Web california tax exemption request and application process included in this package is a completed sample california submission of exemption request (ftb. Effective 01/01/2021, senate bill 934 eliminates filing fees for nonprofit organizations: 2 if yes complete the information below and provide a copy. Exempt organizations unit, ms f120, franchise tax board, po box 1286,.

For More Information, Get Form Ftb 3500A.

Download your adjusted document, export it to the cloud, print it from the editor, or share it with others. Web this form requires general information of the organization and representative along with the reason for exemption. Web follow the simple instructions below: 2 enter the california revenue.

Date Signature Of Officer Or Representative Title Yes No.

Related searches form 3500 a form 3500 vs 3500a. Under penalties of perjury, i declare that i have. Web california form 3500 attach check money order here. Web get california form 3500, exemption application booklet, this booklet contains guidelines for organizing documents, sample articles, and organizational requirements.

Web Form 3500 Is A California Corporate Income Tax Form.

Web california form 3500 a, submission of exemption request. Do you have to pay the $800 california c corp fee the first year? We last updated the submission of exemption request and. This form is for income earned in tax year 2022, with tax returns due in april.