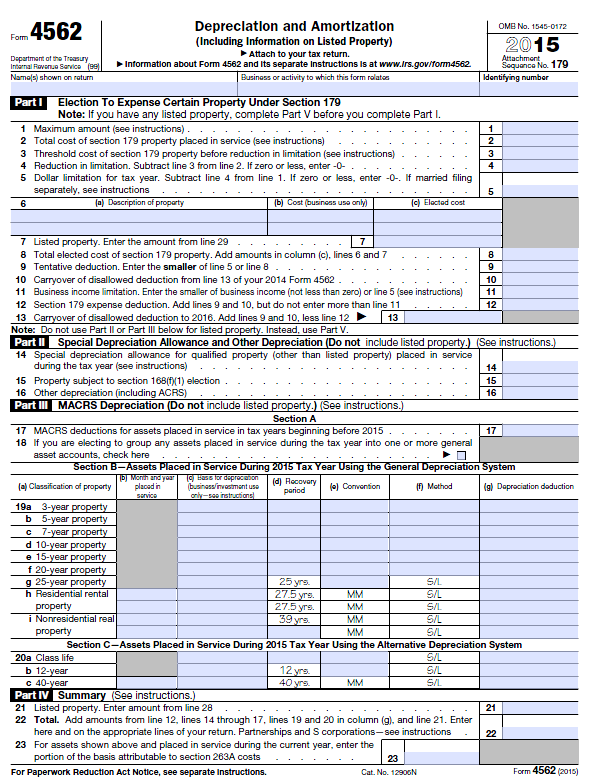

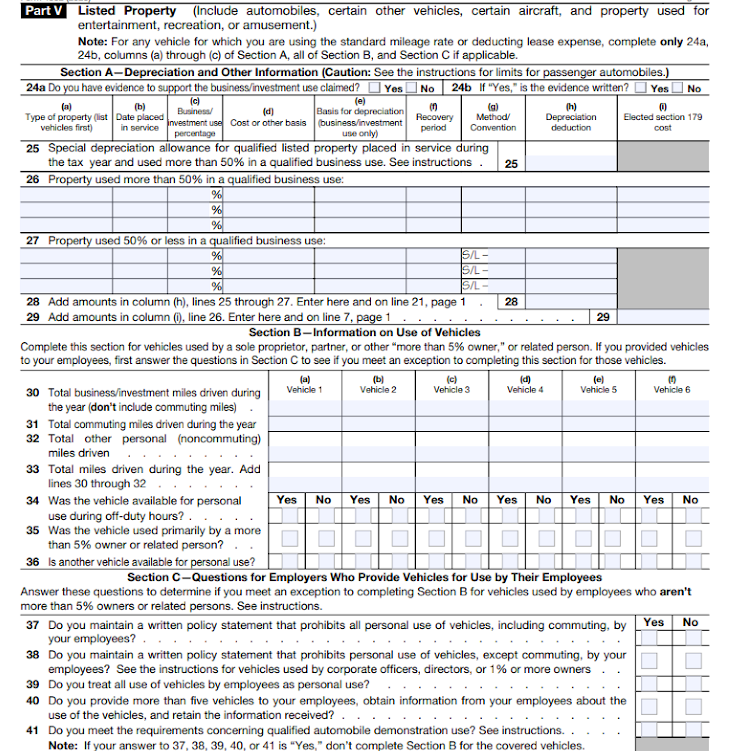

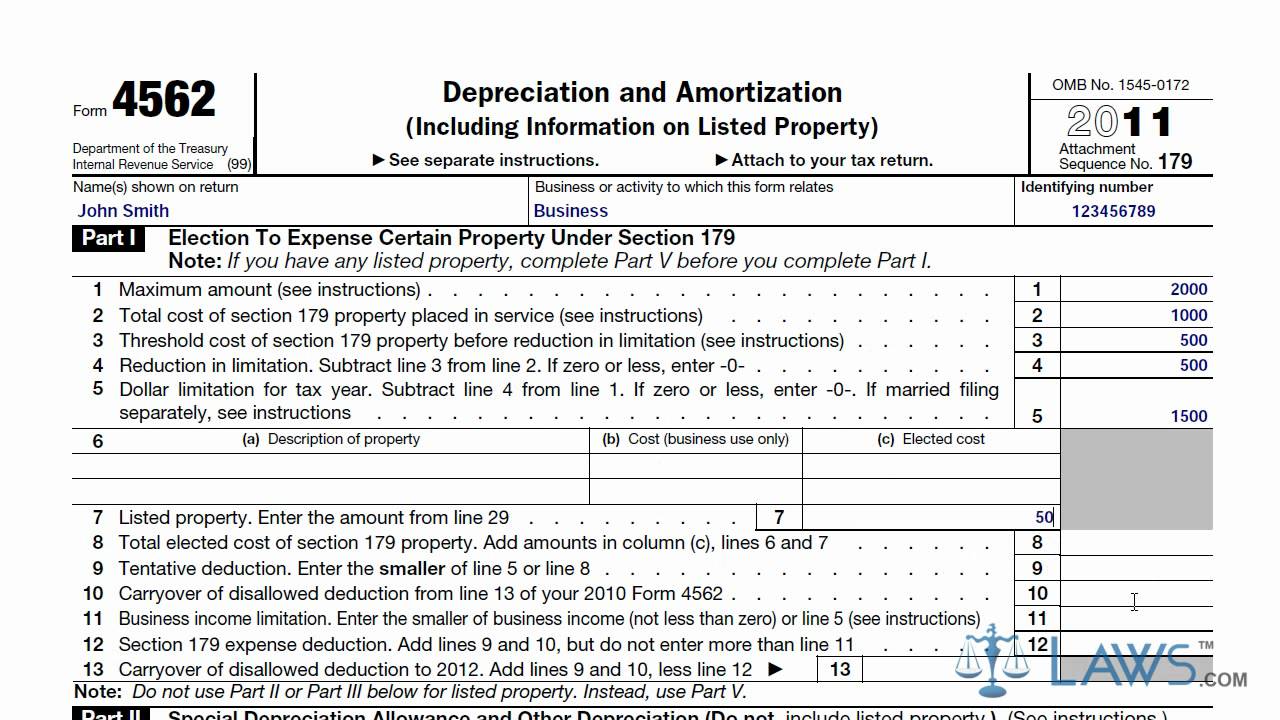

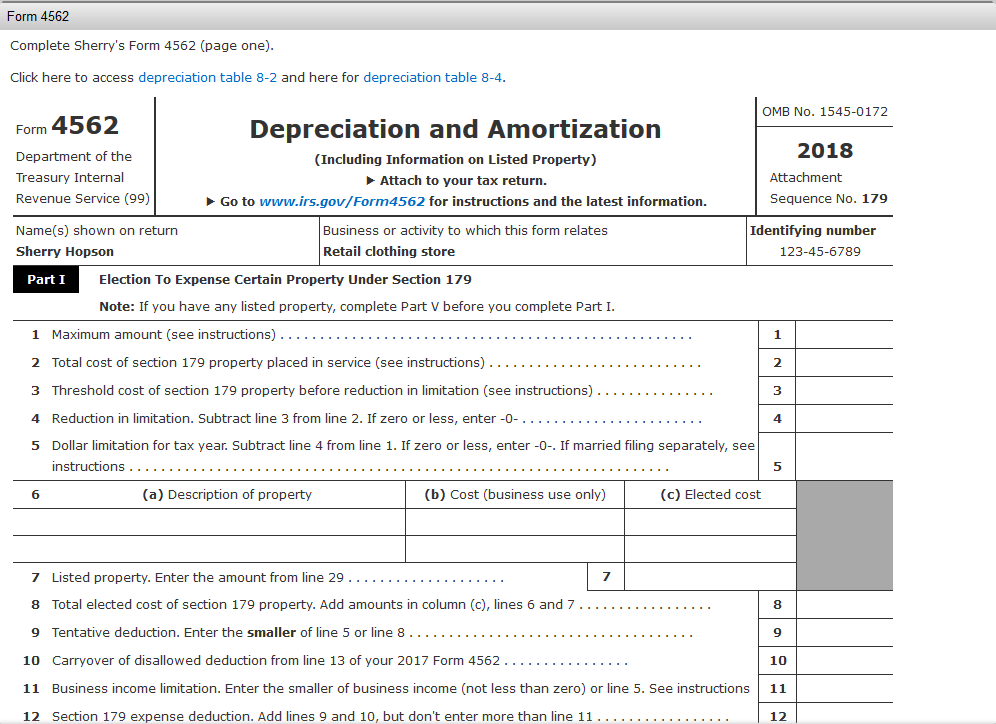

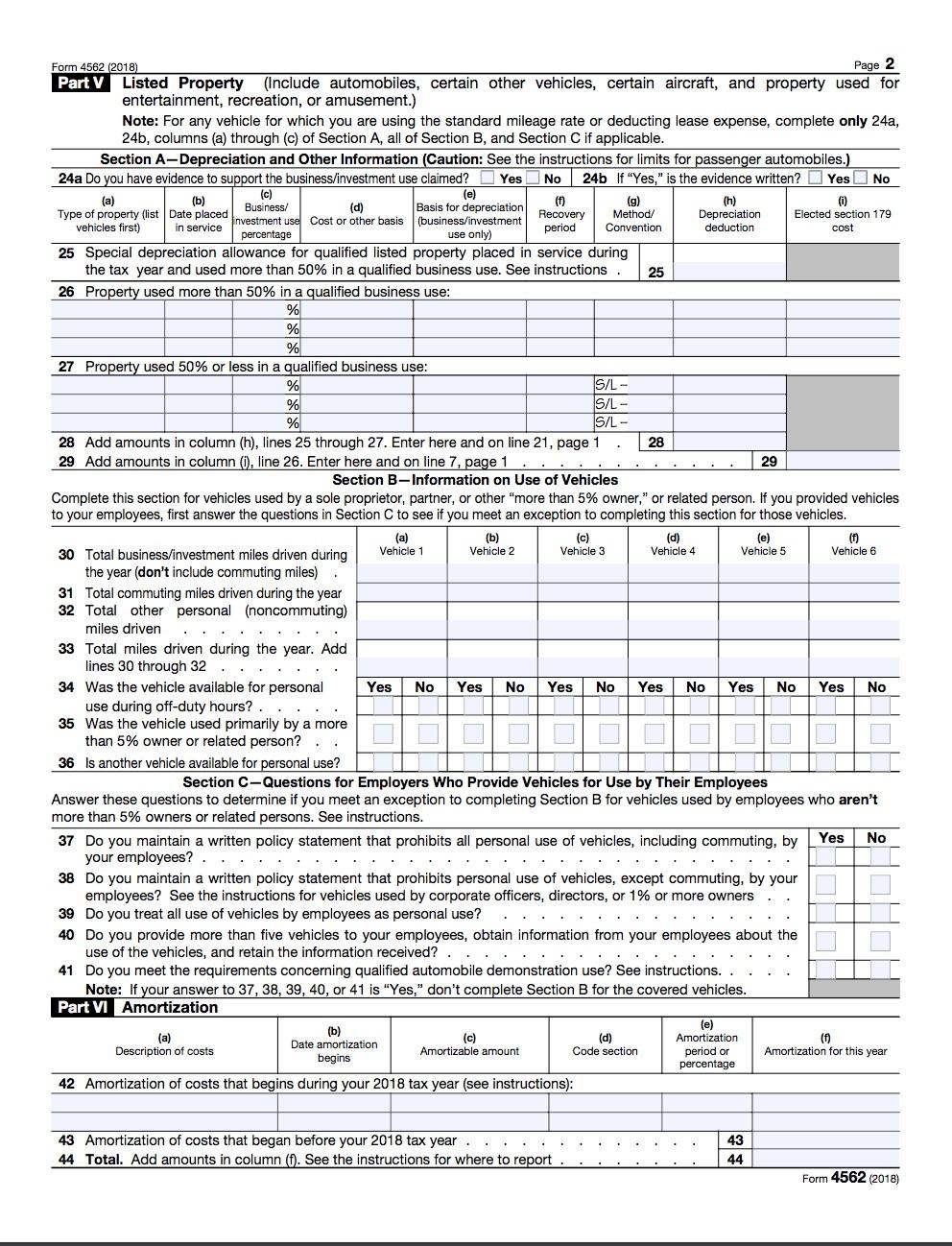

Form 4562 Instruction

Form 4562 Instruction - Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. General instructions purpose of form use form 4562 to: Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Web use form 4562 to: Assets such as buildings, machinery,. Web what is the purpose of this form? • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. See the instructions for lines 20a through 20d, later. Some examples of tax reductions that require the use of this form include: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file.

See the instructions for lines 20a through 20d, later. Web when is form 4562 required? Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. • claim your deduction for depreciation and amortization, •. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted.

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web when is form 4562 required? See the instructions for lines 20a through 20d, later. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web use form 4562 to: Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Some examples of tax reductions that require the use of this form include: Line 1 = $1 million, the maximum possible. • claim your deduction for depreciation and amortization, •. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them.

How do I fill out Irs Form 4562 for this computer.

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Web the instructions.

IRS Form 4562 Explained A StepbyStep Guide The Blueprint

Some examples of tax reductions that require the use of this form include: According to form 4562 instructions, the form is required if the taxpayer claims any of the following: • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web general instructions purpose of form use form 4562.

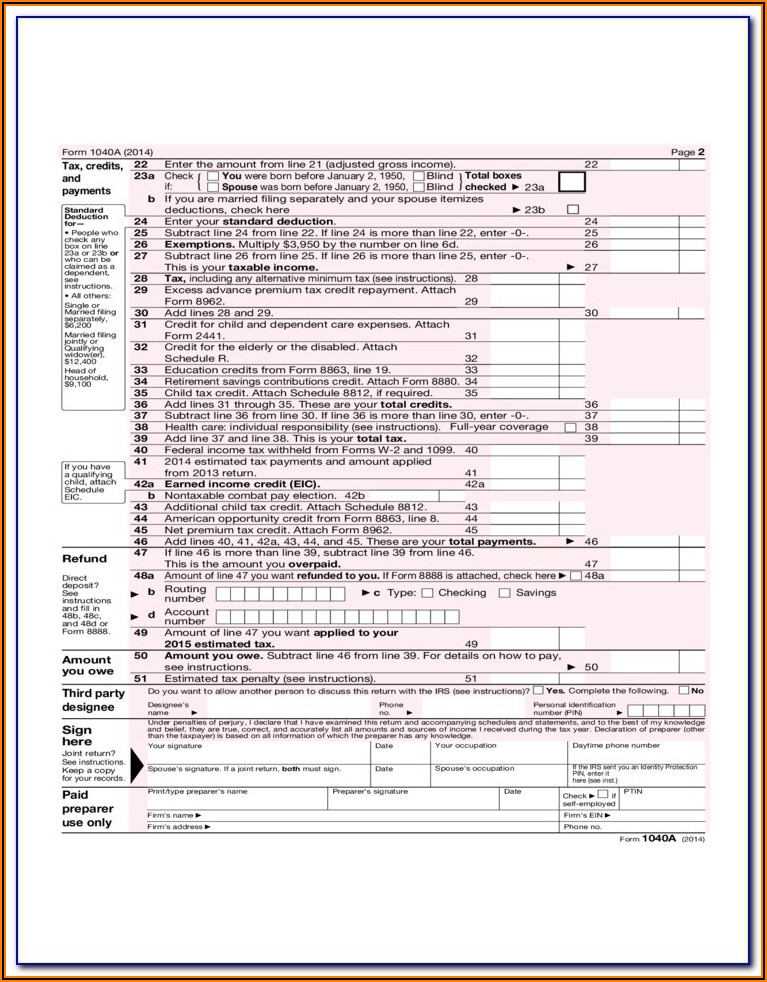

Irs Form 1040x Instructions 2014 Form Resume Examples nO9bk6AY4D

Web what is the purpose of this form? Web form 4562 and the following modifications: Form 4562 is used to claim a. Web general instructions purpose of form use form 4562 to: Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them.

Form 4562 YouTube

Web when is form 4562 required? • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web the instructions for form 4562 include a worksheet that you can use to complete part i. Some examples of tax reductions that require the use of this form include: Line 1 =.

I couldn’t figure out the answer for Schedule 4562

• claim your deduction for depreciation and amortization, •. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. See the instructions for lines 20a through 20d, later. Web you’ll need to file form 4562 each year you continue to depreciate the asset. Web instructions for form 4562 depreciation and.

Instructions for IRS Form 4562 Depreciation and Amortization

• claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. See the instructions for.

2012 Form 4562 Instructions Universal Network

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Some examples of tax reductions that require the use of this form include: Web use form 4562 to: Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Web here’s.

How To File Irs Form 4562 Ethel Hernandez's Templates

• claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Web what is the purpose of this form? To complete form 4562, you'll need to know the. Web when is form 4562 required? Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue.

IRS Form 4562 Instructions The Complete Guide

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web what is the purpose of this form? • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Something you’ll need to consider is that the amount you can deduct. See the instructions for.

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Web instructions for form 4562. Web use form 4562 to: Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. • claim your deduction for depreciation and amortization, •. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987.

Line 1 = $1 Million, The Maximum Possible.

See the instructions for lines 20a through 20d, later. Form 4562 is used to claim a. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. Web the instructions for form 4562 include a worksheet that you can use to complete part i.

Web File A Form 3115 With Your Return For The 2019 Tax Year Or A Subsequent Tax Year, To Claim Them.

• claim your deduction for depreciation and amortization, •. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web when is form 4562 required? Web form 4562 and the following modifications:

Web Instructions For Form 4562.

To complete form 4562, you'll need to know the. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years. Assets such as buildings, machinery,. Web what is the purpose of this form?

General Instructions Purpose Of Form Use Form 4562 To:

Some examples of tax reductions that require the use of this form include: Web general instructions purpose of form use form 4562 to: Web use form 4562 to: Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets.