Form 4563 Irs

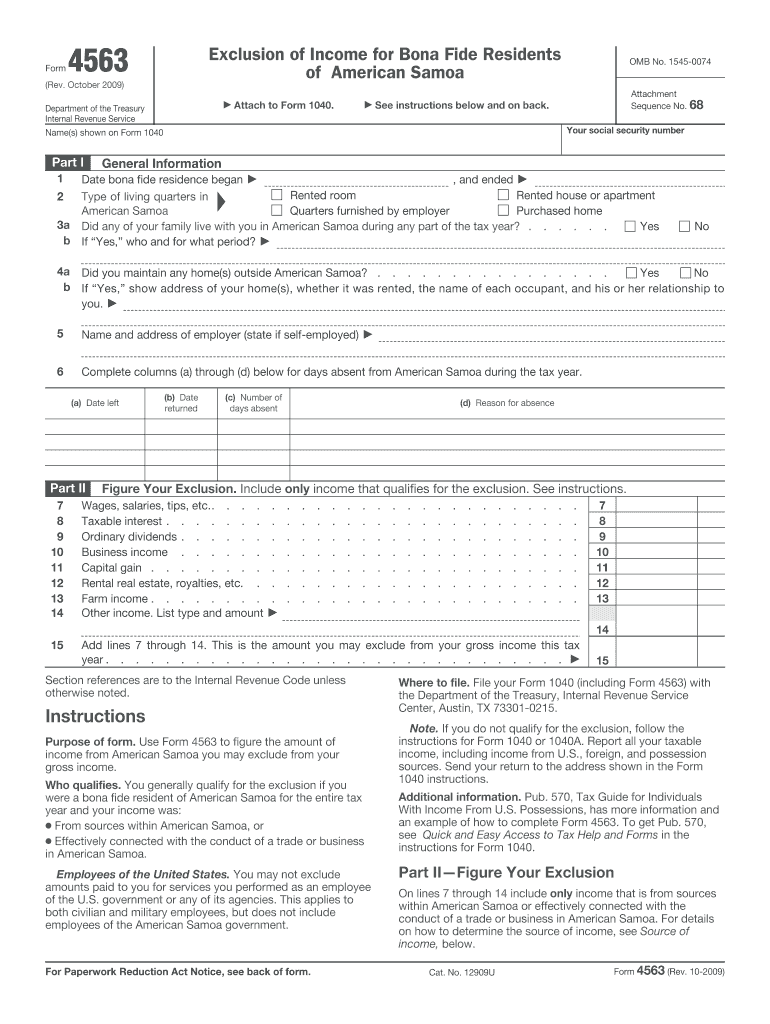

Form 4563 Irs - Individual tax return form 1040 instructions; Exclusion of income for bona fide residents of american samoa keywords: Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Who qualifies you qualify for the exclusion if you were a bona fide. One is eligible to file this. Who qualifies the time needed to complete and file this form will vary. Form 4562 is used to.

Who qualifies you qualify for the exclusion if you were a bona fide. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s. Form 4562 is used to. Web get 📝 printable irs form 4563 exclusion of income for bona fide residents of american samoa for 2020 ☑️ all blank template samples in pdf, doc, rtf and jpg ☑️. Exclusion of income for bona fide residents of american samoa keywords: • form 8396, mortgage interest credit; Individual tax return form 1040 instructions; Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income.

• form 8859, carryforward of the. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. • form 8839, qualified adoption expenses; Who qualifies you qualify for the exclusion if you were a bona fide. The credit amount allowed is 33% of the portion of the federal child tax credit and additional child. One is eligible to file this. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Web irs form 4562 is used to claim depreciation and amortization deductions.

Form 4563 Exclusion of for Bona Fide Residents of American

Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. You generally qualify for the. Web filing form 1040 to exclude your qualifying income from american samoa,.

Fill Free fillable Exclusion of for Bona Fide Residents of

Exclusion of income for bona fide residents of american samoa keywords: Income you must report on form 1040. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. The credit amount allowed.

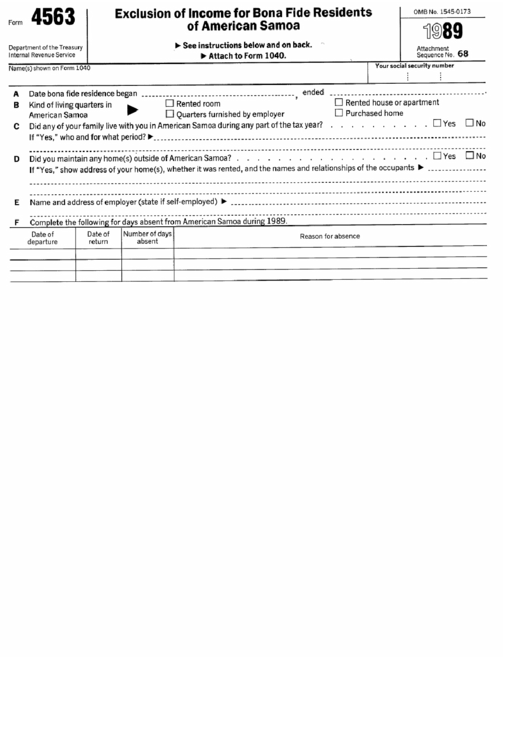

Form 4563 (1989) Exclusion Of For Bona Fide Residents Of

Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. You generally qualify for the. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Individual tax return form 1040 instructions; Web get 📝 printable irs form 4563 exclusion of.

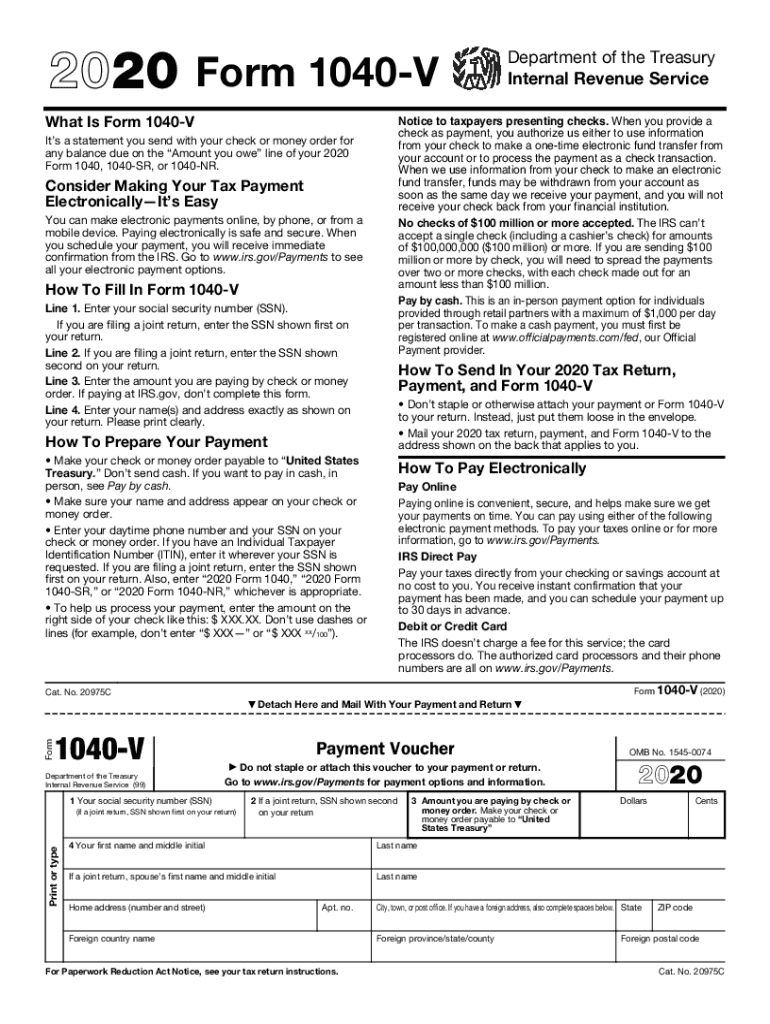

Irs Payment Voucher Fill Out and Sign Printable PDF Template signNow

Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Request for taxpayer identification number (tin) and certification. Individual tax return form 1040 instructions; October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. The credit amount.

Form 4563 Fill Out and Sign Printable PDF Template signNow

Individual tax return form 1040 instructions; One is eligible to file this. Form 4562 is used to. Web federal forms with your federal income tax return: August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service

IRS Form 4563 Download Fillable PDF or Fill Online Exclusion of

Web your tax for the tax year, the excess credit will be refunded without interest. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. Request for taxpayer identification number (tin) and certification. • form 8859, carryforward of the. Web get 📝 printable irs form 4563 exclusion.

Form 4563 Exclusion of for Bona Fide Residents of American

Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s. Web federal forms with your federal income tax return: Who qualifies the time needed to complete and file this form will vary. Web information about form 4562, depreciation and amortization, including recent updates,.

Form 8863 Education Credits (American Opportunity and Lifetime

Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. August.

Form 4563 Exclusion of for Bona Fide Residents of American

Exclusion of income for bona fide residents of american samoa keywords: Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. • form 8859, carryforward of the. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is.

Irs Form 1090 T Universal Network

Form 4562 is also used when you elect to expense certain property under section 179 or. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Federal individual income tax returns. Exclusion of income for bona fide residents of american samoa keywords: August 2019) exclusion of income for bona fide residents.

Form 4562 Is Used To.

Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Exclusion of income for bona fide residents of american samoa keywords: Individual tax return form 1040 instructions;

• Form 8859, Carryforward Of The.

You generally qualify for the. Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s. One is eligible to file this. Federal individual income tax returns.

Web We Last Updated The Exclusion Of Income For Bona Fide Residents Of American Samoa In February 2023, So This Is The Latest Version Of Form 4563, Fully Updated For Tax Year 2022.

October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. Web federal forms with your federal income tax return: The credit amount allowed is 33% of the portion of the federal child tax credit and additional child.

• Form 8396, Mortgage Interest Credit;

A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Web get 📝 printable irs form 4563 exclusion of income for bona fide residents of american samoa for 2020 ☑️ all blank template samples in pdf, doc, rtf and jpg ☑️. Form 4562 is also used when you elect to expense certain property under section 179 or. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at11.58.37PM-68ccc0edb6ce4cb8acf163430cfa938b.png)