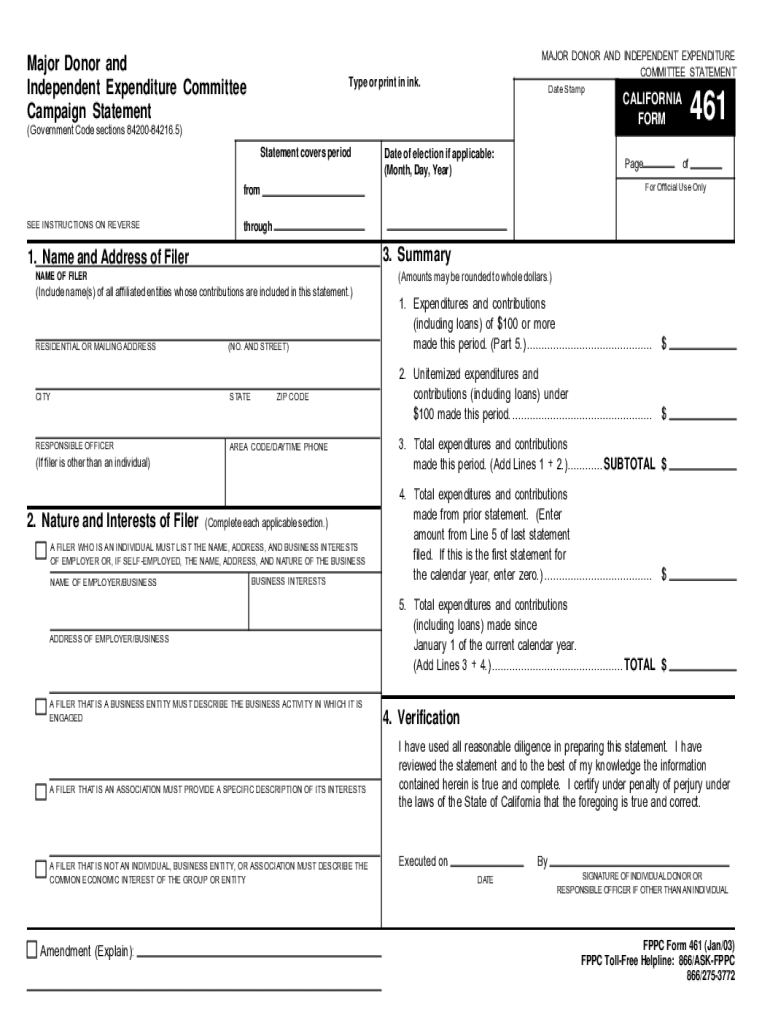

Form 461 California

Form 461 California - Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. 2870, providing the information is necessary in order to. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,.

Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Go to www.irs.gov/form461 for instructions and the. Web secretary of state must file form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. Attach form 461 to the applicable tax return you file. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. January 1, 2003] attachment to qualified domestic relations order (earnings. Web form 461 major donor and independent exependiture committe campaign statement. Statement period covered date period started date period ended date of election, if applicable. Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits.

Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. Attach form 461 to the applicable tax return you file. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Web form 461 department of the treasury internal revenue service limitation on business losses attach to your tax return. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Web form 461 major donor and independent exependiture committe campaign statement.

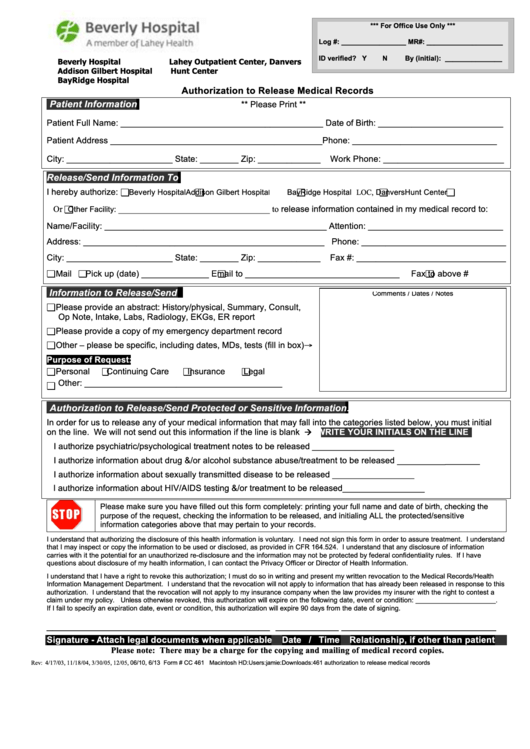

Form Cc 461 Authorization To Release Medical Records printable pdf

January 1, 2003] attachment to qualified domestic relations order (earnings. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web tells the retirement plan information about the employee and the.

Form 461 Instructions Fill Out and Sign Printable PDF Template signNow

Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. Web who uses form 461: Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. January 1, 2003] attachment to qualified domestic relations.

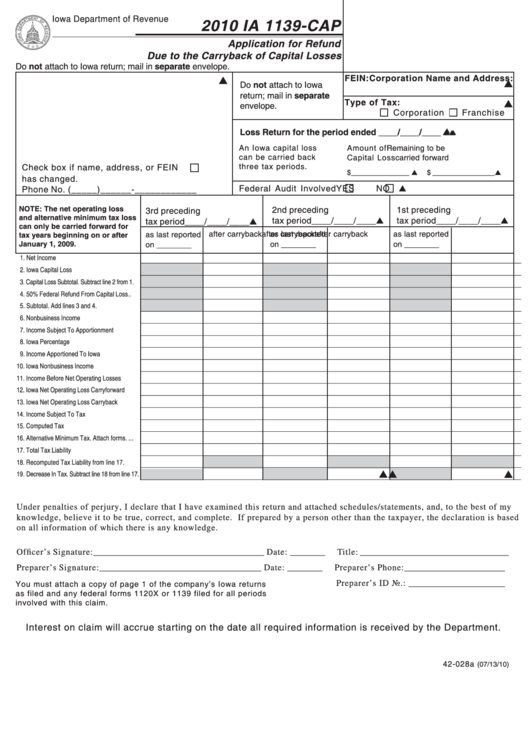

Form Ia 1139Cap Application For Refund Due To The Carryback Of

Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web about form 461, limitation on business losses. Go to www.irs.gov/form461 for instructions and the. Web special filings unit, p.o.

PJI Form 461 Stamped

The fair political practices commission (fppc) maintains the following comprehensive list of every fppc form with brief explanations of who must. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web california courts | self help guide. Web.

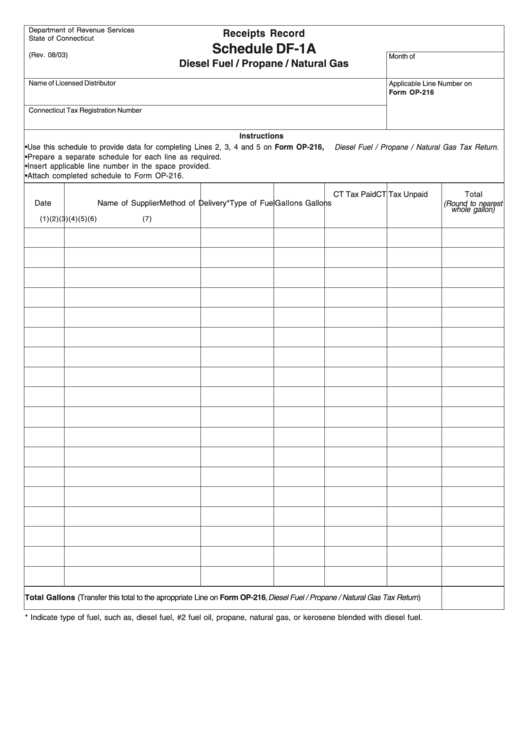

Schedule Df1a Receipt Record Diesel Fuel/propane/natural Gas

Web form 461 major donor and independent exependiture committe campaign statement. Statement period covered date period started date period ended date of election, if applicable. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. Web california form.

Form 461 2022 2023 IRS Forms Zrivo

Go to www.irs.gov/form461 for instructions and the. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web secretary of state must file form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. Use form 461 to figure the excess business loss that is reported on your noncorporate.

Fill Free fillable Form 461 Limitation on Business Losses (IRS) PDF form

Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Statement period covered date period started date period ended date of election, if applicable. Web about form 461, limitation on business losses. Form 461 has 5 sections. Web tells the retirement plan information about the employee.

Form 461 2022 2023 IRS Forms Zrivo

Web california courts | self help guide. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web file form ftb 3461 if you are a noncorporate taxpayer.

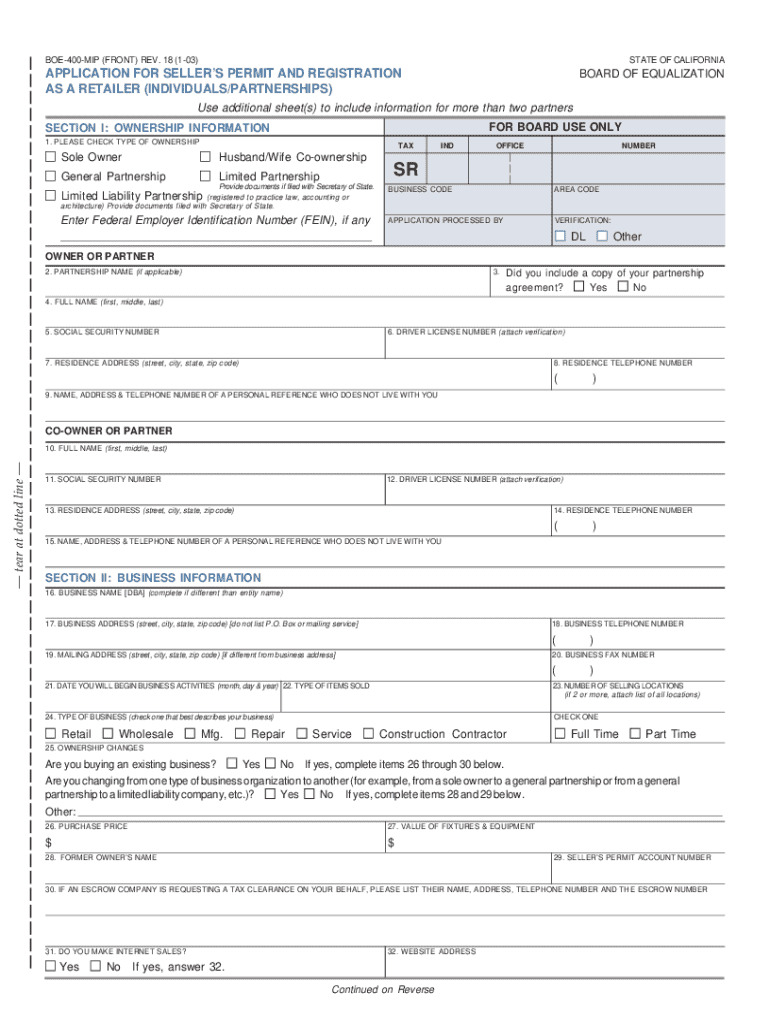

BOE 400 MIP REV 18 1 03 California Sellers Permit Fill Out and Sign

Web special filings unit, p.o. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. I certify under penalty of perjury under the. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Web form 461.

Da Form 461 5 ≡ Fill Out Printable PDF Forms Online

It is attached to qualified domestic relations order. Web who uses form 461: Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Web form 461 major donor and independent exependiture committe campaign statement. Web form 461 department of the treasury internal revenue service limitation on business losses attach to your tax return.

Web For Taxable Year 2020, Complete Form Ftb 3461, California Limitation On Business Losses, If You Are A Noncorporate Taxpayer And Your Net Losses From All Of Your Trades Or.

Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Go to www.irs.gov/form461 for instructions and the. Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Statement period covered date period started date period ended date of election, if applicable.

Web California Courts | Self Help Guide.

Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. 2870, providing the information is necessary in order to. Web about form 461, limitation on business losses. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state:

Web When An Individual Or Entity Qualifies As An Independent Expenditure Committee It Must File The Form 461 As A State, County Or City Committee.

Web tells the retirement plan information about the employee and the person receiving spousal or partner support. January 1, 2003] attachment to qualified domestic relations order (earnings. It is attached to qualified domestic relations order. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6.

I Certify Under Penalty Of Perjury Under The.

Web form 461 major donor and independent exependiture committe campaign statement. The fair political practices commission (fppc) maintains the following comprehensive list of every fppc form with brief explanations of who must. Attach form 461 to the applicable tax return you file. Form 461 has 5 sections.