Form 480 Puerto Rico

Form 480 Puerto Rico - Web instructions form 480.20(ec) circular letter no. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: There is no de minimis for either form. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Nonresident annual return for income tax withheld at source. Formulario 480.5 / for 480.5 (informativo) Just make sure that you include this amount in usd. Annual reconciliation statement of other income subject to withholding. ¿qué formulario se debe completar para solicitar copia del comprobante de retención.

Annual reconciliation statement of other income subject to withholding. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Formulario 480.5 / for 480.5 (informativo) Nonresident annual return for income tax withheld at source. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Series 480.6a and series 480.6d. There is no de minimis for either form. Just make sure that you include this amount in usd.

Annual reconciliation statement of other income subject to withholding. Series 480.6a and series 480.6d. There is no de minimis for either form. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web instructions form 480.20(ec) circular letter no. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Formulario 480.5 / for 480.5 (informativo) Nonresident annual return for income tax withheld at source. ¿qué formulario se debe completar para solicitar copia del comprobante de retención.

2012 Form PR 480.20 Fill Online, Printable, Fillable, Blank pdfFiller

Formulario 480.5 / for 480.5 (informativo) Just make sure that you include this amount in usd. When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Annual reconciliation statement of other income subject to withholding. ¿qué formulario se debe completar para solicitar copia del comprobante de retención.

Form 480.7E Tax Alert RSM Puerto Rico

Series 480.6a and series 480.6d. Nonresident annual return for income tax withheld at source. Formulario 480.5 / for 480.5 (informativo) ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico:

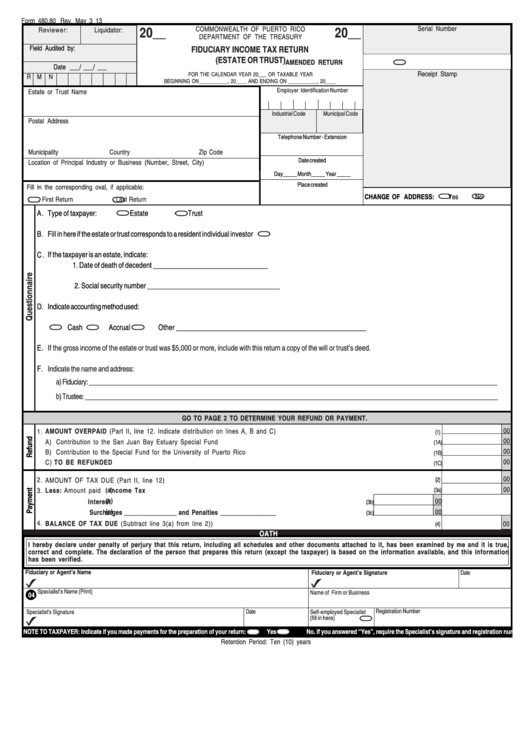

Form 480.80 Fiduciary Tax Return (Estate Or Trust) 2013

Web instructions form 480.20(ec) circular letter no. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Formulario 480.5 / for 480.5 (informativo) Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. There is no de minimis for either form.

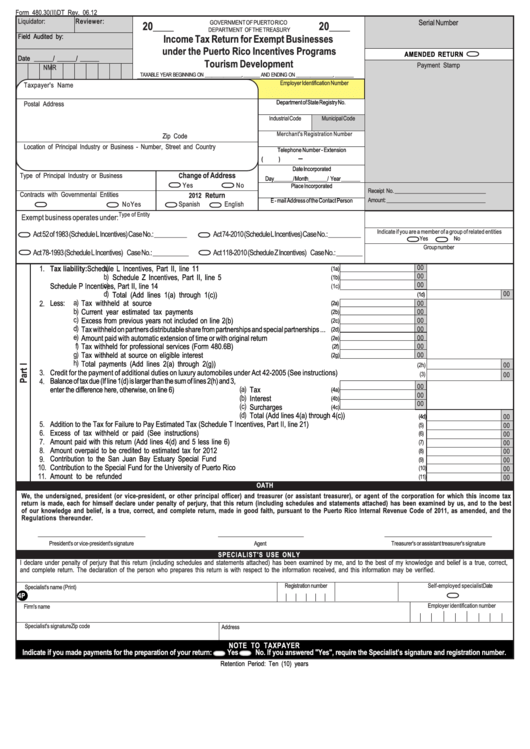

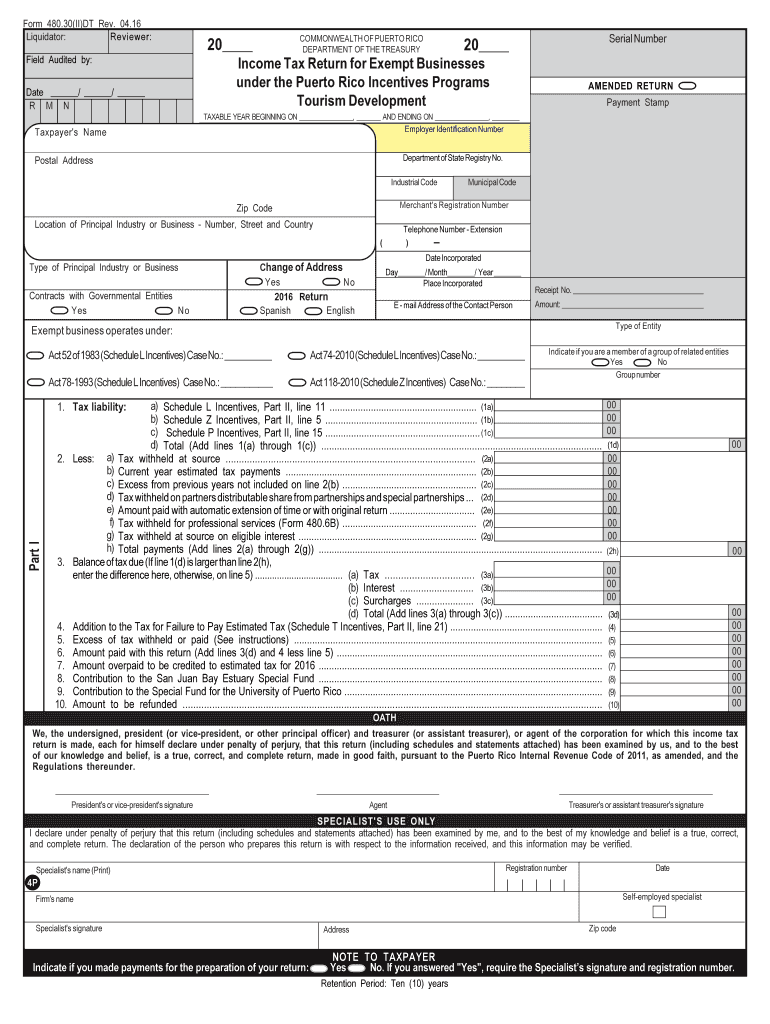

Form 480.30(Ii)dt Tax Return For Exempt Businesses Under The

When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Annual reconciliation statement of other income subject.

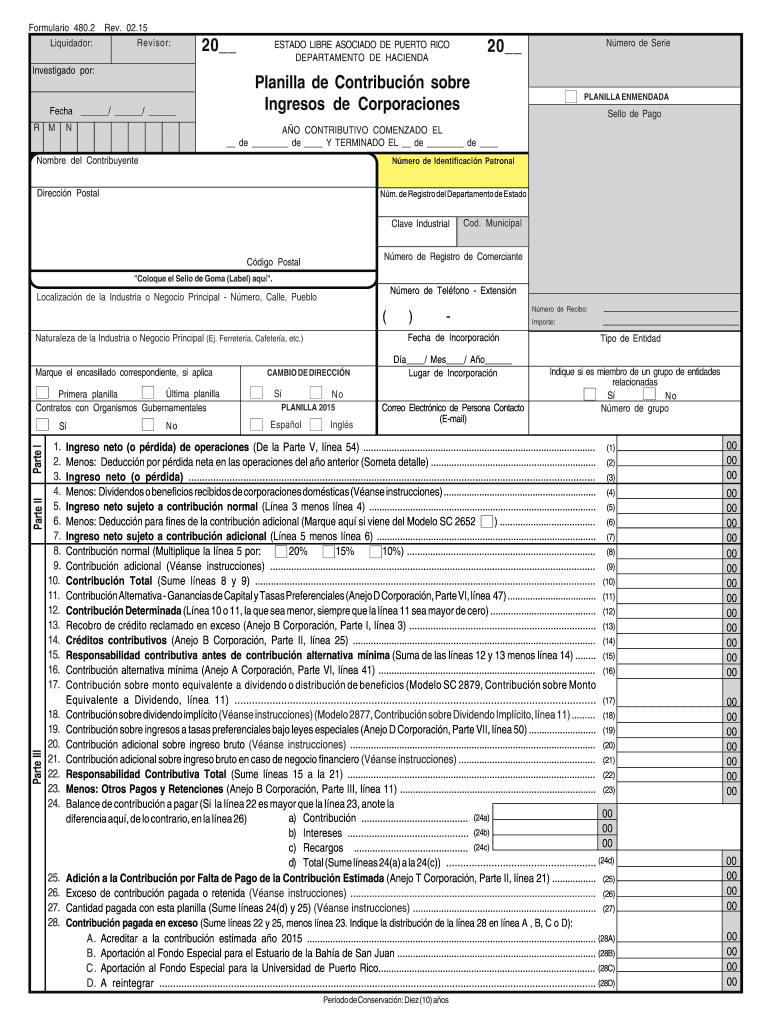

Puerto Rico 480 2 Form Fill Out and Sign Printable PDF Template signNow

Nonresident annual return for income tax withheld at source. Just make sure that you include this amount in usd. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Formulario 480.5 / for 480.5 (informativo) When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source

Puerto Rico Corporation Tax Return Fill Out and Sign Printable

Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Web instructions form 480.20(ec) circular letter no. Series 480.6a and series 480.6d. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Annual reconciliation statement of other income subject to withholding.

W2 Puerto Rico Form Fill Out and Sign Printable PDF Template signNow

Annual reconciliation statement of other income subject to withholding. There is no de minimis for either form. Web instructions form 480.20(ec) circular letter no. Formulario 480.5 / for 480.5 (informativo) When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source

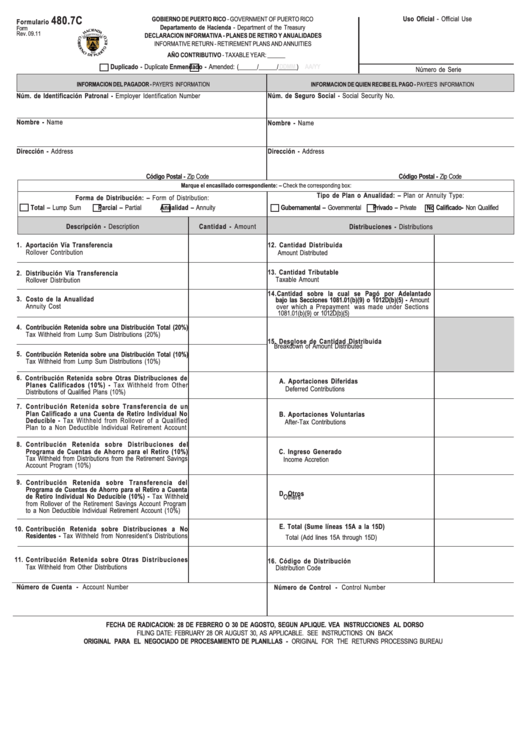

Form 480.7c Informative Return Retirement Plans And Annuities

Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web instructions form 480.20(ec) circular letter no. Annual reconciliation statement of other income subject to withholding. Nonresident annual return for income tax withheld at source. When you need to file 480.6a if you pay natural or juridical person payments that are.

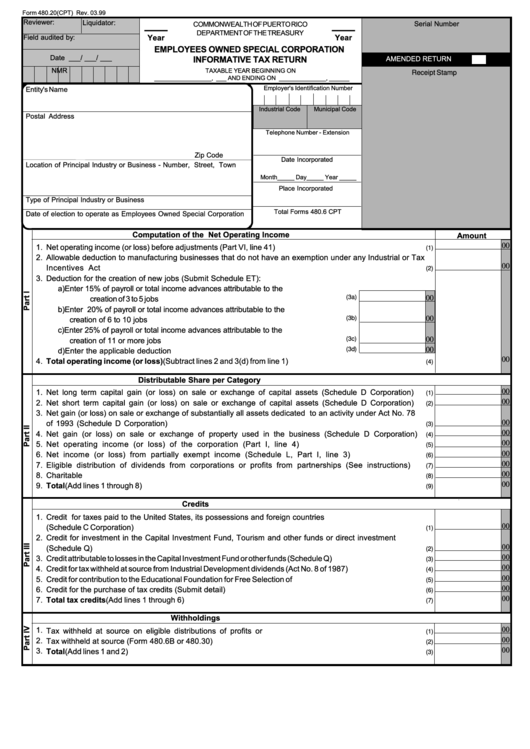

Form 480.20(Cpt) Employees Owned Special Corporation Informative Tax

Web instructions form 480.20(ec) circular letter no. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns. Just make sure that you include this amount in usd. Web there are two separate series 480 forms that wealthfront generates for.

Form 480 puerto rico Fill out & sign online DocHub

Series 480.6a and series 480.6d. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Web instructions form 480.20(ec) circular letter no. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Nonresident annual return for income tax withheld at source.

Just Make Sure That You Include This Amount In Usd.

When you need to file 480.6a if you pay natural or juridical person payments that are not subject to withholding at the source Formulario 480.5 / for 480.5 (informativo) Series 480.6a and series 480.6d. Web yes, you will need to report this puerto rican bank interest as income on your income tax returns.

Web Instructions Form 480.20(Ec) Circular Letter No.

There is no de minimis for either form. Annual reconciliation statement of other income subject to withholding. ¿qué formulario se debe completar para solicitar copia del comprobante de retención. Nonresident annual return for income tax withheld at source.

Series 480.6A Reports Any Taxable Dividends And/Or Gross Proceeds From Realized Capital Gains Or Losses In Your Taxable Investment Account.

Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: