Form 4835 Instructions

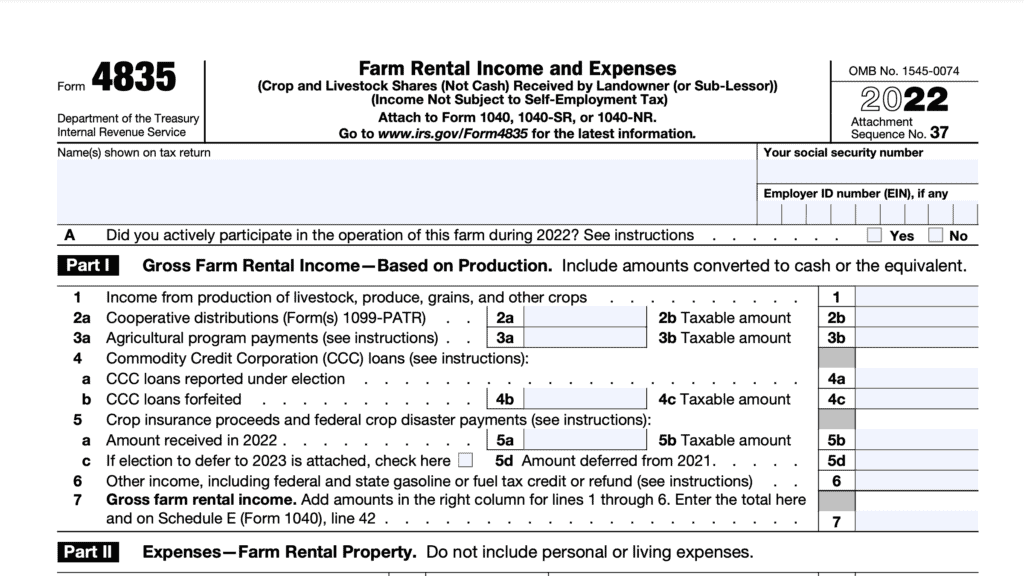

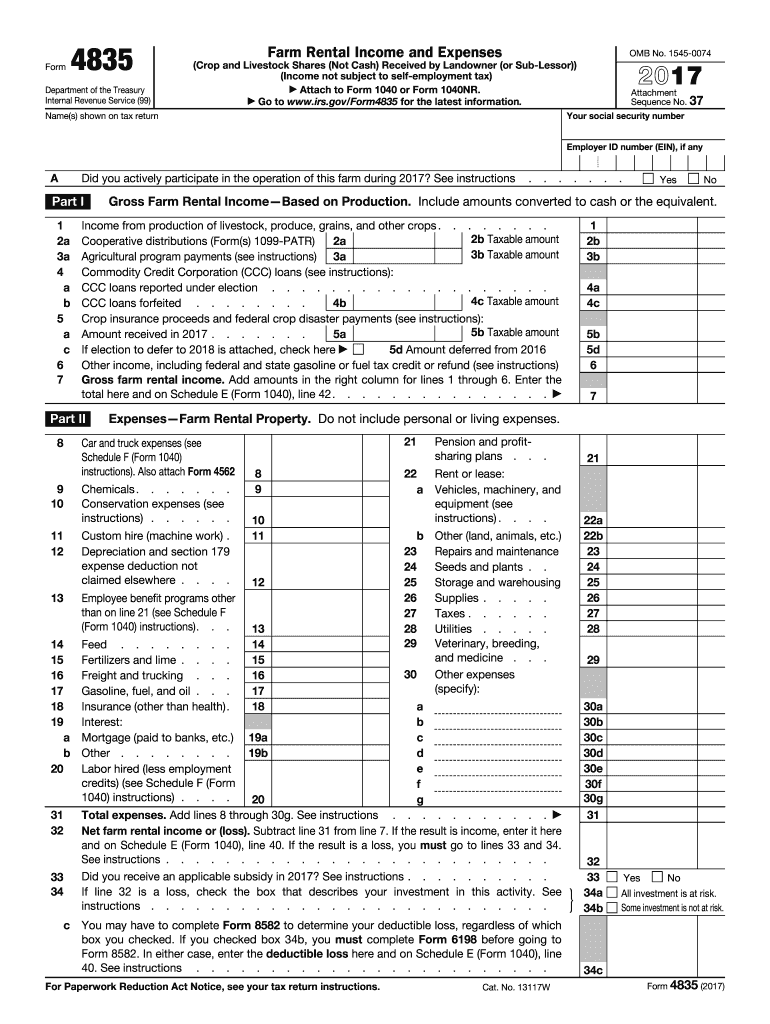

Form 4835 Instructions - All forms individual forms information returns fiduciary. Find the sample you will need in the collection of templates. Under both the cash and the accrual methods of accounting,. Web up to $40 cash back 2014 4835 form. Web instructions to printers form 4835, page 1 of 2 margins: Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Upload, modify or create forms. Report income you received from livestock, produce, grains, and other crops based on production. Web the farm, use form 4835 to report farm rental income based on crops or livestock produced by the tenant.

Web keep to these simple instructions to get irs 4835 prepared for sending: All forms individual forms information returns fiduciary. Report income you received from livestock, produce, grains, and other crops based on production. Try it for free now! Web developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. Irs form 4835 is a fairly straightforward form. If all your client does is cash rent the land, then it goes on. Web 1040 form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Find the sample you will need in the collection of templates.

Web form 4835 is to report farm rental income based on crops or livestock produced by the tenant. Web keep to these simple instructions to get irs 4835 prepared for sending: Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Use screen 4835 on the. Upload, modify or create forms. Irs form 4835 is a fairly straightforward form. Under both the cash and the accrual methods of accounting,. Web the farm, use form 4835 to report farm rental income based on crops or livestock produced by the tenant. All forms individual forms information returns fiduciary. Top 13mm (12), center sides.

Fill Free fillable IRS PDF forms

Find the sample you will need in the collection of templates. Report income you received from livestock, produce, grains, and other crops based on production. Web developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. All forms individual forms information returns fiduciary. Upload, modify or create forms.

Form 4835 Farm Rental and Expenses (2015) Free Download

This publication explains how the federal tax laws apply to farming. Under both the cash and the accrual methods of accounting,. All forms individual forms information returns fiduciary. Web form 4835 is to report farm rental income based on crops or livestock produced by the tenant. Web 1040 form 4835 is available in an individual return for taxpayers who need.

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

Web about publication 225, farmer's tax guide. Ad download or email irs 4835 & more fillable forms, register and subscribe now! Web developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. 3 when should i file form i. Under both the cash and the accrual methods of accounting,.

Handleiding Playmobil 4835 (pagina 6 van 12) (Nederlands, Deutsch

Use screen 4835 on the. Web developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. 2 who may not be eligible to adjust status? Report income you received from livestock, produce, grains, and other crops based on production. 3 when should i file form i.

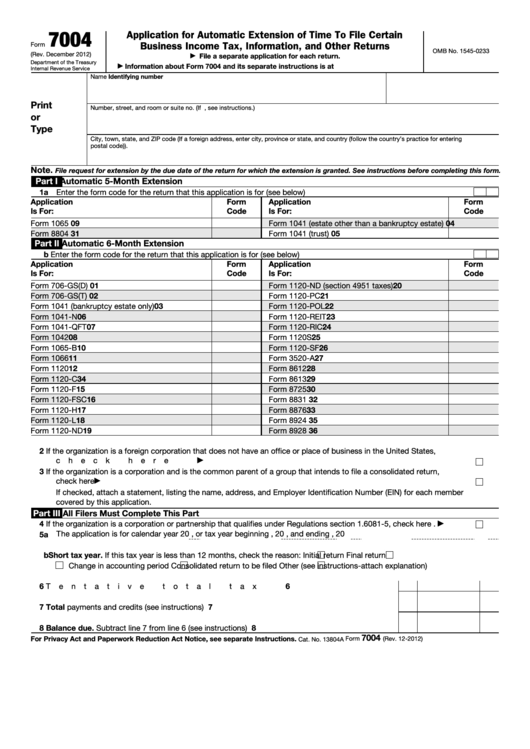

Fillable Form 7004 Application For Automatic Extension Of Time To

You are in the business of farming if you. Web 1040 form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Purpose of form if you were the. This publication explains how the federal tax laws apply to farming. Web form 4835 department of.

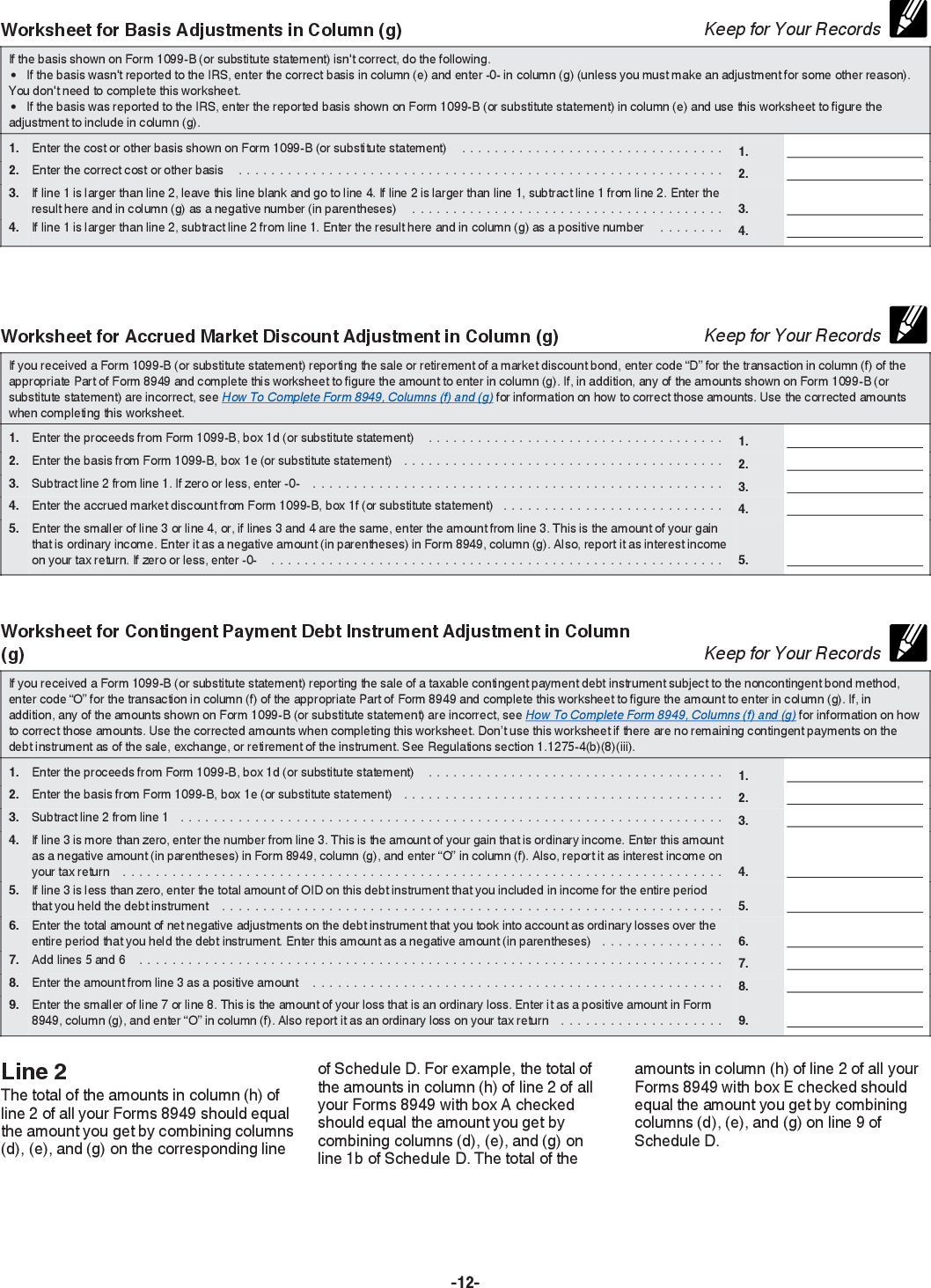

Online generation of Schedule D and Form 8949 for 10.00

If all your client does is cash rent the land, then it goes on. Web 1040 form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Under both the cash and the accrual methods of accounting,. Web information about form 4835, farm rental income.

IRS Form 6252 Instructions Installment Sale

Web up to $40 cash back 2014 4835 form. Web instructions to printers form 4835, page 1 of 2 margins: Report income you received from livestock, produce, grains, and other crops based on production. Under both the cash and the accrual methods of accounting,. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses.

Form 4835 Fill Out and Sign Printable PDF Template signNow

Must be removed before printing. Under both the cash and the accrual methods of accounting,. 2 who may not be eligible to adjust status? Use this form only if the activity was a rental activity for purposes of the. Open the document in our online editing tool.

Fill Free fillable F4835 Accessible 2019 Form 4835 PDF form

Purpose of form if you were the. Web form 4835 is to report farm rental income based on crops or livestock produced by the tenant. Use this form only if the activity was a rental activity for purposes of the. You are in the business of farming if you. Try it for free now!

Instructions for Form 8995 (2021) Internal Revenue Service

Under both the cash and the accrual methods of accounting,. Use screen 4835 on the. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. If all your client does is cash rent the land, then it goes on. This publication explains how.

3 When Should I File Form I.

Must be removed before printing. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web up to $40 cash back 2014 4835 form. Use this form only if the activity was a rental activity for purposes of the.

Top 13Mm (12), Center Sides.

All forms individual forms information returns fiduciary. Use screen 4835 on the. Web the farm, use form 4835 to report farm rental income based on crops or livestock produced by the tenant. You are in the business of farming if you.

Web How Do I Complete Irs Form 4835?

Web form 4835 is to report farm rental income based on crops or livestock produced by the tenant. Web developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. Web about publication 225, farmer's tax guide. Web keep to these simple instructions to get irs 4835 prepared for sending:

Find The Sample You Will Need In The Collection Of Templates.

Web farm rental income and expenses form 4835 (2007)page2 general instructions purpose of form. Web information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. Upload, modify or create forms. If all your client does is cash rent the land, then it goes on.