Form 4852 Instructions

Form 4852 Instructions - Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Web form 4852 is not included in the electronic file. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. September 2020) department of the treasury internal revenue service. Information about any future developments affecting form 4852 (such as legislation enacted after we release it) will be available at. In other words, this form serves as a substitute for the following tax forms: Section references are to the internal revenue code.

Information about any future developments affecting form 4852 (such as legislation enacted after we release it) will be available at. Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Section references are to the internal revenue code. Web form 4852 is not included in the electronic file. September 2020) department of the treasury internal revenue service. In other words, this form serves as a substitute for the following tax forms: If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852.

Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Information about any future developments affecting form 4852 (such as legislation enacted after we release it) will be available at. In other words, this form serves as a substitute for the following tax forms: Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. Section references are to the internal revenue code. Web form 4852 is not included in the electronic file. September 2020) department of the treasury internal revenue service.

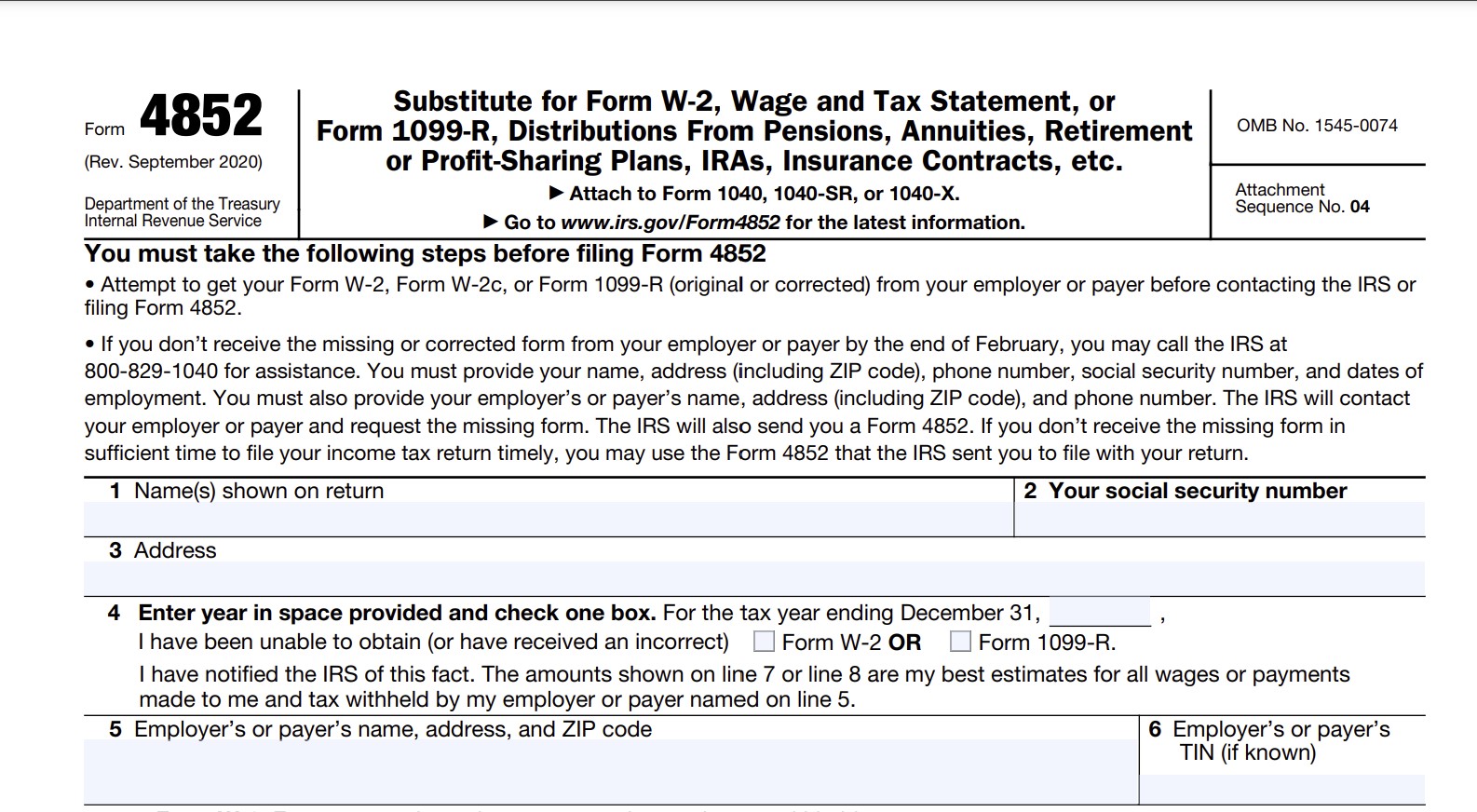

FORM 4852

Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. September 2020) department of the treasury internal revenue service. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration..

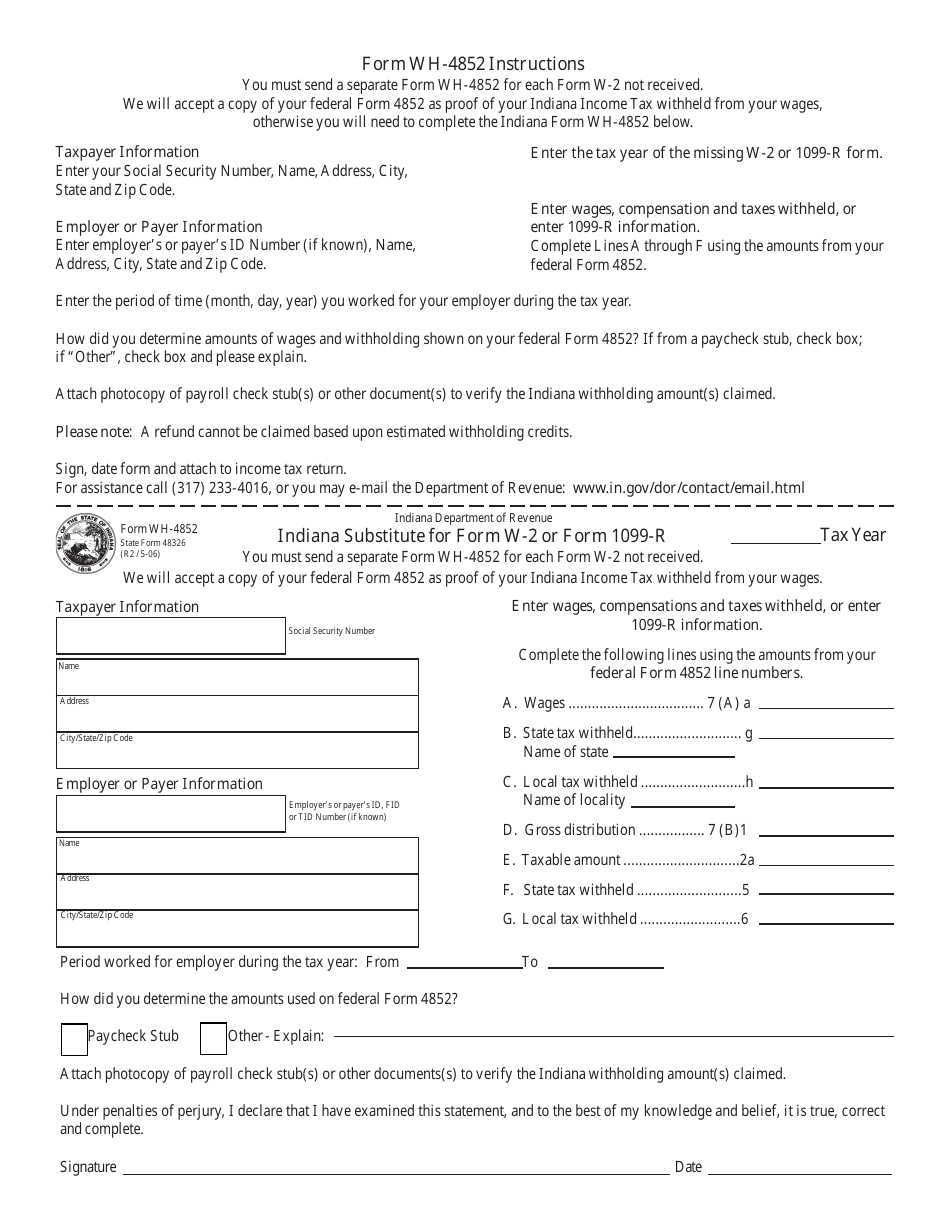

Form WH4852 Download Fillable PDF or Fill Online Indiana Substitute

Section references are to the internal revenue code. Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. Information about any future developments affecting form 4852 (such as legislation enacted after we release it) will be available at. Web form 4852 is not included in the electronic file. If you are filing a.

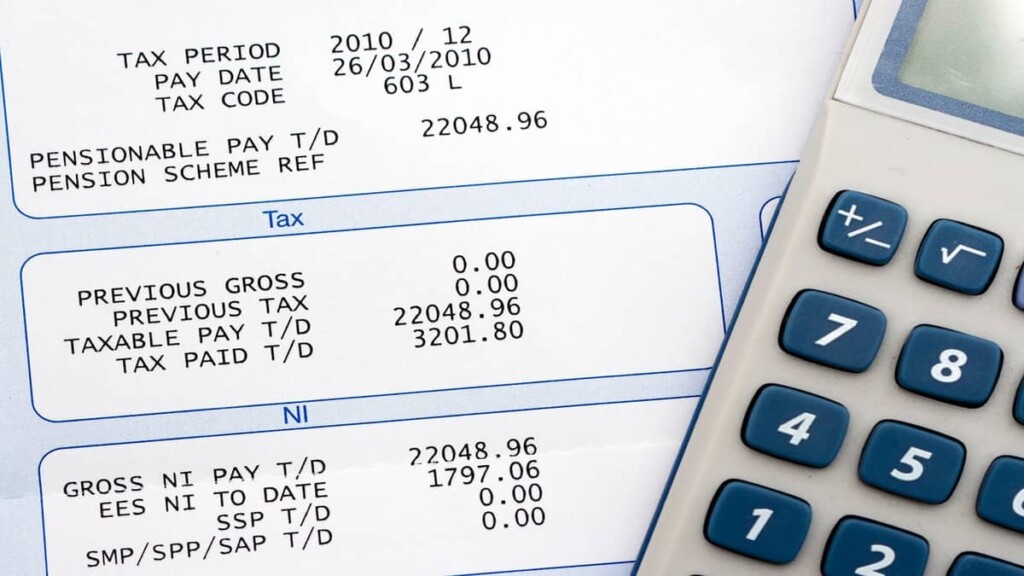

Missing a W2? Follow these 3 easy steps to file a tax return

In other words, this form serves as a substitute for the following tax forms: Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. September 2020) department of the treasury internal revenue service. Section references are to the internal revenue code. If you are filing a form 4852, you should keep this form.

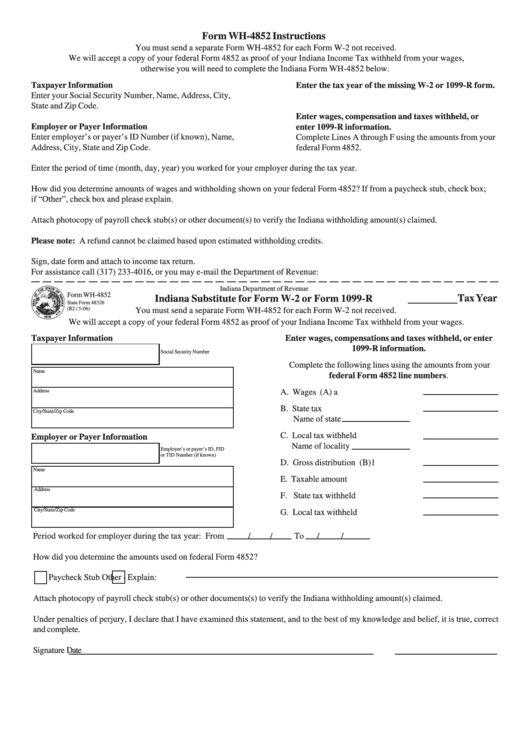

h&r block form 4852 Fill Online, Printable, Fillable Blank form

Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. In other words, this form serves as a substitute for the following tax forms: If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings.

How to fill out Form I485 (expires july 31 2021) Aplication to

Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Section references are to the internal revenue code. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. Taxpayers must.

Dealing with a missing W2 or using Form 4852 instead Don't Mess With

Web form 4852 is not included in the electronic file. In other words, this form serves as a substitute for the following tax forms: Section references are to the internal revenue code. Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Taxpayers must explain their efforts to obtain the missing form in box.

IRS Form 4852 Timothy A. Phillips, CPA, PC Explains the Substitute for

In other words, this form serves as a substitute for the following tax forms: Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with.

Form 4852*Substitute Form W2 or 1099R

Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Section references are to the internal revenue code. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. Web form.

Fillable Form Wh4852 Indiana Substitute For Form W2 Or Form 1099R

Information about any future developments affecting form 4852 (such as legislation enacted after we release it) will be available at. Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. Web form 4852 is not included in the electronic file. In other words, this form serves as a substitute for the following tax forms:.

4852 Form 2022 Instructions to File 4852 Forms TaxUni

Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration. In other words, this form serves as a substitute.

Information About Any Future Developments Affecting Form 4852 (Such As Legislation Enacted After We Release It) Will Be Available At.

Refer to irs publication 1345 for more information regarding irs electronic filing requirements for form 4852. In other words, this form serves as a substitute for the following tax forms: Taxpayers must explain their efforts to obtain the missing form in box 10 of the form 4852. Section references are to the internal revenue code.

Web Form 4852 Is Not Included In The Electronic File.

September 2020) department of the treasury internal revenue service. If you are filing a form 4852, you should keep this form for your records as you may need to verify that your employer credited you for the earnings with the social security administration.