Form 4884 Michigan

Form 4884 Michigan - Issued under authority of public act 281 of 1967. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Easily fill out pdf blank, edit, and sign them. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. However, with our preconfigured web templates, everything gets simpler. If the older of filer or spouse is born during. Web see form 4884, line 29 instructions for more information. Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of.

Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884 (michigan pension. Save or instantly send your ready documents. We last updated the pension schedule in february 2023, so this is the latest. However, with our preconfigured web templates, everything gets simpler. Web follow the simple instructions below: Issued under authority of public act 281 of 1967. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web instructions included on form: Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. Form 4884 section c worksheet:

Easily fill out pdf blank, edit, and sign them. Issued under authority of public act 281 of 1967. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884 (michigan pension. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return. If the older of filer or spouse is born during. Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. We last updated the pension schedule in february 2023, so this is the latest. However, with our preconfigured web templates, everything gets simpler. Web see form 4884, line 29 instructions for more information.

Fill Michigan

Web instructions included on form: Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884.

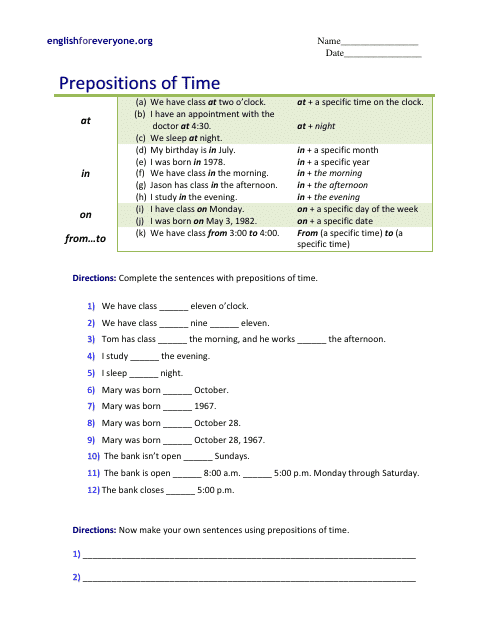

Prepositions of Time Worksheet Download Printable PDF Templateroller

Save or instantly send your ready documents. Web taxslayer support is my retirement income taxable to michigan? 2013 michigan pension schedule, form 4884 note: Web we last updated michigan form 4884 worksheet from the department of treasury in february 2023. Web instructions included on form:

Fill Michigan

We last updated the pension schedule in february 2023, so this is the latest. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Web instructions included on form: Web follow the simple instructions below: Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction.

Fill Michigan

Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. Save or instantly send your ready documents. Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form.

Fill Michigan

Web we last updated michigan form 4884 worksheet from the department of treasury in february 2023. Show sources > about the corporate income tax the irs and most. Save or instantly send your ready documents. However, with our preconfigured web templates, everything gets simpler. This form is for income earned in tax year 2022, with tax returns due in april.

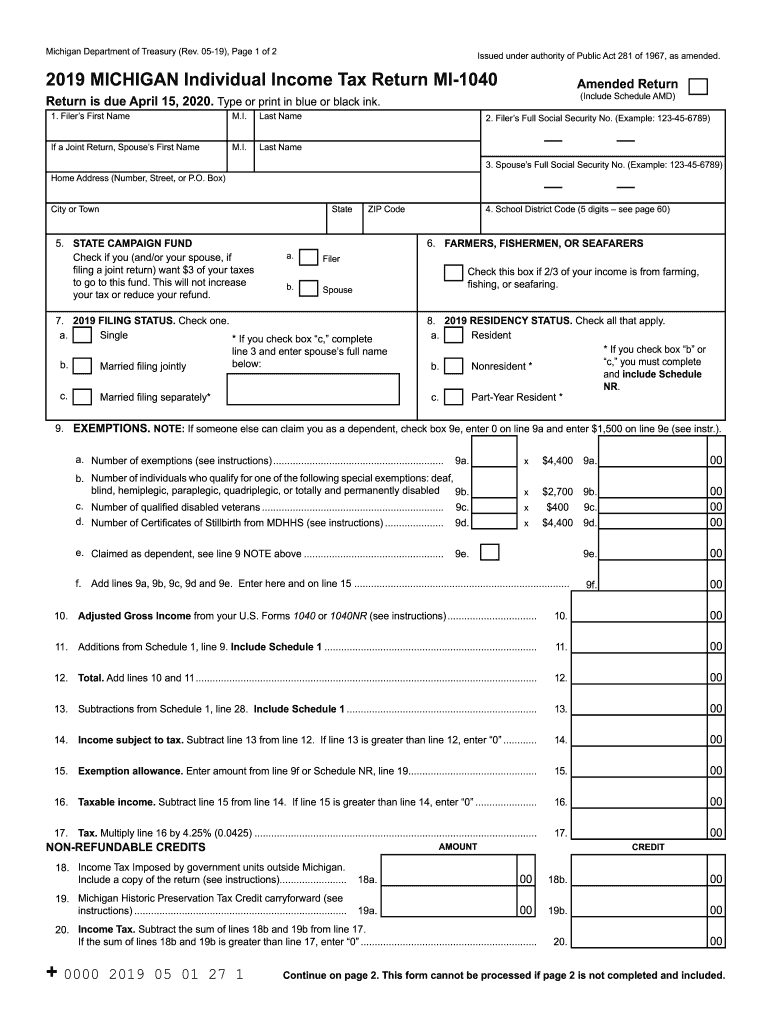

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return. Web see form 4884, line 29 instructions for more information. Sign it in a few clicks draw your signature, type it,. Easily fill out pdf blank, edit, and sign them. Web taxslayer support is my retirement income taxable to.

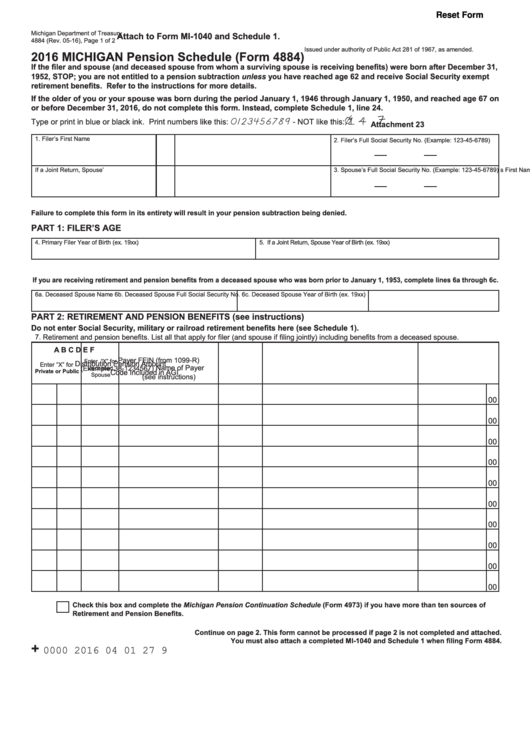

Form 4884 Michigan Pension Schedule 2016 printable pdf download

Show sources > about the corporate income tax the irs and most. Web follow the simple instructions below: However, with our preconfigured web templates, everything gets simpler. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Fill Michigan

2013 michigan pension schedule, form 4884 note: We last updated the pension schedule in february 2023, so this is the latest. Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. This form is for income earned in tax year 2022, with tax returns due.

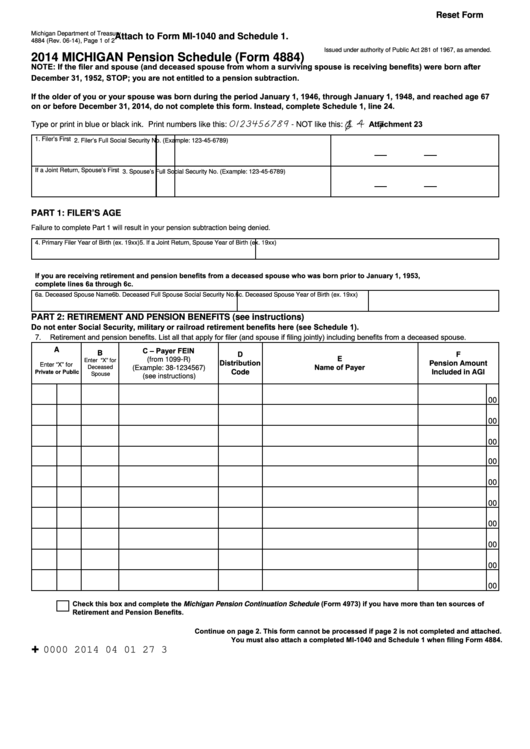

Fillable Form 4884 Michigan Pension Schedule 2014 printable pdf

Show sources > about the corporate income tax the irs and most. Your selection for the type of retirement and. Form 4884 section c worksheet: If the older of filer or spouse is born during. We last updated the pension schedule in february 2023, so this is the latest.

Fill Michigan

Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return. Form 4884 section c worksheet: Save or instantly send your ready documents. We last updated the pension schedule in february 2023, so this is the latest. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a.

Web We Last Updated Michigan Form 4884 In February 2023 From The Michigan Department Of Treasury.

Web follow the simple instructions below: Show sources > about the corporate income tax the irs and most. Your selection for the type of retirement and. Issued under authority of public act 281 of 1967.

Recipients Born After January 1, 1954, Received Retirement Benefits From Ssa Exempt Employment, And Were Retired As Of.

This form is for income earned in tax year 2022, with tax returns due in april. Form 4884 section c worksheet: 2013 michigan pension schedule, form 4884 note: Web taxslayer support is my retirement income taxable to michigan?

Web We Last Updated Michigan Form 4884 Worksheet From The Department Of Treasury In February 2023.

Web (form 4884) federal civil service. Save or instantly send your ready documents. If the older of filer or spouse is born during. Easily fill out pdf blank, edit, and sign them.

According To The Michigan Instructions For Form 4884, Retirement And Pension Benefits Are Taxed.

Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. We last updated the pension schedule in february 2023, so this is the latest. Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884 (michigan pension.