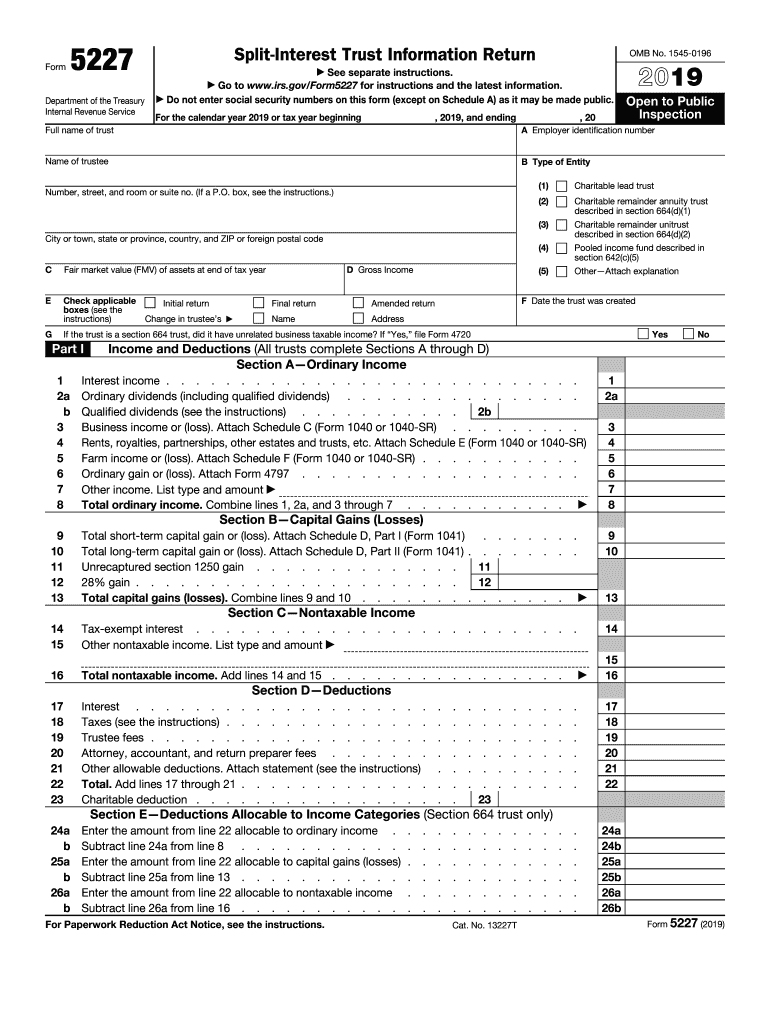

Form 5227 Instructions

Form 5227 Instructions - Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Web to file form 5227. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web use form 5227 to: Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. What’s new electronic filing expected to be available in 2023. , 2020, and ending, 20. For instructions and the latest information.

For the calendar year 2020 or tax year beginning. Do not enter social security numbers on this form (except on schedule a) as it may be made public. For instructions and the latest information. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. What’s new electronic filing expected to be available in 2023. Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. For instructions and the latest information. , 2020, and ending, 20. All charitable remainder trusts described in section 664 must file form 5227. Do not enter social security numbers on this form (except on schedule a) as it may be made public.

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Web use form 5227 to: What’s new electronic filing expected to be available in 2023. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. For instructions and the latest information. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. All pooled income funds described in section. All charitable remainder trusts described in section 664 must file form 5227. Web to file form 5227.

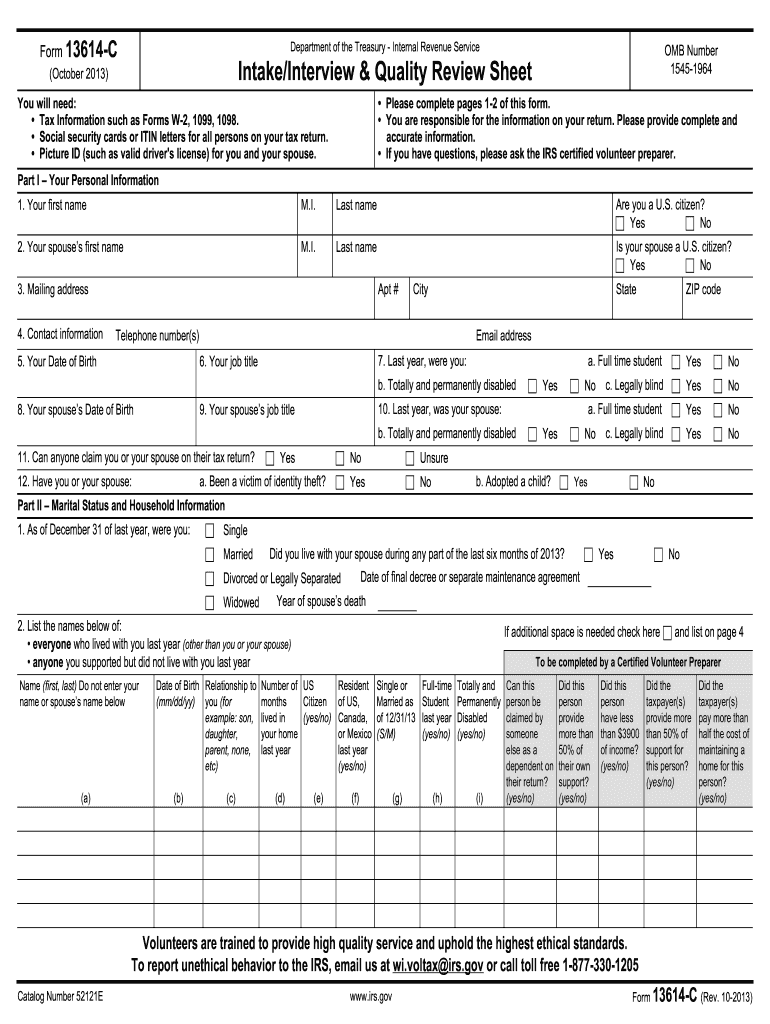

2013 Form IRS 13614C Fill Online, Printable, Fillable, Blank PDFfiller

, 2020, and ending, 20. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. Department of the treasury internal revenue service. Web use form 5227.

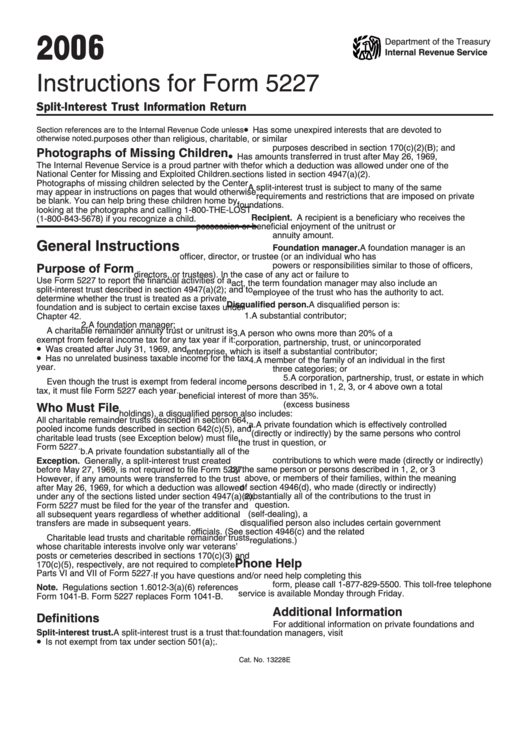

Instructions For Form 5227 printable pdf download

The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. Department of.

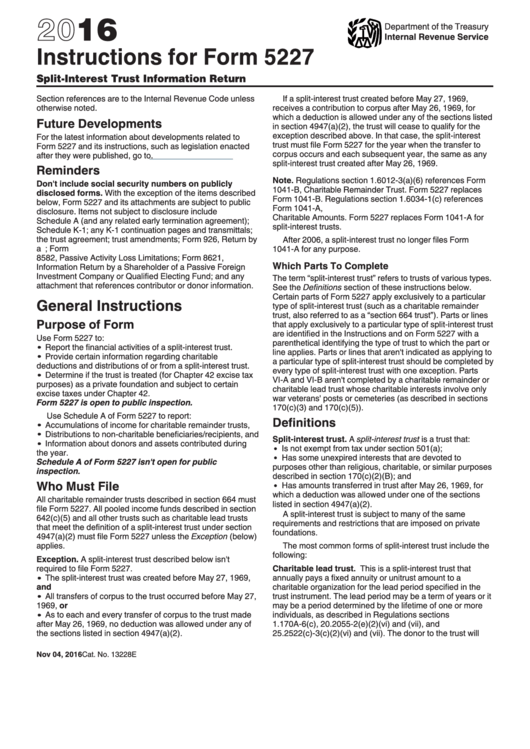

Instructions For Form 5227 2016 printable pdf download

What’s new electronic filing expected to be available in 2023. Web to file form 5227. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. All pooled income funds described in section. , 2020, and ending, 20.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. What’s new.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Do not enter social security numbers on this form (except on schedule a) as it may be made public. All pooled income funds described in section. Web to file form 5227. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. , 2020, and ending,.

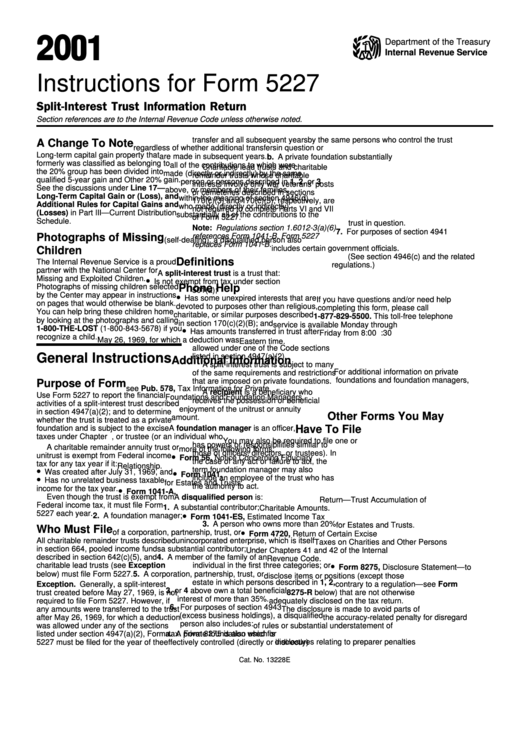

Instructions For Form 5227 printable pdf download

Web to file form 5227. For instructions and the latest information. All pooled income funds described in section. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. What’s new electronic filing expected to be available in 2023.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service. All pooled income funds described in section. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. See the instructions pdf for more information about when and where to file these returns, and how to obtain.

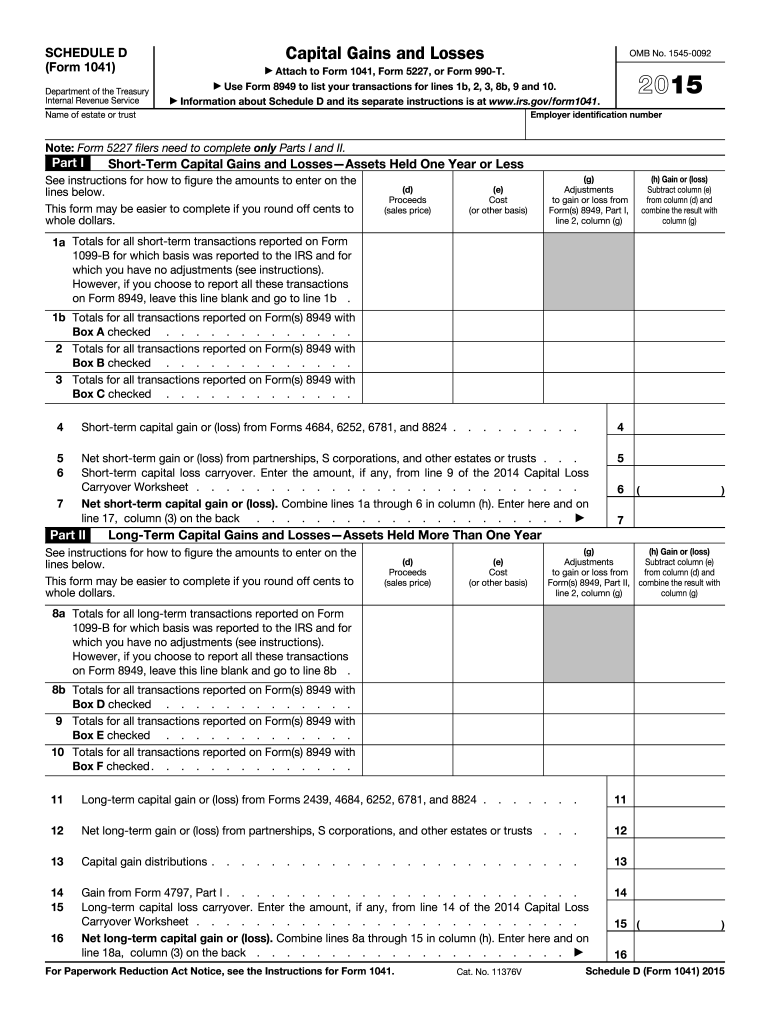

2015 Form IRS 1041 Schedule D Fill Online, Printable, Fillable, Blank

All pooled income funds described in section. What’s new electronic filing expected to be available in 2023. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web to file form 5227. Department of the treasury internal revenue service.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Electronic filing of form 5227 is expected to be available in 2023, and the irs will.

Instructions for Form 5227 Internal Revenue Service Fill Out and Sign

Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Web to file form 5227. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. See the instructions pdf for more information about when and where to file these returns,.

See The Instructions Pdf For More Information About When And Where To File These Returns, And How To Obtain An Extension Of Time To File.

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. For instructions and the latest information. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Department of the treasury internal revenue service.

Web The Trustee Will File Form 5227 For The Crt (Crat Or Crut) Using A Calendar Tax Year.

For instructions and the latest information. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. For the calendar year 2020 or tax year beginning. Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42.

Web To File Form 5227.

, 2020, and ending, 20. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. What’s new electronic filing expected to be available in 2023.

Do Not Enter Social Security Numbers On This Form (Except On Schedule A) As It May Be Made Public.

All pooled income funds described in section. Web use form 5227 to: All charitable remainder trusts described in section 664 must file form 5227.