Form 5329 Instructions 2021

Form 5329 Instructions 2021 - Must be removed before printing. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Start completing the fillable fields. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Use get form or simply click on the template preview to open it in the editor. I have tt desktop edition and have successfully filled. Waives the early withdrawal penalty for money. California law conforms to the following federal provisions under the caa, 2021: You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. I have tt desktop edition and have successfully filled. Waives the early withdrawal penalty for money. Start completing the fillable fields. California law conforms to the following federal provisions under the caa, 2021: Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Must be removed before printing. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. When and where to file.

Waives the early withdrawal penalty for money. When and where to file. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Must be removed before printing. Start completing the fillable fields. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Use get form or simply click on the template preview to open it in the editor. California law conforms to the following federal provisions under the caa, 2021:

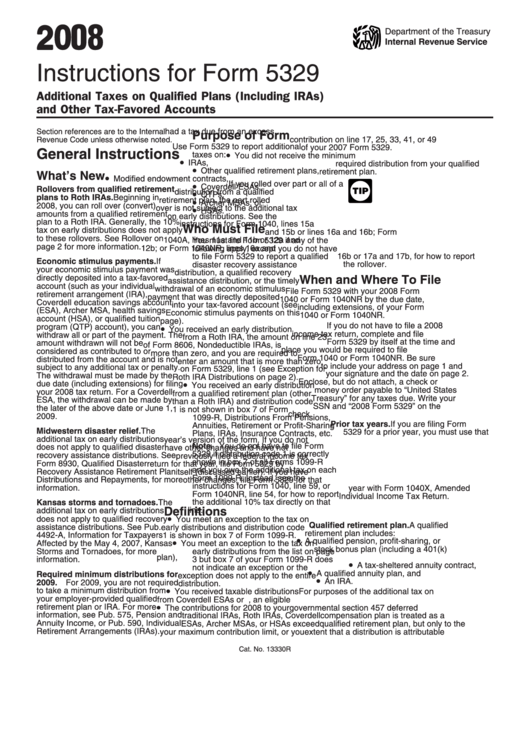

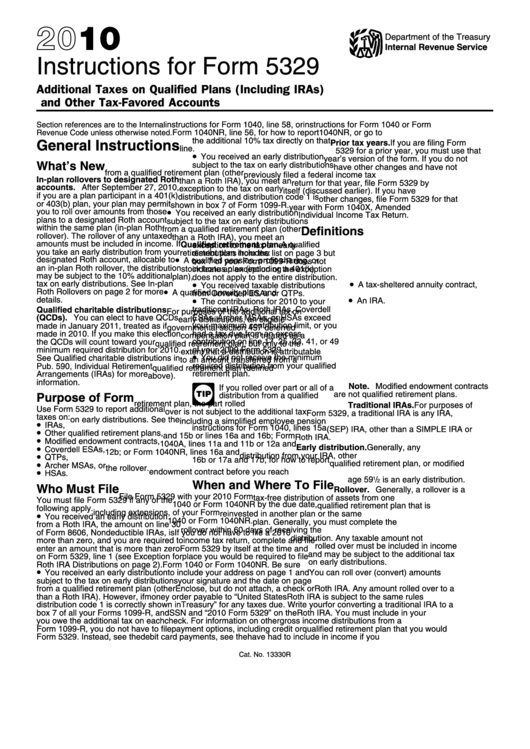

Instructions For Form 5329 Additional Taxes On Qualified Plans

Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Web the table below explains exceptions to form 5329, additional tax on early.

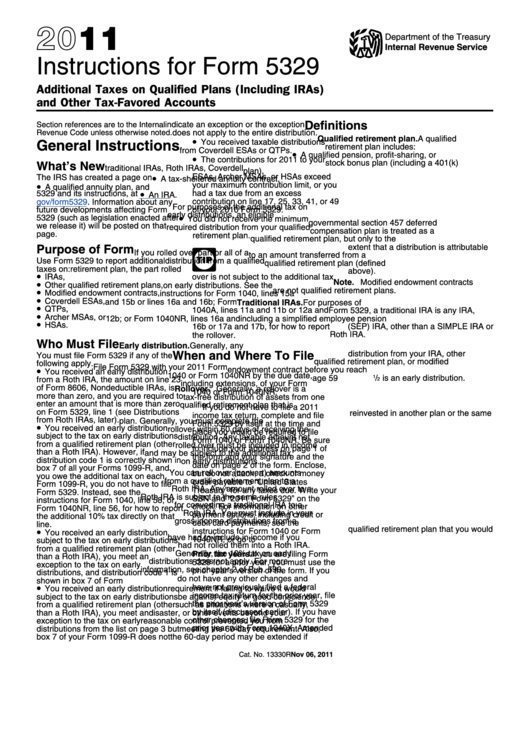

Instructions For Form 5329 Additional Taxes On Qualified Plans And

California law conforms to the following federal provisions under the caa, 2021: Use get form or simply click on the template preview to open it in the editor. When and where to file. Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Web on.

Roth Ira Form 5329 Universal Network

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. California law conforms to the following federal provisions under the caa, 2021: When and where to file.

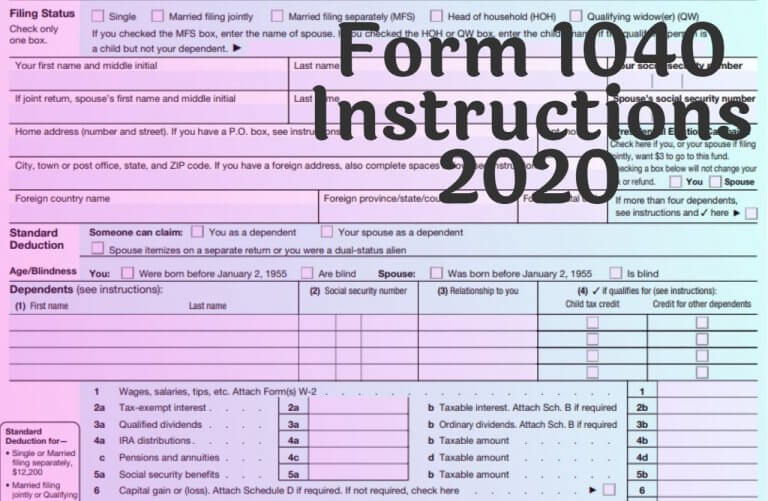

Form 1040 Instructions 2020

Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. Must be removed before printing. When and where to file. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. California law conforms to the.

Irs form 5329 2017 Fill out & sign online DocHub

Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Web use form 5329 to report additional taxes on iras, other qualified.

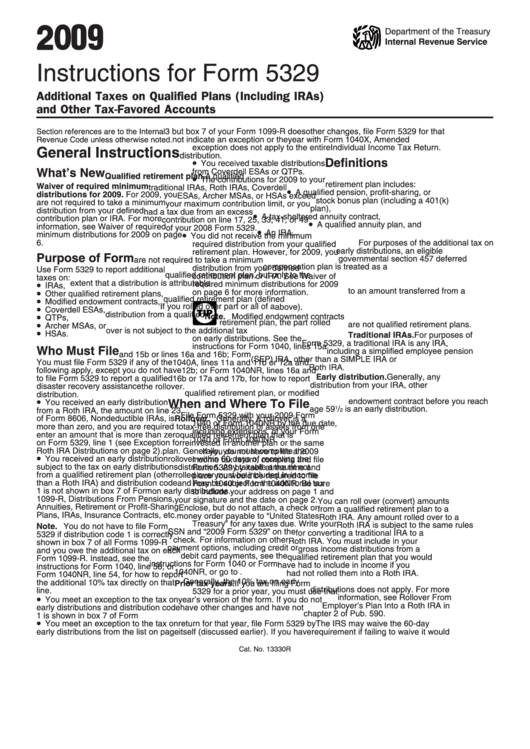

Instructions For Form 5329 Additional Taxes On Qualified Plans

Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Must be removed before printing. Web 2021 form 5329 waiver explanation and efile hello.

Form 5329 Instructions & Exception Information for IRS Form 5329

When and where to file. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. Waives the early withdrawal penalty for money. I have tt desktop edition and have successfully filled.

Instructions for How to Fill in IRS Form 5329

Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. I have tt desktop edition and have successfully filled. File form 5329 with your 2022 form 1040, 1040. California law conforms to the following federal provisions under the caa, 2021: Web use form 5329 to report additional taxes.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. When and where to file. File form 5329 with your 2022 form 1040, 1040. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web the table below explains exceptions to.

Instructions For Form 5329 2010 printable pdf download

Web for the latest information about developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form5329. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. You must file form 5329 for 2020 and 2021 to pay the.

Start Completing The Fillable Fields.

Web 2021 form 5329 waiver explanation and efile hello all, i missed my rmd for 2021 and have to file form 5329. File form 5329 with your 2022 form 1040, 1040. Use get form or simply click on the template preview to open it in the editor. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

Web For The Latest Information About Developments Related To Form 5329 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Www.irs.gov/Form5329.

Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. California law conforms to the following federal provisions under the caa, 2021: When and where to file. I have tt desktop edition and have successfully filled.

Web On September 7, 2022, You Withdrew $800, The Entire Balance In The Roth Ira.

Waives the early withdrawal penalty for money. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Must be removed before printing.