Form 5471 Extension

Form 5471 Extension - Web changes to form 5471. Filer’s federal income tax return and is generally due when the u.s. 12 during the tax year, did the foreign corporation pay or accrue any foreign tax that was. Attach form 5471 to your income tax. Web internal revenue service form 5471, information return of u.s. When and where to file. Web a form 5471 is also known as the information return of u.s. Web if a person needs more time to file the form 5471, they can request an extension. Web form 5471 should be attached to the u.s. Form 5471 due date and extension.

Web form 5471 should be filed as an attachment to the taxpayer’s federal income tax, partnership or exempt organization return, and filed by the due date (including. Persons with respect to certain foreign corporations. Web form 5471 is filed when the tax return due. Web form 5471 should be attached to the u.s. Persons with respect to certain foreign corporations, has been in existence for many years. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Form 5471 is due to be filed at the same time the taxpayer files their tax return.

I just found out that this means that i. Filer’s federal income tax return and is generally due when the u.s. Web form 5471 is filed when the tax return due. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web internal revenue service form 5471, information return of u.s. Web form 5471 and filing an extension so i am an american expat living abroad who became a 13% shareholder of a foreign corporation in 2020. Form 5471 due date and extension. Web if a person needs more time to file the form 5471, they can request an extension. When and where to file.

Publica SL KP31S FIA Historic Database

Web internal revenue service form 5471, information return of u.s. A form 5471 goes on extension when a person files an extension for their tax return. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web if a person needs more time to file the form 5471, they can.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Attach form 5471 to your income tax. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Complete, edit or print tax forms instantly. How to file a 5471 extension. Web form 5471 should be filed as an attachment to the taxpayer’s.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Persons with respect.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

Web changes to form 5471. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Web a form 5471 is also known as the information return of u.s. Form 5471 due date and extension. Form 5471 is due to be filed at.

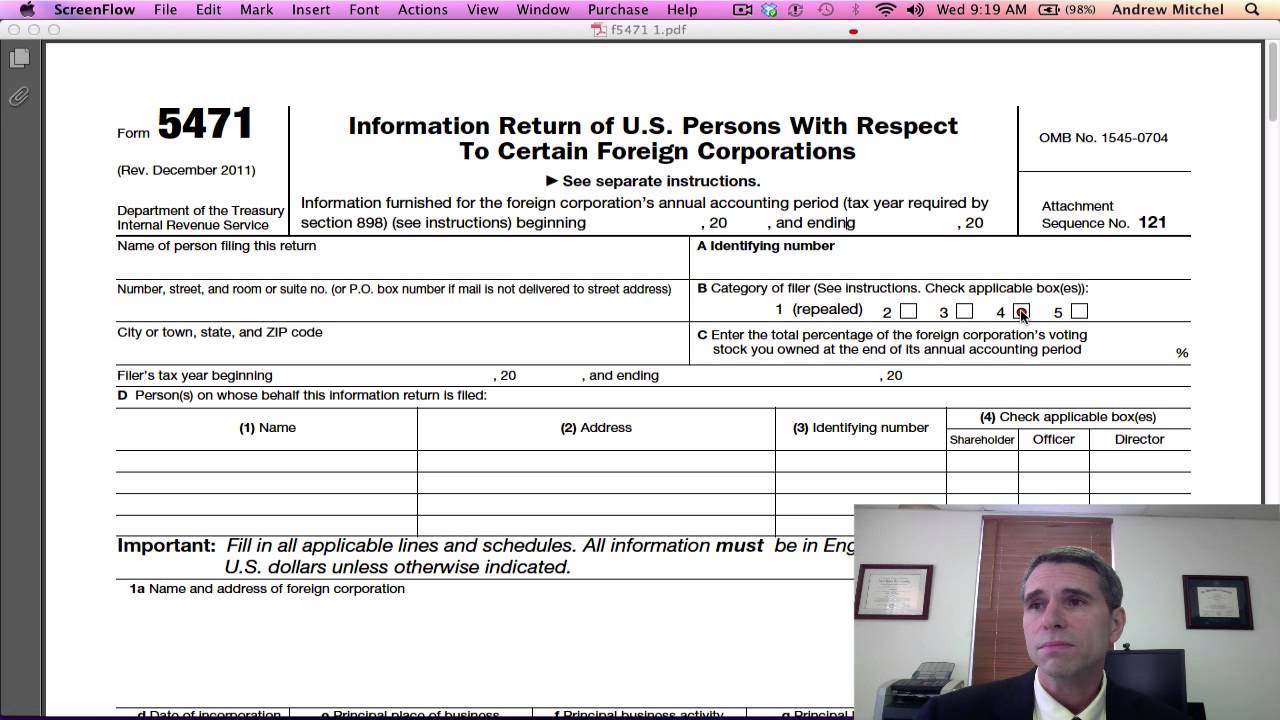

IRS Form 5471, Page1 YouTube

Attach form 5471 to your income tax. Web if a person needs more time to file the form 5471, they can request an extension. Web a form 5471 is also known as the information return of u.s. Web form 5471 should be attached to the u.s. Web delinquent form 5471 or delinquent form 5472, as applicable, and utilizing the delinquent.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web form 5471 and filing an extension so i am an american expat living abroad who became a 13% shareholder of a foreign corporation in 2020. Web expats with the following relationships with a foreign corporation have to file form 5471: Attach form 5471 to your income tax. Web the notice states this extension specifically applies to the following international.

IRS Form 5471 Reporting for U.S. Shareholders of Foreign Companies

Persons with respect to certain foreign corporations. Web the notice states this extension specifically applies to the following international forms: Complete, edit or print tax forms instantly. Web form 5471 should be filed as an attachment to the taxpayer’s federal income tax, partnership or exempt organization return, and filed by the due date (including. If a taxpayer requires an.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

How to file a 5471 extension. A form 5471 goes on extension when a person files an extension for their tax return. Web form 5471 should be attached to the u.s. Web the notice states this extension specifically applies to the following international forms: Web expats with the following relationships with a foreign corporation have to file form 5471:

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 5471 should be attached to the u.s. It is a required form for taxpayers who are officers,. Attach form 5471 to your income tax. Web delinquent form 5471 or delinquent form 5472, as applicable, and utilizing the delinquent international information return submission procedures (diirsp) by the relief deadline,. Complete a separate form 5471 and all applicable schedules for.

IRS Issues Updated New Form 5471 What's New?

Ad access irs tax forms. Form 5471 is due to be filed at the same time the taxpayer files their tax return. Web a form 5471 is also known as the information return of u.s. Web expats with the following relationships with a foreign corporation have to file form 5471: Get ready for tax season deadlines by completing any required.

Ad Access Irs Tax Forms.

Filer’s federal income tax return and is generally due when the u.s. Web if a person needs more time to file the form 5471, they can request an extension. Web the notice states this extension specifically applies to the following international forms: A form 5471 goes on extension when a person files an extension for their tax return.

Persons With Respect To Certain Foreign Corporations, Has Been In Existence For Many Years.

12 during the tax year, did the foreign corporation pay or accrue any foreign tax that was. Filer’s income tax return is due, including extensions. Web form 5471 and filing an extension so i am an american expat living abroad who became a 13% shareholder of a foreign corporation in 2020. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation.

Web Expats With The Following Relationships With A Foreign Corporation Have To File Form 5471:

Web form 5471 should be filed as an attachment to the taxpayer’s federal income tax, partnership or exempt organization return, and filed by the due date (including. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Persons with respect to certain foreign corporations. Form 5471 due date and extension.

Web Delinquent Form 5471 Or Delinquent Form 5472, As Applicable, And Utilizing The Delinquent International Information Return Submission Procedures (Diirsp) By The Relief Deadline,.

On page 5 of form 5471, new questions 20 and 21 have been added to schedule g to reflect p.l. Get ready for tax season deadlines by completing any required tax forms today. Web form 5471 should be attached to the u.s. Complete, edit or print tax forms instantly.