Form 5471 Requirements

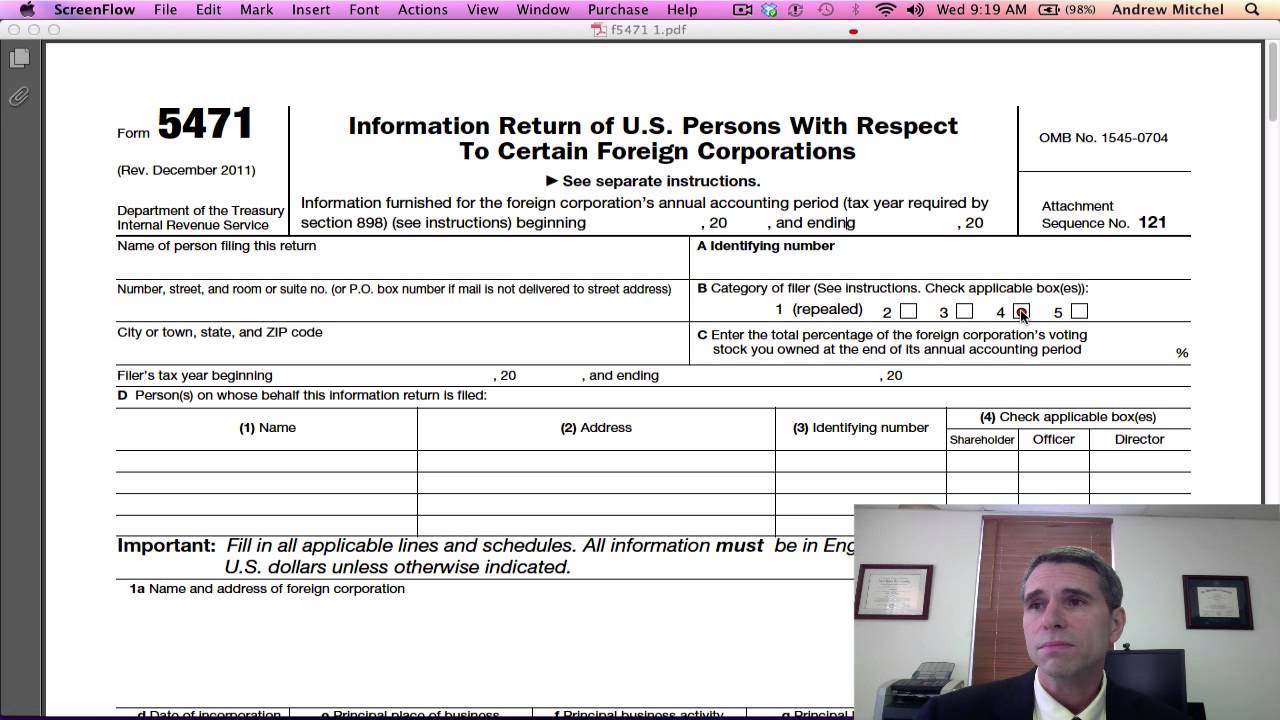

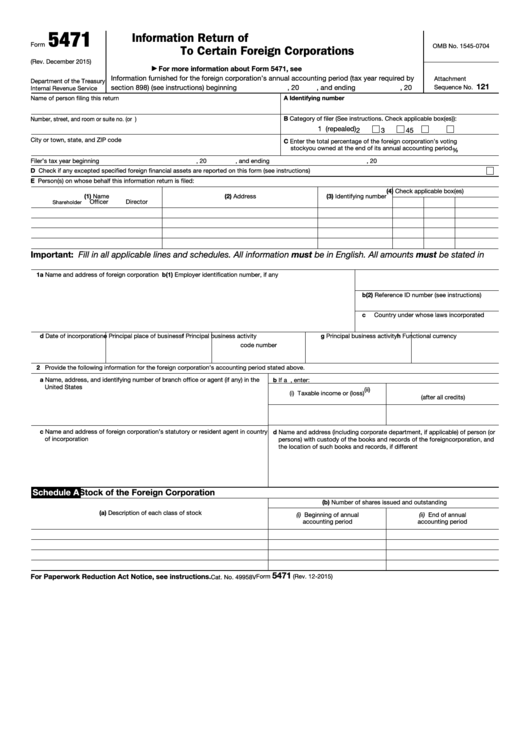

Form 5471 Requirements - Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web for most corporations, that would be march 15th or the extended due date. Web form 5471 is an informational tax form that must be filled out each year by any u.s. For most individuals, that would be april 15th or, if you are an expat, june 15th. Form 5471 is used by u.s. Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Web a filing obligation is an irs requirement to file a particular form or schedule with your tax returns. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company. Persons who are officers, directors, or shareholders in. The form and schedules are used to satisfy.

The form and schedules are used to satisfy. Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038. All amounts must be stated in u.s. Form 5471 is what is known in the trade as an informational filing,. Citizen and resident alien individuals, u.s. Taxpayer who has partial or total ownership of a foreign corporation. Web form 5471 is an informational tax form that must be filled out each year by any u.s. Web certain taxpayers related to foreign corporations must file form 5471. Web a filing obligation is an irs requirement to file a particular form or schedule with your tax returns. First, let’s clarify what a foreign corporation is.

Web form 5471 is an informational tax form that must be filled out each year by any u.s. During this course you will learn how to identify form 5471. Web all information must be in english. Taxpayer who has partial or total ownership of a foreign corporation. Web must be removed before printing. Form 5471 is what is known in the trade as an informational filing,. Web what is form 5471? Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. The form and schedules are used to satisfy. Form 5471 is used by certain u.s.

FORM 5471 TOP 6 REPORTING CHALLENGES Expat Tax Professionals

Web certain taxpayers related to foreign corporations must file form 5471. Web form 5471 & instructions. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Citizen and resident alien individuals, u.s. Web what is form 5471?

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web form 5471 instructions, requirements, and deadlines determine your filing obligations. All amounts must be stated in u.s. Web form 5471 & instructions. Web for most corporations, that would be march 15th or the extended due date. The form and schedules are used to satisfy.

Form 5471 Your US Expat Taxes and Reporting Requirements

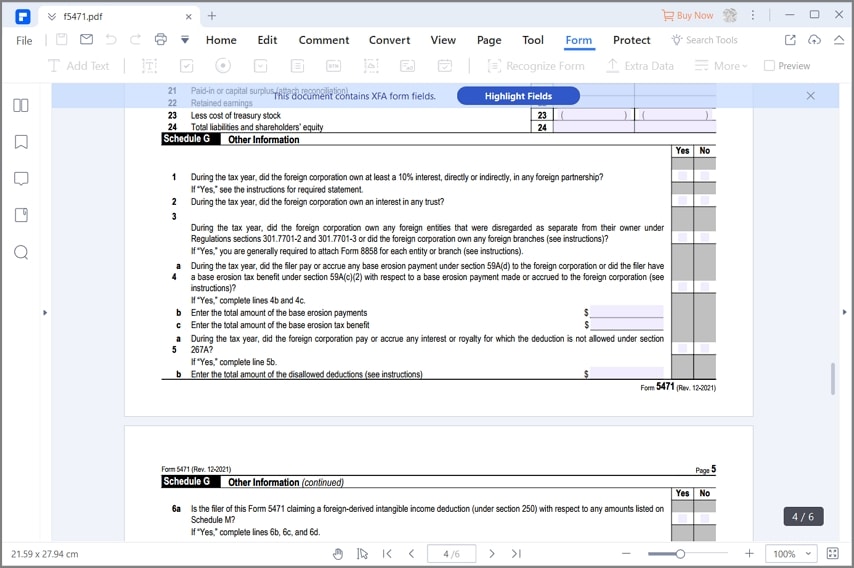

Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company. Form 5471 is what is known in the trade as an informational filing,. Web form 5471 & instructions. Web to adhere to the reporting requirements of secs. Web must be removed before printing.

Form 5471 Information Return of U.S. Persons with Respect to Certain

First, let’s clarify what a foreign corporation is. For most individuals, that would be april 15th or, if you are an expat, june 15th. 2 provide the following information for the foreign corporation’s. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company. Web.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

The form and schedules are used to satisfy. Web form 5471 is an informational tax form that must be filled out each year by any u.s. Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Form 5471 is used by u.s. 2 provide the following information for the foreign corporation’s.

IRS Form 5471, Page1 YouTube

First, let’s clarify what a foreign corporation is. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. Taxpayer who has partial or total ownership of a foreign corporation. Web not filing form 5471 at all, filing it inaccurately, or filing it late will lead to certain penalties. Web for most corporations, that would be march 15th or the.

IRS Issues Updated New Form 5471 What's New?

For most individuals, that would be april 15th or, if you are an expat, june 15th. Web to adhere to the reporting requirements of secs. Taxpayer who has partial or total ownership of a foreign corporation. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. Web these changes add clarity but also increase the compliance burden and complexity.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Form 5471 is what is known in the trade as an informational filing,. Web to adhere to the reporting requirements of secs. Web form 5471 & instructions. Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Form 5471 is used by u.s.

How to Fill out IRS Form 5471 (2020 Tax Season)

Web form 5471 & instructions. Web all information must be in english. For most individuals, that would be april 15th or, if you are an expat, june 15th. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company. Internal revenue service (irs) form 5471.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Citizen and resident alien individuals, u.s. 2 provide the following information for the foreign corporation’s. Persons who are officers, directors, or shareholders in certain foreign corporations. Web not filing form 5471 at all, filing it inaccurately, or filing it late will lead to certain penalties. If you aren’t sure if you.

6038 And 6046, Form 5471 Is Required To Be Filed By Certain U.s.

Form 5471 is used by certain u.s. Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038. Taxpayer who has partial or total ownership of a foreign corporation. Web form 5471 & instructions.

Web Not Filing Form 5471 At All, Filing It Inaccurately, Or Filing It Late Will Lead To Certain Penalties.

Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Web what is form 5471? If you aren’t sure if you.

Form 5471 Is What Is Known In The Trade As An Informational Filing,.

The penalty under irc section 6038 (b) (1) is $10,000 for each late or. First, let’s clarify what a foreign corporation is. Web must be removed before printing. Web form 5471 instructions, requirements, and deadlines determine your filing obligations.

Form 5471 Is Used By U.s.

Web certain taxpayers related to foreign corporations must file form 5471. Web form 5471 is an informational tax form that must be filled out each year by any u.s. Web all information must be in english. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company.