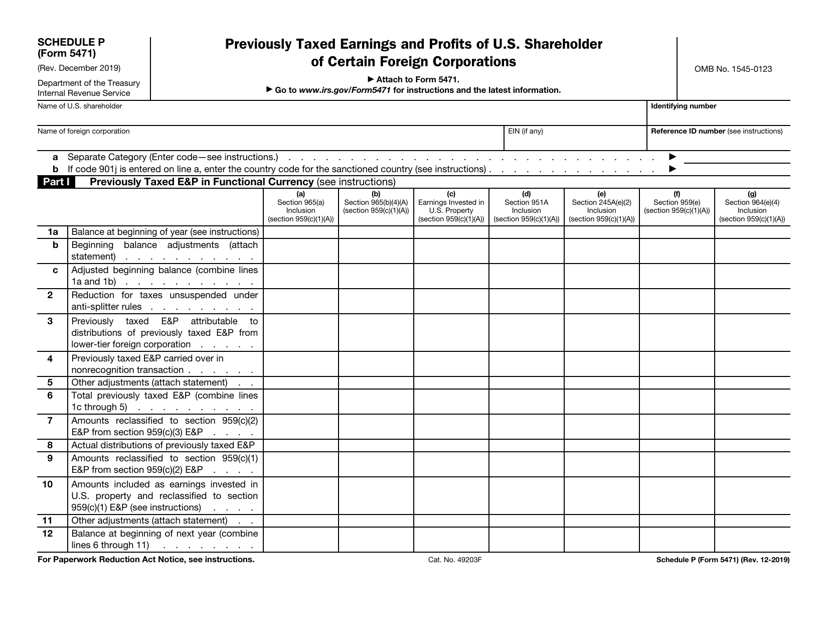

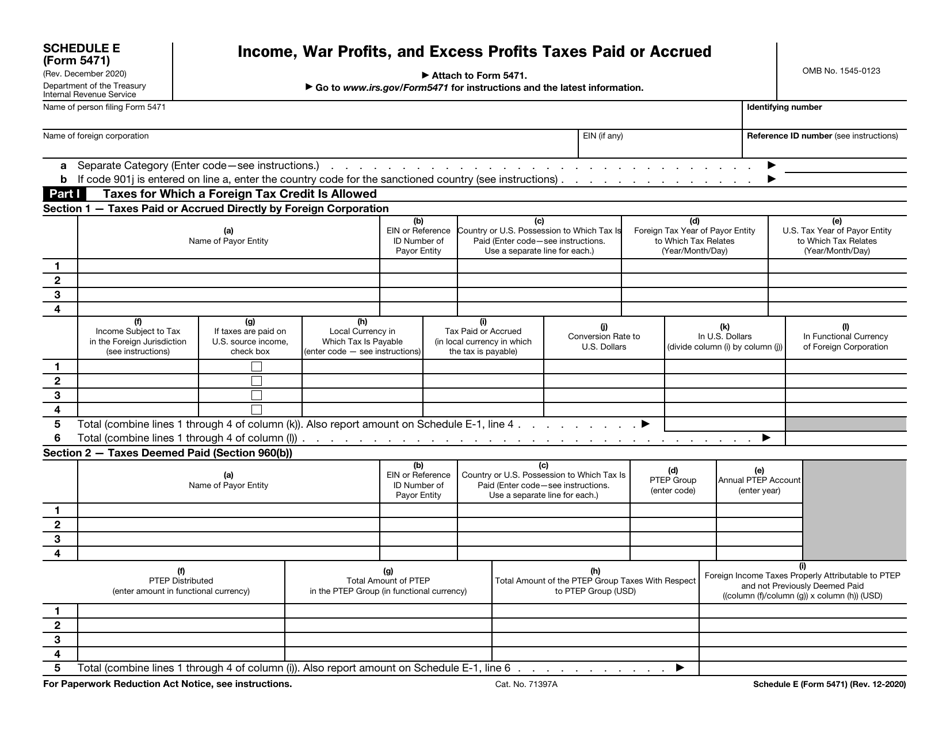

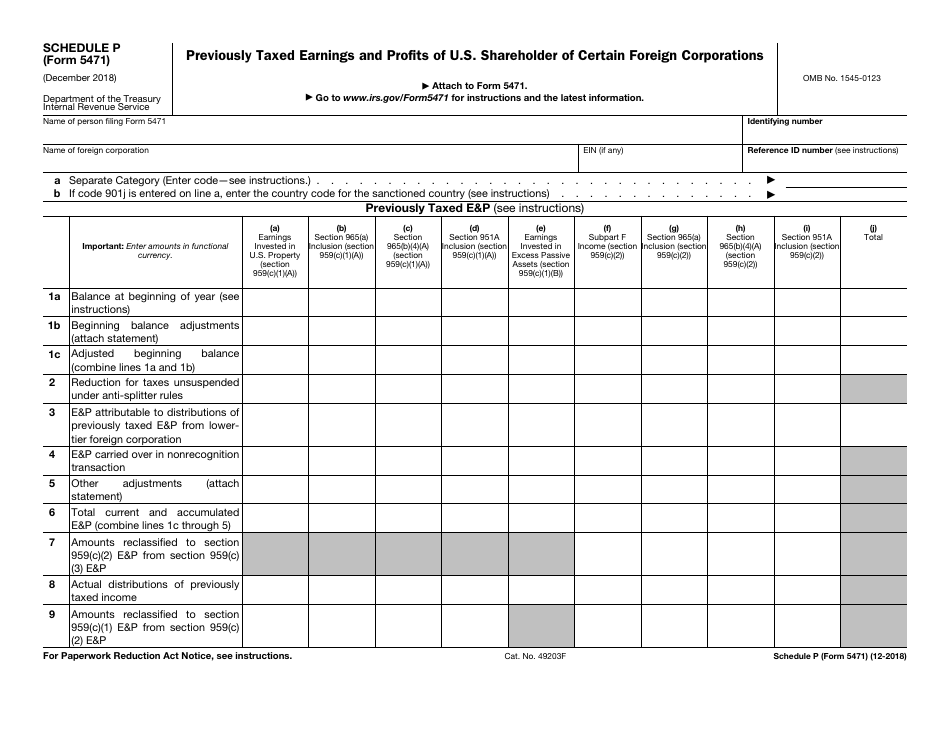

Form 5471 Schedule P Instructions

Form 5471 Schedule P Instructions - The term ptep refers to earnings and. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. When and where to file. Previously taxed earnings and profits of u.s. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Let’s go through the basics of schedule p and ptep: December 2020) department of the treasury internal revenue service. For instructions and the latest information. December 2019) department of the treasury internal revenue service. In such a case, the schedule p must be attached to the statement described above.

Web instructions for form 5471(rev. The term ptep refers to earnings and. Web schedule p (form 5471) (rev. When and where to file. There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. Now, the following forms are also available for download today. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. However, category 1 and 5 filers who are related constructive u.s. The december 2018 revision of schedule m; Lines a and b line a asks the preparer to enter a “separate category” code.

And the december 2012 revision of separate schedule o.) Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Shareholder described in category 1a, 1b, 4, 5a, or 5b. Lines a and b line a asks the preparer to enter a “separate category” code. When and where to file. For instructions and the latest information. Shareholder of certain foreign corporations. The december 2018 revision of schedule m; There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. The term ptep refers to earnings and.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

December 2020) department of the treasury internal revenue service. Web schedule p (form 5471) (rev. There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. For instructions and the latest information. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

And the december 2012 revision of separate schedule o.) For instructions and the latest information. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Shareholder of certain foreign corporations. Shareholder of certain foreign corporations.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Shareholders are not required to file schedule p. In such a case, the schedule p must be attached to the statement described above. The term ptep refers to earnings and. Shareholder of a controlled foreign corporation (“cfc”). Web instructions for form 5471(rev.

Download Instructions for IRS Form 5471 Information Return of U.S

The december 2018 revision of schedule m; Now, the following forms are also available for download today. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholder described in category 1a, 1b, 4, 5a, or 5b. When and where to file.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Now, the following forms are also available for download today. Lines a and b line a asks the preparer to enter a “separate category” code. Shareholders are not required to file schedule p. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Previously taxed earnings and profits of.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web schedule p (form 5471) (rev. Shareholders are not required to file schedule p. Now, the following forms are also available for download today. Specific schedule p reporting rules

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Shareholders are not required to file schedule p. Shareholder of certain foreign corporations. Specific schedule p reporting rules Shareholder described in category 1a, 1b, 4, 5a, or 5b. Previously taxed earnings and profits of u.s.

The Tax Times IRS Issues Updated New Form 5471 What's New?

When and where to file. The term ptep refers to earnings and. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Shareholder of certain foreign corporations. December 2020) department of the treasury internal revenue service.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p (form 5471) (rev. Web schedule p (form 5471) (rev. The december 2018 revision of schedule m; Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r;

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. In such a case, the schedule p must be attached to the statement described above. Lines.

There Are Five (5) Different Categories Of Filers, Various Schedules To Be Filed, And Balance Sheets To Prepare.

The term ptep refers to earnings and. Lines a and b line a asks the preparer to enter a “separate category” code. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r;

Shareholder Of Certain Foreign Corporations.

Previously taxed earnings and profits of u.s. When and where to file. Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s.

Shareholders Are Not Required To File Schedule P.

For instructions and the latest information. However, category 1 and 5 filers who are related constructive u.s. Web schedule p (form 5471) (rev. Now, the following forms are also available for download today.

December 2019) Department Of The Treasury Internal Revenue Service.

There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Specific schedule p reporting rules Web schedule p (form 5471) (rev.