Form 5500 Extension Due Date 2022

Form 5500 Extension Due Date 2022 - (usually due by july 31, which falls on a weekend in 2022. 17 2022) by filing irs form 5558 by aug. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web about form 5558, application for extension of time to file certain employee plan returns. Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Plan sponsors can request an.

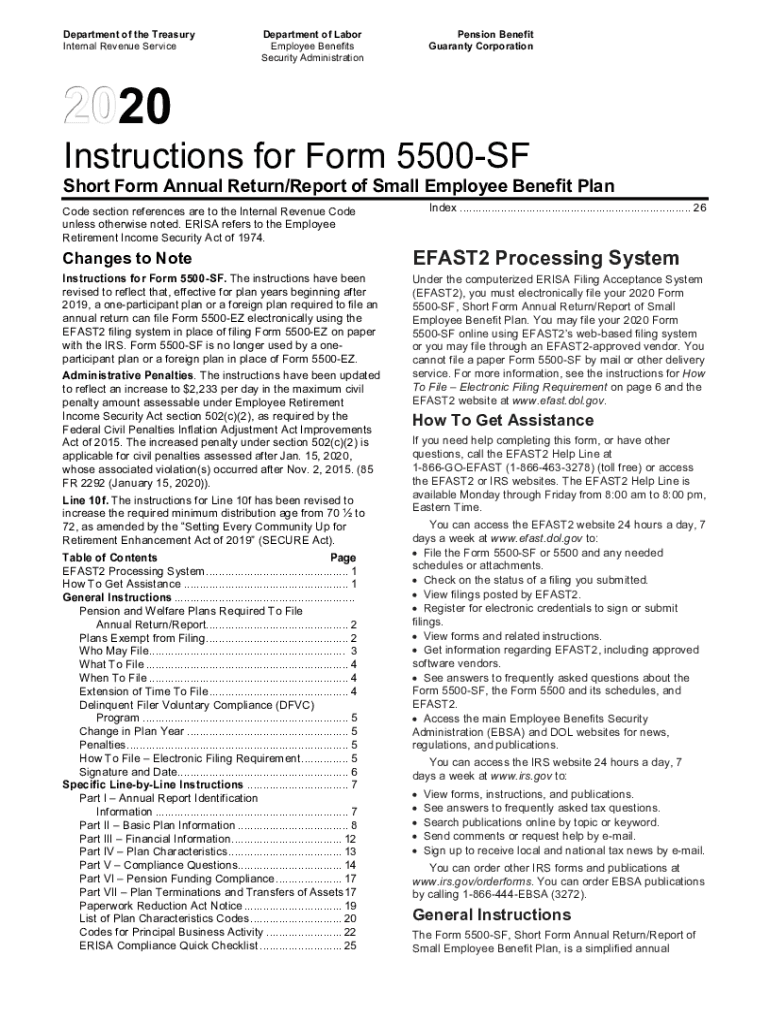

Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. Must file electronically through efast2. Web about form 5558, application for extension of time to file certain employee plan returns. Plan sponsors can request an. The deadline to file is linked to the last day of the plan year. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. (usually due by july 31, which falls on a weekend in 2022. The dol provides that filing dates that fall on a saturday, sunday or holiday are delayed until the next business day.)

17 2022) by filing irs form 5558 by aug. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. (usually due by july 31, which falls on a weekend in 2022. Must file electronically through efast2. Form 5500, annual return/report of employee benefit plan; The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web about form 5558, application for extension of time to file certain employee plan returns. The deadline to file is linked to the last day of the plan year.

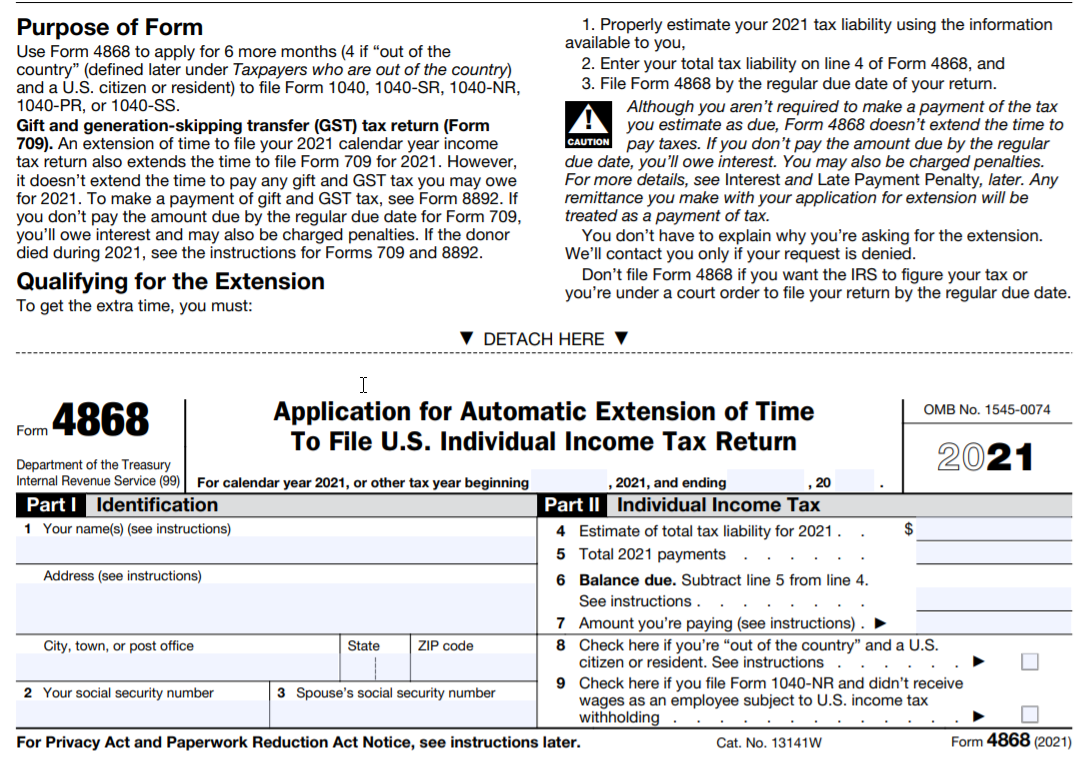

How to File a Tax Extension? ZenLedger

Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The dol provides that filing dates that fall on a saturday, sunday or holiday are delayed until the.

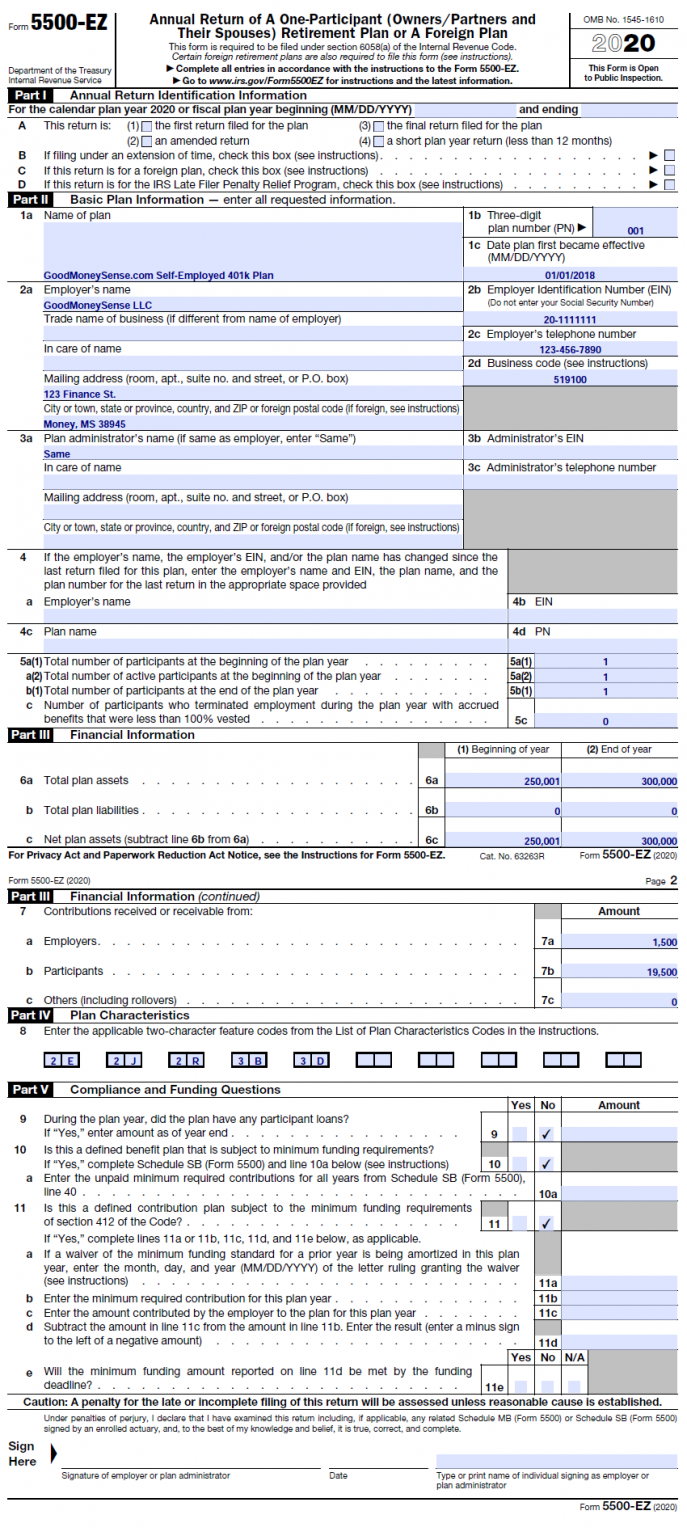

Form 5500EZ Example Complete in a Few Easy Steps!

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Form 5500, annual return/report of employee benefit plan; 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Web if you received a cp.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Form 5500, annual return/report of employee benefit plan; 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. 17 2022) by filing irs form.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. The dol provides that filing dates that fall on a saturday, sunday or holiday are delayed until the next.

Extension Due Date on Tax Return Form Filling (Latest Updated

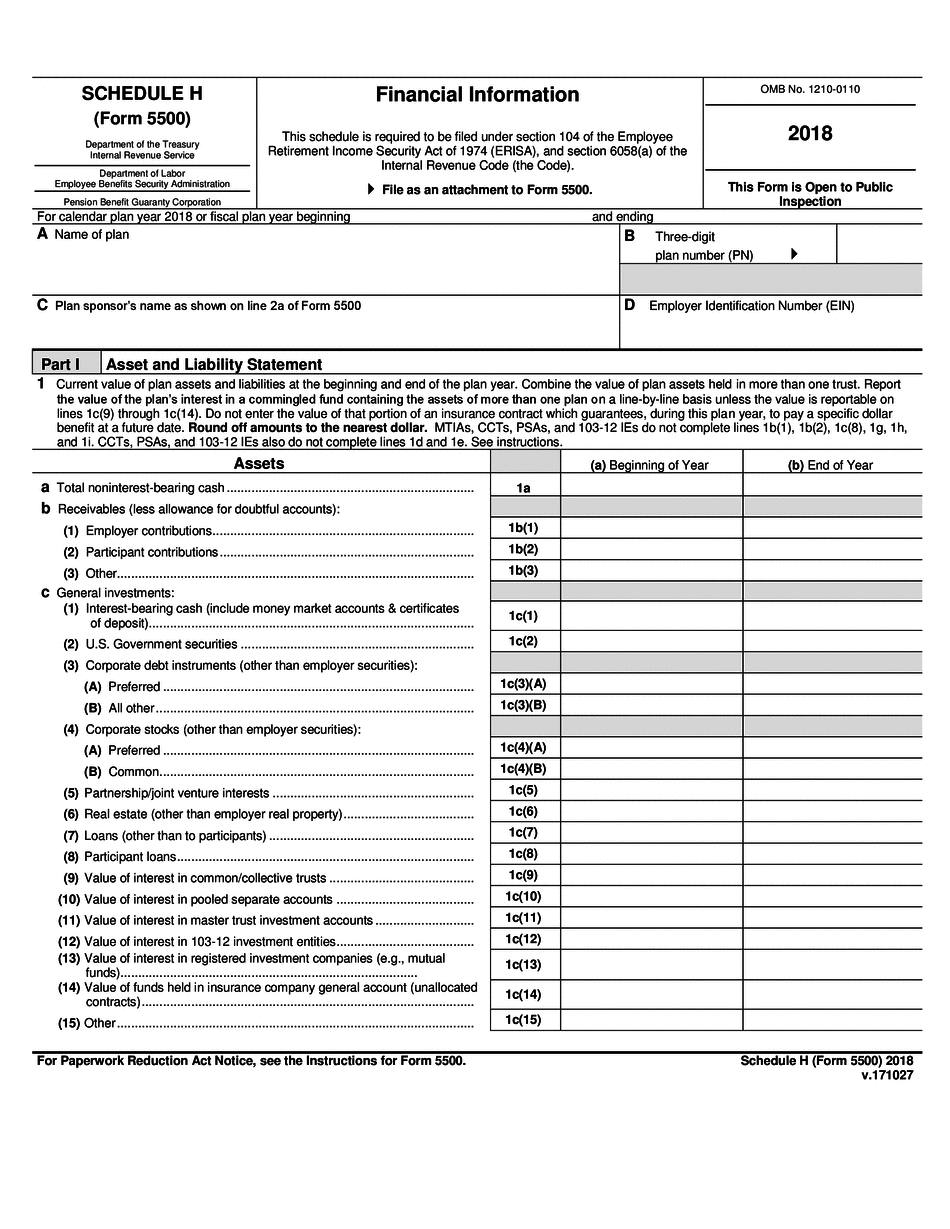

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. The deadline to file is.

SLT Adapting to New Federal Tax Returns Due Dates in New York The

The deadline to file is linked to the last day of the plan year. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Must file electronically through efast2. Web about form 5558, application for extension of time to file certain employee plan returns. The dol provides that filing dates that.

5500 Extension Due To COVID 19 B3PA

Web what is the deadline to file? Form 5500, annual return/report of employee benefit plan; Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. The dol provides that filing dates that fall on a saturday, sunday or.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Must file electronically through efast2. Web agencies release 2021 form 5500 for reporting in 2022 advance.

How to File Form 5500EZ Solo 401k

Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. (usually due by july 31, which falls on a weekend in 2022. Unless specified otherwise, reference to form 5500 series return includes: Web what is the deadline to.

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of.

Unless Specified Otherwise, Reference To Form 5500 Series Return Includes:

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. The deadline to file is linked to the last day of the plan year.

17 2022) By Filing Irs Form 5558 By Aug.

(usually due by july 31, which falls on a weekend in 2022. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Must file electronically through efast2. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day.

The Dol Provides That Filing Dates That Fall On A Saturday, Sunday Or Holiday Are Delayed Until The Next Business Day.)

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Plan sponsors can request an. Form 5500, annual return/report of employee benefit plan; Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

Web About Form 5558, Application For Extension Of Time To File Certain Employee Plan Returns.

Web agencies release 2021 form 5500 for reporting in 2022 advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil. Web what is the deadline to file?